Assisted Economy

The Economic Impact of an Assisted Living Facility in One Virginia County

Introduction:

The Lynchburg Regional Business Alliance (the Alliance) is an economic development organization in Virginia representing the Lynchburg Metropolitan Statistical Area (MSA) in its efforts to promote economic growth throughout the region. Focused on encouraging entrepreneurial start-ups, stimulating business expansions, inspiring small business development, and more, the Alliance aims to advance the health of the area’s business climate by generating jobs and investments. So, when an assisted living facility expressed interest in moving to Amherst County, Virginia, the Alliance wanted to ensure that it happened.

The Lynchburg Metropolitan Statistical Area includes Lynchburg City, Bedford City, Bedford, Amherst, Campbell, and Appomattox counties.

The facility expressed that, in addition to the construction of the care center itself, the relocation would include the construction of a collection of patio homes and a series of renovations to existing structures on the proposed property which would require an investment totaling over $13 million.

Furthermore, the effort was expected to contribute 60 jobs (35 full-time and 25 part-time), with wages ranging from $23,000 to $75,000, to the local economy after completion merely by virtue of the facility’s operations.

Sounds like a perfect opportunity for the Alliance to come through for the community, right?

The Problem:

While the facility’s interest in Amherst County had the potential to bring obvious economic benefits to the area, the fact is, it was only that…potential. The facility had not committed to Amherst, but was simply exploring the idea of the county becoming its new home. The possibility still lingered that the facility could find a location they perceived to be a better choice, relocate there instead, and leave Amherst and the surrounding Lynchburg MSA communities to wonder what might have been.

That’s precisely what the Alliance hoped to prevent. They had to close the deal.

To do so, they suggested offering a personalized incentive to the facility which would nearly guarantee the county landed the project. Specifically, they suggested offering the facility its proposed property as a gift. That’s right; they suggested that the county give the facility it’s land for free!

With a strategy so bold, the Amherst County Board of Supervisors would undoubtedly need a sizeable amount of convincing. It wouldn’t be enough to merely pitch them on the “suspected” economic benefits. The Alliance was going to need to build, and present to the deciding parties, a near-bulletproof case for taking such a brave step. And to build that case…they were going to need some metrics.

The Solution:

With its objective firmly in mind, the Alliance decided to take a data-driven approach and gather some hard numbers that reflected the economic benefits of their proposed strategy.

To gather those metrics, they turned to IMPLAN to perform an economic impact analysis.

Economic impact analysis is a type of study which allows an analyst to examine the effects of a specific event on a given economy. Moreover, it can also be used to measure the contributions of a specific industry or firm to a given economy. So naturally, the Alliance turned to this method to assess the economic ramifications of both the facility’s initial construction effort and its continued operations after completion.

To initiate the analytical process, the Alliance purchased a collection of economic impact data from IMPLAN, an economic data and analytical software provider, which reflected Amherst County. The data provided them with an economic snapshot of the region (complete with in-depth information regarding its industry spending patterns, employment numbers, and more) which established the basis for their analysis.

Having collected the necessary components, the Alliance turned to IMPLAN once more and used its economic modeling software to perform the actual impact analysis. With IMPLAN, they were able to assess the potential benefits of the proposed relocation and gain the necessary metrics to strengthen their case to the Board of Supervisors.

The Results:

The analysis ultimately provided the Alliance with several sets of impact results. Those sets are presented and discussed below.

Construction:

The project’s construction effort revealed the potential to stimulate over $16 million in local spending, create nearly 125 jobs, and generate roughly $450,000 in combined state & local taxes. The details of those results are presented and discussed below:

| Description | Direct | Indirect | Induced | Total |

| Economic Activity | $13,400,000 | $1,704,624 | $1,492,243 | $16,596,867 |

| Wages, Salaries, Benefits | $3,520,553 | $513,893 | $380,285 | $4,414,731 |

| Employment | 90 | 19 | 15 | 124 |

| Amherst County Taxes | $77,393 | $59,806 | $52,927 | $190,126 |

| Virginia State Taxes | $147,449 | $58,190 | $50,882 | $256,521 |

| Total Impact | $21,458,245 |

The Alliance’s economic impact analysis also revealed that the residential and commercial construction, truck transportation, wholesale trade, and retail sales (specifically of building supplies) sectors were likely to experience the highest increase in economic activity as a result of the initial construction effort.

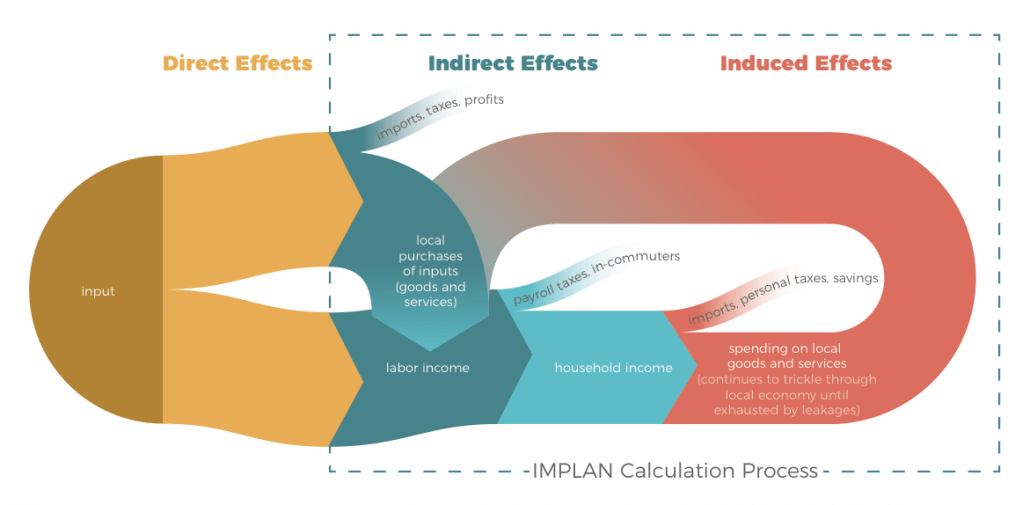

The figures presented in the Direct column of the results table (shown above) represent potential dollars of spending and changes in employment attributed directly the project’s initial construction effort.

The figures presented in the Indirect column of the results table (shown above) represent potential dollars of spending and changes in employment throughout additional sectors of the local economy attributed to intermediate business-to-business expenditures resulting from the project’s initial construction effort.

The figures presented in the Induced column of the results table (shown above) represent potential dollars of household or institutional income spending, and the subsequent changes in employment resulting from it, resulting from the project’s initial construction effort.

Operations:

The facility’s operations (after the completion of the construction effort) revealed the potential to stimulate over $2 million in sustained local spending, to support over 65 long-term jobs, and to generate more than $55,000 in annual local taxes in Amherst County alone. The details of those results are presented and discussed below:

| Description | Direct | Indirect | Induced | Total |

| Economic Activity | $1,670,048 | $97,984 | $496,077 | $2,264,109 |

| Wages, Salaries, Benefits | $1,416,591 | $26,041 | $123,512 | $1,566,145 |

| Employment | 60 | 1 | 5 | 66 |

| Amherst County Taxes | $19,500 | $4,755 | $32,163 | $56,418 |

| Virginia State Taxes | $67,951 | $4,528 | $28,740 | $101,219 |

The figures presented in the Direct column of the results table (shown above) represent potential recurring dollars of spending, and changes in employment, attributed to the operations of the facility itself.

The figures presented in the Indirect column of the results table (shown above) represent potential recurring dollars of spending, and changes in employment throughout additional sectors of the local economy, attributed to ongoing intermediate business-to-business expenditures resulting from the facility’s operations.

The figures presented in the Induced column of the results table (shown above) represent potential recurring dollars of household or institutional income spending, and the subsequent changes in employment, resulting from the facility’s operations.

Additionally, the project also revealed the potential to generate additional annual residential revenue. The Alliance’s study revealed that the inclusion of 40 patio homes on the proposed property, and the renovation effort to existing structure on the property, could potentially total over $80,000 in annual real estate tax and over $30,000 in annual sales & personal property tax. The details of those results are below:

| Description | Tax Revenue |

| Amherst County Income Taxes | $56,418 |

| Amherst County Sales & Personal Property | $30,819 |

| Amherst County Real Estate Tax | $81,740 |

| Total | $168,977 |

The Takeaway:

It’s important to point out that the economic impacts modeled by the Alliance’s analysis were restricted to only the impacts which were expected to occur within Amherst County itself! So, it’s reasonable to assume that the potential economic benefits suggested at by their study are actually conservative. The true impacts of this project might easily be larger than what the study suggests because there would undoubtedly be spillover effects from Amherst County to neighboring jurisdictions, and beyond, as economic activity originating from this project could reasonably be expected to “ripple” throughout the rest of the Lynchburg MSA.

The importance of impact analysis is not a secret to economic development organizations across the nation. Ultimately, the method, and more specifically IMPLAN’s economic impact data and analytical software tool, offered the Alliance the opportunity to formulate a development strategy, model the consequences of that strategy, and then to promote it with strength using data-devised metrics. For decades, IMPLAN has proven instrumental in allowing groups like the Lynchburg Regional Business Alliance to continue promoting economic growth and improving economic health throughout their regions by helping organizations of any size or budget include economic impact analysis in their own development strategies. Economic impact analysis has always been valuable. But IMPLAN is making this once arduous task both easy and accessible to everybody.