CONTENTS

The contents of this article are outlined below. If you already know what you’re looking for, click on a link to advance to a specific section!

1. No more time wasted setting up

4. Multi-tab functionality

6. Easier-to-edit industry spending patterns

INTRODUCTION

From Quesnay’s Tableau économique to Leontief’s Nobel Prize-winning work on modern input-output analysis, impact modeling has a fascinating history. In the nearly 50 years since Leontief, I/O’s application has evolved in both universality and convenience to a degree which few could ever have imagined. Today, coupling improvements in analytical methodology with innovative technologies looks to propel economic impact modeling to its greatest heights yet. And the new IMPLAN hopes to be the primary means by which it reaches them.

WHY IS THERE A NEW VERSION OF IMPLAN?

The honest answer is…we knew we could do better for you. We value the loyalty, support, and trust that you, our users, have given us over the past 25+ years. If we hope to continue receiving them from you over the next 25+ years, we need to earn them. So, we’ve been hard at work improving our data, revolutionizing our tool, and strengthening our organization to better serve your economic needs.

The new IMPLAN is the culmination of nearly 3 years of work. We’ve been revisiting our legacy tools, listening carefully to (and actively engaging with!) the economics community, and then employing the latest in computing power to meet even its toughest demands. We’re really excited about what we’ve built and we think you will be too.

The new platform is designed to alleviate the day-to-day challenges of both economists and non-economist alike. From public policymakers to institutional researchers to economic scholars and beyond, those who rely on input-output modeling to shape our understanding of communities both large and small can now do so more conveniently than ever before. In fact, understanding theses groups’ creative uses of IMPLAN was pivotal in helping us develop a tool which now provides even more ways to access, review, and interpret both regional economic data and powerful impact results.

Plus, with a whole bunch of enhanced features, doing all of those classic things you’ve always done with IMPLAN is not only still possible, it’s easier. You don’t have to click on confusing buttons anymore. You don’t have to navigate overcomplicated screens anymore. And you don’t have to execute procedures in a strict and unforgiving order anymore. The new IMPLAN’s flexibility and ease-of-use is unrivaled by any previous iteration you may be familiar with.

Seriously, this version is a game changer.

HOW IS IT BETTER THAN THE VERSION I USE?

1. NO MORE TIME WASTED SETTING UP

Most single geography “Models” you used to spend valuable time building ad hoc are now simply saved as pre-built Regions. So, instead of going through the motions of opening a saved Model or rebuilding one from scratch because you deleted it, now you just select your study’s Region from a dropdown menu. That’s it. And if you edit it, customize it, rename it, save it, come back to it later, edit it again… Whatever. Literally a brand-new, untouched version of that very same Region is always available to you in that little dropdown menu. No more Model-building responsibilities on your shoulders. IMPLAN’s already done it for you—even before you’ve started.

2. FASTER CALCULATIONS

The new IMPLAN’s analysis engine relies on Amazon Web Services (AWS) to do all its dense, heavyweight computing in the cloud. So, this version has enough muscle under the hood to match the demands of even the most sizable IMPLAN projects. This all but eliminates any “wait time” for complex calculations to finish (…sorry to anyone who’s used those procedural interruptions as an excuse to take a break in the past!).

3. MORE FLUID WORKFLOWS

Jump into an analysis from wherever is most natural to you. Know what real-life impact you want to model but not sure exactly what geography you want to study? No problem. Tell IMPLAN everything you know about the impact first, then come back and select a Region later. Know which regional economy you want to analyze but not sure of all the details of your real-life impact quite yet? That’s cool too. Tell IMPLAN which geography you want to study first, then come back and create an Event later.

With IMPLAN’s new project-based workflow, you can start anywhere. Duplicate Events, Regions, and more, and then mix-and-match them quickly and easily without having to jump through a bunch of hoops to set it all back up again. Honestly, you can run 10 complete analyses and be reviewing their results with the same amount of energy it used to take to run just one.

