INTRODUCTION

So you heard the news: IMPLAN Pro is being laid to rest. It had a good run, being launched in 1999 as the second version of IMPLAN. Here we will outline all the good reasons why you will be so excited about jumping into IMPLAN Version 6! So here they are, all the Pros and cons. Get it?

NEW FEATURES

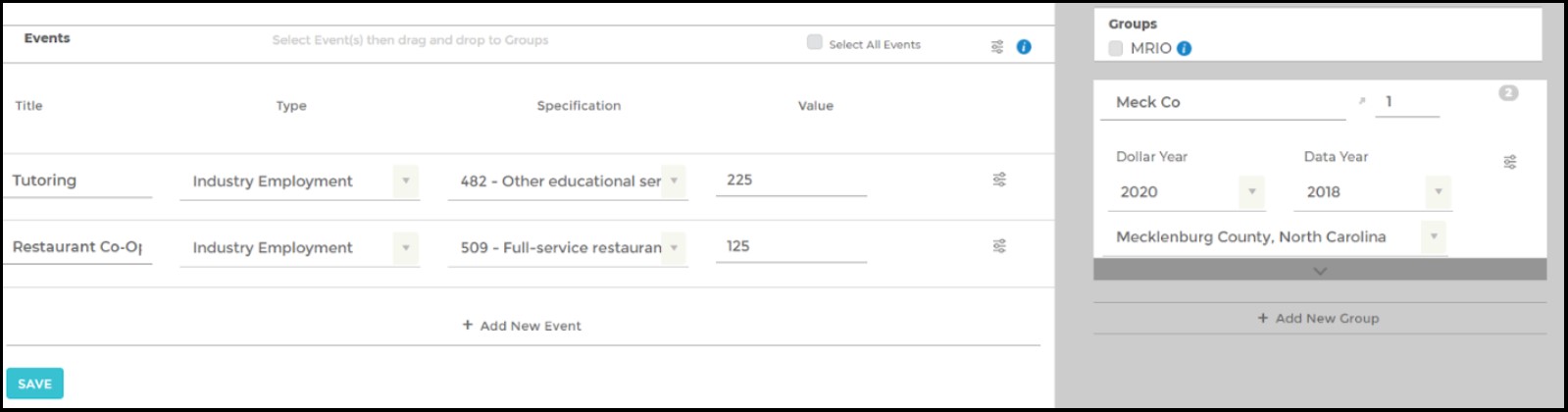

New Industry Impact Analysis Event and no more ABP

The newest version of IMPLAN contains a new Event Type: Industry Impact Analysis (Detailed). You can now enter Values for Employment (Wage & Salary and Proprietor), Employee Compensation, Proprietor Income, Labor Income, Intermediate Inputs, Taxes on Production & Imports, Other Property Income, and Output. Yes – you can now enter any or all of these Values in IMPLAN so Analysis by Parts is no longer required when you want to do something like zero out TOPI.

Event Tags

Event Tags are a feature in IMPLAN that allow you to organize events within your projects by creating self-defined (and color-coded) categories. This process can save you time and help declutter the screen for easy viewing. Now it is remarkably easy to organize your Events and assign them to Groups and to view your Results by the new Event Tags!

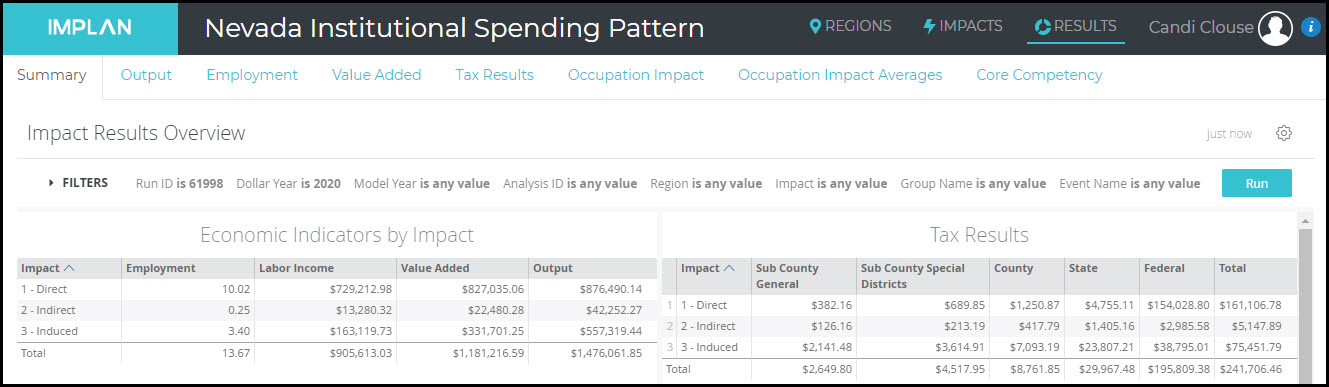

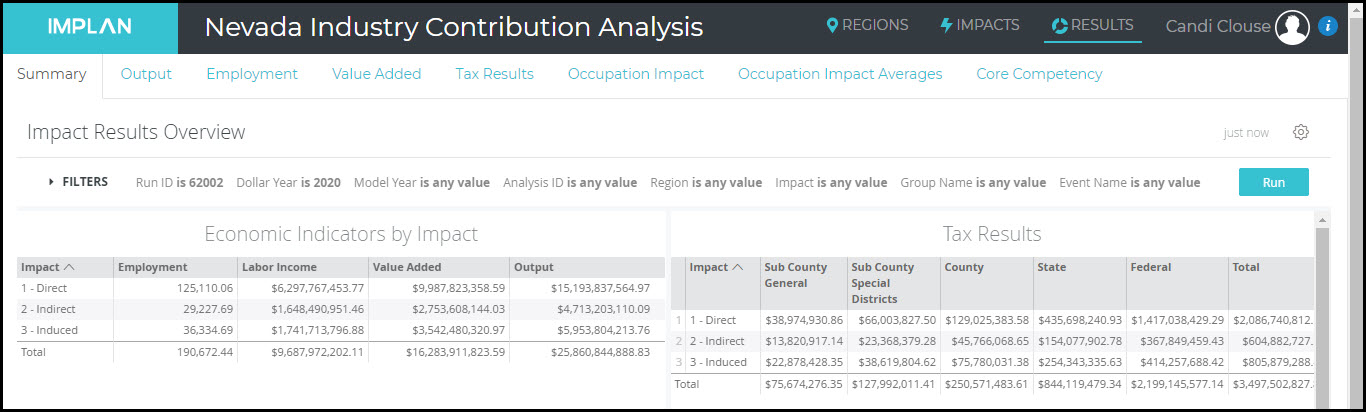

State and Local Taxes are now Split

One of my favorite things in IMPLAN is the ability to examine taxes at a more granular level than “State + Local.” Now taxes are reported at five different levels!

| Tax Level |

Explanation |

| Sub County General |

City & Township |

| Sub County Special District |

School, Fire, Police, etc. |

| County |

County & Parish |

| State |

Fifty Nifty States |

| Federal |

Internal Revenue Service (IRS) |

A new summary table on the Results screen gives a great overview.

You can also dig into the details to see what types of taxes are included in each subset like sales tax, property tax, etc. (Details can be found in the article Where’s the Tax?). The Tax Results tab lets you look at each of the taxes by Direct, Indirect, and Induced Effects by using the Impact Filter. You can also download anything using the Dashboard Actions (vertical ellipses).

Multi-Tab Functionality

IMPLAN now allows you to spread your work out across multiple tabs inside your internet browser while you’re working. Within the confines of even a single Project, you can open three different tabs in your internet browser and separate the Regions, Impacts, and Results screens across them in order to look at all your study’s components at the same time. You can also have the Results open for the same project open on multiple tabs with different filters on each.

