MRIO: Multi-Regional Input-Output Analysis FAQ

1. What data is required to create an MRIO?

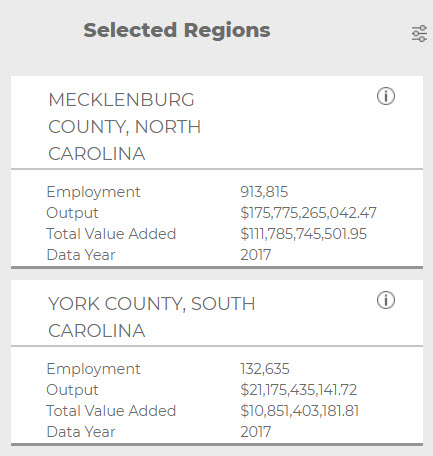

In general, you need to have the data for your Core Region and the additional regions from which you want to see feedback linkages/impacts.

If you want to analyze data at a state level, you need to have State Package data. This data set allows you to create the Rest of State (ROS) Model by combining all of the counties in the state minus the counties where your Direct Effect occurs. These Direct Effect counties are endogenized in the State Total file, and thus you can only use a State Total file with counties that are not included in that state. Attempting to create an MRIO by linking Direct Effect counties within a state to the State Total file will produce erroneous results.

2. When would you use MRIO? Would you use MRIO if you only wanted to analyze the impacts to one specific county?

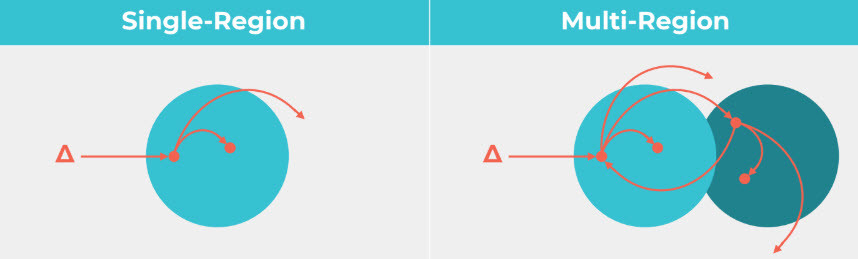

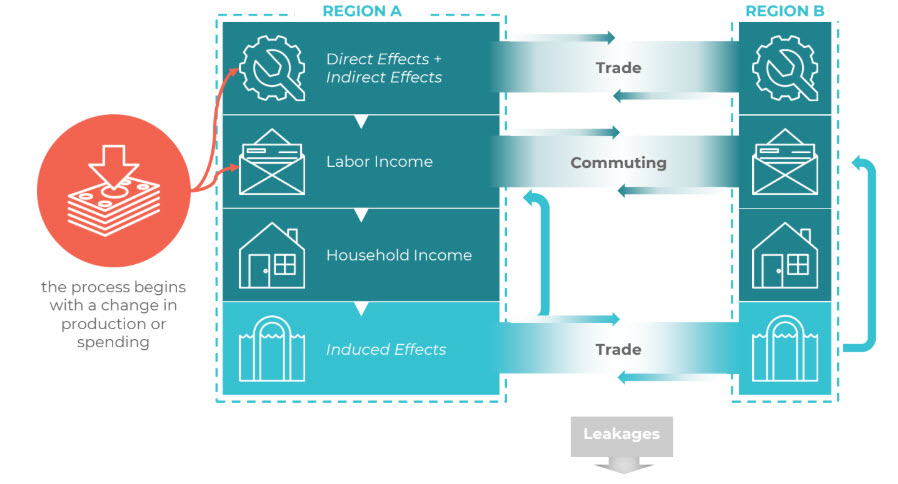

Both Single-Region and Multi-Regional Input-Output Analysis are valid methodologies. MRIO offers the advantage of providing a more robust and accurate picture of a local economy because most economies are not isolated to a single county.

An MRIO analysis allows you to keep the Multiplier identity of the core county (or region) while still being able to see how activity in the core region (where the Direct Effect takes place) touches other regions within a functional economy. Therefore, even if you were interested in the results in a single county, you could use MRIO if you wanted to capture feedback linkages to the core region from purchases your region made to those connected counties. However, in most cases this will not provide significant changes to your results.

3. Does the MRIO analysis provide a different net effect (or multiplier) than an analysis using only a single region?

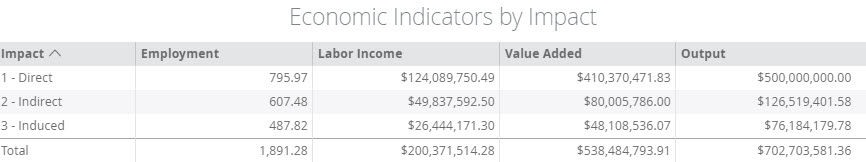

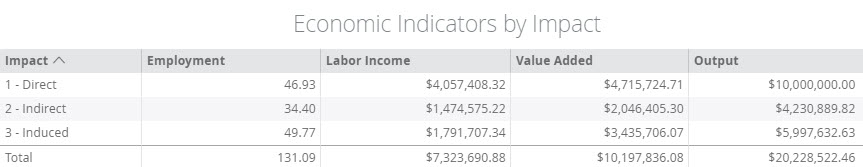

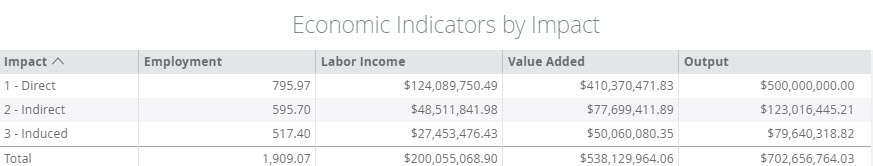

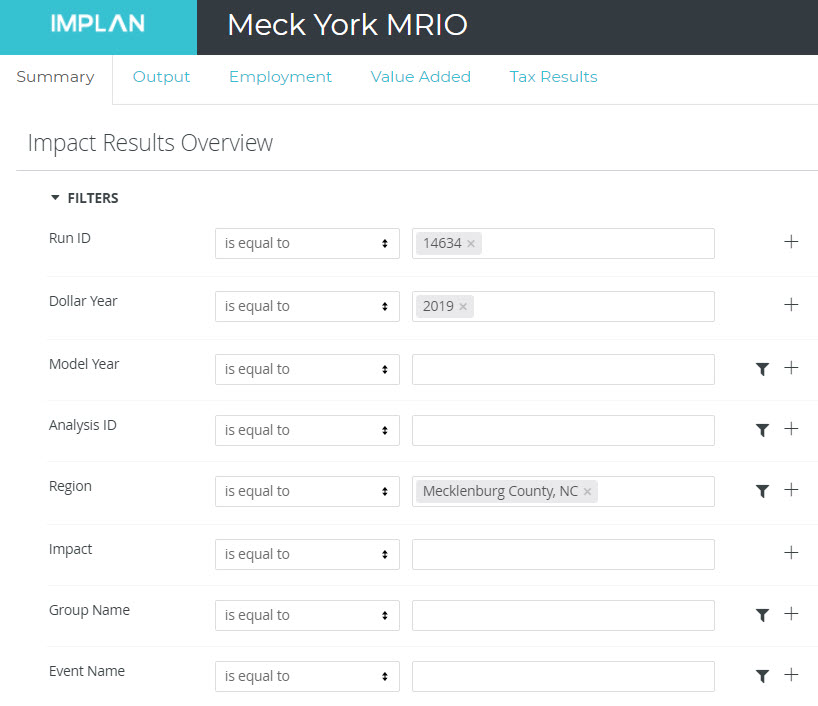

The only way to determine the Multipliers associated to an MRIO anlaysis is to calculate them by hand. We recommend exporting or copying/pasting your results to an Excel spreadsheet and summing the results to calculate the Multipliers using the base equation Total Effect/ Direct Effect. Please read this FAQ article to get more information about summing results from an MRIO and calculating the new Multipliers. The reason the Multipliers are different from single-region Multipliers is that we are capturing leakages to the linked regions that are lost from a single-region analysis. Therefore, there may be feedback from linked regions that will increase the effects in the core Study Area Region as well as the additional captured linkages represented in the linked Models.

The reason that this is a recommend analysis type is that it avoids the Aggregation Bias of aggregating Model regions. The state Multipliers will represent an average of all the firms in the state and their relationships for Output per Worker and Labor Income per worker. These can be drastically different from those in a smaller region, a cluster, or an MSA. Users are occasionally confused when the state actually has smaller values than the region where the Direct Effects occur; MRIO avoids this apparent anomaly that occurs when the supply of a commodity is concentrated in a single geography or a small group of geographies in a state, and thus demand at the state level increases without a substantial increase in supply. This happens in examples like Silicon Valley when considering tech Sectors.

4. Does MRIO provide region-specific effects from the aggregate analysis or completely different results from an aggregate region analysis?

MRIO Multipliers are unique and will be different from the aggregate region’s Multipliers (a region where all the files have been built into a single Model). The Multipliers in an aggregate Model are a weighted average of the region’s individual Industries and are thus subject to Aggregation Bias. These Multipliers are displayed in the Multipliers screen in the Explore menu. Conversely, MRIO Multipliers are unique to each set of linkages and must be calculated for each analysis as at no point are the regional Study Area Data information from the different areas combined.

5. Is MRIO effectively quantifying the ongoing chain of impacts?

MRIO, in effect, extends the supply chain impacts into surrounding regions while still keeping the Multipliers for the core region intact and unique. Thus the rounds of additional impacts are extended to include feedback between all the linked regions until all purchasing dollars are leaked from the Indirect and Induced Effects.

6. Are you able to aggregate the impact results of all models in the MRIO analysis into an “Impact Summary” within IMPLAN instead of exporting to Excel?

Not at this time. Impact results of all models in an MRIO analysis must be exported in order to sum the results. This allows you to individually quantify each regional impact and provides the flexibility to sum the regional impacts together to get a Total impact.

7. How do you aggregate the counties into “regions” and the “rest of state”?

You do this through the Model build process. When you build your Models you will select all the regions that you want incorporated into a single Model and then build that Model. This article provides additional information on aggregating Study Area regions in the Model building process.

8. How do you calculate a Multiplier for an MRIO Scenario?

You take the Total Effect (the sum of all the linked regions and the core) and divide this value by the Direct Effect for each factor. For additional information on how this is done, please see this Knowledge Base article.

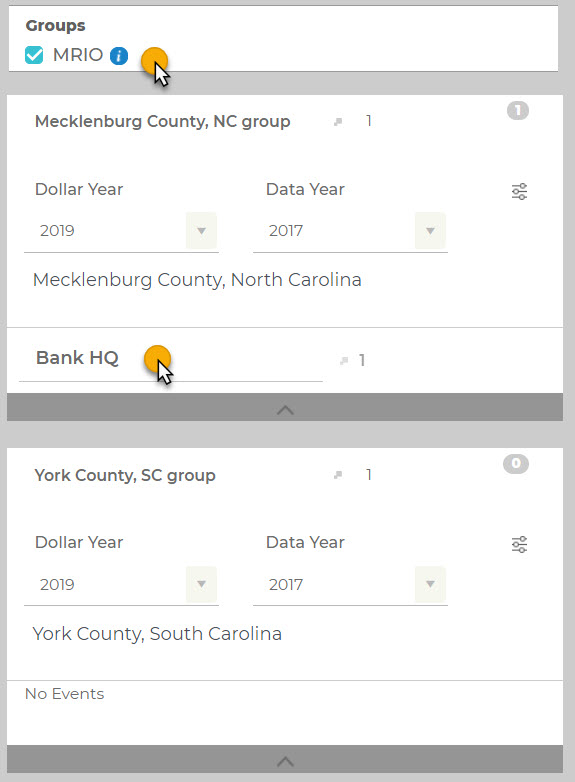

9. Do you need to enter the Activities into the linked models?

No, you only build the Activities in the region where your Direct Effect occurs. The Model linking process will calculate the impacts in the secondary Models. If you have Direct Effects in multiple regions, then you need to build a series of Models for each Direct Effect.

