Construction: Building the Right Model

INTRODUCTION:

There are a few special considerations for modeling construction impacts. Not only are all projects different, they need to be carefully considered in IMPLAN.

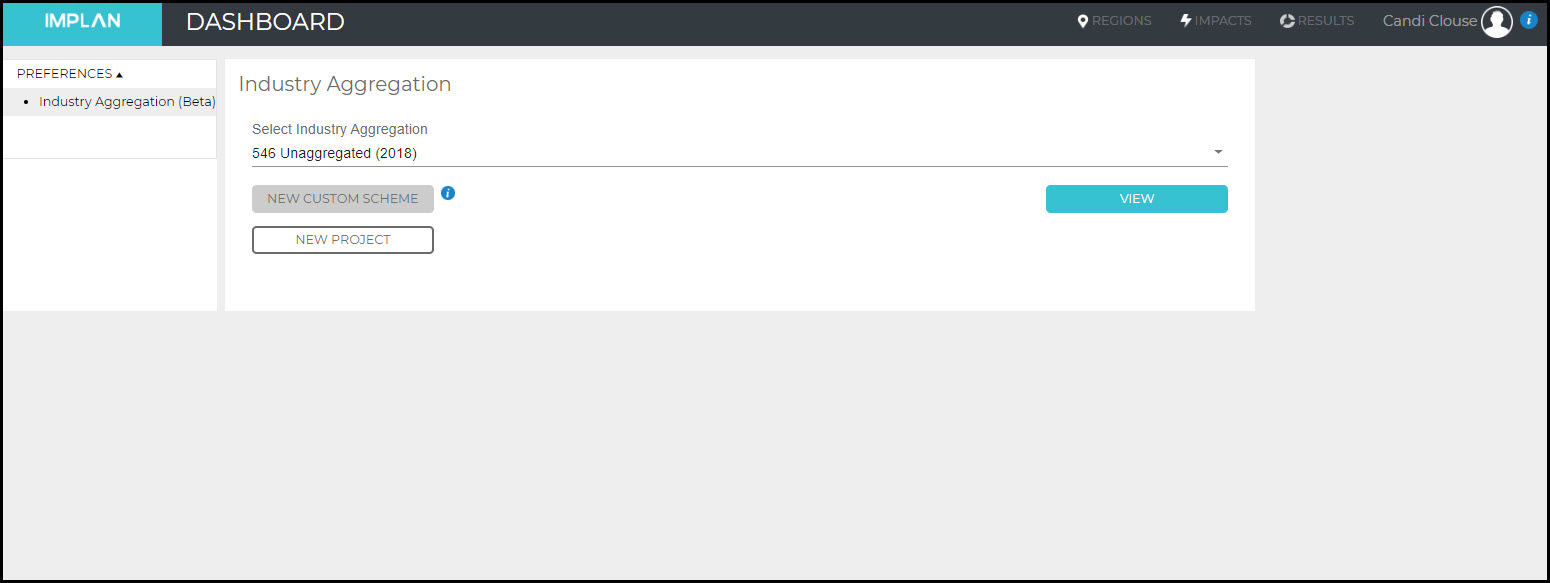

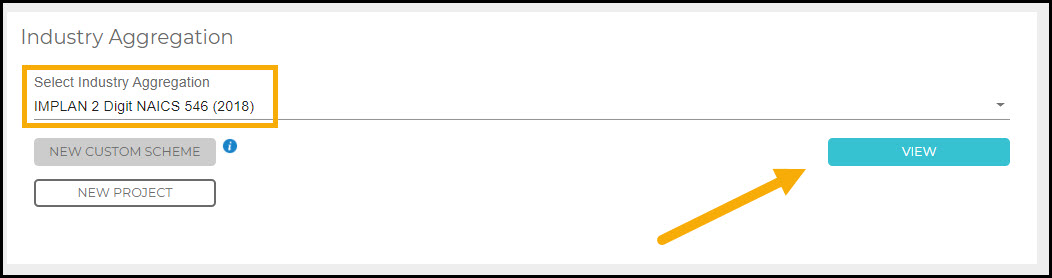

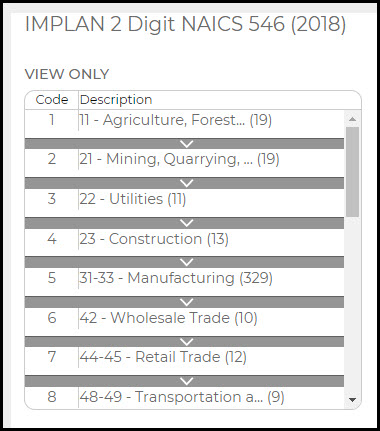

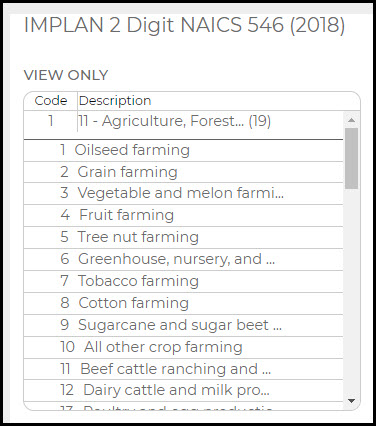

Construction Industries don’t have a perfect NAICS crosswalk as the other Industries do. Instead, there is the file Definitions of IMPLAN’s 546 Construction Industries found on our 546 Industries, Conversions, Bridges, & Construction – 2018 Data page. This is where you can find which Industry will be best to use whether you are modeling the construction of a power plant, office, or even a museum.

The value entered in Industry Output for construction should be the full cost of the structure, and only the structure. This includes hard costs and soft costs. Because Employment, by definition, is based on where the job is located not where an individual resides, Employment should include the full value full-time, part-time and temporary Employment on the job site during the year. Additional considerations of costs attributed to construction are considered below.

