INTRODUCTION:

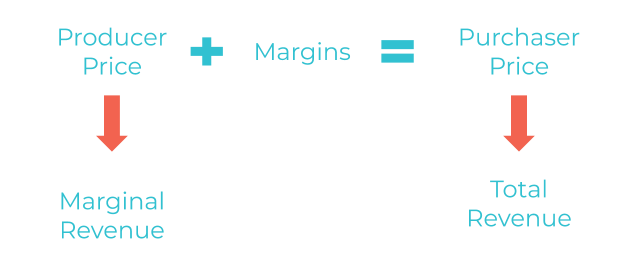

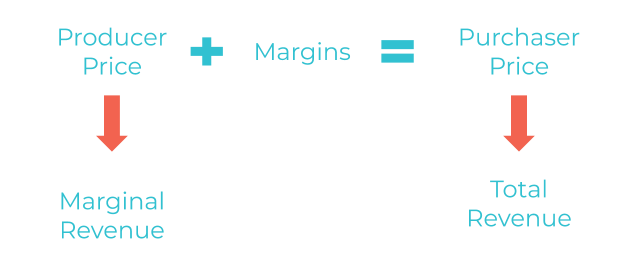

When a good is purchased via a retailer or wholesaler, the price that is paid (Purchaser Price) for the good differs from the actual Producer Price of the good. This is because it includes the cost for transportation and the cost of the wholesale and/or retail service of selling the good conveniently to the consumer. The cost of transportation and the wholesale/retail service are called Margins. The Producer Price of a good plus the costs of Margins equals the Purchaser Price of the good.

Margins are only applicable when you are modeling Industry Output Events with a retail or wholesale Sector specified and when you are modeling Commodity Output Events with a Commodity specified that can be sold via a retailer or wholesaler. Margins are not applicable to Industry Employment, Employee Compensation, or Proprietor Income Events. When you are in a scenario where Margins are applicable, you can indicate in the Advanced Menu of the Event whether your Event Value is a Total Revenue value, equivalent to Purchaser Price, or if your Event Value is Marginal Revenue, equivalent to Producer Price. When choosing between Total Revenue and Marginal Revenue is not an option, the Event Value is assumed to be the Producer Price.

MARGINS IN INDUSTRY OUTPUT EVENTS:

TOTAL REVENUE

Total Revenue represents the increased income resulting from the total sale of goods and services. IMPLAN defines Total Revenue as Total Purchaser Price of Commodities Sold. Total Revenue in an Industry Output Event, with a retail or wholesale Sector specified, indicates to the software that the Event Value is a retail/wholesale sales price (Purchaser Price) and includes Margin Costs for transportation, wholesaling, and retailing services, in addition to the Producer Price of the goods sold.

In the case of applying Margins by selecting Total Revenue in an Industry Output Event, there is no way for IMPLAN to identify the good/Commodity purchased. Therefore, the only impact that will be estimated is the portion of the Event Value that gets assigned as the Margin cost associated with the Sector specified in the Event. This means, when Total Revenue is selected in an Industry Output Event with a retail or wholesale Sector specified, there will only be a Direct Effect in your Results to the Sector specified and it will only be a portion of the Event Value.

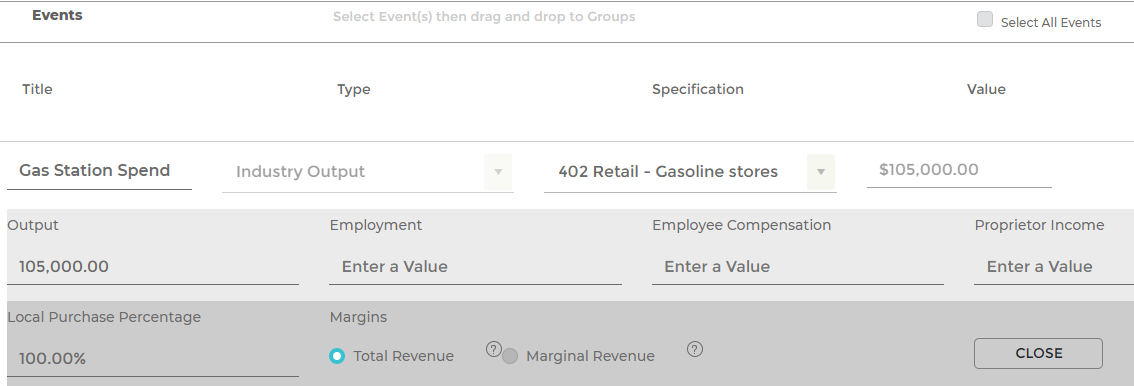

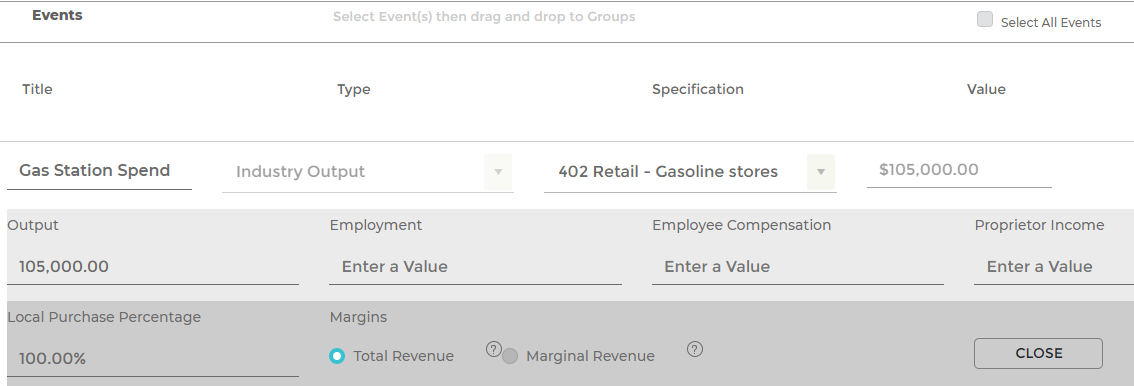

For example, let’s say we know visitors during a week long event in our Region spend on average $15 per day at the gas station. If there are 1,000 visitors spending $15 per day at gas stations in our Region for 7 days, the total spending at the gas stations by these visitors would be $105,000. To model this in IMPLAN we’d be limited to modeling this via an Industry Output Event with the “Retail – Gasoline stores” Sector specified because we do not know the good/Commodity that these visitors are purchasing at the gas station. It is likely mostly gas, but they are likely also purchasing things like snacks and slushies. Because the $105,000 is the total spending by visitors at the gas station, this value is a Purchase Price and we should leave “Total Revenue” selected in the Advanced Menu to apply Margins.

The 2017 Retail Margin Coefficient for the Sector Retail – Gasoline stores Sector is .164. This can be found in the 2017 COMMON (IMPLAN5) MARGINS.

This means on average 16.4% of Total Revenue at a retail gas station is the retail gas station’s revenue, or Marginal Revenue. This Marginal Revenue is the value of the retail gas stations service of selling goods in a convenient place; in other words Marginal Revenue in this example is equivalent to the retailer’s Output.

Therefore, when this Event is Run, we’d only see $105,000 x .164 = $17,220 of Direct Output to the Retail – Gas Store Sector and no other Direct Effects (when Dollar Year = Results Dollar Year). The other $87,780 of spending at the gas station would be a leakage in this analysis because without knowing which Commodities were purchases with the $105,000, IMPLAN cannot appropriately estimate what portion of the $87,780 is the Producer Price of Commodities and what portions of this value is the transportation cost and wholesaling cost.

Note: When additional Event Values are entered in the Advanced Menu (Employment, Employee Compensation, and/or Proprietor Income) IMPLAN assume that even when Total Revenue has been selected in the Industry Output Event, these values can only be known for the Sector specified, the retailer or wholesaler. Therefore, no Margins will be applied to these values. Margins are only applicable to the Output Event Value.

MARGINAL REVENUE

Marginal Revenue represents the increased income resulting from the sale of one or more unit of goods and services. Marginal Revenue in an Industry Output Event with a retail or wholesale Sector specified indicates to the software that the Event Value is a only the Producer Price of the goods sold, and does not include any Margin Costs for transportation, wholesaling, and retailing services.

By selecting Marginal Revenue in an Industry Output Event with a retail or wholesale Sector specified, you are indicating to the software that no Margins should be applied, and therefore the full Event Value will be applied to the multipliers of the Sector specified, just as the software would treat the Event Value for a non-retail/wholesale Industry Output Event. Although it is possible to know the Marginal Revenue to a retailer, it is much more common to know the Purchaser Price paid at the retail/wholesale establishment than the Producer Price.

MARGINS IN COMMODITY OUTPUT EVENTS:

TOTAL REVENUE

Total Revenue in a Commodity Output Event indicates to the software that the Event Value is a retail/wholesale sales price or Purchaser Price and includes Margin Costs for transportation and wholesaling/retailing services in addition to the Producer Price of the goods sold.

There is a difference between applying Margins by selecting Total Revenue in Industry Output Events and Commodity Output Events. When the item purchased is known you should use a Commodity Output Event. Total Revenue is still the appropriate selection when only the price paid at the retailer/wholesaler is available to you. Instead of specifying the retailer or wholesaler where the item was purchased, the Commodity purchased should be specified. Margins cannot be applied in Industry Events when a non-retail/wholesale Sector has been specified.

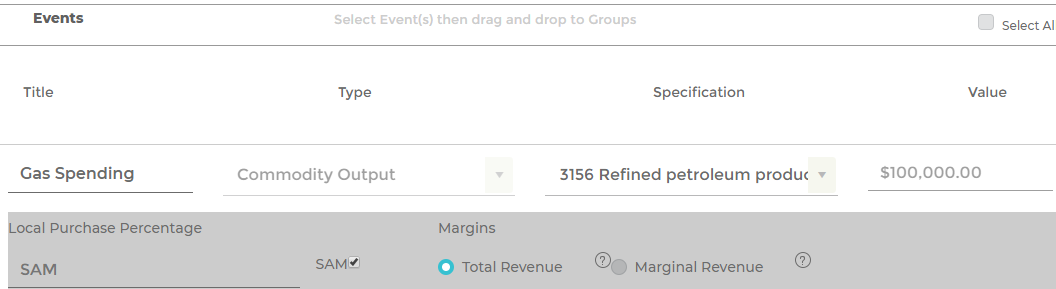

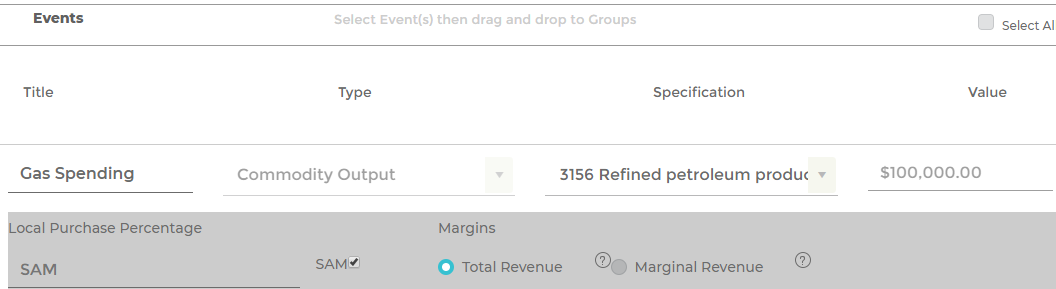

This is very different than the previous gas station example when we only knew that $105,000 was spent at the gas station. Now, let’s assume we know $100,000 of the $105,000 is spent specifically on gas at the gas station. By using a Commodity Output Event, specifying Commodity 3156 – Refined petroleum products and leaving “Total Revenue” selected in the Advanced Menu, IMPLAN estimates the impact of the full Event Value, unlike in the case of applying Margins to an Industry Output Event. IMPLAN will use Commodity margins to distribute the Total Revenue to each producer in the Value Chain. This process converts the provided Total Revenue into Marginal Revenue values for the producer, transporter(s) and wholesale/retailer(s).

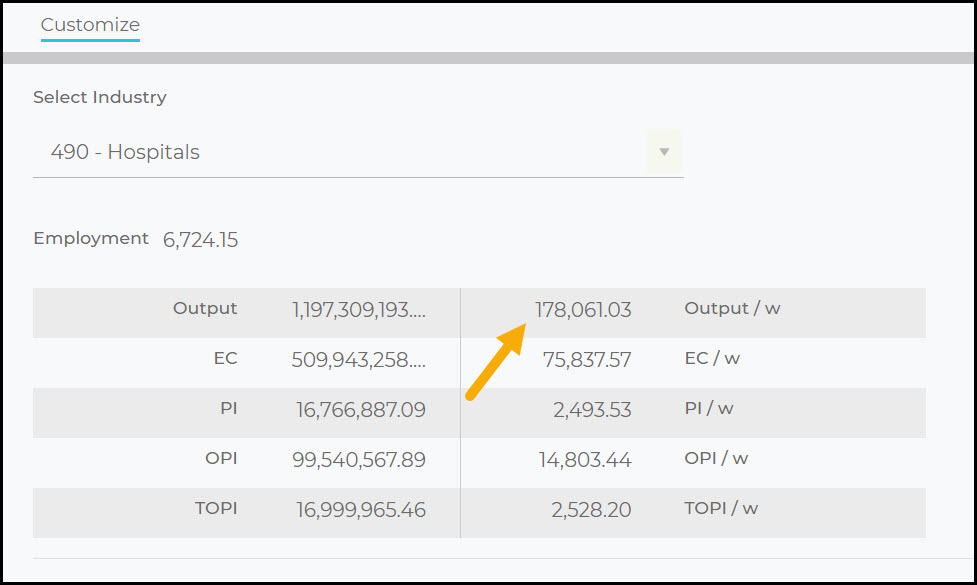

When taking this approach, it is recommended to check the “SAM” box in order to set your Local Purchase Percentage (LPP) to the Regional Purchasing Coefficient (RPC) as shown below. This will set the LPP for the production of each Commodity in the Value Chain to the Regional Purchasing Coefficient for the respective Commodity. This tells IMPLAN to assume each Commodity will be purchased locally at the same rate in which each Commodity was on average purchased locally during the Data Year.

2017 Margin Coefficients for the Refined petroleum product Commodity:

|

Sector

|

Margin Sector

|

Margin Coefficient Value

|

|

3156

|

3156

|

0.63

|

|

3156

|

3395

|

0.19

|

|

3156

|

3402

|

0.17

|

|

3156

|

3408

|

0.00002

|

|

3156

|

3409

|

0.001

|

|

3156

|

3410

|

0.002

|

|

3156

|

3411

|

0.008

|

|

3156

|

3413

|

0.005

|

|

Total

|

|

1.00

|

Data can be found in the document 2017 COMMON (IMPLAN5) MARGINS.

When examining the Margins for Commodity 3156 -Refined petroleum products, we see the full list of Margins above. The Margin from 3156 to 3156 shows the Margin Coefficient Value as 0.63. This means 63% of the Total Revenue is Marginal Revenue/Producer Price of refined petroleum products (gas) purchased at the gas station.

Commodity 3395 – Wholesale trade distribution services represents 19% of the total cost. Commodity 3402 – Retail services – Gasoline stores gets allocated 17% of the retail purchase of the gas. The same goes for Commodities 3408-3413; all transportation sectors.

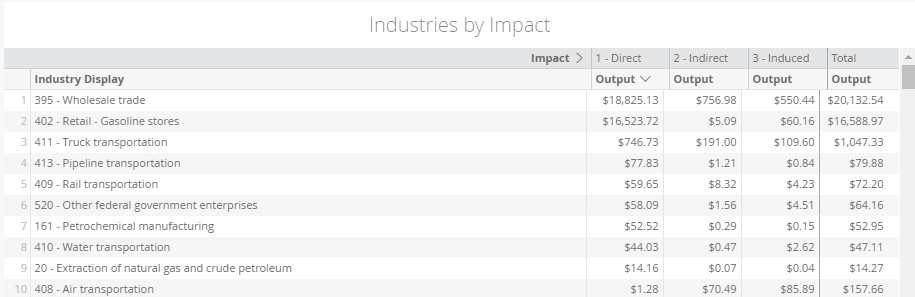

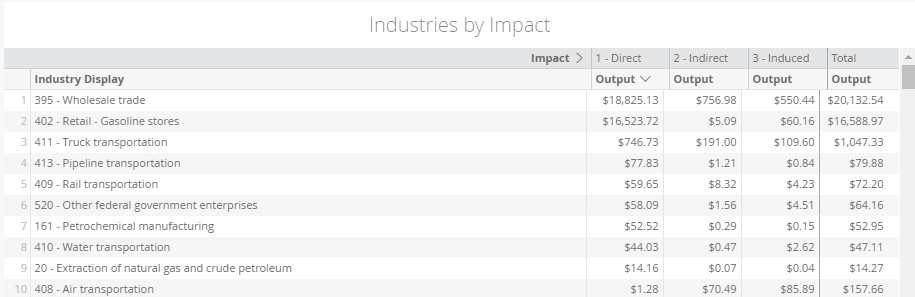

Therefore when this Event is Run, we see Direct Output Effects to each Sector that produces the above Commodities in the Region.

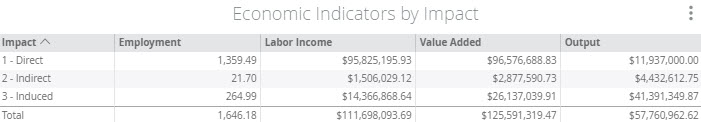

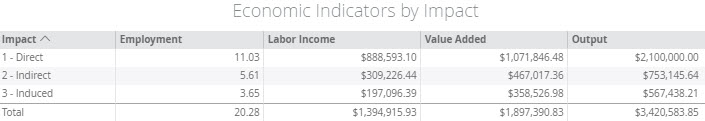

To illustrate this, here are the Detailed Direct Output Results of this Event analyzed as if the gas station in our example is located in Mecklenburg County, NC (2017 Data Year):

These Direct Output Effects sum to $36,403.14 rather than the full Event Value modeled, $100,000, largely due to the setting of LPP to SAM. Notice there is only $52.52 of Direct Output in Petrochemical manufacturing and $14.15 in Extraction of natural gas and crude petroleum (both producers in the Region of refined petroleum) even though the Producer Price for the gas according the Margins was $100,000 x .63 = $63,000. This is because in Mecklenburg County, NC 2017 the RPC for refined petroleum is only 0.11% (found in Region Details > Social Accounts > Reports > Commodity Summary, in the Commodity Averages Summary table see “Average RPC” column). The remained of the $63,000 is a leakage, suggesting most of the gas pumped in Mecklenburg County is produced outside of the Region. The largest Direct Output Effects are to the Wholesale and Retail Sectors because these services are the most locally available portion of the Value Chain in this example. Nonetheless, this approach captured much more of the local impact of the hypothetical visitor gas spending than using an Industry Output Event in the Retail – Gasoline stores Sector. When we took the approach of using an Industry Output Event in the Retail – Gasoline stores Sector the only Direct Output Effect was to the specified retailer of $17,220 based on a Total Revenue of $105,000 (based on $100,000 of Total Revenue this value would have been $100,000 x .164 = $16,400). Notice here in the case of our margined Commodity Output Event, Direct Output Results are quite similar for Retail Gasoline stores at $16,523.72, shown above (based on a Total Revenue of $100,000). In addition to the Direct Effect on the gas station Sector, we also see the local Direct Effects to gasoline producers, transporters and wholesalers.

MARGINAL REVENUE

By selecting Marginal Revenue in a Commodity Output Event, you are indicating to the software that no Margins should be applied, and therefore the full Event Value will be analyzed as Output of the specified Commodity.

Marginal Revenue is most commonly the appropriate selection in a Commodity Event when the Commodity specified in the Event was not purchased via a retailer or wholesaler, even though it is available via retail/wholesale sellers. For example, large corporations often source goods directly from manufacturers, but households would purchase these same goods via a retailer.

Let’s reconsider our example of retail spending at the gas station. If we knew the price of the gas produced by the petroleum refinery before the gas was shipped out, we could enter this Producer Price as the Event Value of our Commodity Output Event with the Refined petroleum products Commodity specified, and select “Marginal Revenue” in the Advanced Menu of the Event. Again, it is possible to know Marginal Revenue to a producer, but it is much more common to know the Purchaser Price paid at the retail/wholesale establishment than the Producer Price.

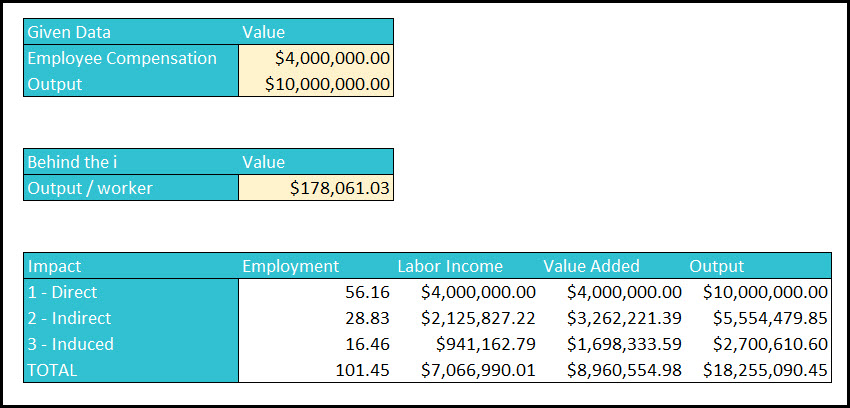

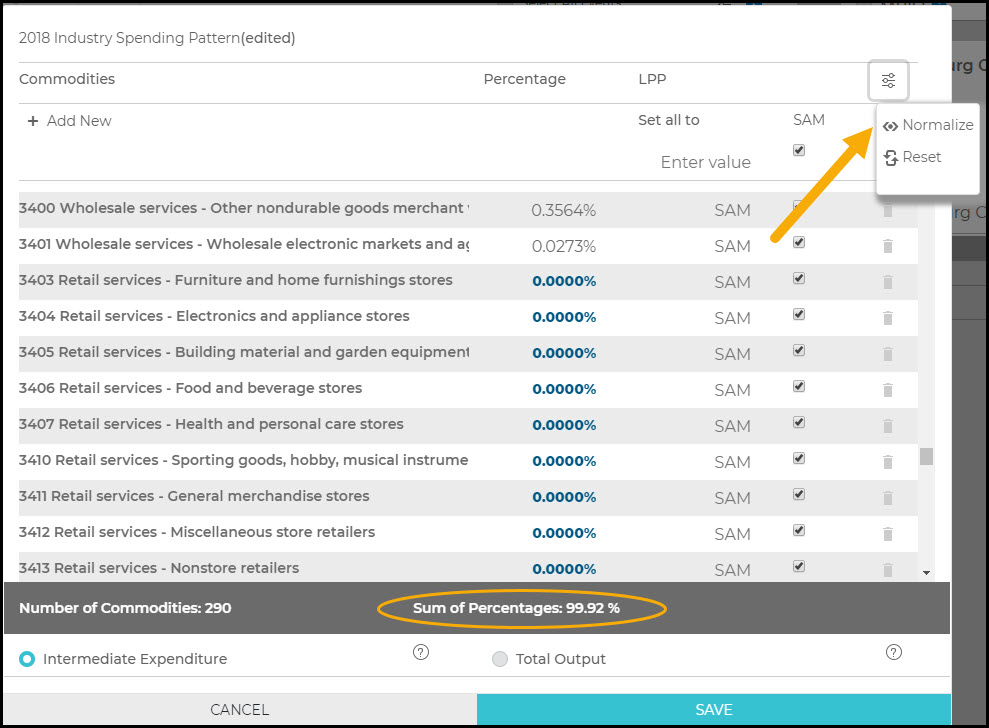

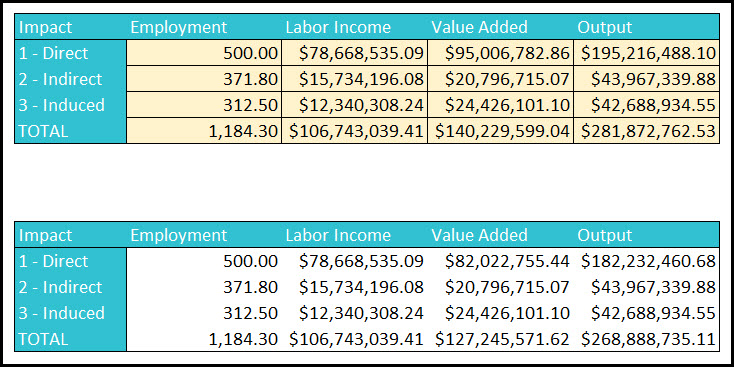

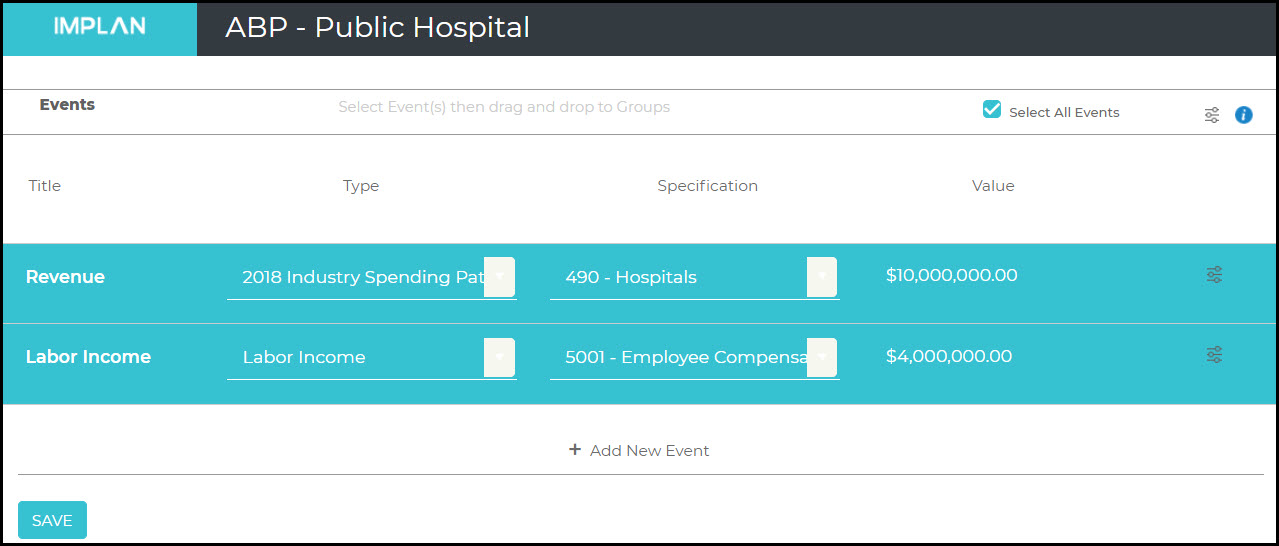

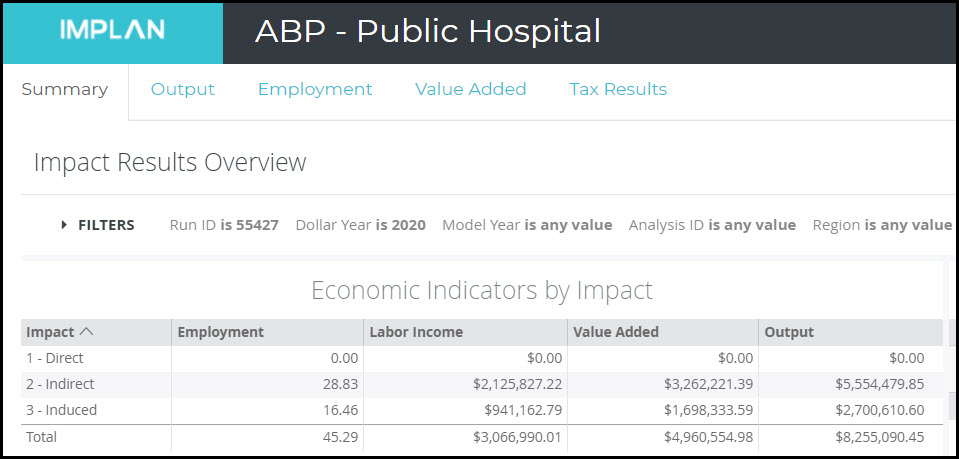

MARGINS IN SPENDING PATTERN EVENTS:

Spending Patterns in IMPLAN are made up of a list of Commodities, so think of Spending Patterns as a grouping of Commodity Events. The key difference between a Spending Pattern and a grouping of Commodity Events is that the Spending Pattern Event will not produce a Direct Effect. Learn more about using Spending Patterns and groups of Commodity Events in the context of Analysis-by-Parts here.

Another variation between Spending Pattern Events and Commodity Events is that the value of each Commodity within a Spending Pattern can only be edited by updating the coefficient associated with the given Commodity. The coefficient on each Commodity reflects the spending per dollar of Intermediate Expenditures (by default) or Output, depending on what is selected in the Advanced Menu of the Spending Pattern Event. There is no option to apply Margins to the Commodities within a Spending Pattern Event because they are already marginned. As mentioned, when Margins are not applicable the Event Value is assumed to be the Producer Price/Marginal Revenue. The same is true for the coefficients associated with the Commodities of a Spending Pattern Event.

Because Spending Patterns in IMPLAN are marginned, the coefficient for each Commodity in a Spending Pattern reflects the portion of spending that will be allocated as the Producer Price of each Commodity. Therefore, the coefficient on retail/wholesale Commodities in a Spending Pattern reflects the portion of spending that will be estimated as the Marginal Revenue to the given Commodities.

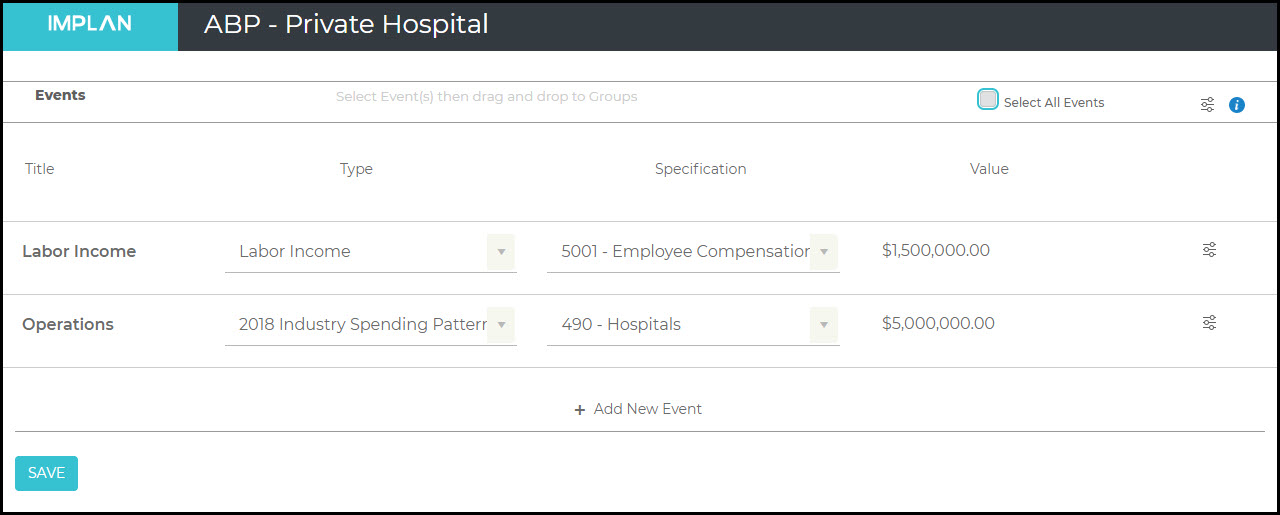

and then clicking on the Advanced Menu

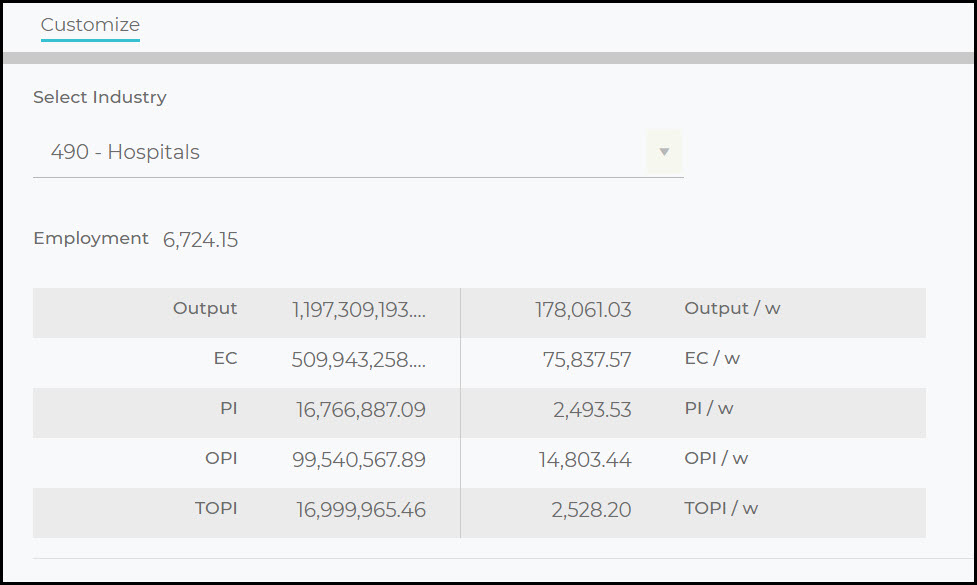

and then clicking on the Advanced Menu  and selecting Customize Region

and selecting Customize Region