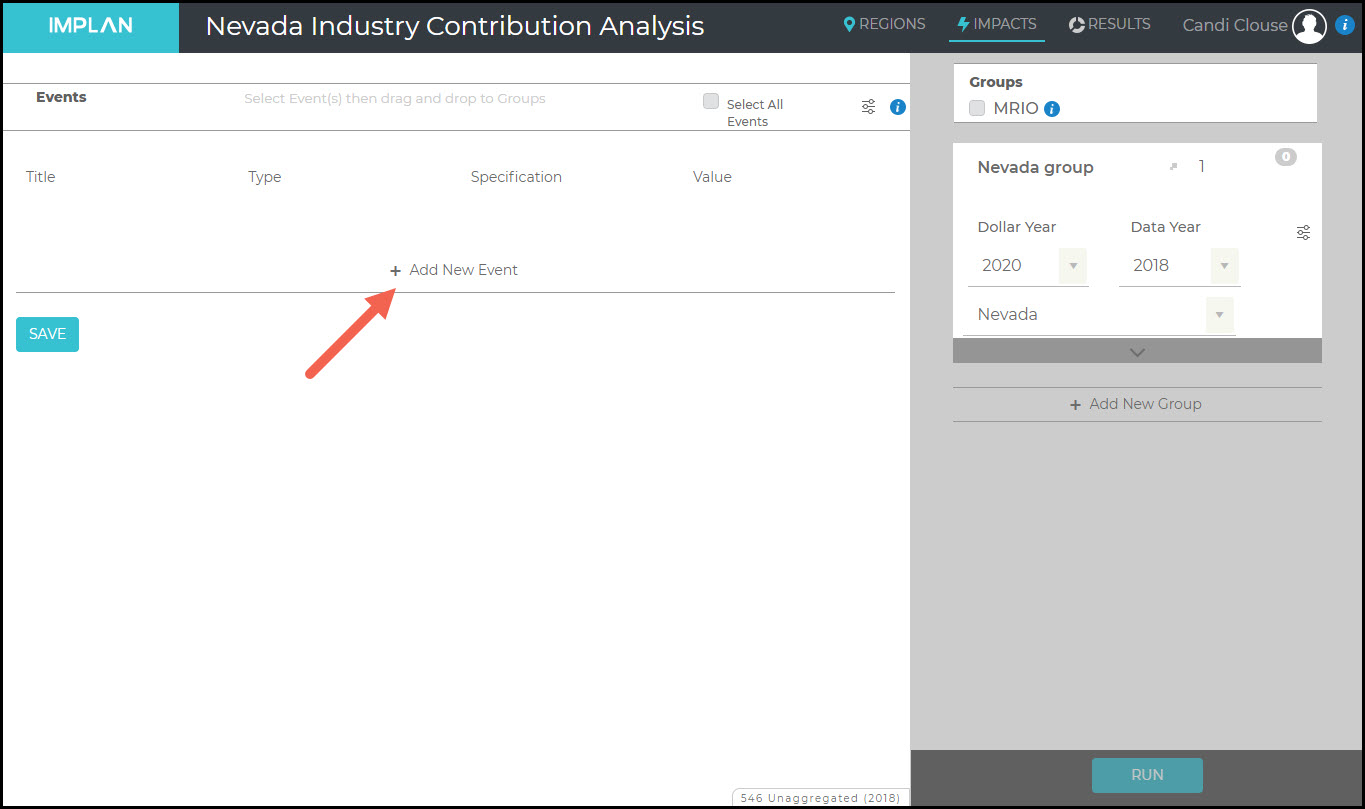

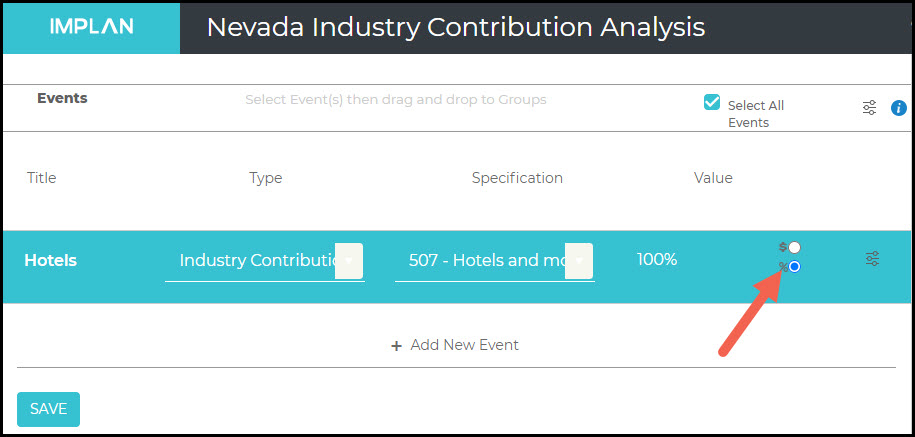

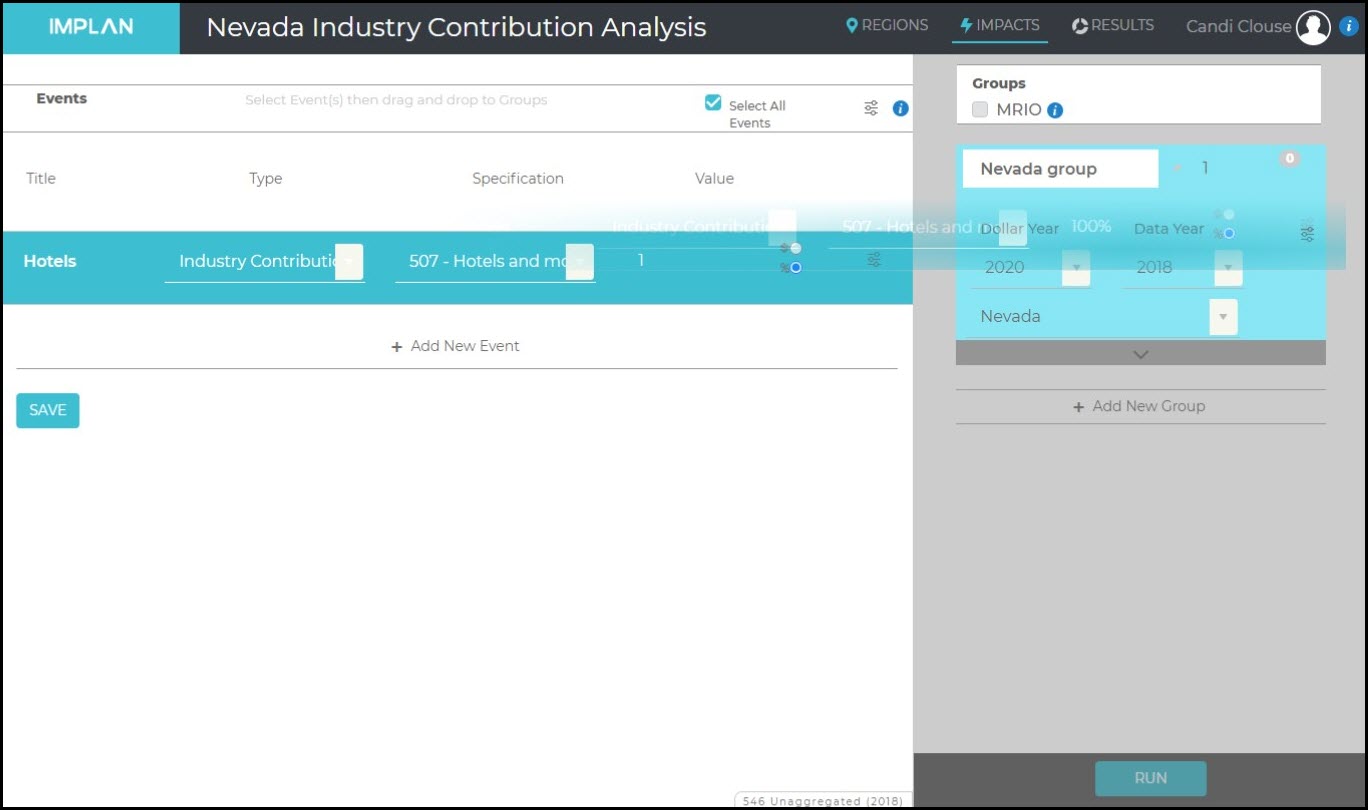

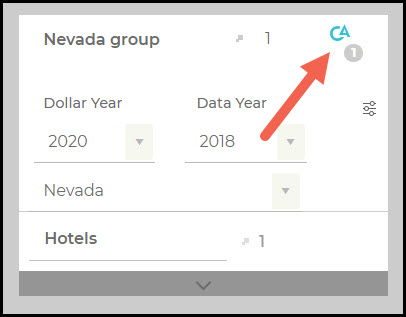

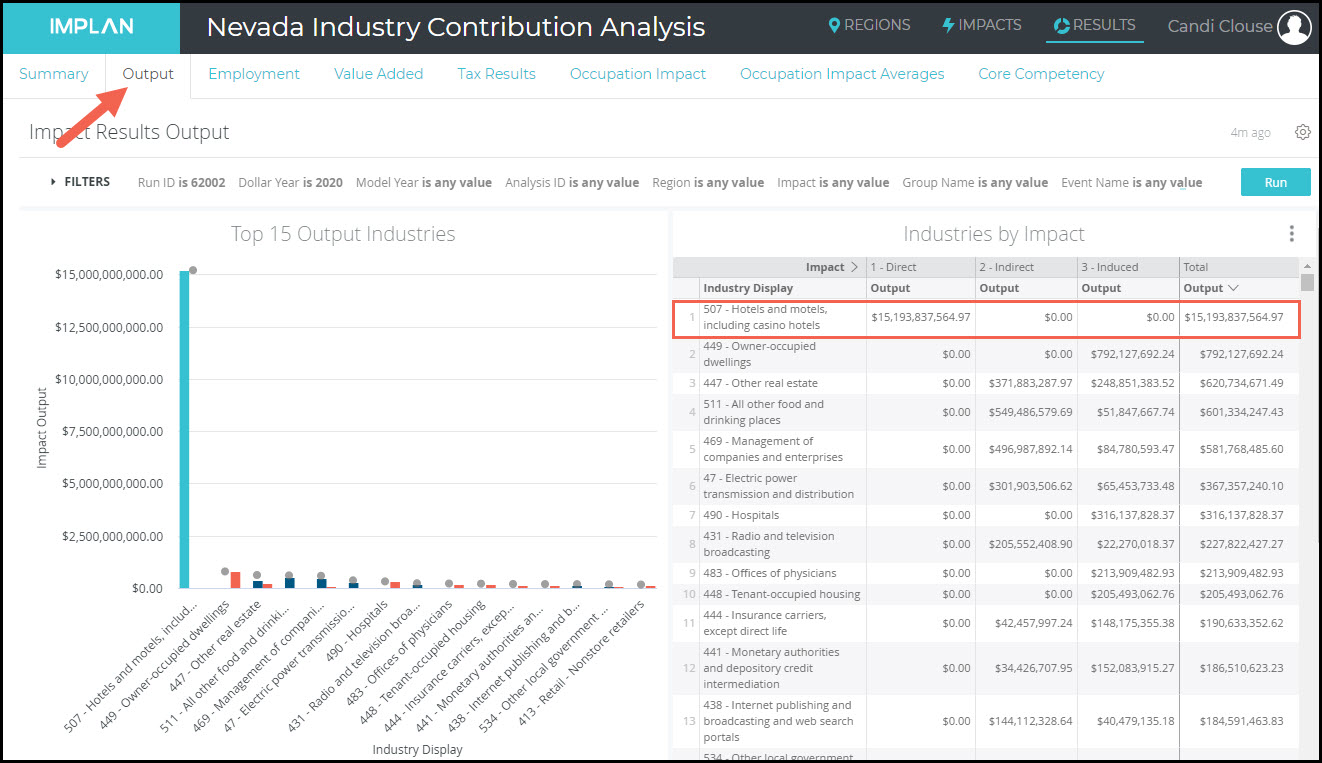

Industry Contribution Analysis with 1 Click

If you ever ran an Industry Contribution Analysis (ICA) or a Multi-Industry Contribution Analysis (MICA) in Pro, I am sorry. Based on the Hypothetical Extraction approach (Miller & Blair, 2009), this once tedious process is now just a simple Event selection. By choosing Industry Contribution Analysis as your Event Type, all the buybacks to the Industry or Industries that are included in your Group will be restricted. It’s that easy. In the results, the effects to the contributing Industries will be limited to Direct Effects that are equal to the Event Value(s) analyzed.

Combine Areas with the Region List

One of the newest features is the ability to combine Regions with just a few clicks, instead of the 99 clicks it previously took to create a Region for North Carolina less Mecklenburg County. The new Region List function is available for State, County, and Zip Code Regions allowing you to “select all” to get all the Counties within a State, for example.

IMPROVEMENTS

Updated Event Template

IMPLAN now allows users to upload any Event type using the Event Template in a streamlined spreadsheet far less quirky than previous versions. The sheet has one tab for each Event Type including Industry Contribution Analysis. You can even utilize Event Tags via this template.

More Data in Region Details

There are some great additions to the data in Region Details. First, there is a new table called Industry Averages under Study Area Data. This table shows the average per worker values for components of Output; calculated as the value divided by Employment. Per worker values are calculated for Output, Labor Income, Employee Compensation, Proprietor Income, TOPI, and OPI. The Industry Detail table in Study Area Data now splits out Wage & Salary Employment from Proprietor Employment. There are also new tables for Occupation Data and Environmental Data.

