Utility Purchases & Energy Rebates

INTRODUCTION:

IMPLAN economists are often asked about best practices when modeling changes in utility prices and rebates on energy purchases. This article gives some general guidance on how to best proceed when investigating these situations.

DETAILS:

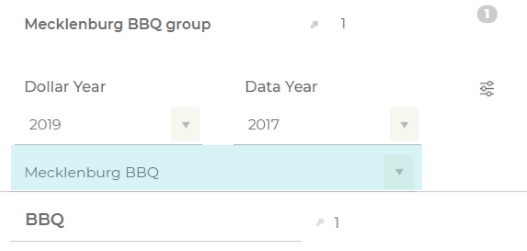

The first step in looking at changes in energy prices is to determine who is the producer and the consumer. In IMPLAN, utilities are produced by both Industries (Sectors 41-51) and Government (Sectors 519, 522, & 525). Consumers of utilities can be Households, Industries, and Government.

Perhaps you want to model a price change in the Commodity, not knowing if it will be produced by a firm or the government. If this is the case, consider using a Commodity such as 3041 – Electricity.

Next, you will need to make assumptions about the price increases or decreases that will be modeled – who will be affected and if that change is positive or negative. This will frame your analysis.

HOUSEHOLDS:

HOUSEHOLDS:

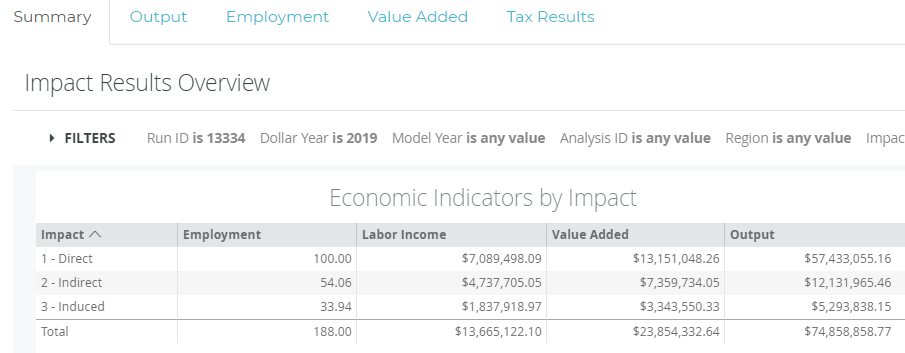

A popular case to examine is modeling increased income that households would see from a decrease in utility pricing or from utility rebates. To model this, a Household Income Change (HHIC) is a great option. The HHIC will remove personal taxes and savings before calculating the results.

Any changes to household spending will be at the same rate across all spending categories. This means that even though the savings might be spent on increased retail shopping or entertainment, the spending pattern will allocate the savings across all household purchases, which doesn’t always make sense. Just because someone saved money on their utility bill doesn’t mean their rent increased. Each analyst must determine how the savings will be spent.

In the case of a rate hike, you would see a reduction or negative impact in households. Be careful in this case as well. Giving a household less disposable income doesn’t necessarily mean they won’t pay their student loans or buy groceries. They may instead cut their utility usage or decrease their entertainment budget. If the increase is small enough it may have little to no impact on household spending for any group.

Remember, different households may respond differently, depending on the size of the rate increase, their needs, and income level. A larger increase will likely affect the spending of lower income households but may not affect the spending of higher income households as these payments may come from savings (leakages in IMPLAN).

INDUSTRIES:

INDUSTRIES:

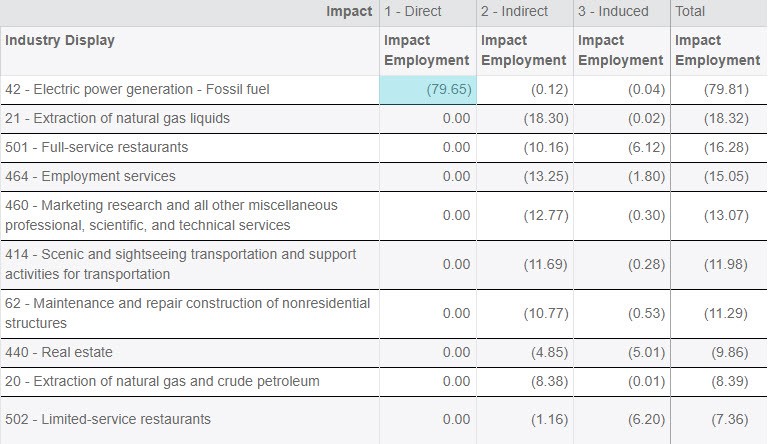

PRODUCING

As a producer, Industries can be positively or negatively affected by price changes. If the cost of inputs skyrockets or bottoms out, these price changes can’t immediately be passed on to the consumer, so short-term losses may occur.