4. MULTI-TAB FUNCTIONALITY

The new IMPLAN isn’t just more convenient to start using, faster in calculating results, and more practical to operate—it’s also categorically more comfortable to interact with. For instance, the new IMPLAN lets you spread your work out across multiple tabs inside your internet browser while you’re working. Within the confines of even a single Project, you can open three different tabs in your internet browser and separate the REGIONS, IMPACTS, and RESULTS screens across them in order to look at all your study’s components at the same time. You don’t have to keep going back and forth between screens to clarify your Region, check your inputs, or confirm your outputs anymore. Apart, IMPLAN and the internet were already awesome. Now they’re awesome together.

WHAT ARE THE BIGGEST DIFFERENCES WITH THIS VERSION?

5. A FEW LABELS…

Some of the new IMPLAN’s most obvious changes pertain simply to how things are labeled or referred to within the tool. The biggest of these changes is with regard to how the tool now refers to the different kinds of impact studies IMPLAN users can run.

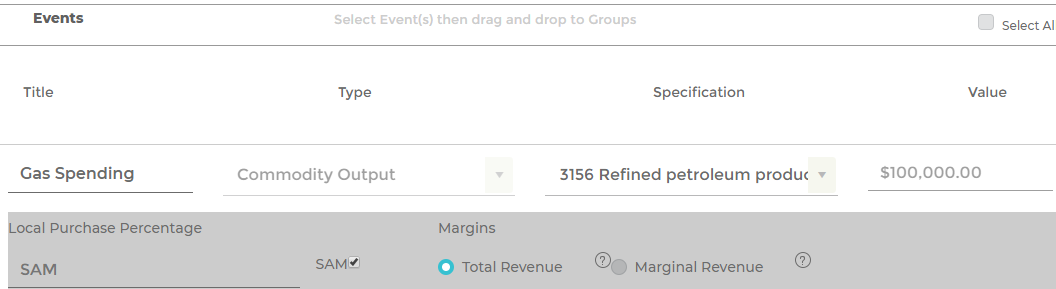

Specifically, what used to be referred to as an “Activity Type” is now simply called an Event Type. While the name may have changed, that’s all that’s changed. Defining an Event Type works exactly the same way as selecting an “Activity Type” always did; simply pick the one that best describes the kind of impact study you’re performing.

So… Why the change? Fair question. The reason is because while “Activities” and “Events” used to exist as two separate items that were created after a regional “Model” was built, the new IMPLAN allows you to create as many Events as you want and then apply them to as many geographies as you want all on the same screen! There’s no longer a need to group or cluster old Events inside an Activity (or any sort of container) within your study because the new tool allows you to simply drag-and-drop new Events into multiple geographies instantly. Now, just create Events by defining the Event Type, entering your study’s inputs, and then dragging those Events into whichever geographies you want to apply them to.

But wait… It gets better.