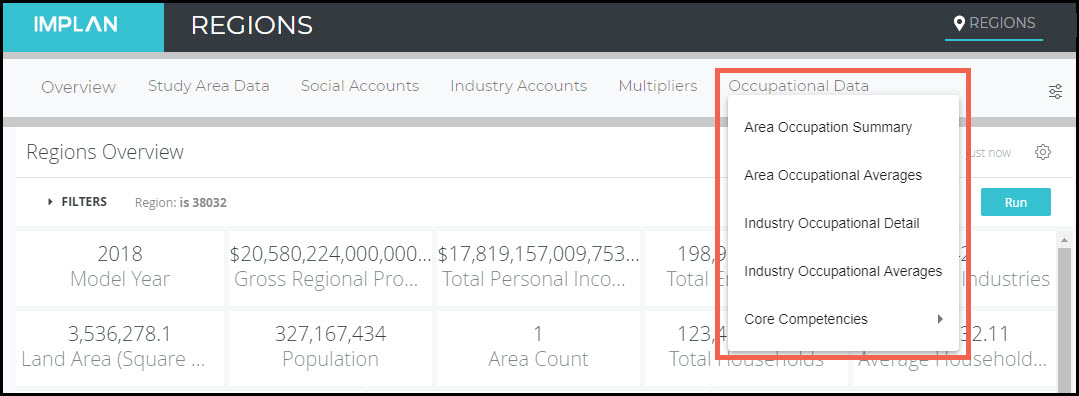

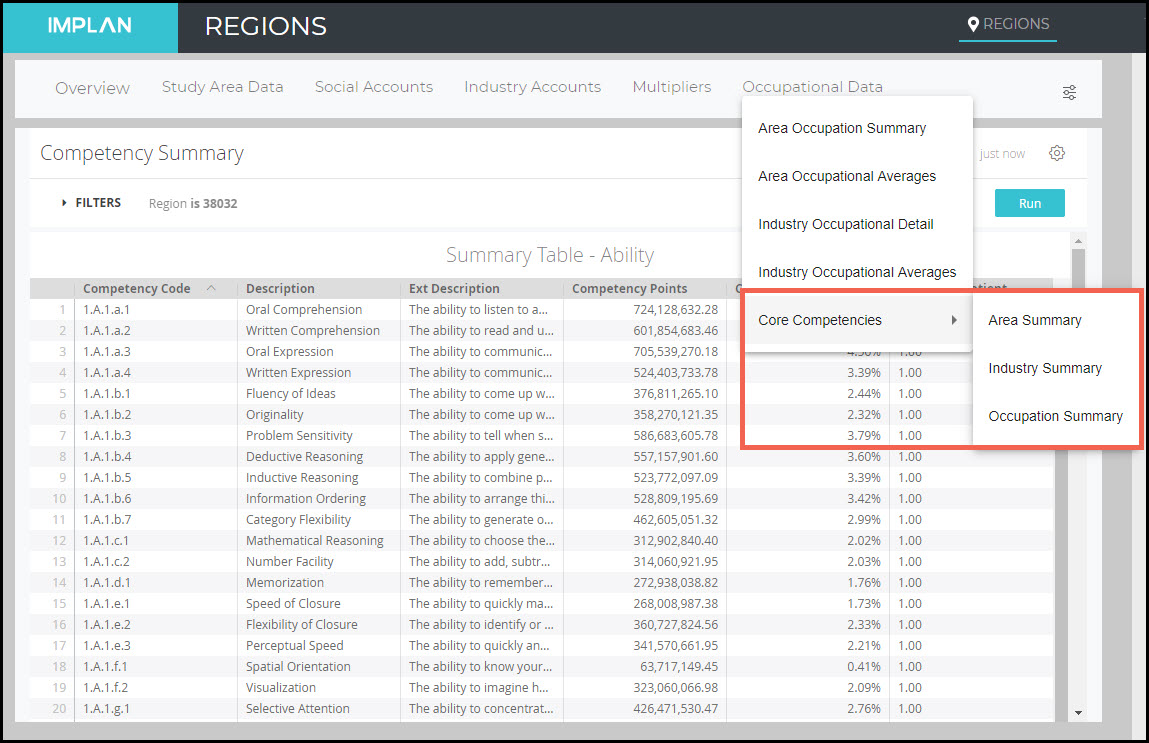

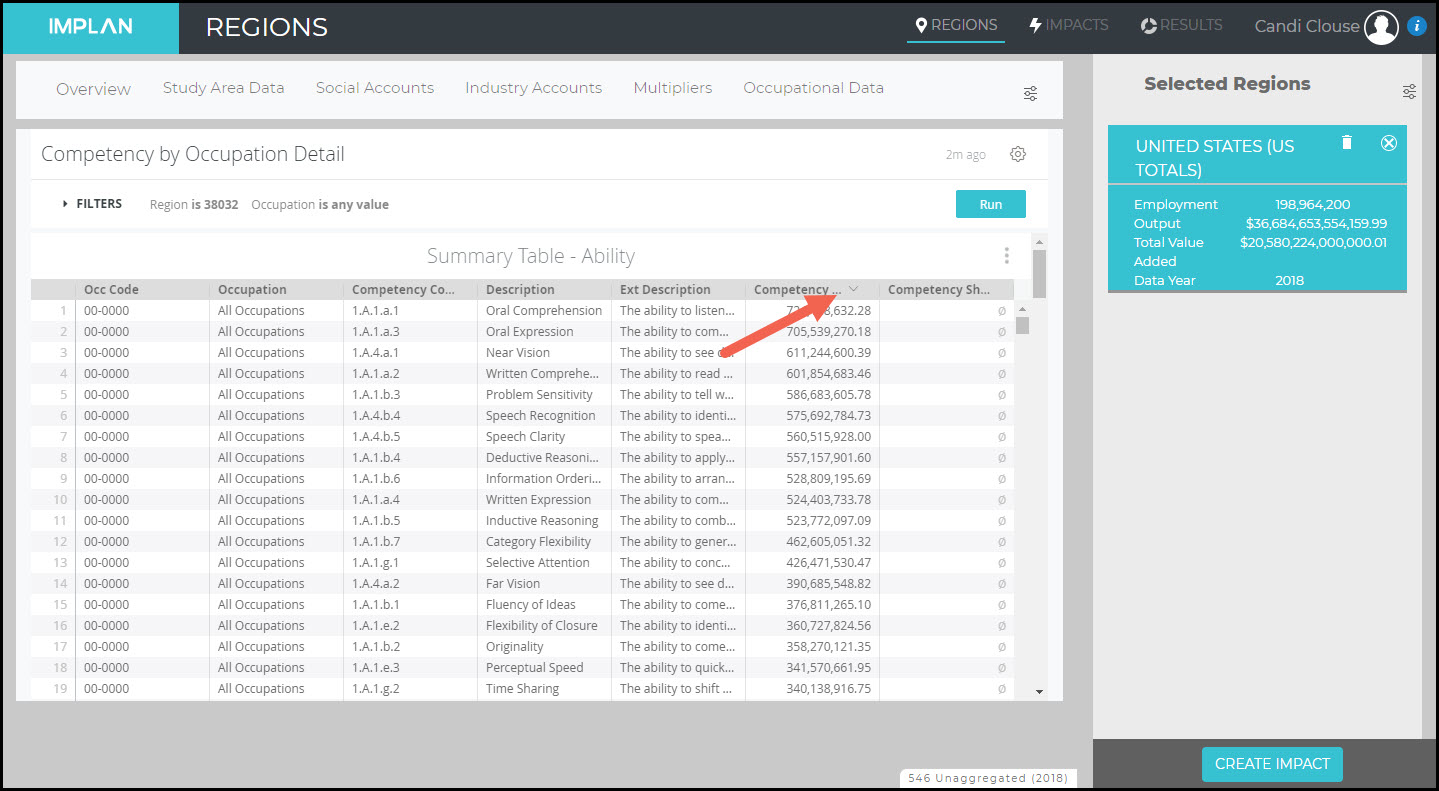

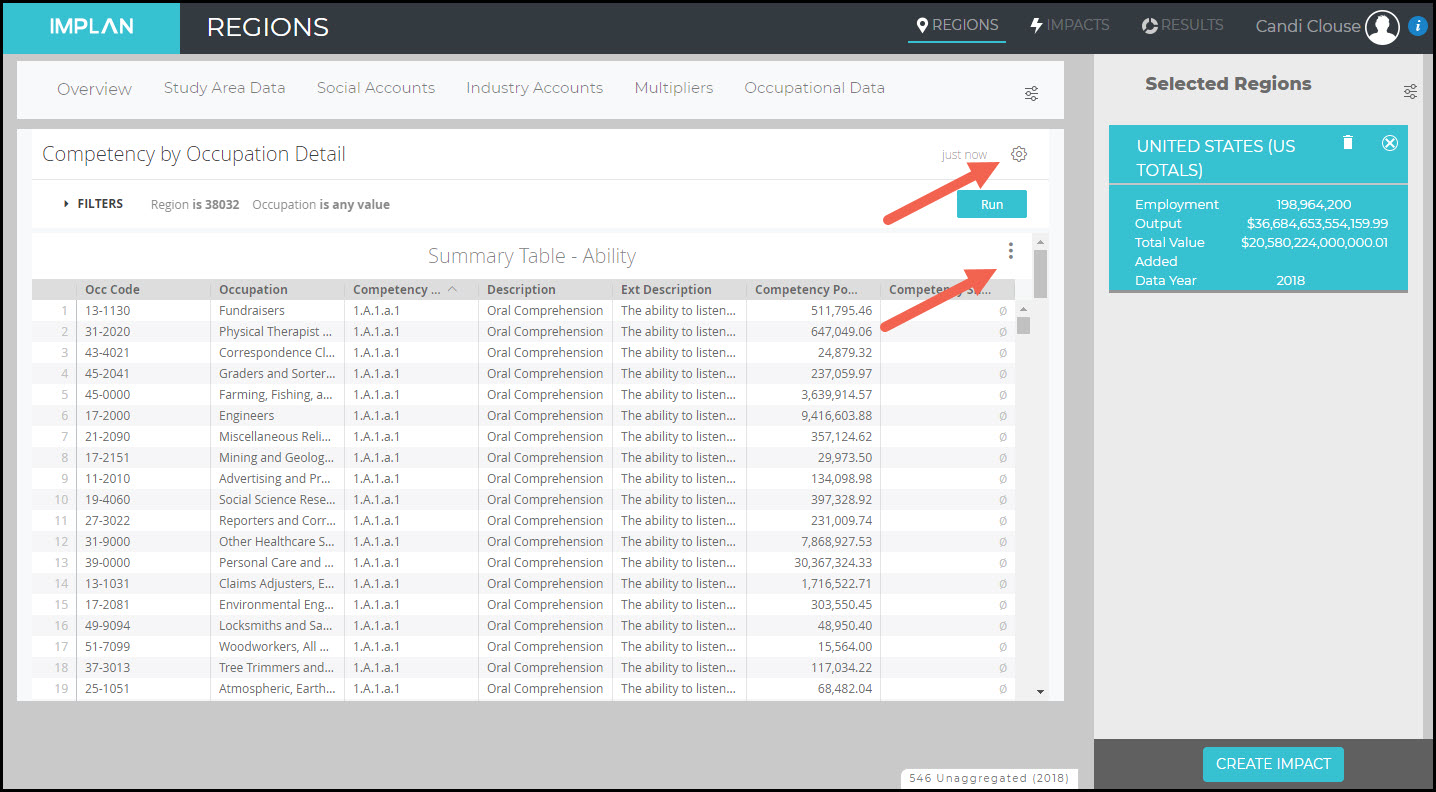

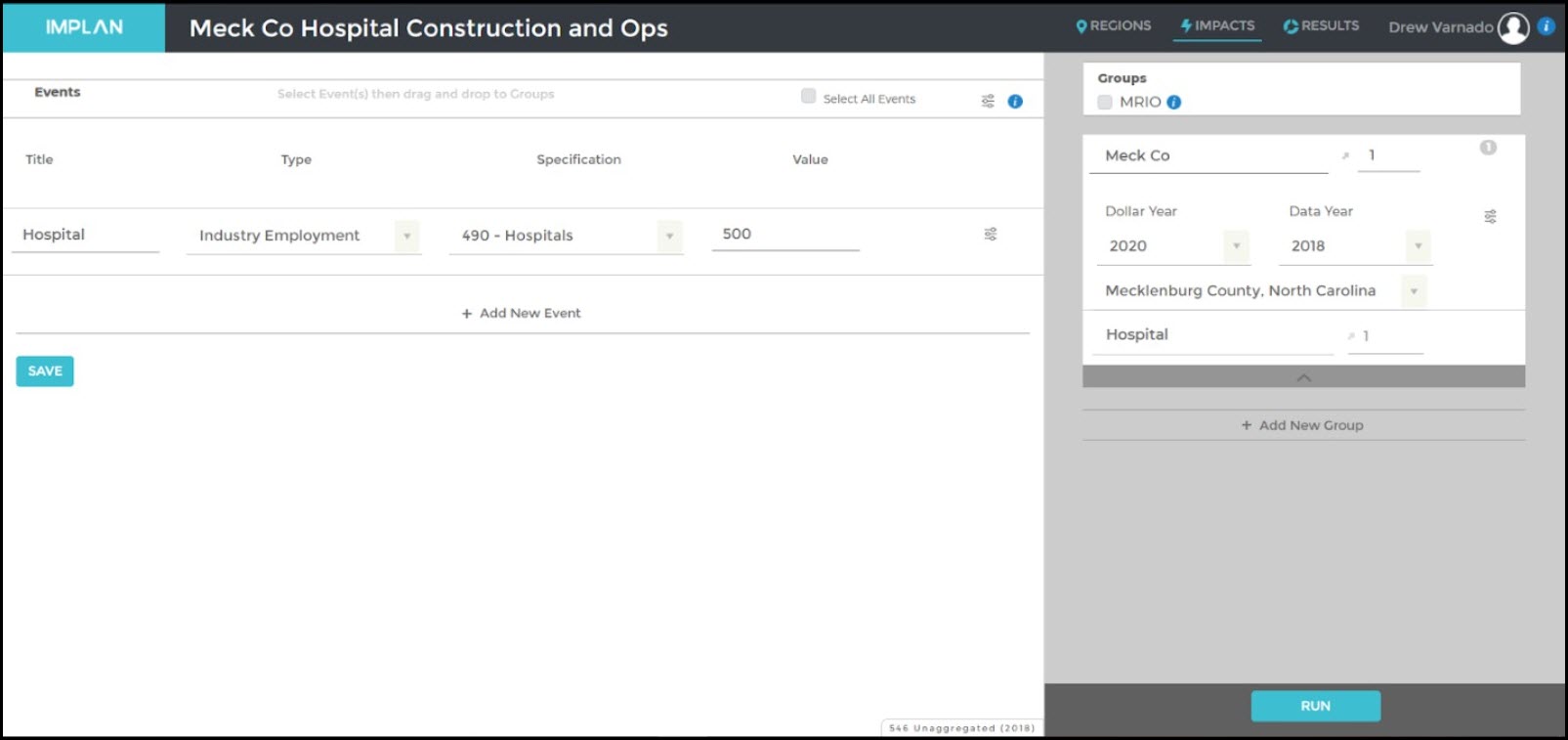

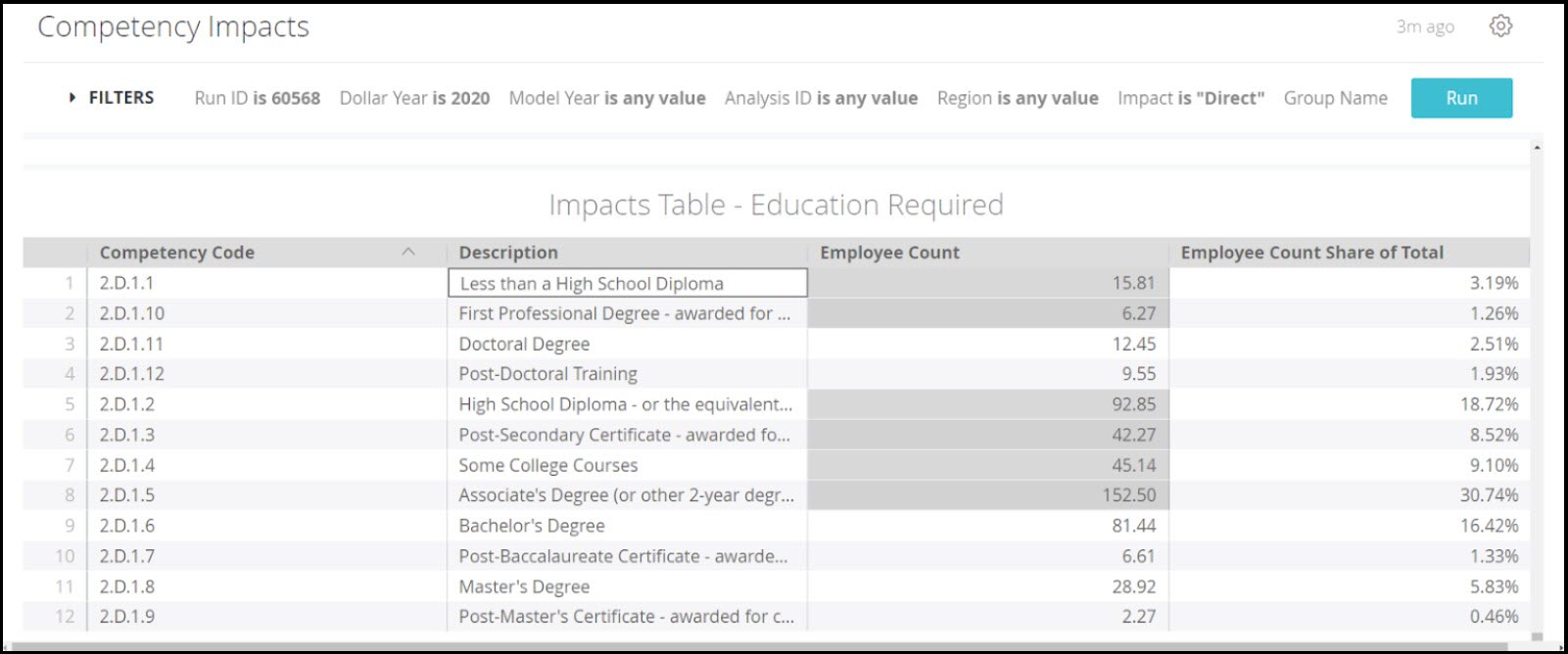

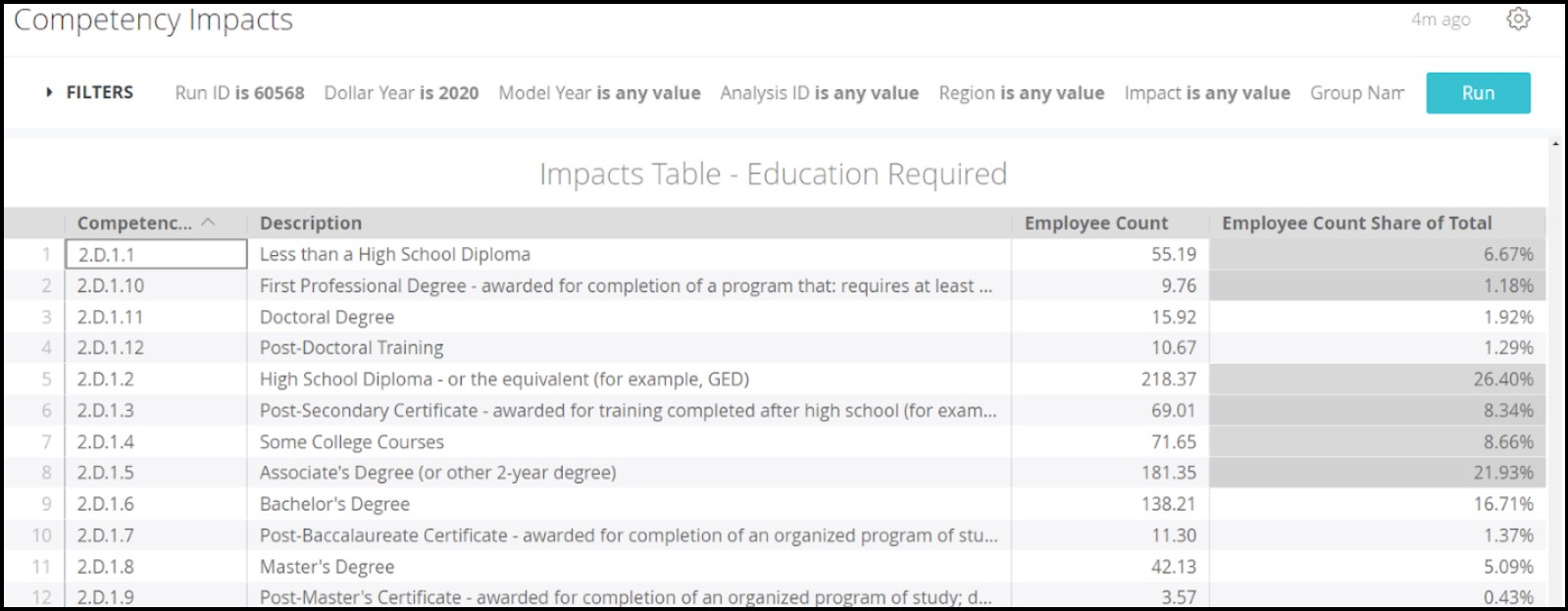

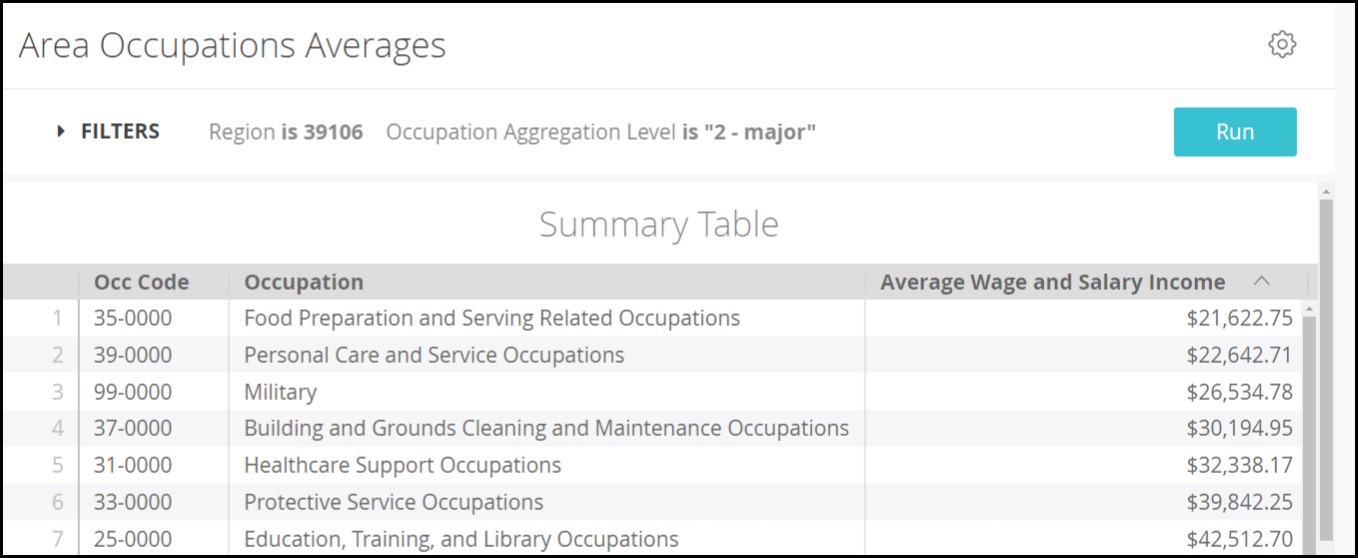

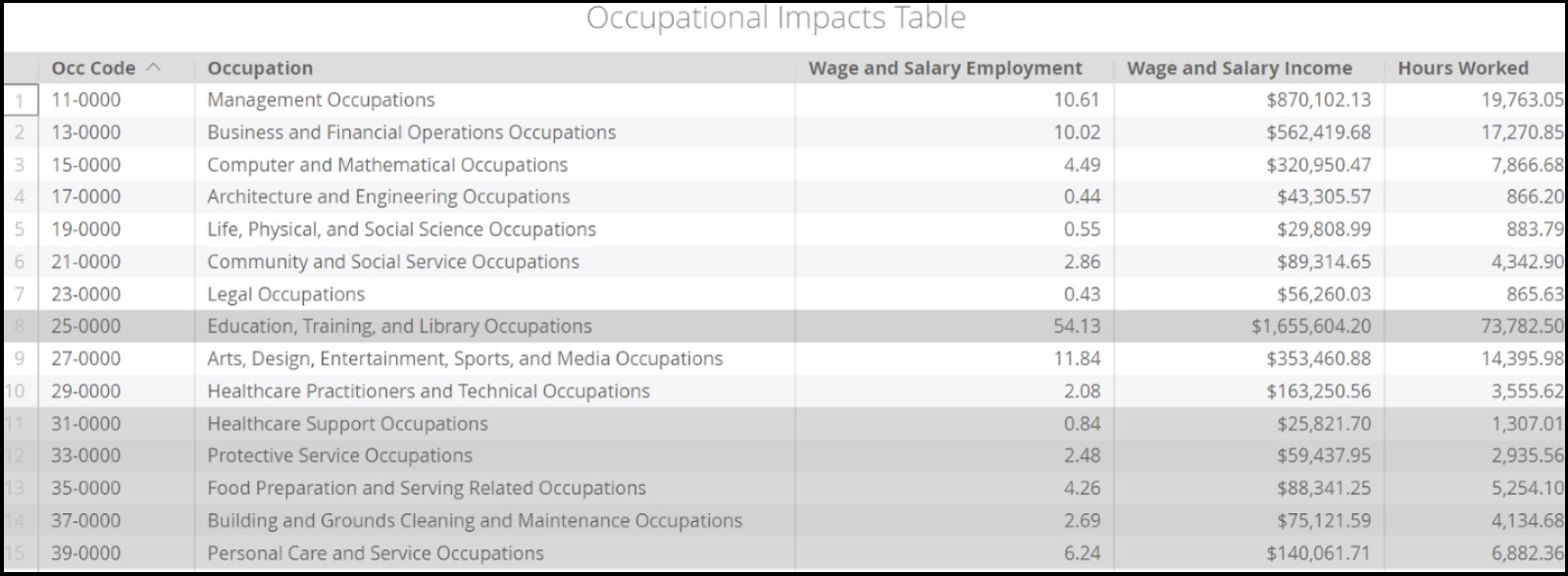

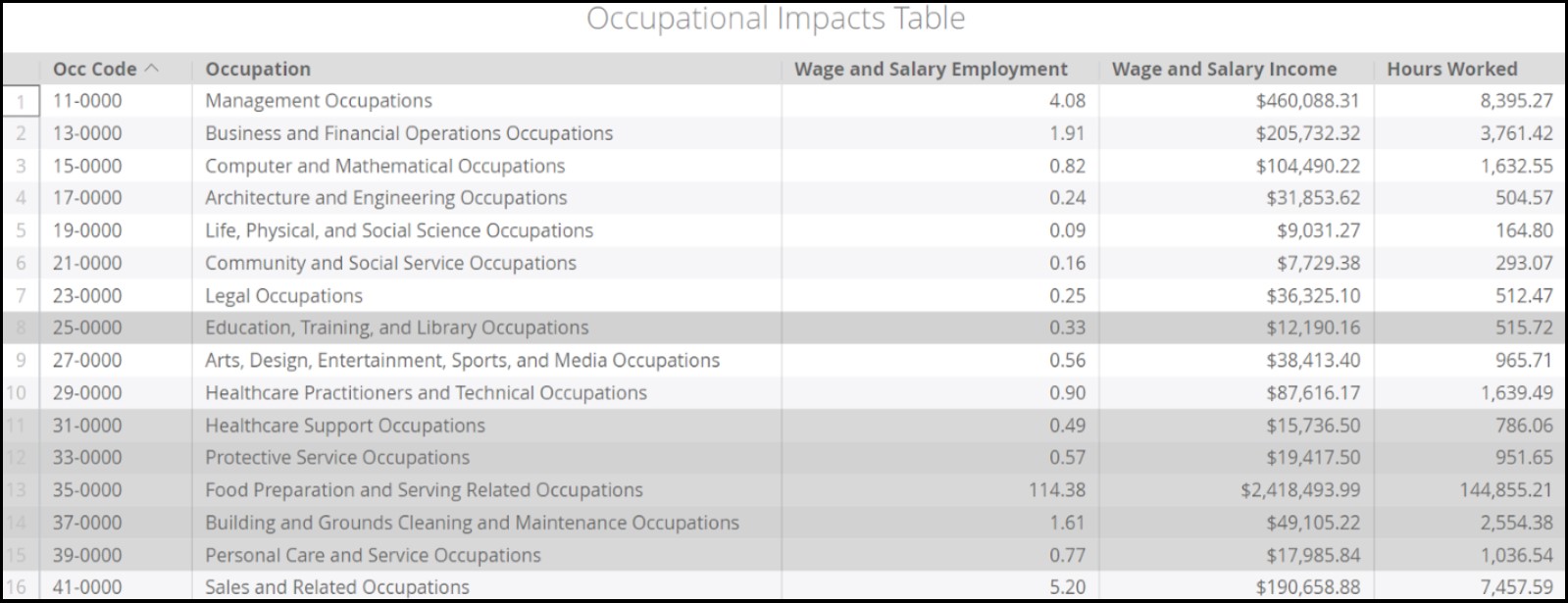

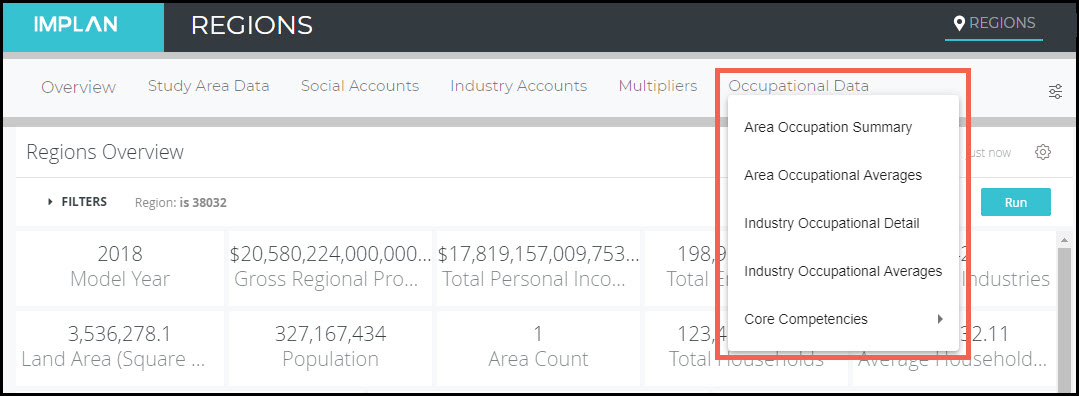

Occupation Data

IMPLAN has added its occupation employment by industry data which shows estimates of occupation employment, wages, hours, and core competencies (including knowledge, skills, abilities, education, work experience, and on-the-job training levels) for over 800 different occupations. Access to Occupation Data makes these details available in the Region Details and Results of all Projects, including Projects using combined regions, customized regions, and aggregated industry schemes! The Occupation Data will even show up in all the Projects you ran previously.

Environmental Data

Environmental Data is now available in the IMPLAN application. Although it is national in nature, the data contains eight satellite accounts for different pollutants with detailed tags under each one. That national environmental Industry ratios are applied across all of the data available in IMPLAN. You can examine the environmental footprint of your region in Region Details and see the environmental impacts that are associated with your economic impacts!

Data Library

