INTRODUCTION

Your answers to the questions you should ask yourself when preparing your analysis: Who, What, Where, When and Why can range in level of detail widely. The more information you bring to IMPLAN, the more detailed your analysis can be defined. IMPLAN is based on Input-Output Analysis which quantifies the secondary demands supported across industries within a given Regional economy due to some primary economic effect. The primary, initial change or effect is entered into IMPLAN using Events by the analyst, you! Therefore you need some information about the level of production, spending, or income/revenue generated from the economic Event you are analyzing.

This article specifically speaks to defining the What element of your analysis, which corresponds to your Event Values and other Event Settings when entering your analysis into the application.

The “What” element of your analysis simply refers to the quantified size of the economic Event you are analyzing. Who answers the Industry, Commodity, Institution or Income type responsible for the initial effect being analyzed.

The more data brought into the application from outside of IMPLAN the more IMPLAN data points and averages are being replaced with the analyst’s known values or assumptions. More specificity is added to the analysis when more data is known about the effect and is incorporated in the setup of the analysis in the application. Doing so takes time, effort and attention to detail to prevent any unintended errors. Taking the time to add extra specificity to your analysis is recommended when the data to do so is available and that data is reliable, the “Who” of your analysis spends differently than the norm for this actor in the economy or how IMPLAN says they do, or the details of your analysis will be heavily criticized by your audience.

INDUSTRY CONTRIBUTION ANALYSIS

Industry Contribution Analysis (ICA) is appropriate when you’d like to estimate how existing production supports demand to other Industries in the economy. As a rule of thumb, we recommend using ICA especially when the existing production you are analyzing makes up more than half of its Industry. ICA allows you to quantify the extent to which that Industry is connected to the Regional economy and on the other side what an economy stands to lose in the hypothetical scenario that the Industry leaves the Region.

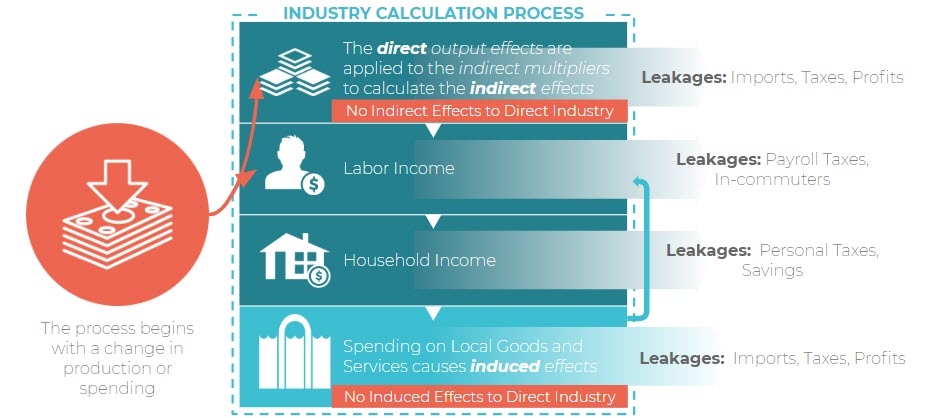

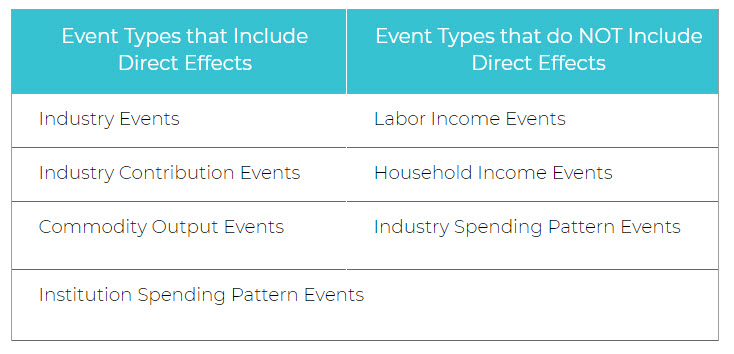

ICA Events in IMPLAN differ from other Event Types, used to analyze Impacts, as they restrict any purchases back to the Industry such that the Indirect and Induced Effects for the specified Industry will always be zero in the Results.

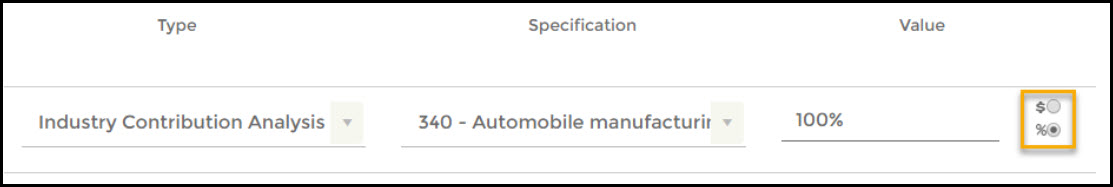

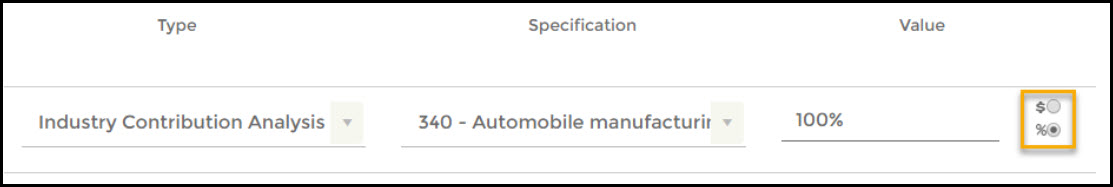

The Event Value of an ICA Event can either be an Output ($) or a percentage (%) of the Output in the Industry according to the Region Details behind the “i” in the Study Area Data. No other data points can be used in ICA. If you’d like to estimate the contribution of an Industry based on an Employment number, you’ll need to first convert the value to Output using the data in:

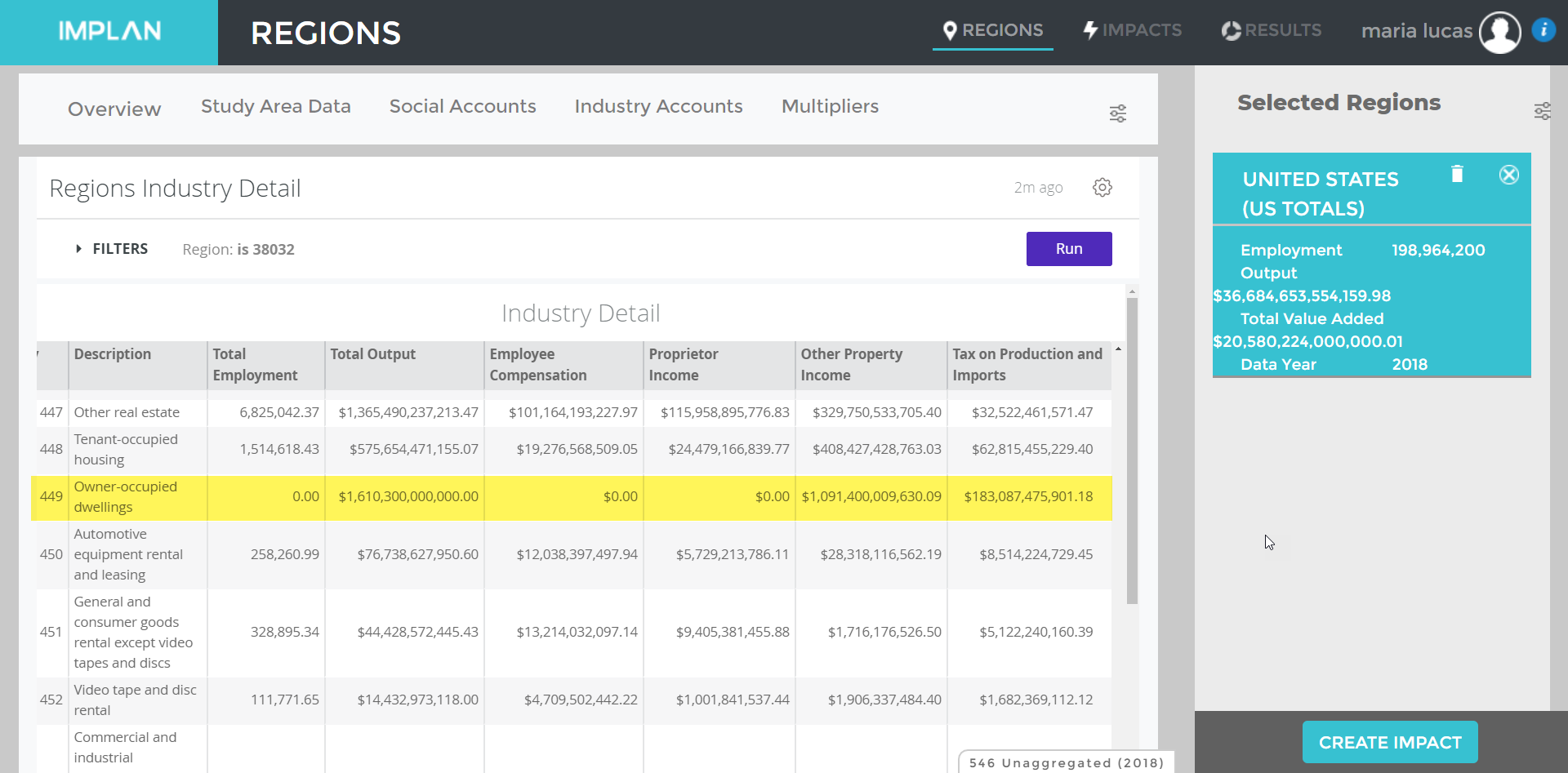

Study Area Data

> Industry Summary

Find the row for the Industry you are analyzing and find the intersecting column for Output per Worker. Multiply your number of employees by Output per Worker for the given Industry.

CONTRIBUTIONS: USING IMPLAN DATA

Using 100% as the Event Value in an Industry Contribution Analysis is the one situation in which you don’t need to bring your own value to IMPLAN.

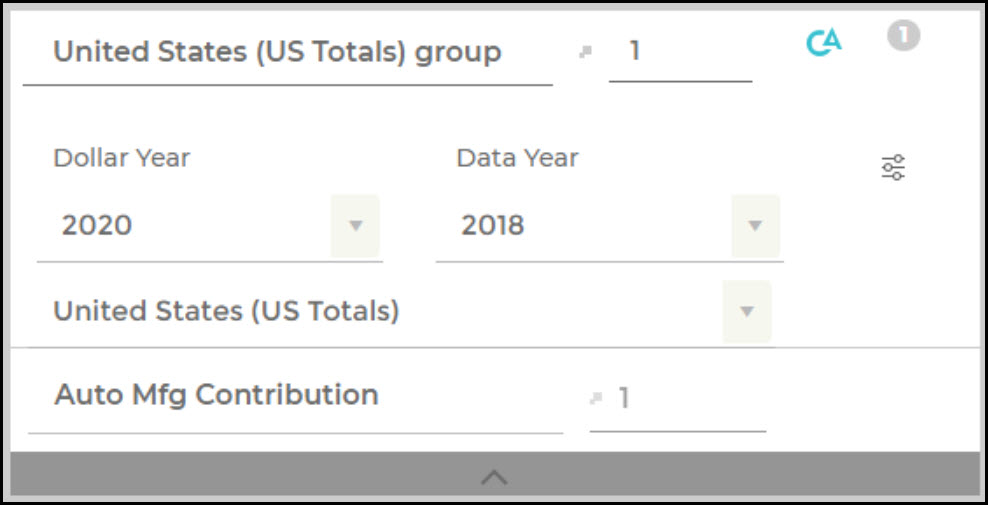

For example, above is an ICA Event setup to analyze the effect of 100% of the Automobile manufacturing Industry. The value of the 100% depends on the Region and Data Year of the Group in which this Event is analyzed.

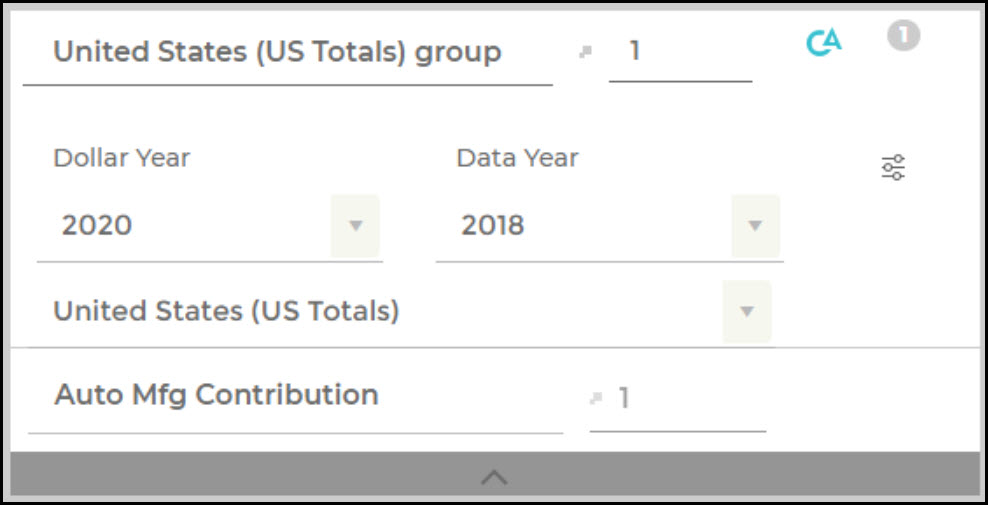

Dragging and dropping the Event into a Group with Region: United States, Data Year: 2018 will analyze the effect of the entire Automobile Manufacturing Industry in 2018 across the whole country. Dollar Year is ignored when using a percentage as the Value. Because the analysis will use the Region Details data, the Value analyzed will always be in the same Dollar Year as the Data Year. You can choose what Dollar Year to report in by using the Dollar Year Filter in the Results.

CONTRIBUTIONS: USING YOUR OWN % OR OUTPUT VALUE

You may want to analyze the contribution of just a segment of an IMPLAN Industry. For example, in 2018, the Output of the U.S. Automobile Manufacturing Industry was $217,100,880,875.11. If the specific manufacturer you want to analyze produced $115B worth of cars in 2018, or about 53% of the value of all cars produced in 2018, I could either us $1115B or 53% as the Event Value.

IMPACT ANALYSIS

The most common types of Impacts analyzed in IMPLAN are:

- New construction

- New business operations

- New final demand spending:

- Tourism/Visitors

- Population growth

- Fiscal spending policy changes

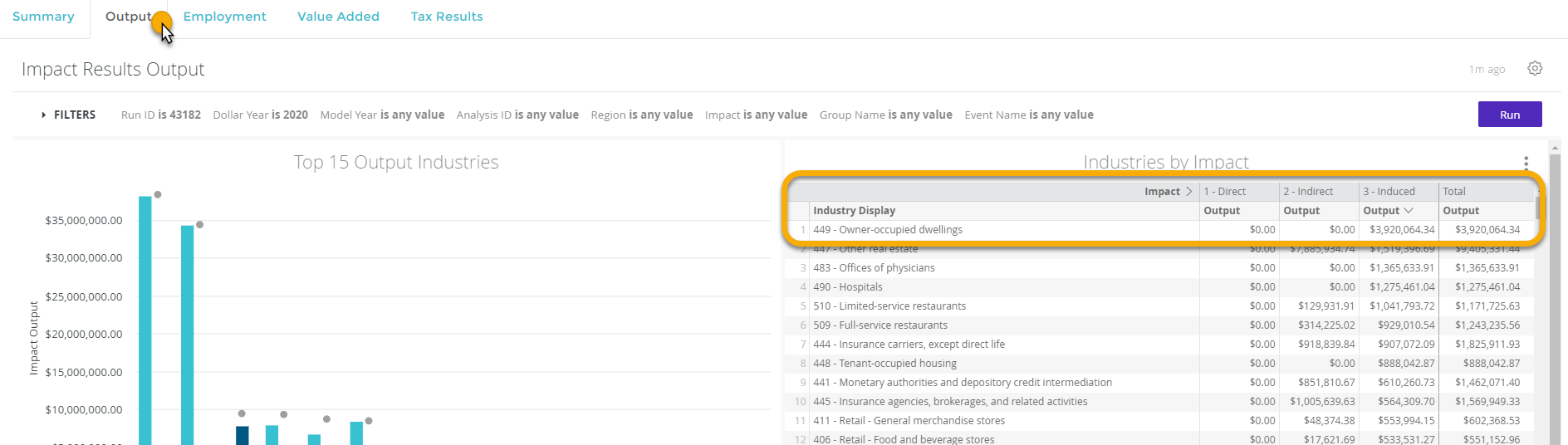

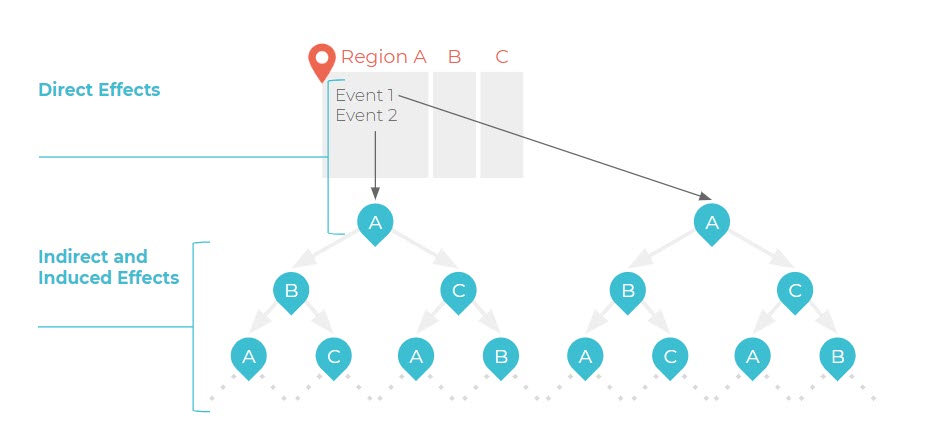

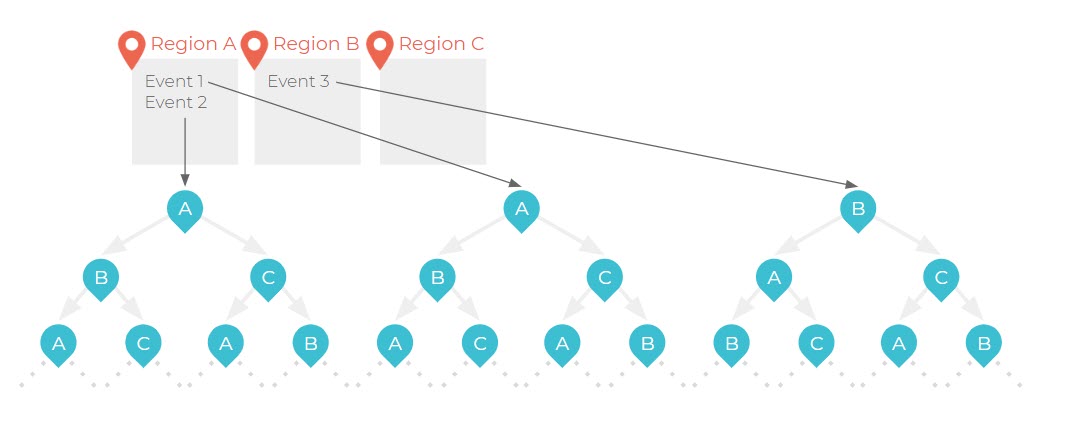

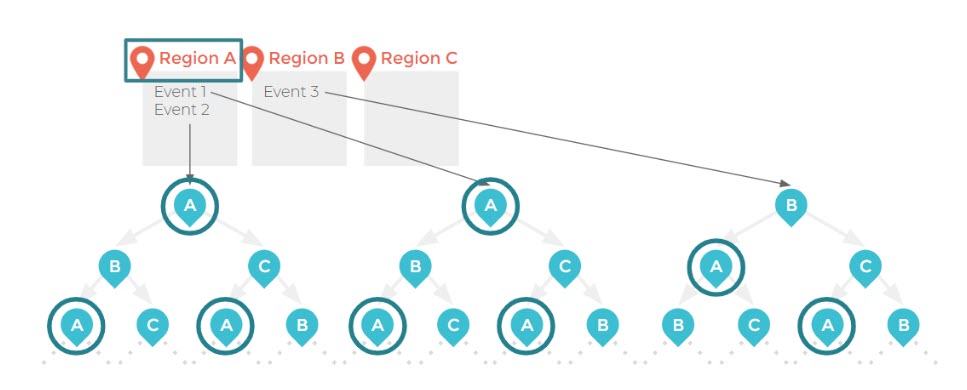

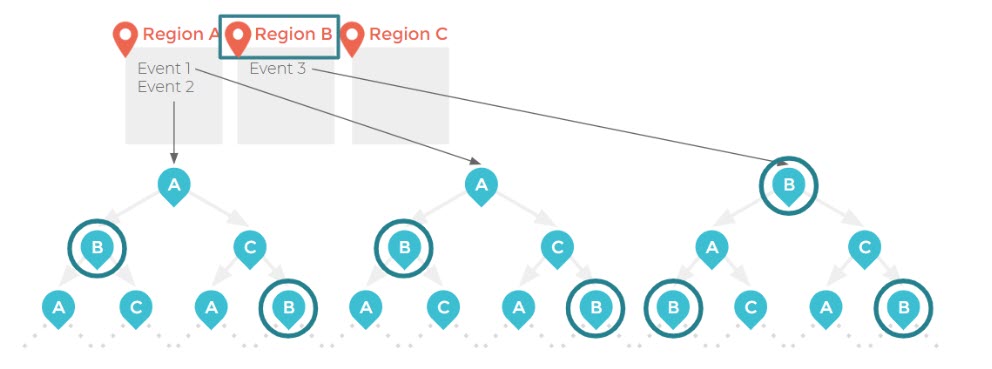

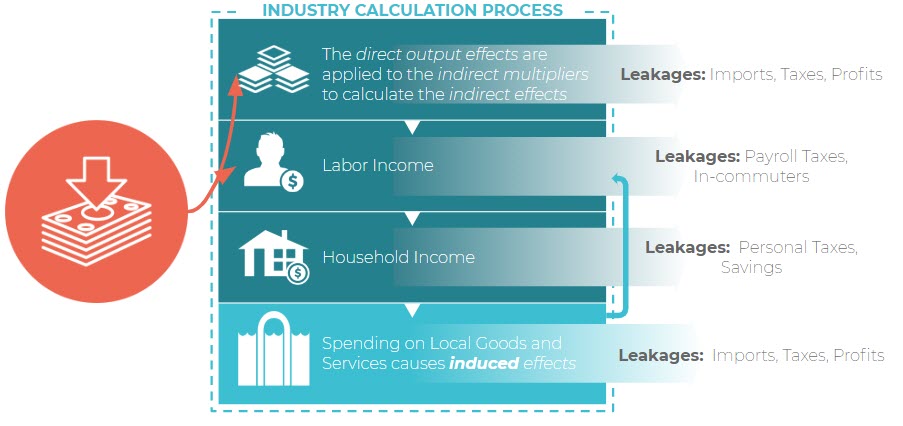

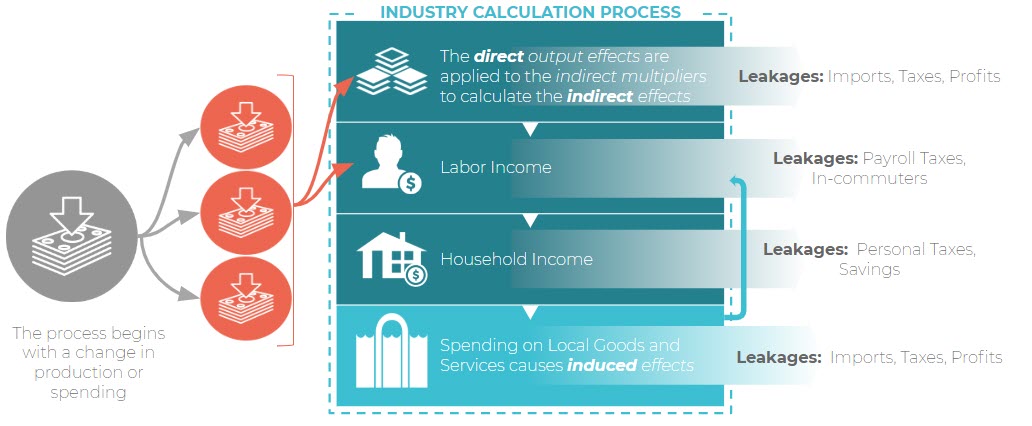

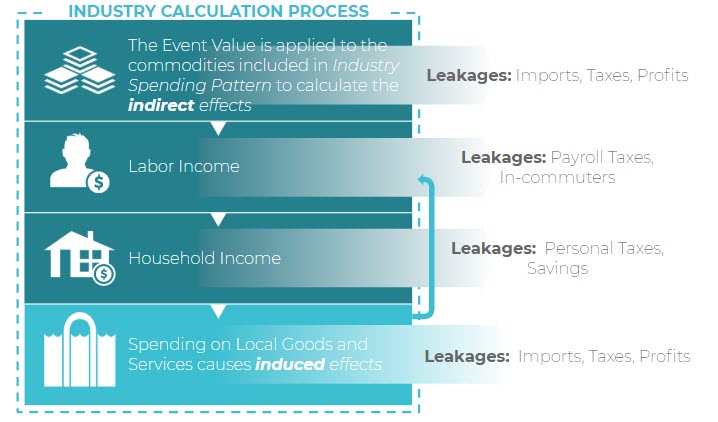

When there is new activity (such as the possible impacts above) in an economy due to a change in demand, there are additional secondary demands that ripple throughout the Region’s economy. These secondary demands stem from impacted Industry’s need for inputs. The chain of transactions that are supported by the impact in the Region are quantified by IMPLAN as Indirect and and Induced Effects. Unlike in ICA, the specified Industry can experience Indirect and Induced Effects.

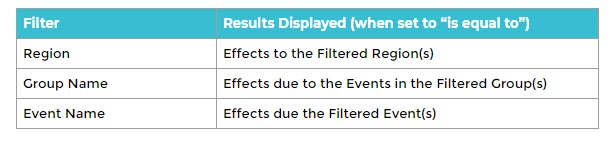

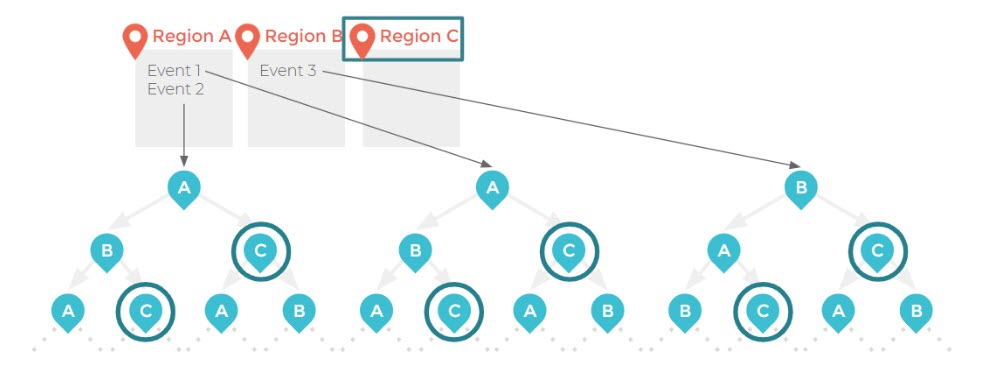

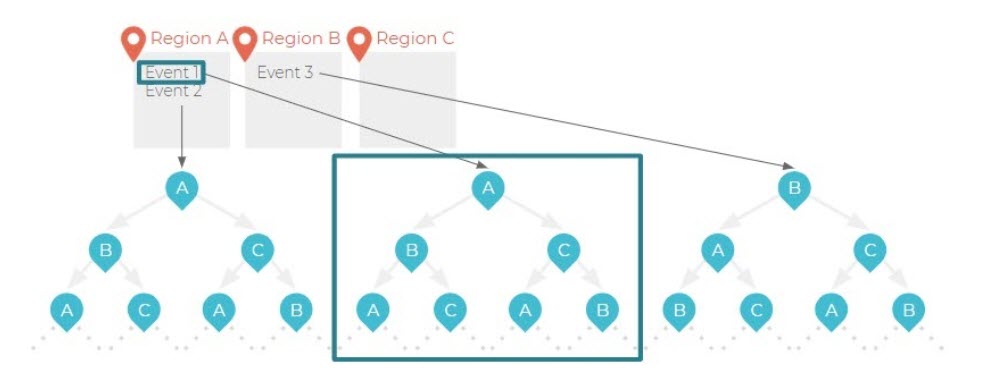

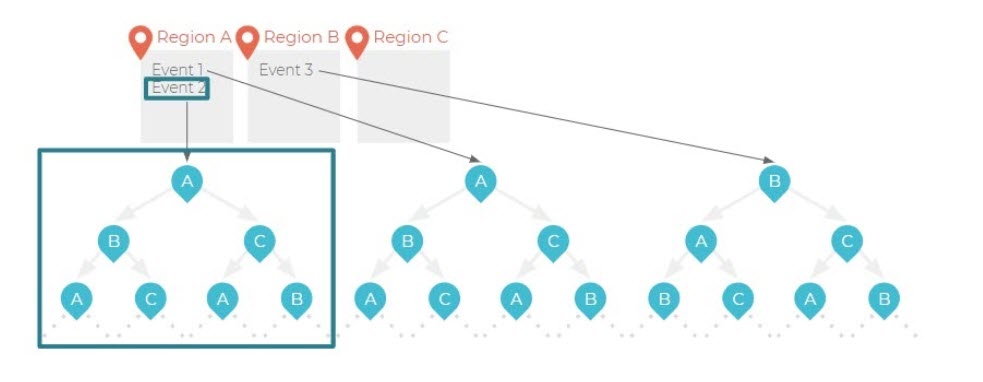

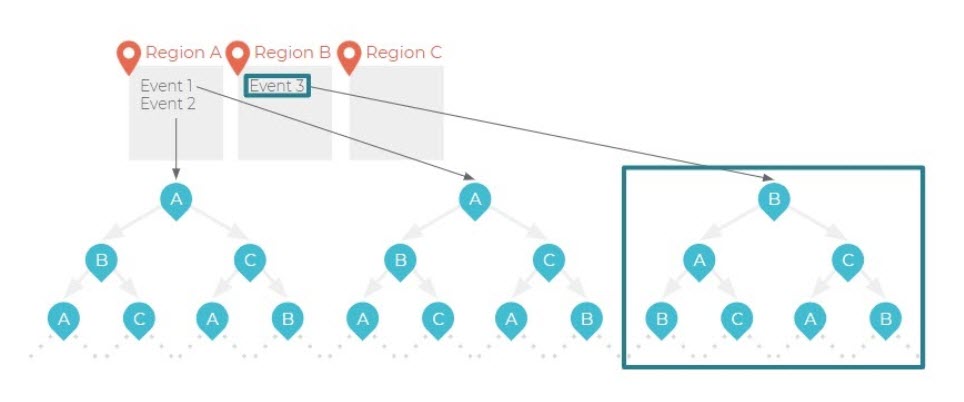

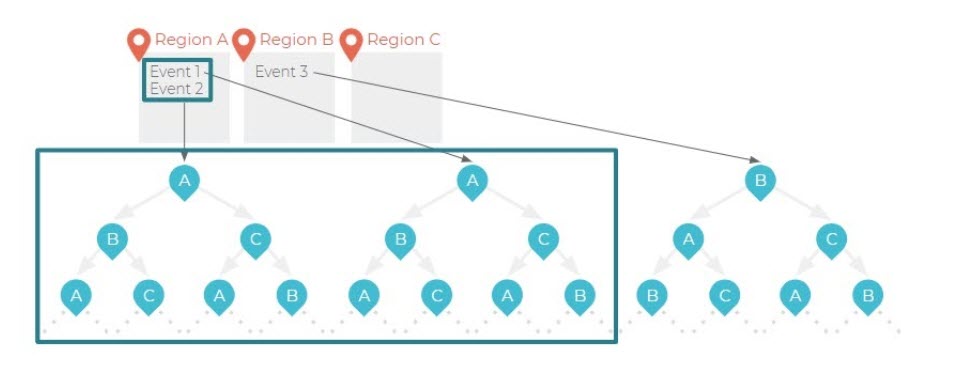

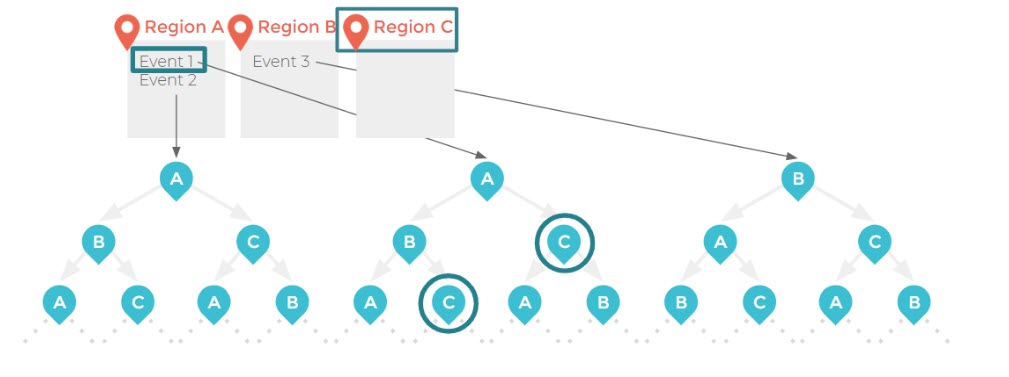

To analyze some new activity, remeber you need to identify in IMPLAN Where and When the Impact occurs by defining the Region, Data Year and Dollar Year. Each of these indicators are captured in a Group. Events specify the economic transactions occurring in the local economy in terms of Type, Specification, and Value. The Who and What of the new activity should be captured by the Event Specification and Value. The Who and What of the economic transaction are paired with Where and When by dragging and dropping an Event into a Group.

For standard Industry Events, the Event Specification can be defined as the IMPLAN Industry impacted by the initial change. There are four different Industry Event Types: Industry Output, Industry Employment, Industry Employee Compensation, Industry Proprietor Income. Choosing between these Event Types should be based on the known Event Value. In some cases, information about new activity may not be known from a production standpoint, but rather from a consumption standpoint. The Industry vs. Commodity Output article provides a questionnaire to help guide you to the appropriate approach for analyzing your data.

IMPACTS: SINGLE VALUE

For construction impacts its common to only know total cost of construction, for operations impacts its common to only known number employees and for new final demand spending, total spend (by Industry or Commodity) is typically all that is known. To analyze any impact, you need to know, at least, either Output, Employment, Total Employee Compensation or Total Proprietor Income.

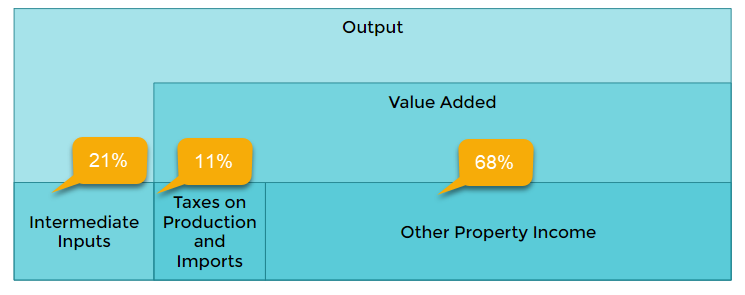

Output is equal to the total value of production. Industry Output in IMPLAN is the value of the Industry’s production, including production that is added to inventory, in the given Data Year. Commodity Output in IMPLAN is the value of the total supply of the Commodity, including from inventory, in the given Data Year. Output is equivalent to the Producer Price of a good or service.

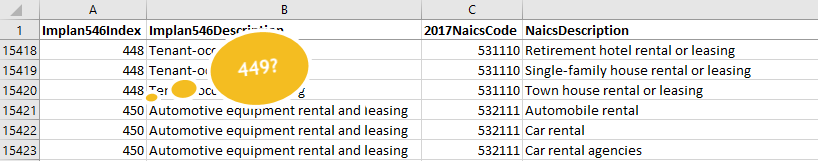

Employment in IMPLAN follows the same definition as Bureau of Economic Analysis Regional Economic Accounts (BEA REA) and Bureau of Labor Statistics Quarterly Census of Employment and Wages (BLS QCEW) data, which is full-time/part-time annual average. Thus, it adjusts for seasonality, but does not indicate the number of hours worked per day. Thus, if you have a full-time equivalent (FTE) value you will want to first convert the FTE value to IMPLAN employment prior to using it as an Event Value IMPLAN. Conversely, if you need to report FTEs you will want to convert the IMPLAN employment to reflect those. FTE and wage and salary to Employment Compensation conversions can be found in the article “546 Industries, Conversions, Bridges, & Construction – 2018 Data.”

Employee Compensation is the total payroll cost of the wage and salary employee paid by the employer. This includes wage and salary, all benefits (e.g., health, retirement), and payroll taxes (both sides of social security, unemployment taxes, etc.). IMPLAN also provides a conversion between Employee Compensation and Wage and Salary data in the article “546 Industries, Conversions, Bridges, & Construction – 2018 Data.”

Proprietor Income is the current-production income of sole proprietorships, partnerships, and tax-exempt cooperatives. Excludes dividends, monetary interest received by nonfinancial business, and rental income received by persons not primarily engaged in the real estate business (BEA).

Typically, information about retail and wholesale Industry impacts are in the form of consumer spending, whether the consumer is a business or household. As discussed in the Output section, Output is in Producer Prices. Therefore when you enter Total Revenue into an Retail or Wholesale Industry Event, IMPLAN calculates the Marginal Revenue, a portion of Total Revenue to the specified Industry as the Direct Effect. Read on in the linked articles to learn more about Industry Margins and Commodity Margins.

IMPACTS: MULTI-VALUE

When only one Event Value is provided, IMPLAN estimates all effects based on this one number and the Industry’s average Leontief Production Function. If more than one Event Value is known it is always best to use this known information as opposed to IMPLAN’s estimate to reflect the more unique characteristics of what you are analyzing.

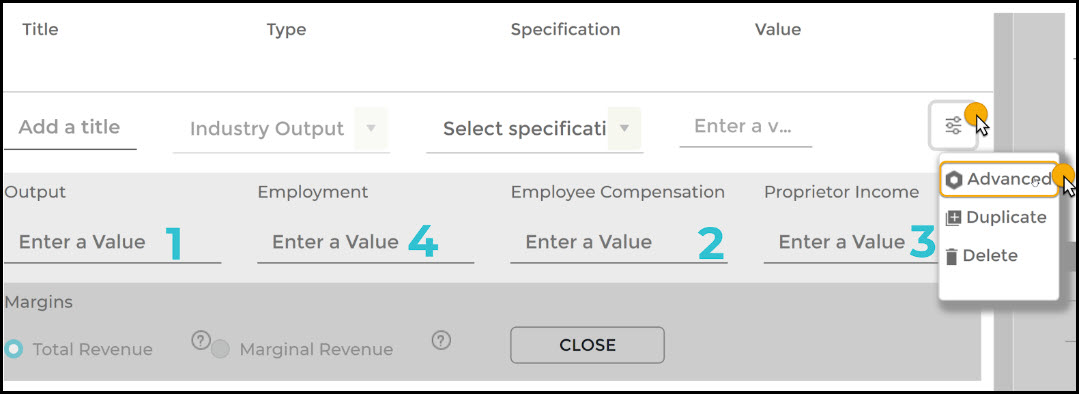

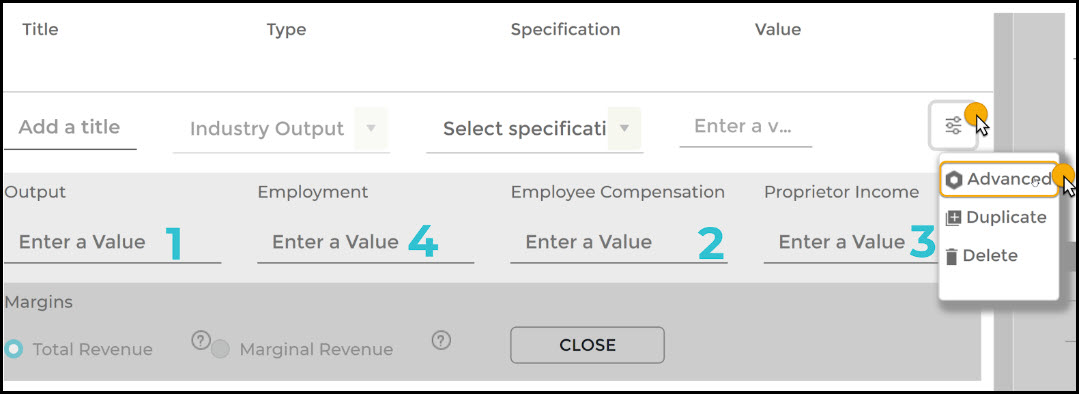

When multiple Event Values are provided in an Industry Event via the Advanced Menu fields shown below, Output will be determined by the Event Values in the following priority, regardless of the selected Event Type:

- Output

- Employee Compensation

- Proprietor Income

- Employment

All secondary Event Values will be a customization to IMPLAN’s estimation for the Event Value.

Other data adjustments can be applied to standard Industry Events for some further customization.

IMPACTS: DOING MORE WITH ABP

Do you have more information beyond the values that can be entered in an Industry Event: Output, Employment, Employee Compensation and Proprietor Income? Analysis-by-Parts or ABP is a technique for that allows you to define the spending associated with Industry as you’d like, giving the option to:

- Specify the purchase amount of all Intermediate Inputs (all commodities purchased from operating the businesses)

- Specify the Local Purchase Percentage of all Intermediate Inputs

- Adjust allocations of Output to TOPI and OPI (essentially tax and profit)

- Specify household income level of employees if known