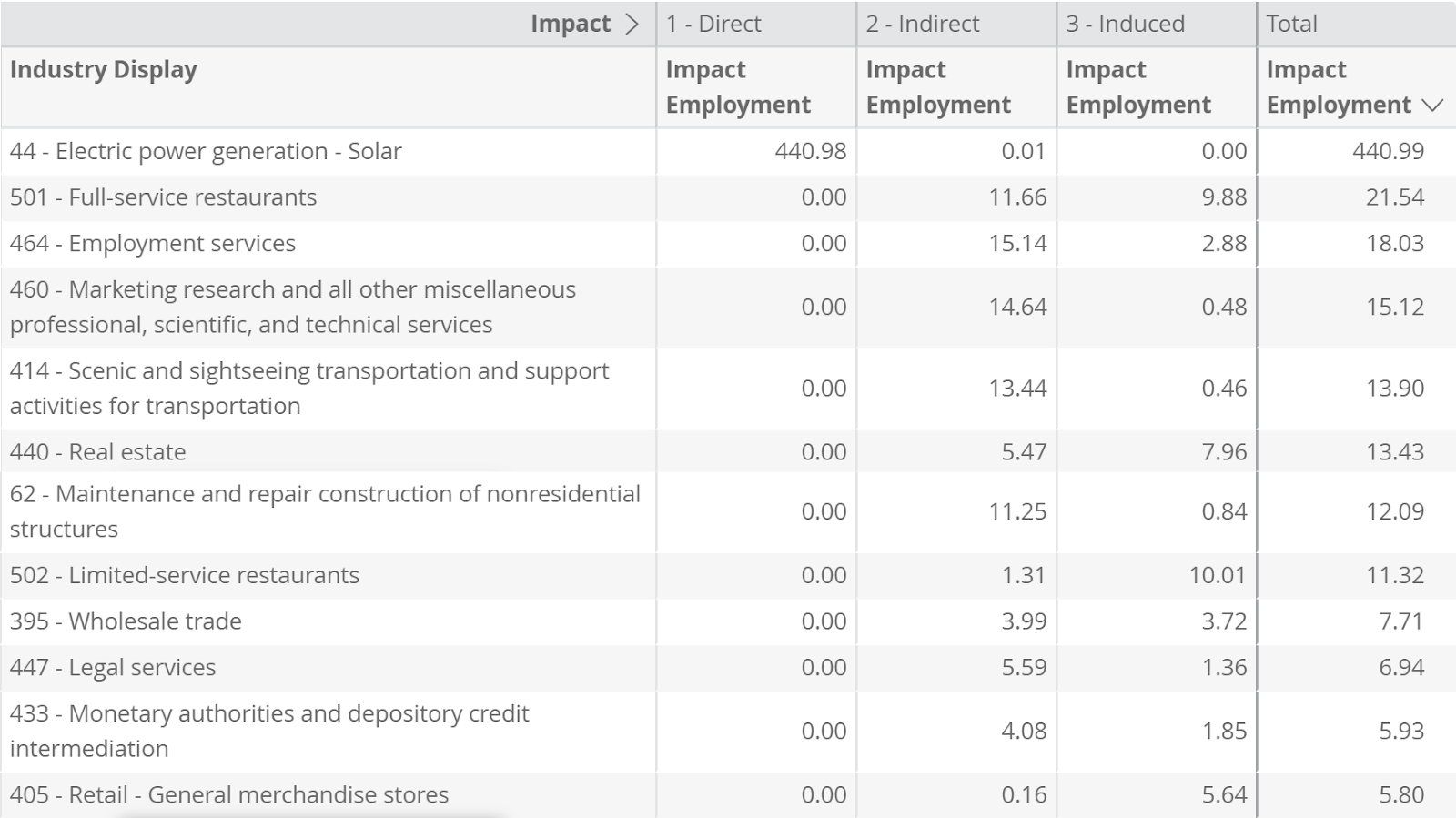

Changes in Industries can be modeled through:

- Sector 41 – Electric power generation – Hydroelectric

- Sector 42 – Electric power generation – Fossil fuel

- Sector 43 – Electric power generation – Nuclear

- Sector 44 – Electric power generation – Solar

- Sector 45 – Electric power generation – Wind

- Sector 46 – Electric power generation – Geothermal

- Sector 47 – Electric power generation – Biomass

- Sector 48 – Electric power generation – All other

- Sector 49 – Electric power transmission and distribution

- Sector 50 – Natural gas distribution

- Sector 51 – Water, sewage and other systems

CONSUMING

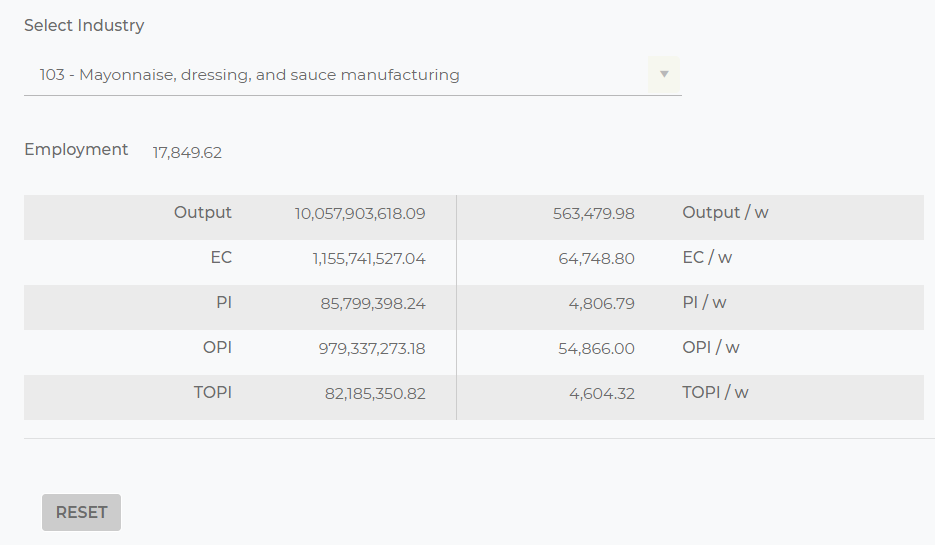

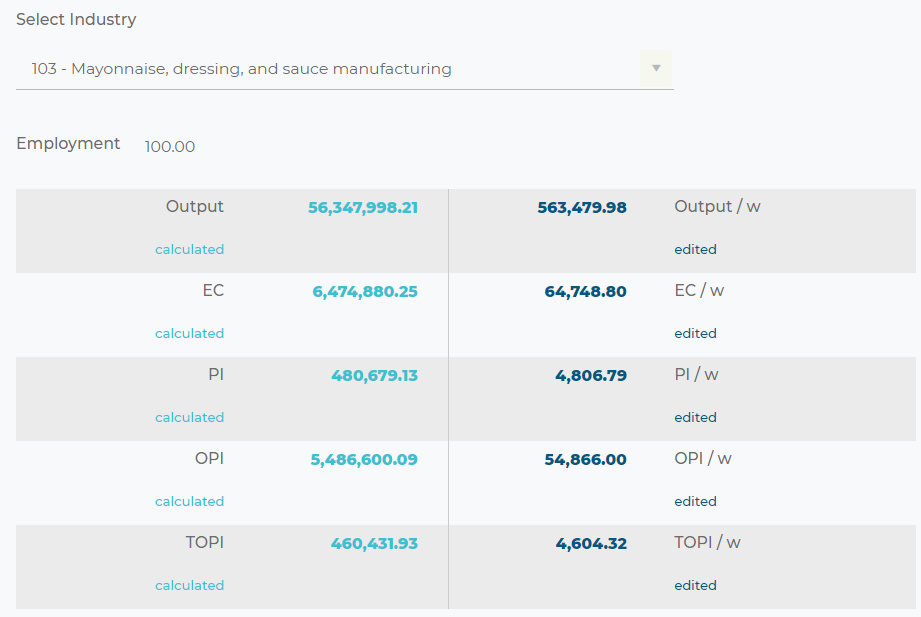

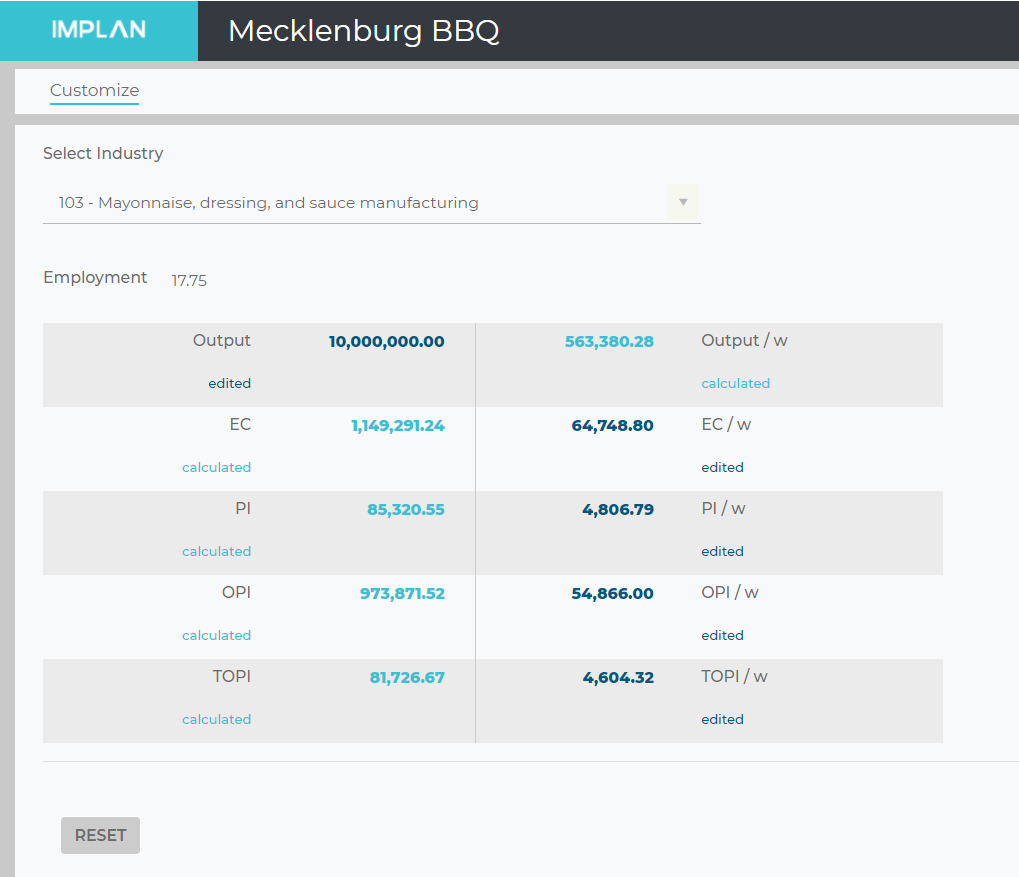

Estimating a change in Industry price or profit is outside of the scope of Input-Output analysis. Therefore, the analyst must make assumptions about where the price changes would occur and how to model them.

For a price reduction or rebate, the likelihood is that this savings would go into Other Property Income (OPI). OPI in IMPLAN is treated as leakage. However, you may know that this savings is allowing the affected Industries to hire more staff or produce more widgets. This can be modeled in IMPLAN.

If you want to assume that the businesses cannot control the price of their products, any increase in utility costs could show a loss in profit. It might even be enough to shutter some businesses altogether. More likely, however, they will just raise the price of their products to offset the higher bills.

GOVERNMENT:

GOVERNMENT:

PRODUCING

As a producer of utilities in many areas, the changing cost of inputs can affect the operating margin of government-run utilities. Changes to government utility production can be modeled through one of the government utility Sectors:

- Sector 519 – Federal electric utilities

- Sector 522 – State government electric utilities

- Sector 525 – Local government electric utilities

CONSUMING

Governments can be affected negatively by increased utility costs, as well. More money being spent on electricity, for example, decreases the overall budget and might lead to program cuts or elimination. Often this is just in the short-run, however, as increased costs will likely be passed onto the consumer.