IMPLAN Data Library is a feature that allows users to compare data across Regions, Industries, and time. You can examine all of IMPLAN’s data from 2001-current including data on Commodities, Industries, Environmental, Occupation, Trade Flow, Tax, Core Competencies, Deflators, Demographics, and Employment & Wages by NAICS (Imputed CEW Data). Data Library is great when you want to compare any piece of IMPLAN data and show the Results in a table, map, or graph.

More Data Years

IMPLAN now displays data for 2001 all the way through the most current Data Year that can be examined with just a click of a drop down menu. That means you can examine the details of your Region in any Data Year, including the two special COVID datasets. You can also now choose your Region by typing the name or by clicking on the map.

Due to programming limitations in Pro, the newest IMPLAN Industry Scheme can only display 544 instead of the full 546 Industries. IMPLAN includes a split between “hospitals and health services” and “other services” within state and local government entities that is not available in Pro.

MRIO is Bigger and Better

The new version of IMPLAN comes with a few great improvements to Multi-Regional Input-Output (MRIO). First off, it is now multi-angular. In IMPLAN Pro, MRIO allowed users to observe the ripple effects of impacts which are occurring in a specific economy throughout its neighboring economies. However, when doing this, the software is unable to let users observe any Direct Effects upon economies besides that in which the original Impact is occurring. Basically, you could link two Regions, but Events could only occur in one of them. So, despite offering insights