Economic Impact, Economic Contribution, and Export Base

Introduction

The purpose of this paper is to clarify the differences between three commonly confused terms and methods in the more general realm of input-output (I-O) analysis: economic impact analysis, economic contribution analysis, and gross-base analysis. While each of the three types of analyses has a distinct purpose and method, they all rely on data from an I-O model, which itself is a bit of a misnomer. When first popularized by Wassily Leontief, I-O tables focused on the purchasing behavior (input) and production (output) of industries only. Later, the purchasing, producing, saving, and investing behavior of institutions such as governments and households was also added to the I-O tables, forming what is now known as a Social Accounting Matrix (SAM) and spurring a corresponding name change from I-O models to SAM models.

Please note that in the discussion that follows, Output is used as the measure of interest, though the same principles apply to Employment and any of the individual components of Output. Please also note that we have included a technical section that gives a detailed numerical demonstration of IMPLAN’s recommended contribution analysis methods and their relationship to the established literature.

Economic Impact Analysis

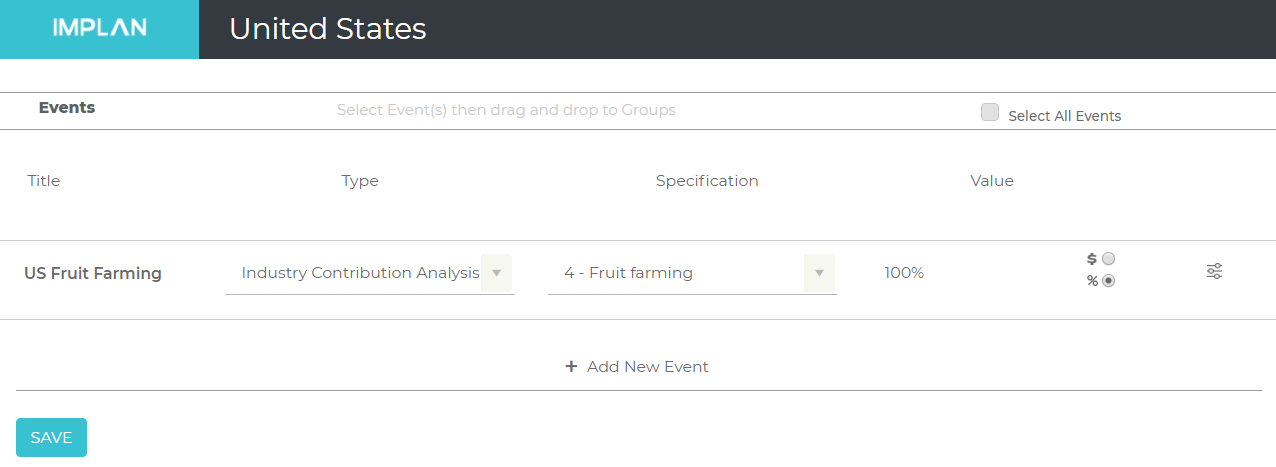

In a typical final demand change (i.e., “impact”) analysis, the analyst is modeling a new firm or a change in the level of Output of a given firm. In such cases, the Direct Effect is the new firm’s total Output or the existing firm’s change in Output. In such cases, it is likely (and logical) that the industry in which that firm belongs will experience total impacts that exceed the direct impacts – that is, the industry will experience indirect and induced effects that stem from the direct effects.

Consider the example of wood window and door manufacturing in Washington County, MN. This industry already exists in the county, with Anderson Windows being one of the existing firms in this industry in Washington County. Now suppose a new wood windows and doors manufacturer, Wonder Windows, is planning to locate in Washington County with expected Output of $5 million dollars. This new plant would create new demand for some local businesses (the purchase of dimension lumber and preserved wood products, for example), which may spur some of these local businesses to undertake building improvements or expansions, thereby necessitating new windows, thereby creating indirect demand for the wood windows and doors sector. Additionally, most firms make purchases from other firms in their own industry (for example, consulting services, equipment rental), which generates additional indirect demand for that same industry. In addition to these indirect effects, the new Wonder Windows plant would also attract some new workers to the region, spurring home improvements to some existing homes and apartments, thereby generating induced demand for the wood windows and doors industry. Such “feedback” effects to the industry are part of that industry’s overall impact in the region.

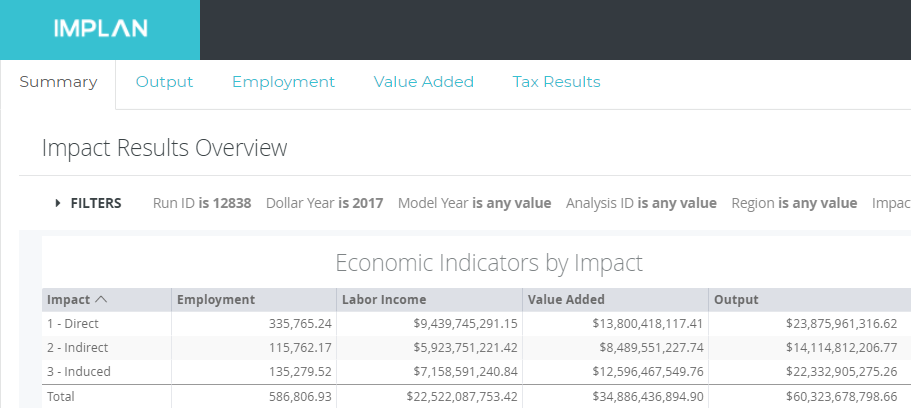

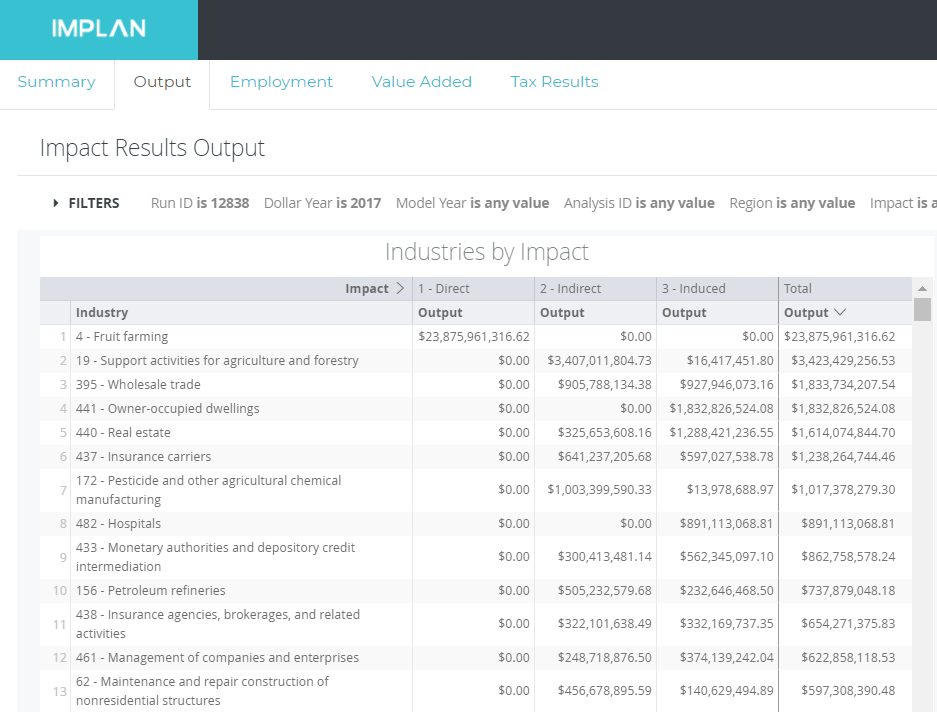

Contribution Analysis – Extraction Method

However, there are occasions when an analyst would like to see the indirect and induced effects that the current level of Output of an existing industry as a whole has on other industries in that region. In this case, the goal is to generate a total Output effect on the primary industry of interest that is equal to the current level of production of that industry, while showing the indirect and induced effects that this current level of Output has on other industries in the region. In other words, the only “effects” that the industry of interest should experience are the direct effects (e.g., current Output), while other industries in the region experience indirect and induced effects associated with (i.e., in support of) the direct effects in the industry under study. In such a study, it does not make sense to allow feedback effects on the primary industry of interest, since an existing Industry cannot experience a total Output “effect” that exceeds its current level of Output. In other words, the question of contribution analysis assumes by definition that the effect on the sector whose contribution is being measured is the entire value of its own Output.[1]

As another example, consider the shutting down of an industry. If the current level of industry Output were to be modeled as a negative direct effect using the traditional impact analysis approach, the model would show a total loss to this industry that is greater than its current level of Output – but it’s not possible to lose more Output (or Employment) than currently exists!

Therefore, special modeling techniques are required in these cases to ensure that the results accurately reflect the addition/loss of just the projected/current level of Output of the industry of interest plus the indirect and induced effects in other industries. This is the purpose of what we at IMPLAN term Contribution Analysis. The basic idea is to disallow indirect or induced purchases from the industry of interest in such a way that does not affect the indirect and induced effects on other industries. In the input-output literature, these methods often are called “mixed endogenous-exogenous models.”

If the industry of interest produces just one type of commodity (e.g., wood windows and doors), this is accomplished by setting the regional purchase coefficient (RPC)[2] for that commodity to zero. If, on the other hand, the industry of interest produces additional commodities as by-products of the production of its primary commodity (e.g., cut stock, re-sawn and planed lumber), it is necessary to either a) modify the model to assume that the industry only produces its primary product or b) set the RPC for each of the industry’s by-products to zero. This method can be used for both single- and multi-industry contribution analyses, and instructions to do so in IMPLAN can be found on the IMPLAN website, currently at https://implanhelp.zendesk.com/hc/en-us/articles/115009542247-Multi-Industry-Contribution-Analysis-In-IMPLAN-Pro. This is a similar approach to that described in Miller and Blair’s seminal input-output modeling textbook (2009, pp. 624-625 and Appendix 13.2), although they zero out local purchases from the primary industry directly in the A matrix, whereas in IMPLAN we zero them out indirectly by way of multiplying them by an RPC of zero.

When performing a contribution analysis on a single industry, an alternative approach, also recommended by Miller and Blair, is available. It involves starting the analysis with a direct Output effect reduced by a factor of that industry’s detailed multiplier on itself, accomplished by dividing the industry’s current Output by its detailed output multiplier on that same industry. When this approach is used, there are indirect and induced Output impacts on the original industry that, when summed with the appropriately reduced direct Output, reproduce the original (i.e., current) level of total Output in that industry, and thereby also generate the appropriate indirect and induced effects in other industries, equal to those generated by the RPC method above. The only difference between the results is that with this method, the “indirect” and “induced” effects on the primary industry must be reclassified as “direct” effects. A limitation of this approach is that it can be used only when analyzing a single industry, but an advantage of this approach is that the industry in question is allowed to produce more than one commodity (i.e., no need to reduce the number of by-products to just the one primary commodity). This approach is described in Miller and Blair (2009, p. 625). Instructions for performing this type of analysis in IMPLAN can be found on the IMPLAN website, currently at

https://implanhelp.zendesk.com/hc/en-us/articles/115002812694-Estimate-the-Contribution-of-a-Single-Industry-in-IMPLAN-Pro [3]

A criticism of the multi-industry contribution analysis methodology is that, if one were to perform the analysis for all industries simultaneously, the only “impacts” would be the direct impacts (i.e., the gross outputs of every industry), with no indirect or induced impacts. In other words, there would be no new information gained from such an exercise. We agree that there indeed is no point to such an exercise, since it assumes its own conclusion; but, that neither invalidates the approach nor negates its usefulness when used to examine any number of sectors less than all possible sectors.

In the technical section of this paper, we present a numerical analysis that explains IMPLAN’s contribution analysis methods in reference to established input-output literature and demonstrates their consistency and appropriateness for the contribution analysis problem.

Contribution Analysis – Gross-Base Method

In gross-base contribution analysis, the goal is not to determine what would happen were a sector to disappear from the local economy, but rather to determine the output (or employment, etc.) required by all local industries in support of that region’s exogenous demands, which consist of demands by all non-internalized institutions.[4] We argue that gross-base contribution analysis is a straightforward variant of impact analysis, not a substitute for extraction-based contribution analysis. The context of the analysis determines the preferable method.

Gross-base contribution analysis, as described in Watson et al. (2015), makes one noteworthy deviation from typical impact analysis. It tabulates exogenous demands as a diagonal matrix rather than as a column vector, which gives a matrix of resulting output, rather than a column vector of gross output. It uses the same multiplier matrix as traditional impact analysis; again, the only difference is the dimensionality of the exogenous demand vector. If one models exogenous demand only for a single industry, gross-base analysis is indistinguishable from impact analysis, since both results will be column vectors of identical value.

In gross-base analysis, internalization considerations (also known in the literature as the model closure) are the same as they are for impact and extraction analysis. Internalizing affects assumptions about re-spending in the local economy: at the county level, for example, internalizing federal government implies that federal spending in a particular county is a linear function of federal tax revenue collected due to economic activity in the county. For more information on internalizing institutions, please see this article: http://support.implan.com/index.php?view=document&alias=56-type-sam-multiplier&category_slug=studies-1&layout=default&option=com_docman&Itemid=1764.

Additionally, note that the gross-base method is not a mixed exogenous-endogenous model. For any given institution, it treats either all or none of that institution’s demand as exogenous, rather than extracting certain industries, e.g., agriculture, by characterizing agriculture as exogenous and the remaining industries as endogenous. The methods recommended by Miller and Blair for “extracting” a sector involve treating some industries as exogenous and the rest as endogenous, and recalculating the multiplier matrix (the Leontief inverse) after adjusting for these specifications. The practice of multiplying exogenous demand, when defined for all institutions of a particular type, regardless of whether that demand is all final demand, only some of final demand, or only exports, by its corresponding multiplier matrix better resembles impact analysis than it resembles extraction contribution analysis.

Using either a diagonal matrix or a column vector of exogenous demands performs the same mathematical operation. The only difference is that using the diagonal matrix effectively pauses the calculation before summing each row in the result set. The sum of the elements in a row of the product of a multiplier matrix and consistently defined diagonal matrix of final demands yields the same values that would result were a column vector of exogenous demand to be used; moreover, the column vector approach gives each element that the diagonal exogenous approach yields as one of the steps in its calculation. Simply put, if one used the column vector approach and stopped before finishing it, the values would be the same as what the diagonal matrix approach gives. The individual elements of the sum, however, are informative in their own right and, depending on the context, may be worth reporting and analyzing. Watson et al. characterize the sum of the columns, rather than of the rows, as “base” output.

Accordingly, we believe that the methodology outlined in Watson et al. (2015) would be better termed base-gross contribution analysis and that it should not be confused with extraction contribution analysis, since it is incapable of consistently estimating the effect of extracting an entire sector.[5] Using the multiplier matrix recommended in Watson et al., and applying an industry’s total output as the direct effect would result in an output effect larger than the total output. Similarly, using only final demand for a single industry as the direct effect would not reproduce all of that industry’s gross output, some of which goes to support intermediate production in other industries. In other words, it is ill-suited to answering the question of what would happen if an industry were to disappear in an input-output framework. It appears well-suited, however, to performing “base analysis” for a given specification of a model’s closure (i.e., its specification as to which institutions are internalized/endogenous). Classifying exports as the only exogenous demand is the approach often adopted in gross-base analysis, and has sometimes been termed “export base analysis.” The method of using a diagonal vector of exogenous demands, however, can be applied to any model closure (internalization) specification. To recover total industry output for all industries, however, the exogenous demand vector needs to include all institutions not internalized in the model. Overall, studying the components of the product of the multiplier matrix and diagonalized matrix of exports (or other combination of demand elements that have been classified as exogenous) can be informative in its own right, as explained by Watson et al., but ought to be classified as a distinct method. In short, base output for a given sector represents the effect of modeled exogenous demand for the given sector on all other sectors; gross output for a given sector, in turn, represents the effect of modeled exogenous demand for all other sectors on the given sector.

Technical Section: Internal Consistency of IMPLAN’s Contribution Analysis Methods

In this section, we demonstrate via numerical examples that IMPLAN’s two methods for extraction contribution analysis – single industry and multi-industry – are internally consistent with the model, consistent with the existing literature, and consistent with each other (that is, the multi-industry approach, when used for a single industry, will replicate the results of the single-industry approach).

To establish a common terminology and notation, we briefly review the basic input-output (I-O) model. The common specification of a basic I-O model holds that intermediate inputs plus final demands equals gross output. Algebraically, in matrix form, let A be a be a matrix of intermediate input ratios, I be the identity matrix, y be a column vector of final demand by sector, and x be a column vector of gross output by sector. The y vector also can be described more generally as “exogenous demand.” In the basic I-O model specification, all of final demand – that is, household demand, government demand, investment demand, net inventory additions, and export demand – is classified as exogenous. What the modeler chooses to classify as exogenous is implied by what is internalized in the model. If only industries are internalized, all of final demand is exogenous (this is the specification for IMPLAN’s Type 1 multipliers). If industries and households are internalized (the default specification for IMPLAN’s Type SAM multipliers), then only demand by governments, capital investment, inventory, and exports are exogenous. Another way to think of this is that payments to institutions that are considered exogenous are “leaked” from the economy, whereas some portion of payments to endogenous institutions (usually industries and households in IMPLAN) are re-spent locally. According to the Leontief equation, x = Ax + y. Rearranging, x – Ax = y, and, factoring out x, (I – A)x = y. The matrix of multipliers is found by identifying the matrix by which exogenous demand can be multiplied to reach total output, which is the inverse of (I – A). Put differently, for a given amount of exogenous demand, multipliers tell how much total output needs to be produced by each industry. One multiplies the inverse of (I – A) by both sides of the equation to reach the solved equation, which is (I – A)-1y = x. This definition provides a test of the consistency of an input-output model. If any two of the three elements (multipliers, exogenous demands, and gross outputs) can be used to find the previously-known third element, then the model should be considered internally consistent.

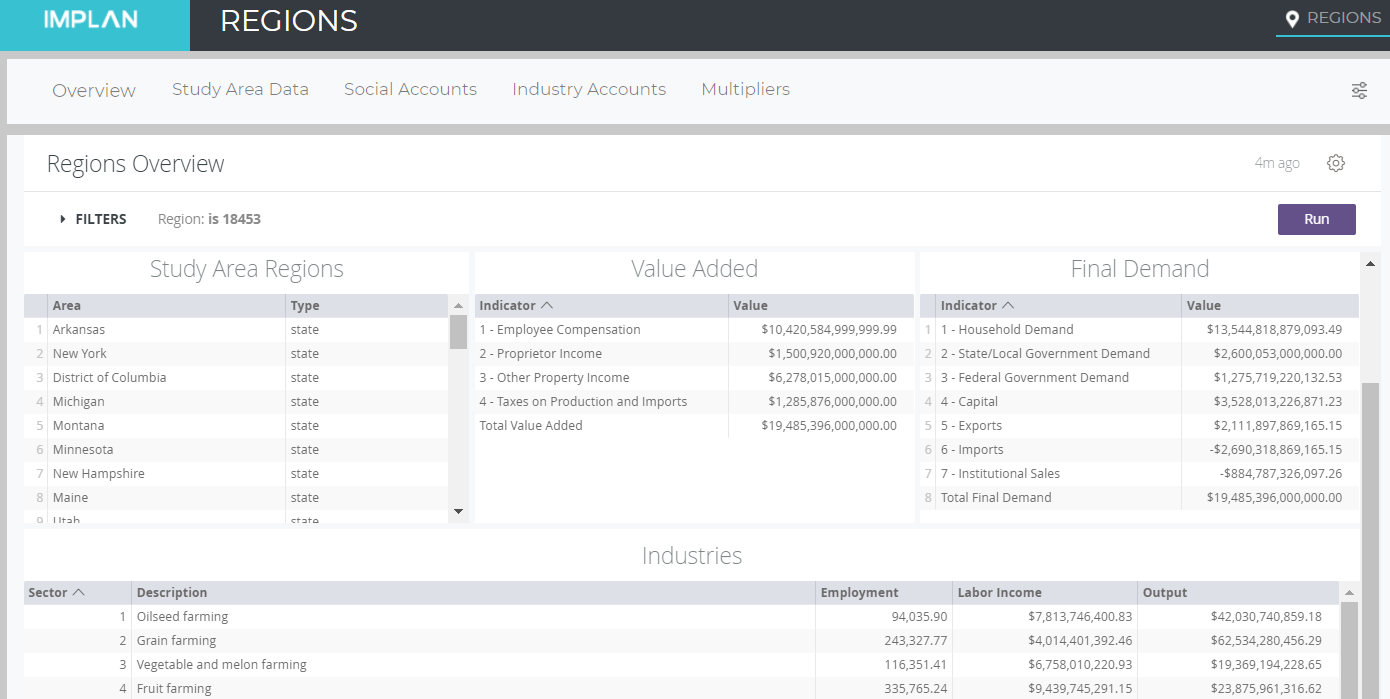

For the numerical illustrations below, we use 2014 IMPLAN data for the United States, aggregated to 5 sectors and a single household type. We begin with a basic I-O model, not yet attempting to perform a contribution analysis. Figure 1 shows the IxI SAM, with exogenous demands (final demands, in this case) highlighted in green, endogenous spending highlighted in yellow, leakages in orange, and transfers in light yellow. Exogenous demands are summed by row in the rightmost column. Figure 2 shows the corresponding multiplier matrix, which is based on an A matrix from just the endogenous industries and institutions (only the industries in this case), also shows sums of exogenous demand, and multiplies the exogenous demands by the multiplier matrix. The resulting vector is of gross output, which matches the initial gross output estimate. Accordingly, the model is internally consistent when set up as a basic IO model in which all of final demand is exogenous and the multipliers are calculated according to the “Type 1” specification.

Figures 3 and 4 provide a corresponding setup based on the default IMPLAN Type SAM specification. Figure 3 shows which components of the IxI are exogenous demands – now households are no longer exogenous – and which are endogenous. The default Type SAM specification (or “model closure”) assumes that labor income payments are re-spent in the economy, less leakages to in-commuting and taxes. Figure 4 shows that the Type SAM specification is internally consistent when the corresponding multiplier matrix is estimated and applied to the new set of exogenous demands.[6]

Next, we extend the Type SAM specification to demonstrate two different methods of contribution analysis. As noted above, contribution analysis asks and answers the question of what would be the effects on all sectors’ output if an entire other sector (or sectors) were to disappear. Miller and Blair describe this as “extracting” a sector and mathematically portray that by reclassifying the contribution sector(s)’ gross output as exogenous. A necessary, but not sufficient, condition for a contribution analysis method to be consistent is that the method’s result must show that the entire gross output of the contribution sector(s) is lost. That is, the result must reproduce the contribution sector(s)’s gross output. Usually, another matter of primary importance in contribution analysis is the effect on all of the other sectors. It follows that the other condition for a contribution analysis to be consistent is that the appropriate levels of multiplier effects on the non-contribution sectors are consistently estimated. As noted above, an IO model can be deemed consistent if a set of exogenous demands and multiplier matrix reproduce gross outputs.

In the first example of contribution analysis, shown in Figures 5 and 6, the entire total output of sector 1 is exogenous, and the remaining sectors have their previous (i.e., default Type SAM-based) levels of exogenous demand. Miller and Blair explain that a viable method for estimating any number of sectors’ contribution to the economy is to “zero-out” certain rows of the A matrix before calculating the multiplier matrix (p. 624-625, with general proof on p. 662). IMPLAN’s method of zeroing-out RPCs achieves the same effect, as zero multiplied by the gross absorption rate for all industries equals zero, leaving zeroes in the A matrix for the contribution industry’s row.[7] Figure 5 identifies exogenous and endogenous demands, and Figure 6 demonstrates that the new exogenous specification (all output of sector 1, as well as previously exogenous demands for the other sectors) reproduces gross output. One can see that sector 1’s gross output is used as its exogenous (or “direct impact”) value, and is the same as the resulting value.

Note that Figures 5 and 6 merely show that this contribution analysis method is consistent. Figure 7 then shows the results for one sector without including exogenous demands for the non-contribution sectors, as one usually is interested in just that one sector’s contribution to all other sectors’ output. Figure 8 shows that the single-industry method, when used only on one industry, produces results identical to the multi-industry method as in Figure 7. Recall that the single-industry method involves either dividing the leftmost column of the multiplier matrix by the own-sector multiplier (as in Miller and Blair, p. 625, with extensions following) or the algebraically equivalent function of dividing the top row of the exogenous demand vector by that same own-sector multiplier (as recommended by IMPLAN).

Since Figures 5 and 6 demonstrate the consistency of the multi-industry contribution analysis method, and Figures 7 and 8 confirm that the multi-industry method is consistent with the single-industry method when estimating the contribution of just one industry, it remains to be shown only that the multi-industry method is indeed consistent for more than one industry. Figure 9 shows the identification of exogenous and endogenous payments. Figure 10 demonstrates consistency: by specifying the gross output of the first two sectors as exogenous and using the ordinary exogenous demand for the remaining sectors, it reproduces gross output when multiplied by a multiplier matrix based on an A matrix with the first two rows zeroed-out. Again, we rely on Miller and Blair for the formal mathematical demonstration that the method continues to be consistent for any number of “extracted”, or “contribution”, sectors.

Click here to find figures in the Word doc version of this article.

Other Related Articles:

References

Miller, R.E. and P.D. Blair. 2009. Input-Output Analysis: Foundations and Extensions, Second Edition. New York: Cambridge University Press.

Watson, P., S. Cooke, D. Kay, and G. Alward. 2015. A Method for Improving Economic Contribution Studies for Regional Analysis. Journal of Regional Policy and Analysis, 45(1): 1-15.

[1] Economic contribution analysis usually is not, as stated in Watson et al. (2015), “generally regarded as referring to the ex post effects on economic activity in a region from the exogenous sales of a given sector in a previous time period.” That definition typically applies to economic impact analysis.

[2] The RPC represents the proportion of local demand for a commodity that is met by local producers of that commodity.

[3] Miller and Blair’s example divides the first column of the multiplier matrix by the detailed multiplier, which is algebraically equal to, but computationally less efficient than IMPLAN’s recommended method of dividing the first row of the exogenous demand vector (i.e., the direct impact vector) by the detailed own-sector output multiplier.

[4] Exogenous demand is defined as demand by institutions that are not internalized in the model. Accordingly, if only exports are classified as exogenous, all other institutions are internalized.

[5] See the technical section below for a more detailed development of the notion of a consistent method for contribution analysis.

[6] The Type SAM multipliers reported in IMPLAN are not the sum of every row in the table presented here; rather, in its multiplier reports IMPLAN displays only the sums of the industry-by-industry Type SAM Output multipliers. Additionally, the Type SAM multipliers reported in the software may differ slightly from those calculated outside of IMPLAN due to rounding issues involved in large matrix operations.

[7] Note that one cannot directly zero-out the A matrix in IMPLAN, which is why we recommend the RPC approach. To fully zero out a row of the A matrix in IMPLAN, then, one must ensure that an industry produces only one commodity, else the row will not be completely zeroed-out.