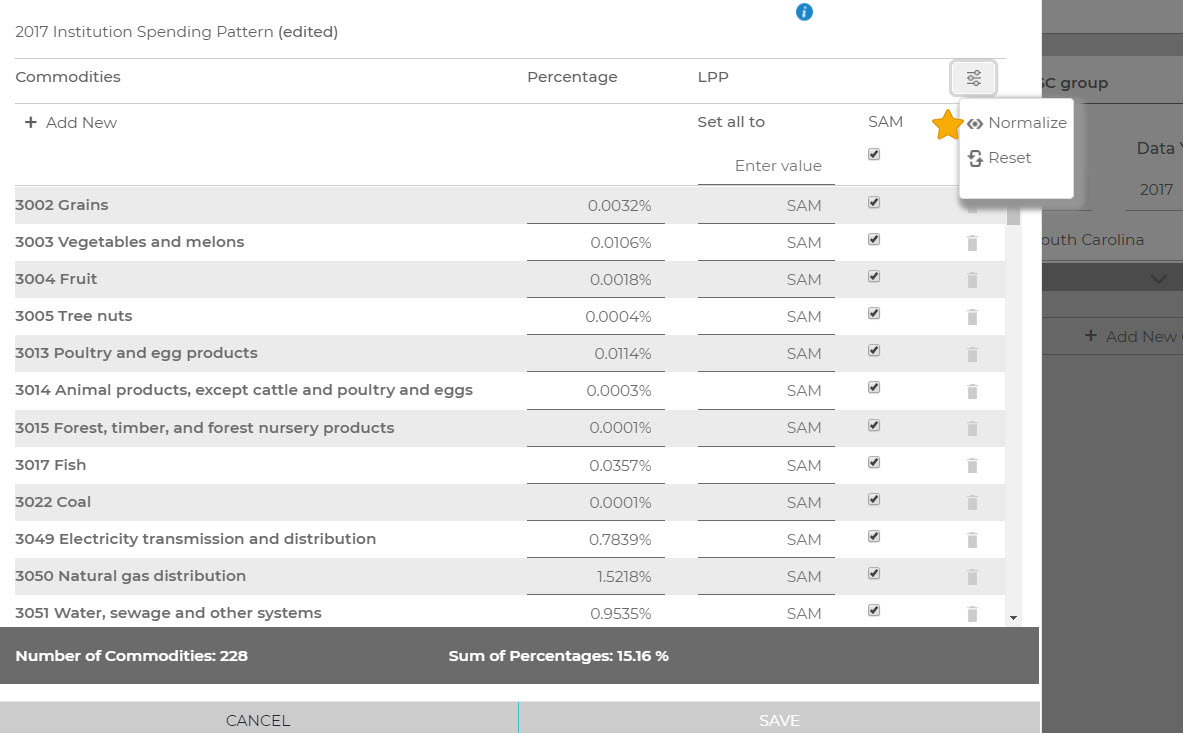

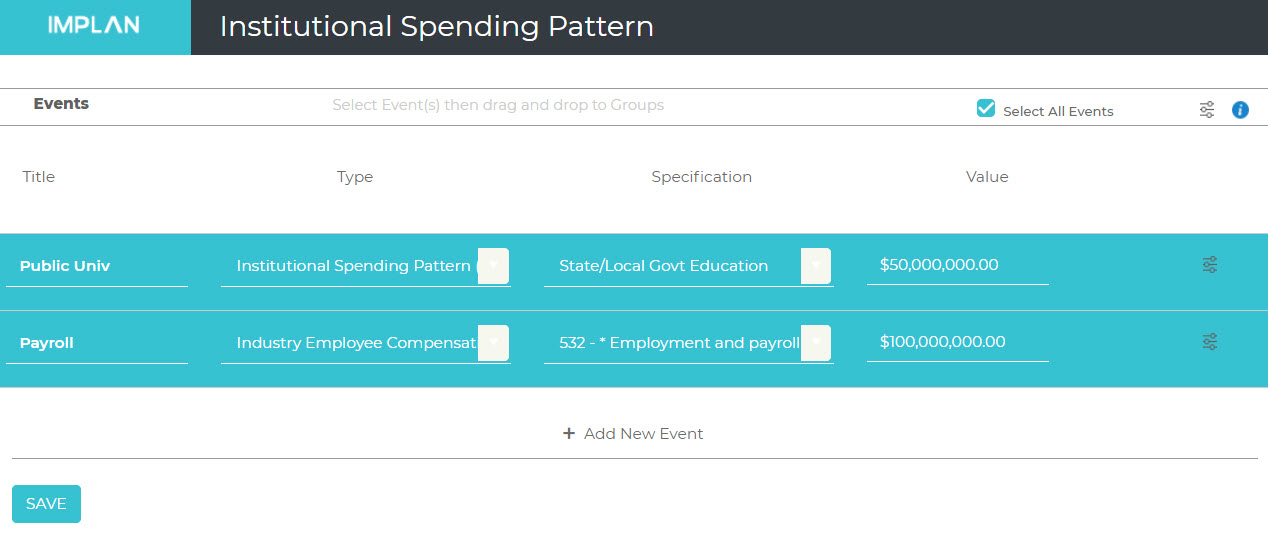

Governments can see savings as well when utility costs decrease. Analysts will need to determine how to model these cost savings. Knowing how the savings will be spent is key to being able to modeling the impact. If a new school is built with the savings, then a simple construction Event is appropriate. Perhaps you may only know which government entity will spend the savings, in which case you should choose from the Institutional Spending Patterns. When using an