into multiple economies, MRIO analyses were limited to a singular, outward perspective. Now, different Events can be entered in multiple linked Regions via MRIO. Using the Filters on the Results screen allows for the examination of the intricacies of these complicated analyses.

The IMPLAN Product Team is always working on improvements to reduce the time necessary for large MRIO projects to run. Both Versions 5.16 and 6.2 brought performance enhancements to the run time. Now, more Events can be run in more Regions.

Also, when using a Labor Income Change in IMPLAN Pro, the software incorrectly reported Indirect and Induced Impacts. Now, the Results from a Labor Income Event linked via MRIO correctly yield only Induced Results.

Improved SAMS & Multipliers

Social Accounting Matrices (SAMs) expand upon the traditional I-O tables to also include transactions between Industries and Institutions and between Institutions themselves, thereby capturing all monetary market transactions in a given time. The SAMs in IMPLAN Pro and IMPLAN Online reported commuting as net flows and sub-national SAMs consolidated all reported commuting into the Domestic Trade account. But, now SAMs report commuting as gross flows, meaning you can see total in-commuting and out-commuting at both state and county levels. Also, SAMs retain all reported foreign commuting within the Foreign Trade account.

When using MRIO in Pro, Employee Compensation sent to linked Regions for generating Induced Effects incorrectly failed to remove payroll tax before applying the commuting rate. This means that most of the time the Induced Effects were overstated. This is no longer the case.

These improvements to the SAMs, and therefore the multipliers, both make it easier to observe estimated commuting flows both into and out of economies and are more on target with regional economies. Some payments to governments have been reclassified in IMPLAN, like rents and royalties paid from Other Property Income (OPI) to governments rather than from Taxes on Production & Imports (TOPI). Such changes serve to align the new IMPLAN’s SAMs with National Income and Product Accounts (NIPAs) from the Bureau of Economic Analysis (BEA) to improve the quality of both tax and impact results.

Improved Trade Flows

Due to its internal consistency and ability to account for spatial variables like the proximity and size of alternative markets, the trade flow method is presumed to be superior to the econometric method for estimating regional RPCs. The IMPLAN National Trade Flows Model uses actual trade data and estimations and a Gravity Model. In IMPLAN Pro, it required extensive amounts of data to be stored locally. For this reason, the state and county models in IMPLAN Pro use this option (unless you specify otherwise), but the zip codes and the US total used Econometric RPC which allowed Pro to make estimates without using the gravity model.

The new version is based in the cloud so we don’t have this limitation. This means states, counties, and zip codes all use the gravity model method to produce trade flows. The options for Supply Demand Pooling and Econometric RPCs are considered inferior and therefore not a part of the newest version of IMPLAN.

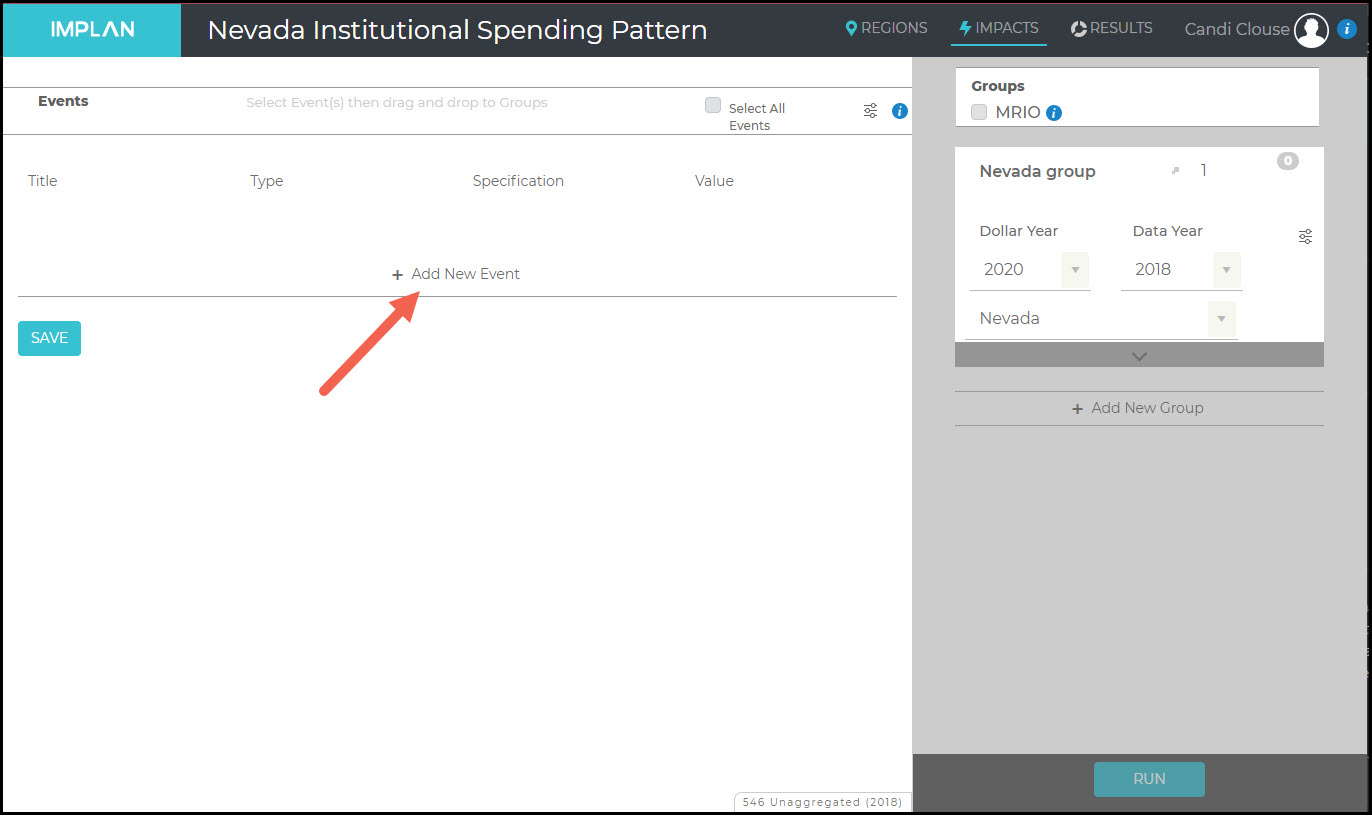

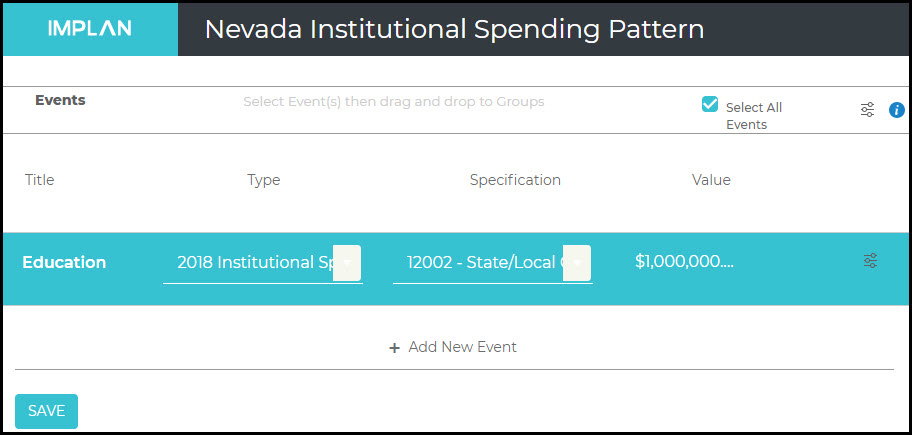

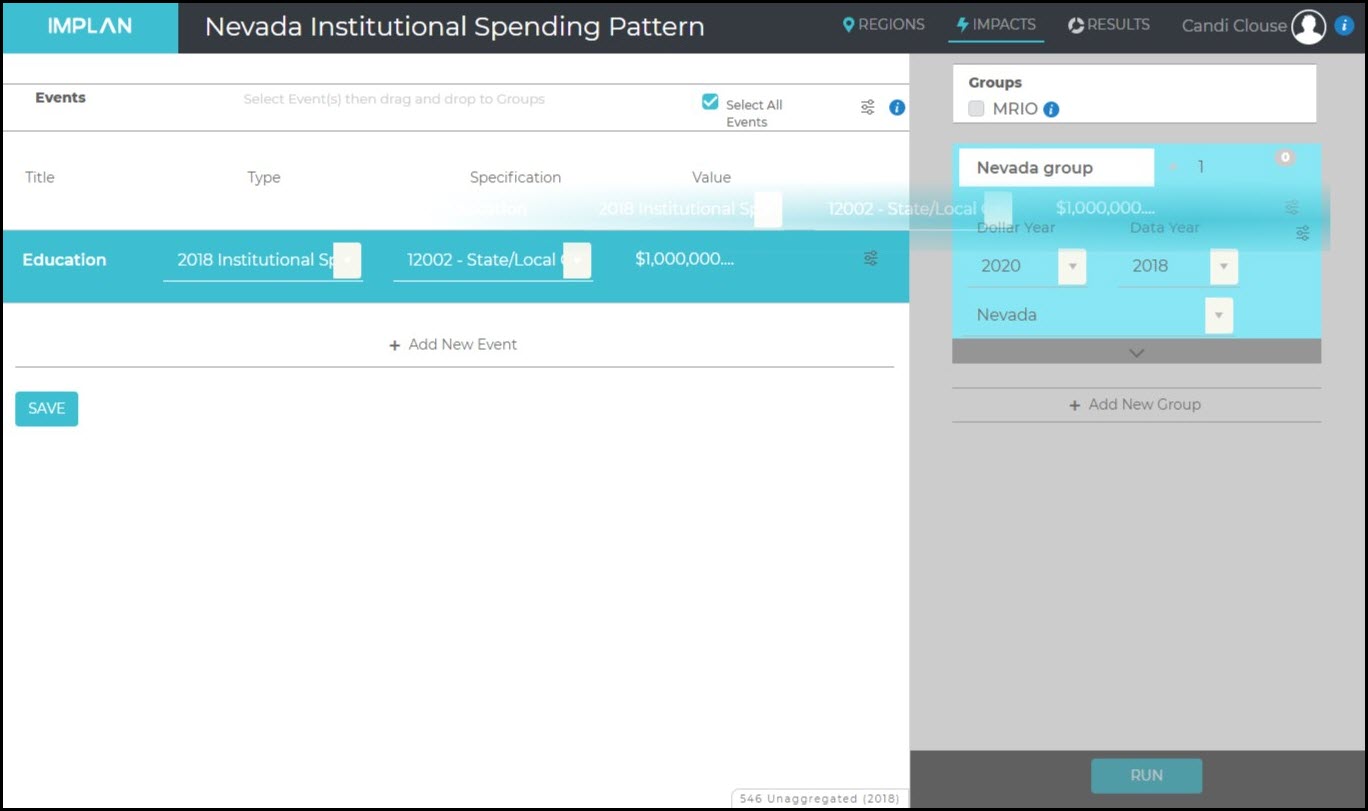

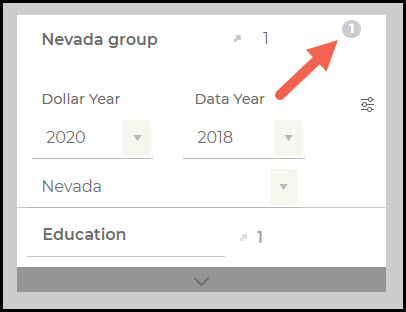

Easily Edit Industry Spending Patterns

In previous iterations of IMPLAN you had to import an industry spending pattern into the program itself, customize it to your liking, and then use that customized spending pattern as a proxy for your study’s selected IMPLAN Industry. Now, even that’s easier. To edit an industry spending pattern in IMPLAN, simply select Industry Spending Pattern as your study’s Event Type and then modify it to your liking.

Name Changes

The new version of IMPLAN also brings some improvements to naming conventions.

| Old Name |

New Name |

| Activity Type |

Event Type |

| Industry Change |

Industry Output

Industry Employment

Industry Employee Compensation

Industry Proprietor Income |

| Commodity Change |

Commodity Output |

| Intermediate Expenditures |

Intermediate Inputs |

| Other Property Type Income |

Other Property Income |

| IMPLAN Sector |

IMPLAN Industry |

Improved Communication and Messaging

The IMPLAN Product Team is working to ensure that all functionality is up to your high standards. Occasionally issues do arise and we document all Known Issues. There is also a whole host of new error messages to help you navigate when something might be off. This is a big improvement over Pro asking if you would like to let IMPLAN know about the issue before it crashes, right? Spoiler: Pro never tells us anything.

Customized Support

Some IMPLAN users have built custom macros, automations, and reports using IMPLAN Pro. Many of these processes are targeted at exporting large amounts of data. For example, we have seen users who need to run the exact same scenario in a large group of Regions and export all of the Results. Still other users are looking to export model data like multipliers or per million dollar effects by Industry for a large number of Regions. IMPLAN is now capable of helping you with these processes through Data Services. That is, instead of working with macros around IMPLAN Pro files, our team can simply pull the data you’re looking for and send it to you in a variety of formats to help you get what you need quickly and easily reducing the time and effort needed to get your research moving.

Our staff is here to help ensure that your transition is seamless. We can assist in setting you up with model building, project building, analysis processing, extracting results, pulling model data and other custom data services. Just email support@implan.com with your project details.

MORE TO COME

There are just a few things from Pro that our Product Team is working on adding to IMPLAN Version 6. Stay tuned as they are on the job.

- User Year Preferences – NEXT RELEASE

- Total Value Added Multipliers – NEXT RELEASE

- Support for 51 State MRIO Projects – NEXT RELEASE

- Project Organization

- Leakages of Direct Effects on Results

- Editing margins – check out the workaround

- NAICS to IMPLAN Searching

- Batch processing