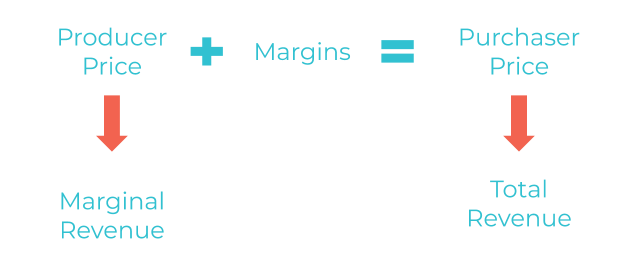

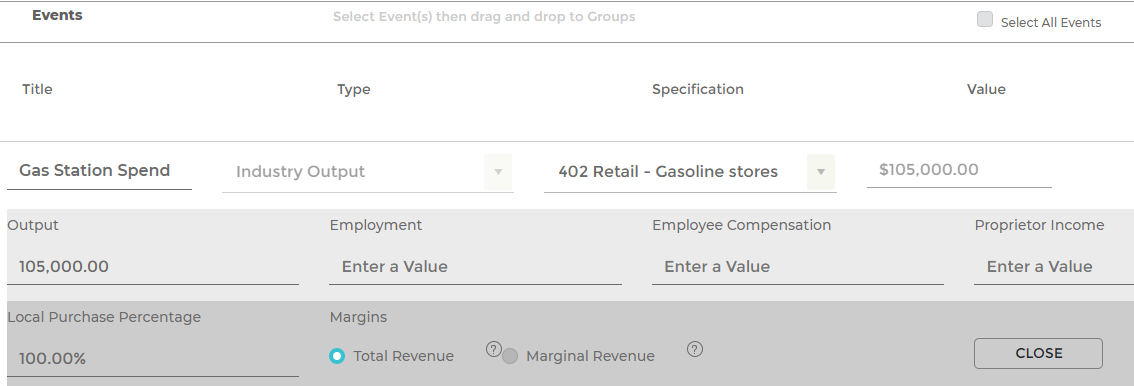

Because studies are now constructed by simply applying Events to geographies, the new tool allows you to exert greater control when creating Events by changing the way it refers to IMPLAN’s most common Event Type: the “Industry Change”.

When you open the Type menu on the IMPACTS screen in the new IMPLAN, you’ll see a few more options than you did in previous iterations of the tool. But, they’re all still technically “Industry Change” as far as the computer’s concerned.

Huh? Don’t worry, all this means is that we’ve taken it upon ourselves to itemize the “Industry Change” Event Type for you so that you can specifically define (sooner rather than later) whichever facets of the economy your study’s real-life impact will affect.

For instance, if you’re creating an Event and know the dollars of labor income that your study’s real-life impact will generate, simply select Industry Employee Compensation as your Event Type. Or, if you’re creating an Event and know the number of jobs that your study’s real-life impact will create, simply select Industry Employment as your Event Type.

In previous versions, each of these scenarios would have simply been recognized as an “Industry Change”. But now, the options that IMPLAN asks you to select from when setting up your study are a little easier to distinguish from one another because the terminology that the software uses has become more pointed, relevant, and intuitive. Plus, we think this small change will help you, the user, be able to tell which of your finished Events holds which your study’s values more easily since they’ll be indicated visually. This way, you won’t need to open up Events to see what values you’ve entered into them anymore. Nor will you need to remember which order all your Events are organized in on the screen. Instead, each Event will just tell you what it represents right in the Event Type field!

In addition to these changes, we’ve also modified the names of each of the other Event Types ever-so-slightly just to be consistent with the changes we’ve made to what was previously known as the “Industry Change”. For instance:

See what I mean? We just removed the “change” part of the label because, well, we don’t need it anymore. When defining your Event Type now, Commodity Output will do; the “change” is implied simply by virtue of the fact that you’re creating an Event.

6. Easier-to-edit industry spending patterns

Another important change in the new IMPLAN is the simplification of the process by which you can edit industry spending patterns. In previous iterations of IMPLAN you had to import an industry spending pattern into the tool itself, customize it to your liking, and then use that customized spending pattern as a proxy for your study’s selected IMPLAN Sector. Guess what? Now, even that’s easier.

To edit an industry spending pattern in the new IMPLAN, simply select Industry Spending Pattern as your study’s Event Type and then modify it to your liking. Then, you’re done.