Institutional Spending Pattern, remember to modify it to remove the purchases of Commodities related to the utility generation you are examining.

CONSTRUCTION:

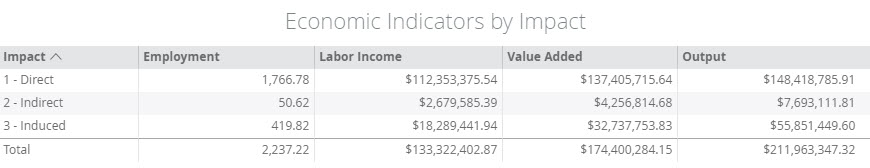

CONSTRUCTION:

Although temporary in nature, construction projects conducted by utility companies are often large and costly. Consider modeling this as a separate impact from operations or price changes.

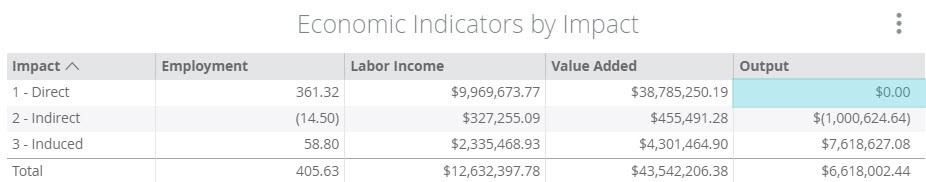

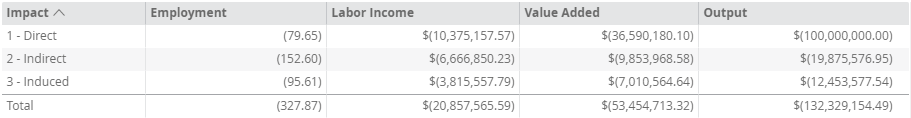

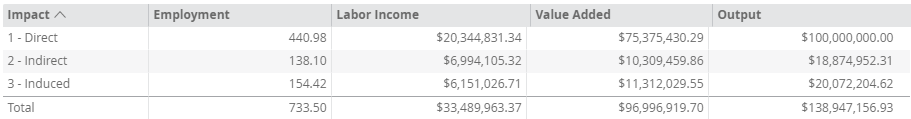

NET ANALYSIS:

NET ANALYSIS:

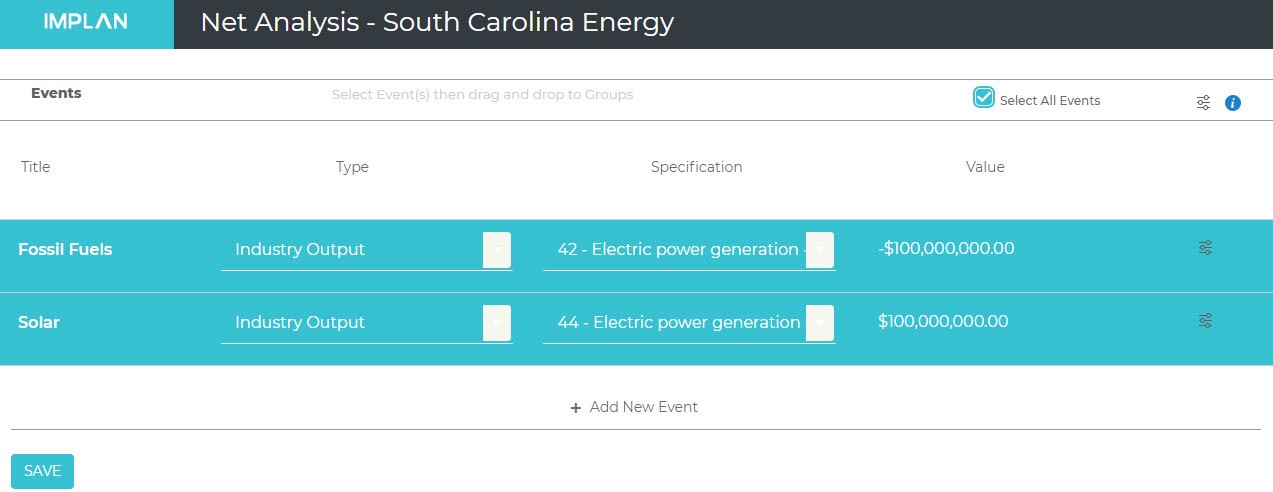

If a government entity is considering building a new facility to produce utilities more efficiently in the long-term, a Net Analysis should be used to model both the losses to private Industry and the cost savings to Government (increased spending) or Households (additional HH income). This assumes, however, that the utility company would not continue to produce that Commodity and that the previous local consumption could not be replaced by non-local consumption (exports).

HOUSEHOLDS:

HOUSEHOLDS: INDUSTRIES:

INDUSTRIES: GOVERNMENT:

GOVERNMENT: CONSTRUCTION:

CONSTRUCTION:

Student Spending

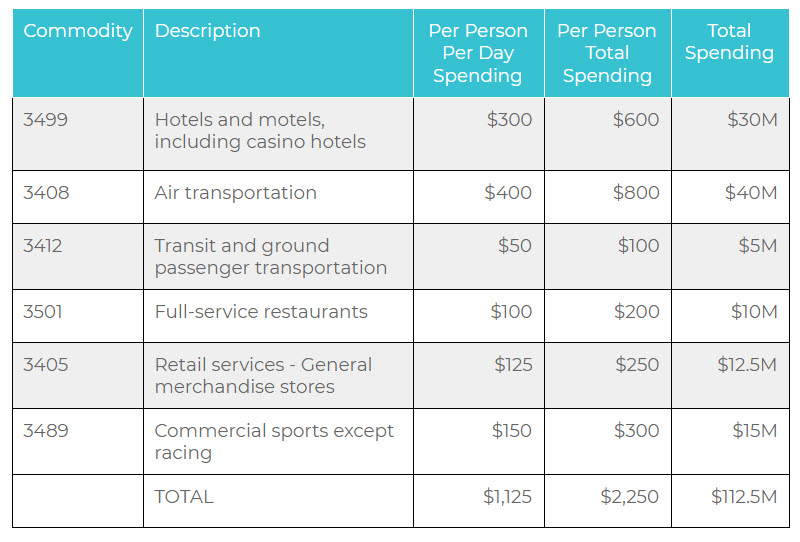

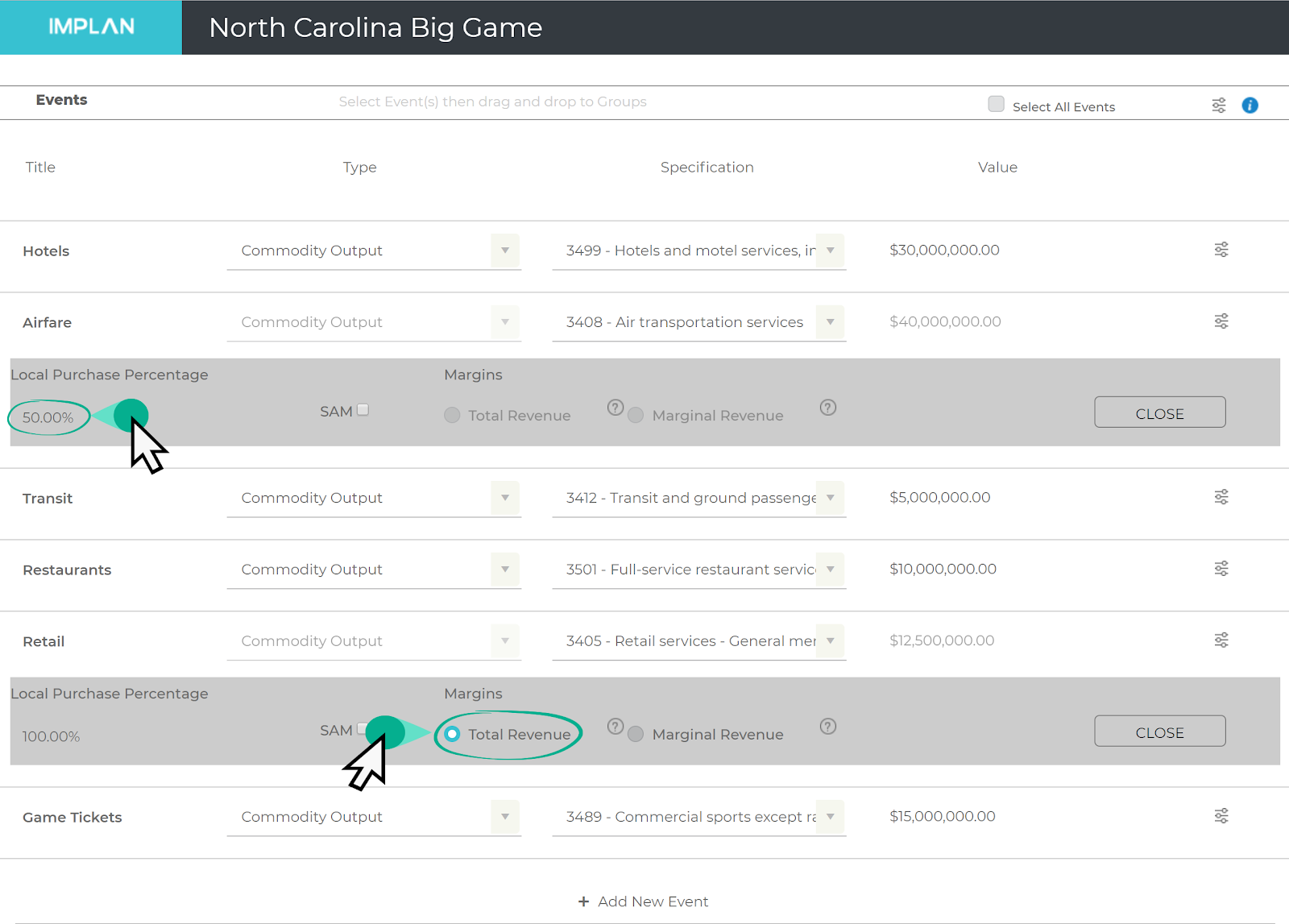

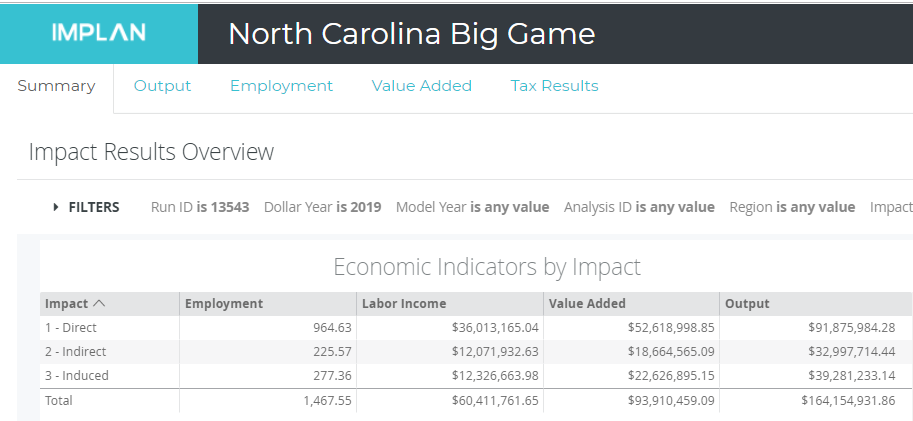

Student Spending Tourist Spending

Tourist Spending Business Spending

Business Spending