So let’s assume that we are dividing the state of CA into 4 regions: North California (NCA), North Central California (NCCA), South Central California (SCCA), and Southern California (SCA). If we only had impacts in NCA, we would need four Models: the NCA Model where Direct Effects are occurring and the three remaining Models we are linking to.

If we then have multiple Direct Effects in each region, we will need 16 Models: NCA, NCCA, SCCA, and SCA where NCA is the Direct Effect; NCA2, NCCA2, SCCA2, and SCA2 where NCCA is the Direct Effect; NCA3, NCCA3, SCCA3, and SCA3 where SCCA is the Direct Effect, and finally NCA4, NCCA4, SCCA4, and SCA4 where SCA is the Direct Effect. This prevents exponential explosion of the impacts from cross linking Models.

10. Where can I find information about the methodology IMPLAN uses to calculate the inter-regional flows of commodity?

We have a white paper in our downloads section that talks about the Gravity Model that lies behind the trade calculations. In addition, commodity flow data from the Bureau of Transportation is used as a Benchmark for the IMPLAN Trade Flows.

11. Where can I find additional documentation about MRIO?

We have some free documentation about setting up an MRIO on our website, and we also have available for purchase our Principles of Impact Analysis & IMPLAN Applications user manual. In addition, we can certainly assist you with analysis setup on our community pages.

12. Do ZIP code areas function similar to counties when conducting an MRIO Analysis?

MRIO is not viable for ZIP Codes at this time, as these data do not have Trade Flows. The level of data currently available at the ZIP Code level is too sparse for us to develop confident Trade Flows. However, there is a methodology for mock MRIO that can be done with ZIP Code level data and also Congressional Districts, which likewise do not have Trade Flow data.

Unfortunately, this means that if you add a ZIP Code or Congressional District level file to your county Model, the resulting Model will not be available for MRIO.

13. As an MRIO analysis links multiple study regions, how does IMPLAN determine each region’s share of the regional purchasing coefficient?

RPCs are calculated on the basis of the Gravity Trade Flow Model in the standard build (eRPC and Supply-Demand Pooling are also options you can exercise). The Trade Flows are also the basis of the MRIO analysis. This Trade Flow Model takes into account a variety of factors including the gravity of certain economies, impedences to trade, and cross-hauling.

14. How does MRIO take into account regions that border another country (Mexico)?

Unfortunately, IMPLAN does not have international trade flows at this time. Thus if imports are from outside the U.S., they are recognized by the Model as foreign imports/exports and are not tracked after they cross the national border. Therefore, international flows cannot be captured by the current Model. The Trade Flow data and MRIO are looking at domestic commodity flows.

Currently IMPLAN does not have data for most regions of Mexico, and therefore we are unable to develop Trade Flows at this time for North America; although, that is certainly something that we have in mind. It is important to note that the foreign imports/exports of commodities themselves are known, we just don’t have at this time flows to track where those foreign commodities are produced. This limitation is also exasperated by the limits of up-to-date raw data for international countries and their states and provinces.

15. How is MRIO’s ability to account for leakages an advantage over traditional Single-Region analyses?

Knowing where leakages go allows you to account for them. In a single region analysis, leakages are just lost. Thus, importing 75% of commodity A means that 75% of the value of commodity A is lost in the first round of the impact analysis. But in reality, that 75% goes to some economy somewhere. MRIO allows you to see if and how your impact in the core region is affecting surrounding regions. Thus if you can buy an additional 5% from region R2, then you can now account for (in region R2’s results) that 5% and demonstrate both where it goes and that it results from your change to the economy. Likewise, if that 5% in region R2 is spent on a commodity that can now be imported from region R1, you capture that additional round of impact.