7. Better SAMs

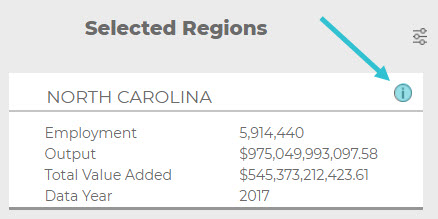

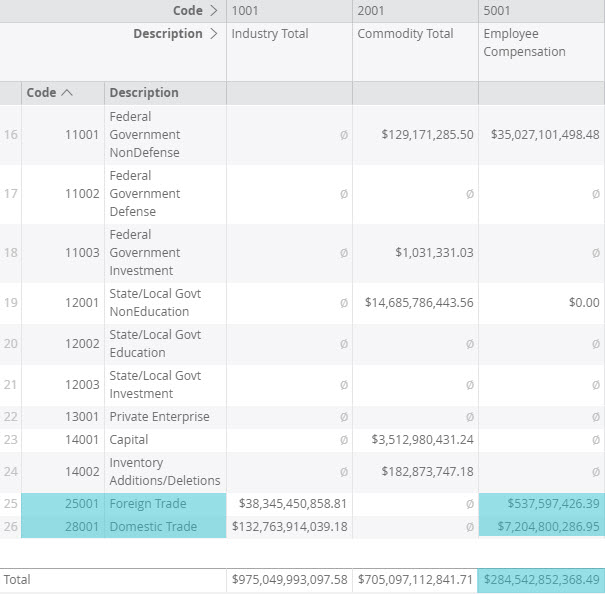

Social Accounting Matrices (SAMs) offer complete pictures of the flow of both market and non-market funds throughout economies in a given year. Market flows occur between the producers of both industrial and institutional goods & services and the industrial and institutional purchasers of those goods & services. Serving as the perennial backbone of the tool’s entire dataset, this essential component now includes even more to explore than it has in previous iterations of IMPLAN.

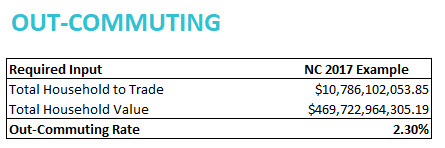

For instance, in IMPLAN Pro and IMPLAN Online:

- SAMs reported commuting as net flows.

- Sub-national SAMs consolidated all reported commuting into the Domestic Trade account.

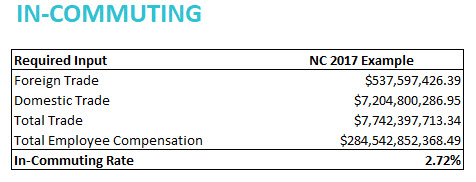

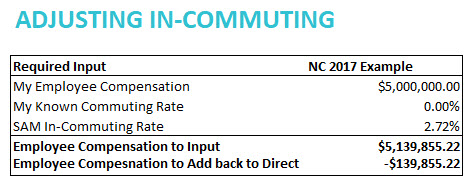

But, in the new IMPLAN:

- SAMs report commuting as gross flows, meaning you can see total in-commuting and out-commuting at both state and county levels.

- SAMs retain all reported foreign commuting within the Foreign Trade account.

These improvements to the SAMs both ensure greater accuracy and make it easier to observe estimated commuting flows both into and out of economies. Additionally, some payments to governments have been reclassified in the new IMPLAN, like rents and royalties paid from Other Property Income (OPI) to governments rather than from Taxes on Production & Imports (TOPI). Such changes serve to align the new IMPLAN’s SAMs with National Income and Product Accounts (NIPAs) from the Bureau of Economic Analysis (BEA) to improve the quality of both tax and impact results.

8. Multi-angular MRIO

In IMPLAN Pro, Multi-Regional Input-Output (MRIO) analyses allow users to observe the “ripple effects” of impacts which are occurring in a specific economy throughout its neighboring economies. However, when exercising this capability, the software is unable to let users observe any “Direct Effects” upon economies besides that in which the original impact is occurring. So, despite offering insights into multiple economies, MRIO analyses are limited to a singular, outward perspective. In order to observe the impacts of events themselves which occur in neighboring economies, those events need to be modeled in their own analyses. IMPLAN users who practice this technique know how time-consuming this process can become.

Imagine a tool with which you could a.) perform multiple separate analyses which each contain only a single Region, but then b.) link those separate Regions to one another such that you’re able to c.) observe both the results of the events occurring within them and the “ripple effects” of those events throughout each of the others respectively…

This is that tool.

IN CLOSING…

Okay, we’ve covered the main stuff at this point.

Lastly, some final, more behind-the-scenes, improvements of note include that this version’s programmatic anatomy is designed to allow for faster uploads of IMPLAN’s annual dataset, the easy addition of future features, and the smooth integration of new functions moving forward.

We know, we know. Those don’t sound like a huge deal. But trust us, they’re pretty big.

In the past, part of what’s prevented IMPLAN tools from evolving as quickly or as seamlessly as you (and we!) would have liked has been a smattering of systematic inadequacies thanks to those tools’ antiquated designs; they simply weren’t dynamic enough in their architecture to accommodate the rapid growth in your analytical needs.