SQUARE FOOTAGE:

Sometimes rather than construction cost or Employment, only the square footage of the project is known. Calculators to convert square footage to construction costs, by building type, can be found online.

EMPLOYMENT & SPECIALIZED SKILLS:

While all Industries are likely to source some Employment from outside the region, construction Industries are among a group that may be more likely to do so, because in many cases either:

- The needed skills for a project may not be available in the region

- Contractors may be sourced from outside the region

In these cases, it is important to remember that Employment is site based in IMPLAN, so even if a worker is brought in from outside the region they still count as “local” employment during the period of their work.

It is sort of unreasonable to assume that these outside workers will spend their income in the same way as residents. Thus, what we will modify is the Labor Income values for the construction Industry. The Employee Compensation and Proprietor Income should be reduced by the amount of payroll that is going to workers outside the region, less the regional commuting rate. But do these outside workers then have no local impacts? That also is unlikely if they are in the region for any period. The best way to capture these impacts is by using per diem spending patterns, ideally from the company’s budget or allowances, but when these are not available government per diems can be used as an estimate. This not only captures a more reflective amount of local spending by these temporary residents, but it also prevents their income from being spent on common resident household expenditures like utilities and the costs of owning a home.

An in-commuting rate is gross regional rates in which local workers commute out of the region to go home. In the calculation of the Induced Effects the in-commuting regional rate reduces the total income before it’s distributed to local households. To avoid underestimating the effects of Labor Income you will want to be sure to account for the commuting rate from the Social Accounting Matrix.

CONTRACTORS:

Construction employment differs between new construction and maintenance/repair. New construction is considered a capital purchase, which is a final demand (not an intermediate demand). Therefore, new construction contractors and subcontractors do not appear in any Industry’s production function. So, in new construction the contractors and subcontractors are found in the Direct Effect as proprietors. Maintenance and repair, however, is not considered a final demand, therefore it can be purchased by Industries. So for maintenance and repair, contractors and subcontractors are found in the Indirect Effect.

LAND VALUES:

When construction impacts are being considered, a question that often arises is: “What is the impact of the sale of the land?” The truth is, the sale of the land has very little impact on the economy. The purchase of the land necessary for a construction activity should not be included as Industry Output for the construction Industries. Why? Land sales are considered asset transfers, where one person receives money while the other receives tangible property. Thus, the land sale itself has no value in IMPLAN. Some small impact may be captured however, by creating an Event for real estate fees, and for large commercial projects, legal fees.

HARD & SOFT COSTS:

Construction spending patterns in IMPLAN include architectural engineering, legal fees and other common soft costs, so these should be included into the Industry Output value. However, if you want to specify these values or have soft costs that are significantly different than a typical construction project in your selected Industry, these can be modeled separately.

A common question we hear is how to handle interest payments for pre-development or construction loans. If these are to be included in your model, ensure that it is only the interest portion of the loan, not any principle, as that is considered an asset transfer and has no impact. Interest can be input in Industry 441 – Monetary authorities and depository credit intermediation.

FURNITURE, FIXTURES, & EQUIPMENT:

Furniture, Fixtures, and Equipment (FF&E) are large, movable investments that businesses make. FF&E consists of movable furniture, fixtures, and other equipment that is not directly attached to a building. FF&E should not be modeled through the construction Industry.

Often times, the specialized FF&E will not be produced in your region of study. If you know that everything is being brought in, it is considered leakage and you can omit the spending from your model. Investments like these can be captured but must be modeled separately. You may know that it was purchased through a local retailer or wholesaler, so then you can model the purchases through the appropriate Industry. Maybe you know that some of the purchases will be sourced locally. Then you can again choose the appropriate Industry, like 370 – Wood office furniture manufacturing, and enter the spending.

You could also consider using an Investment Spending Pattern to model the FF&E expenditures. This file has the general capital investment spending patterns for FF&E alone and for FF&E and construction for consolidated Industries. These spending patterns can be input into IMPLAN by modeling the associated Commodity Events.

HOUSING CONSTRUCTION & NEW HOUSEHOLD INCOME:

When new housing developments or multi-family apartments are built, there is obviously an economic impact due to the construction. Just because it is built, however, doesn’t necessarily mean that there will be new income in the area. If the residents of the new development are moving from other locations within the region, there is really no impact due to their spending just because the new houses were built. If you can make the argument that a portion of the buyers are coming from outside of your region and that they will be employed, then you can make the assumption that their spending is new and run it through the appropriate Household Income category. Remember that Household Income needs to be Employee Compensation less payroll taxes.

TEMPORARY AND LONG-TERM IMPACTS:

It is important to distinguish between temporary impacts and long-term impacts. For construction projects, the impact is limited to one time frame. This is unlike the continued operations of a college or a casino that will have yearly impacts.

People love job numbers. It is not uncommon for studies to overstate construction jobs by assuming they are recreated each year. Also, it is not advisable to report rolled-up construction and operational impacts to have job numbers that mix both temporary and ongoing Employment. This is one popular way that input-output analyses overestimate impacts.

The same principles apply to other economic factors as well. The Labor Income, Value Added, and Output of the construction are occurring only over a short period of time and thus have a more limited impact than operational changes. This is best reflected when the two types of impacts are handled separately.

CREATED VERSUS SUPPORTED:

Are the construction jobs created or supported? In most impact scenarios, the Direct Employment impact is considered to be created the first year of the project, but with construction this typically not the case. The reason is that construction jobs are usually supported job to job. Thus new construction projects are keeping construction workers employed rather than genuinely creating new jobs in the economy. Of course, there are some cases where construction jobs clearly are created, such as the real estate boom that occurred in North Dakota because of drilling.