But that was then and this is now. We’ve spent nearly three years on this tool alone and have put in the time upfront to ensure that it not only meets your needs today but can keep up with how quickly they’ll change tomorrow—and even the day after that.

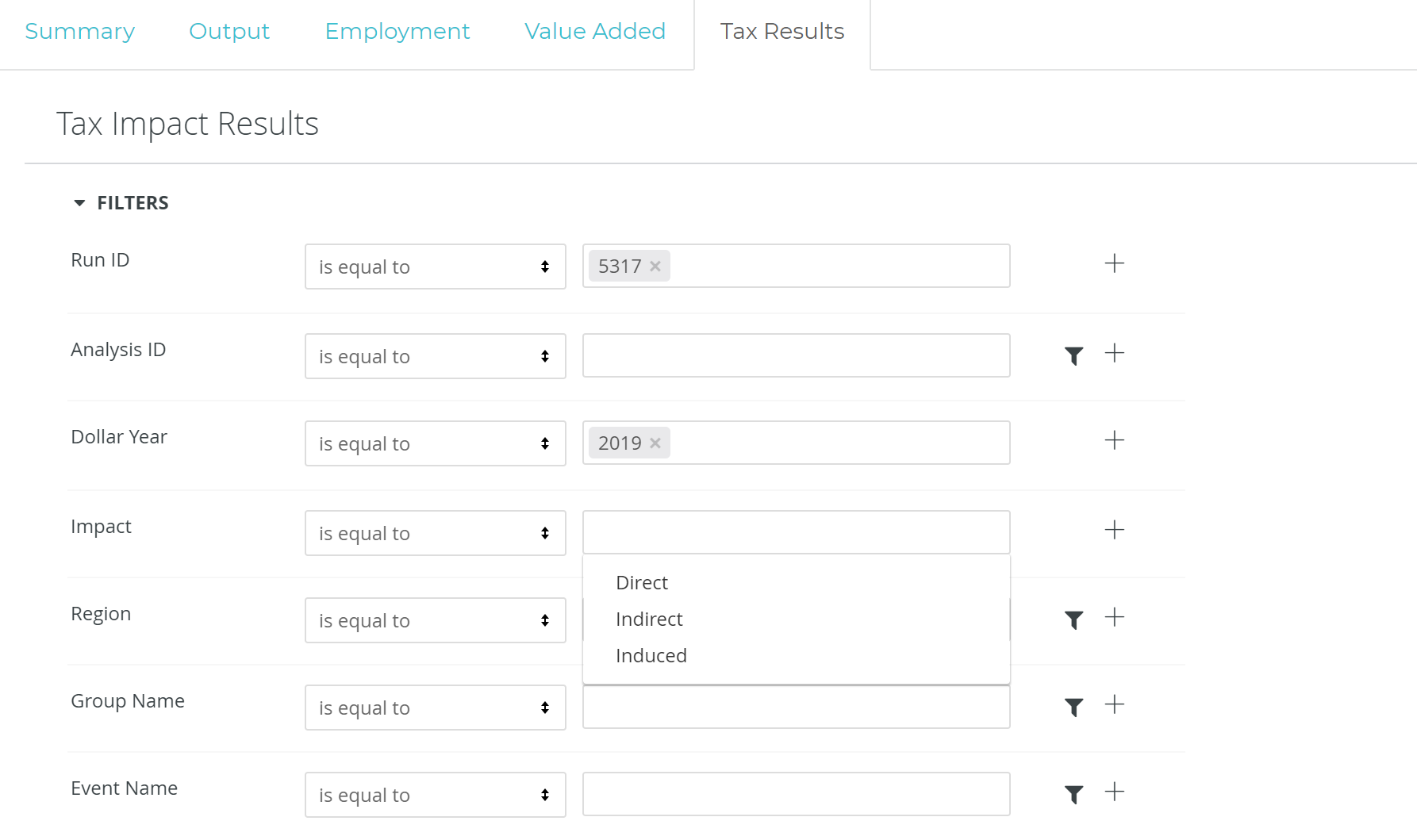

FILTERS:

FILTERS: