Indian Tribes: Considerations for Native American Impacts

INTRODUCTION

There are 1.9 million American Indians and Alaska Natives belonging to 574 federally recognized American Indian tribes and Alaska Native Villages in the U.S. Not only are Native Americans an important part of our national identity, but they are also a large part of the national economy.

TRIBAL GOVERNMENTS

Generally, Tribal Governments are covered by QCEW (from the BLS, our main source for wage & salary employment) and BEA (another source for employment), and both sources classify tribal establishments as local government. Therefore, they are included in IMPLAN data. However, some tribal authorities are not subject to Federal/State employment security (ES-202) laws. Those who are must report employment and income. It is optional for those who are not.

If they are covered and included, there is unfortunately no way to identify in the data sets which employment is Tribal vs. other Local Government. You could ask employment security for your state if the reservation reports. If it does, their information will be included in the county data – if not, it probably is not included. It is best to work with Tribes to get detailed data or use proxies based on related IMPLAN spending patterns like Institutional Spending Pattern 12001 – State/Local Government Other Services.

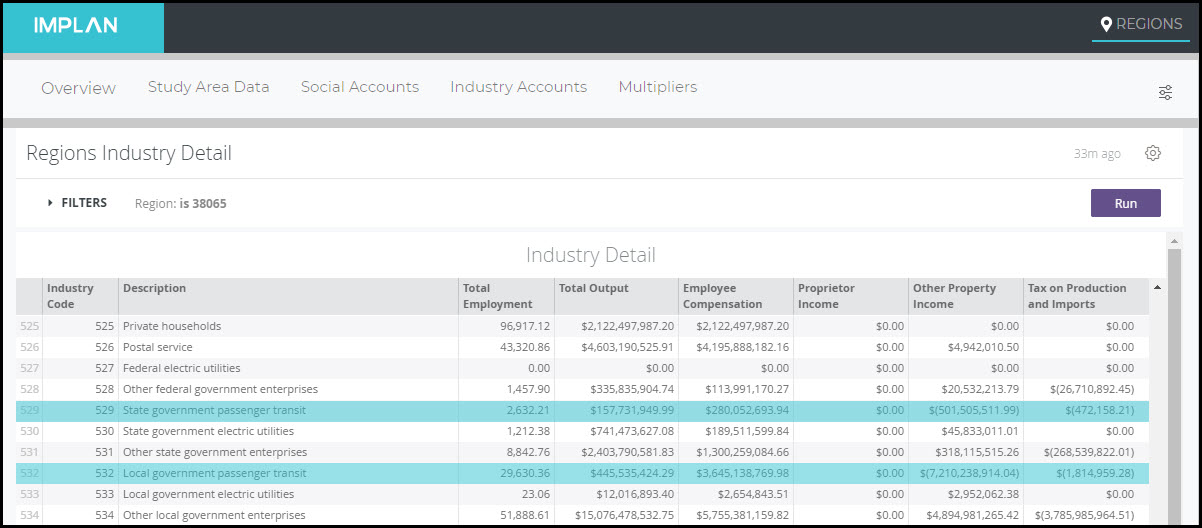

Tribal Government can potentially be found in:

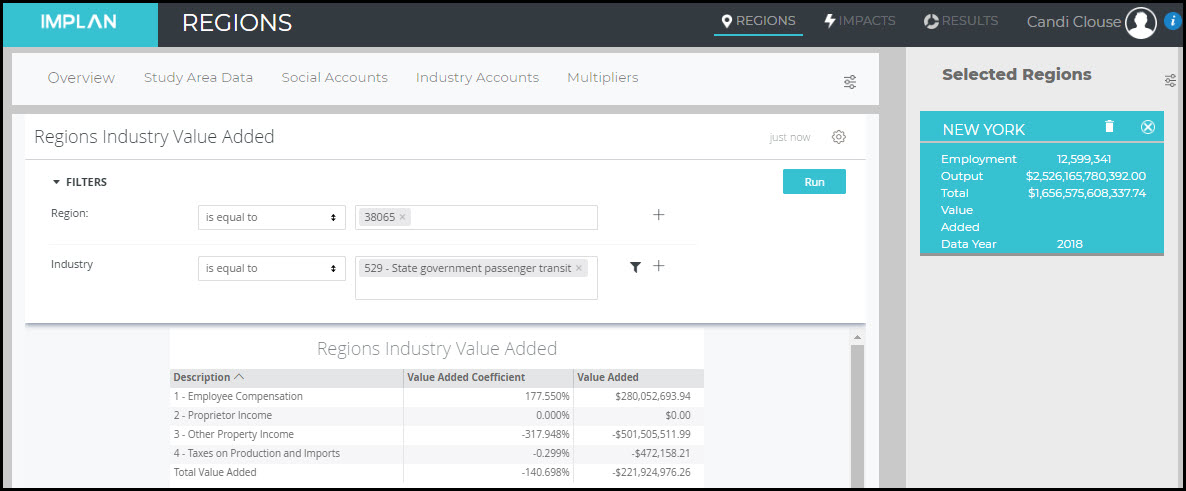

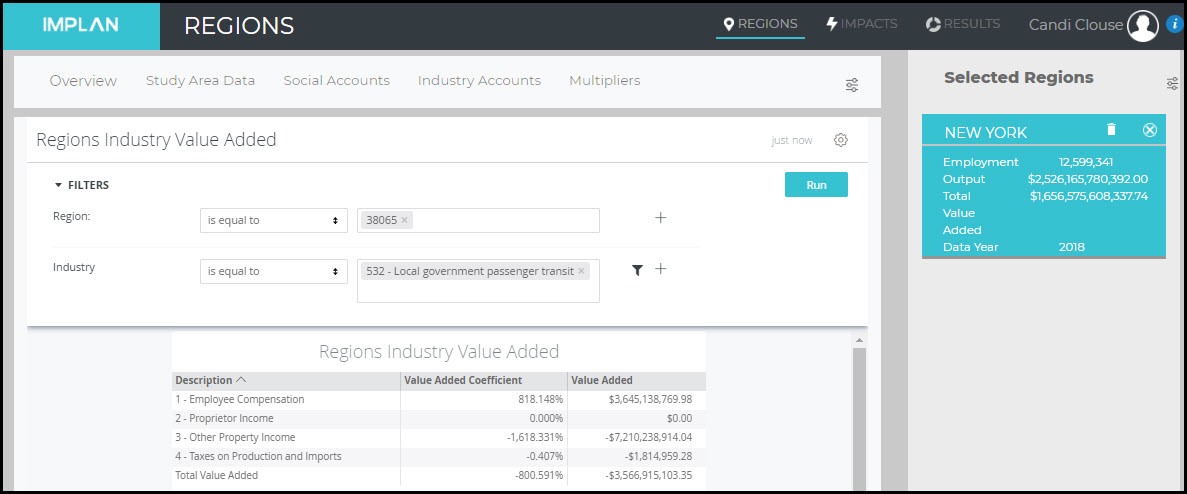

- 532 – Local Government Passenger Transit

- 533 – Local Government Electric Utilities

- 534 – Other Local Government Enterprises

- 542 – Employment and payroll of local govt, education

- 543 – Employment and payroll of local govt, hospitals and health services

- 544 – Employment and payroll of local govt, other services

BUSINESSES

Tribes operate many businesses and enterprises. While Tribal data falls into the above mentioned Industries, determining the effects of a specific Tribal business operations is often better achieved through using the appropriate Industry for each business, working with the Tribe to determine appropriate inputs, and applying some modifications to the results as required.

For example, many casinos are owned by Tribes, in which case these establishments will be captured in the region’s data for Industry 534 – Other local government enterprises. Unfortunately, in such a case there’s no way to determine how much of Industry 534 belongs to the Tribal government, and of that, how much belongs to Tribal casino operations. If we want to analyze the operations of a Tribal casino, working with the Tribe to determine the scale and specifics of their casino operations is recommended. With those initial findings, we can utilize the methods described in the article Casinos: Acing the Impact to run our analysis.

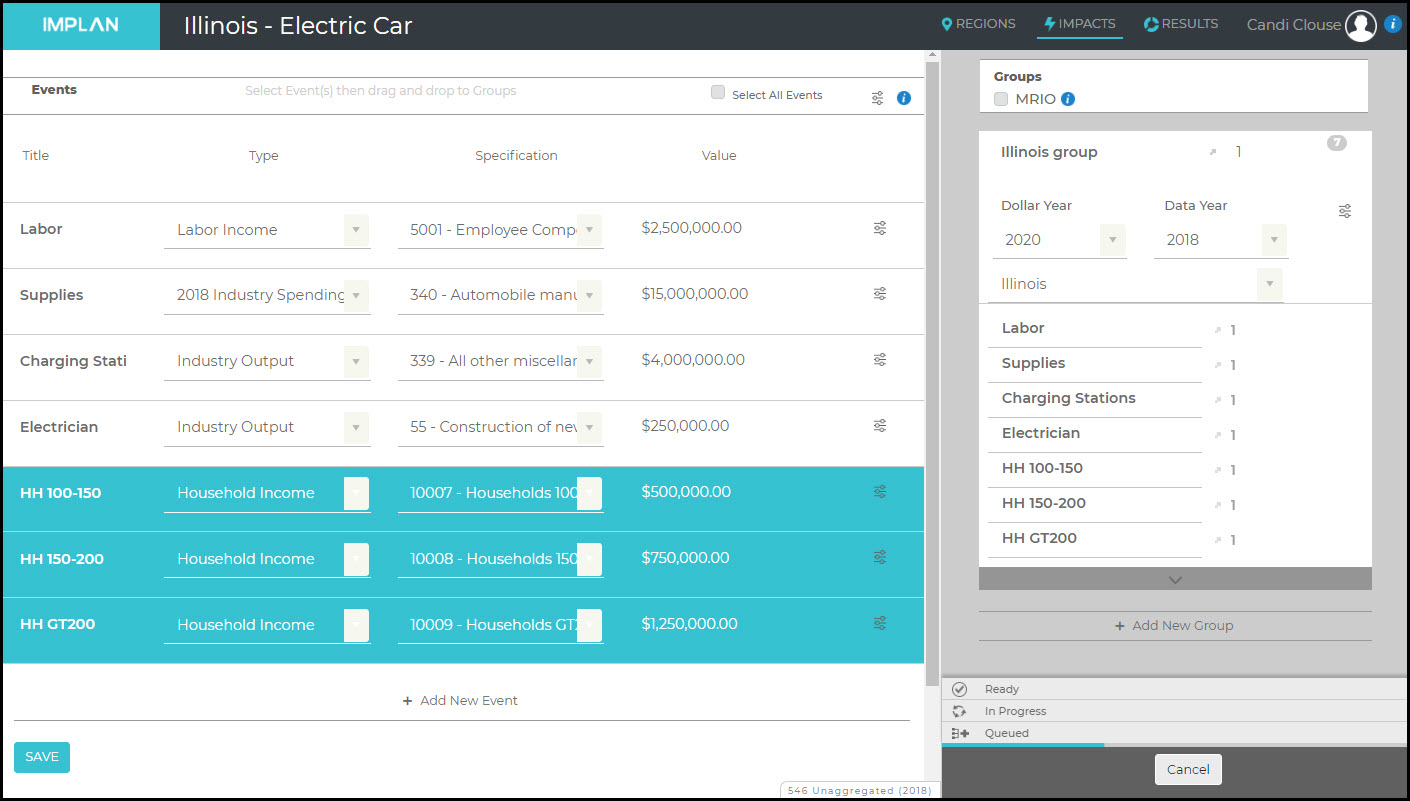

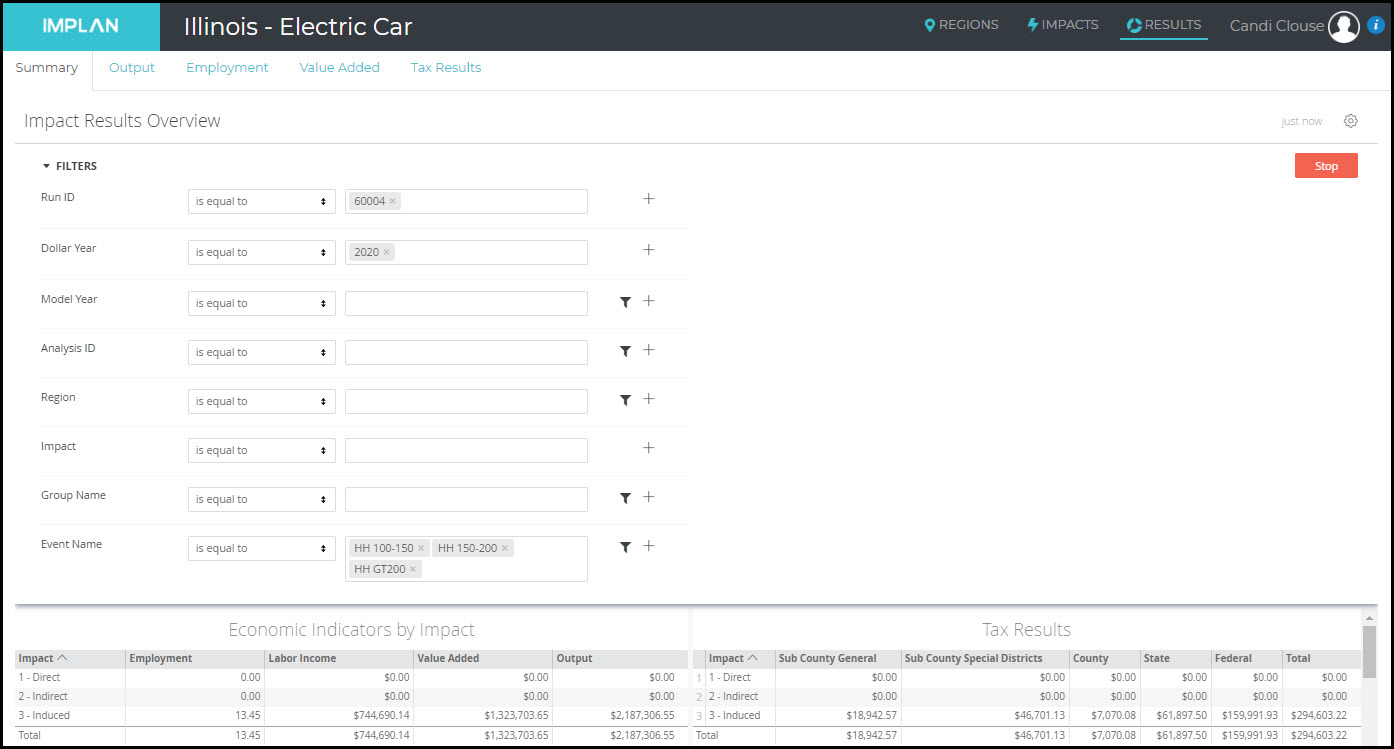

INTERNALIZING TRIBAL GOVERNMENT

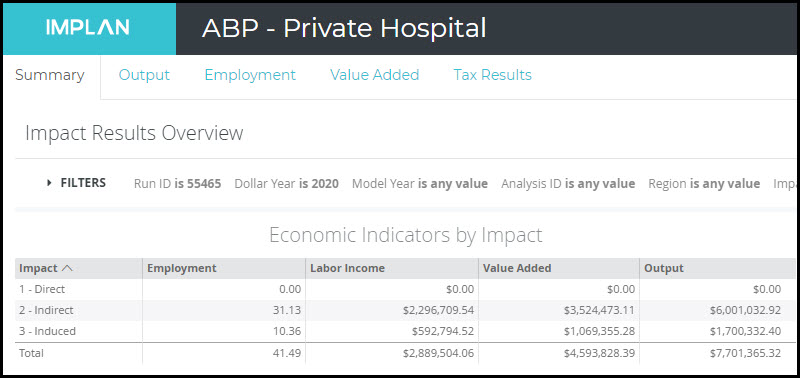

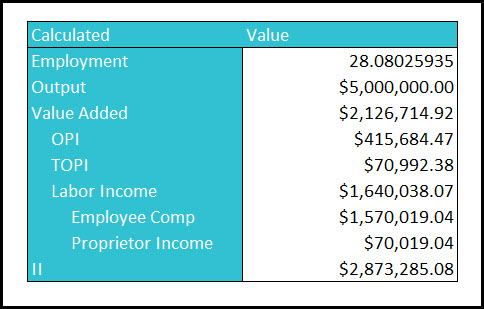

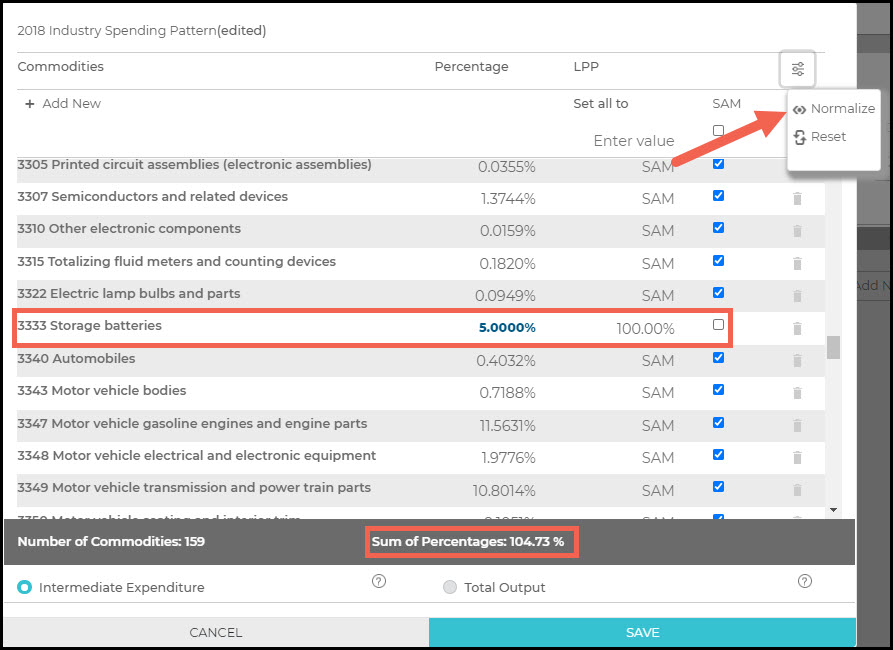

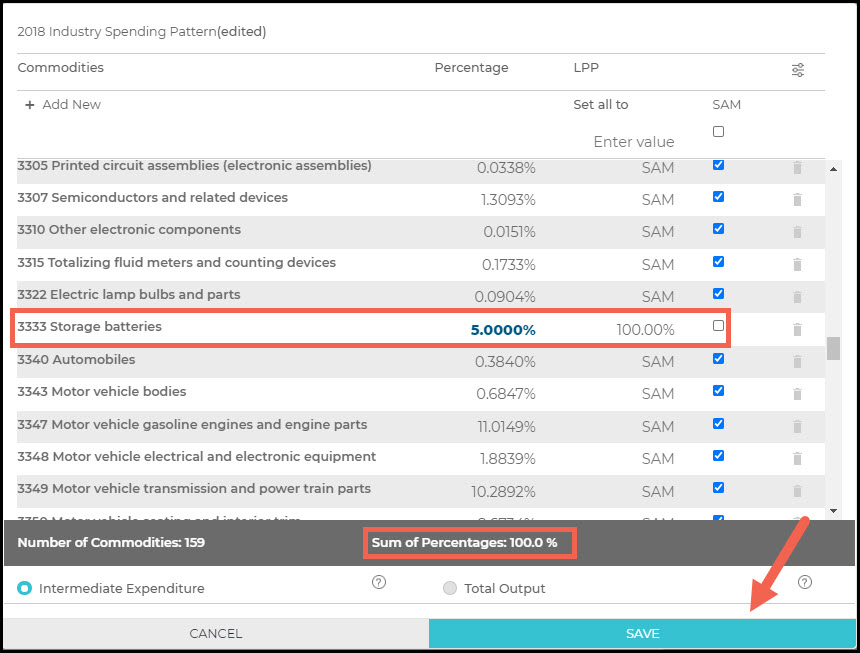

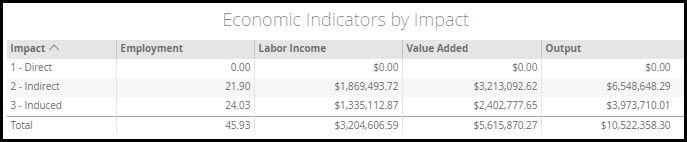

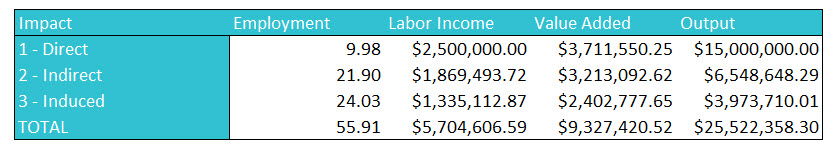

Let’s take an example where a Tribal casino makes a payment to the Tribal government (like a tax). By default, IMPLAN will treat this payment as a leakage, as it treats all tax payments. If we want to look at how that government payment ripples through the economy, we can add an Institutional Spending Pattern 12001 – State/Local Government Other Services Event in the amount of the payment, being sure to set the LPP to 100% in the Menu by unclicking the SAM checkbox. Because this is not a Direct Effect (or even an Indirect one), all of the Results of the Institutional Spending Pattern (Direct + Indirect + Induced) should be moved to the Induced line. Then the Results from the casino can be added to the Results from the Tribal Government.

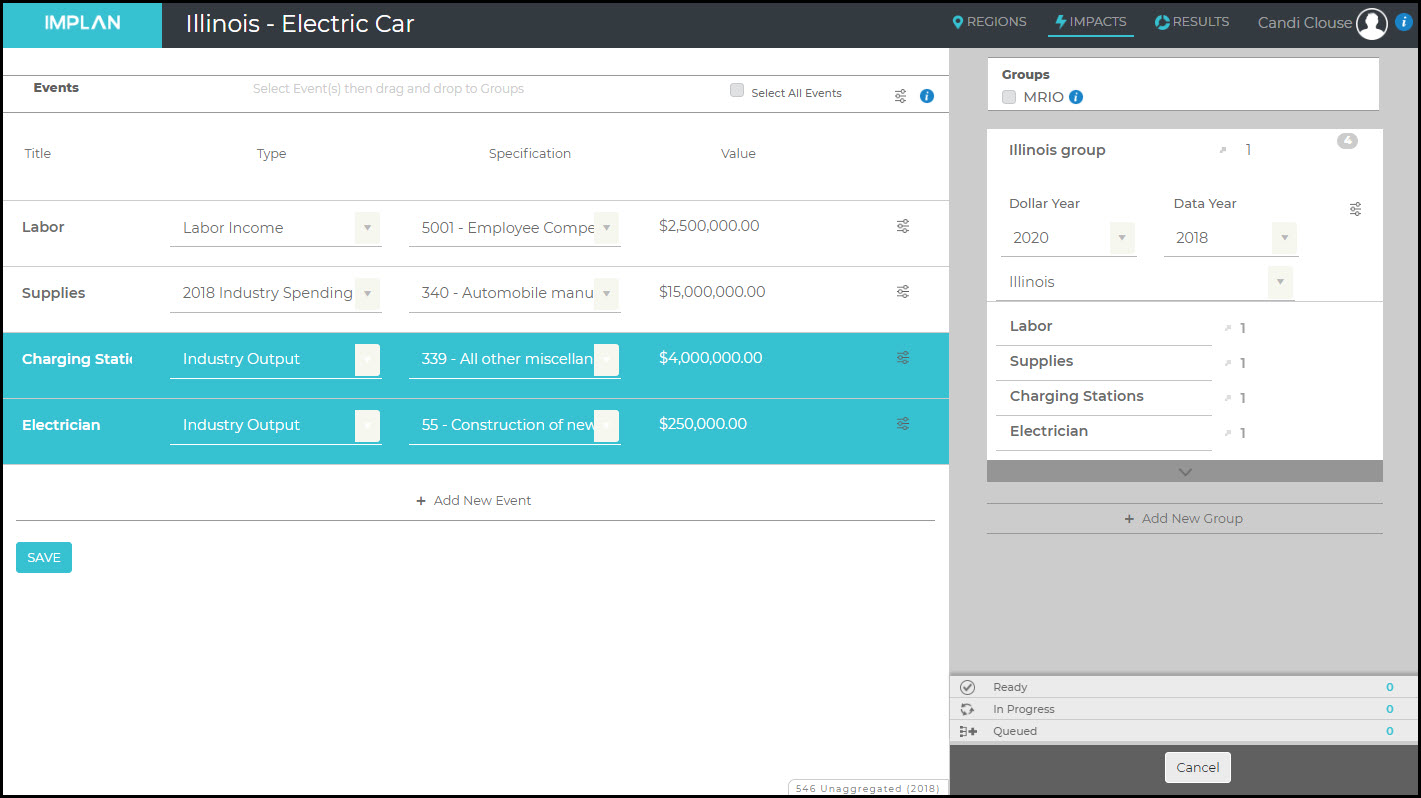

FEDERAL PROGRAMS

There are many federal programs specifically designated for Tribes like the Tribal Transportation Program and the Indian Health Service. Through various programs, federal dollars are invested in local economies on everything from healthcare to bridge construction. To best model this funding, the Industry receiving the grant should be utilized. So, if you are modeling the construction of a new school, Industry 53 – Construction of new educational and vocational structures should be used.

OTHER RESOURCES

Federally Recognized Indian Tribes and Resources for Native Americans

National Congress of American Indians

U.S. Department of the Interior Bureau of Indian Affairs

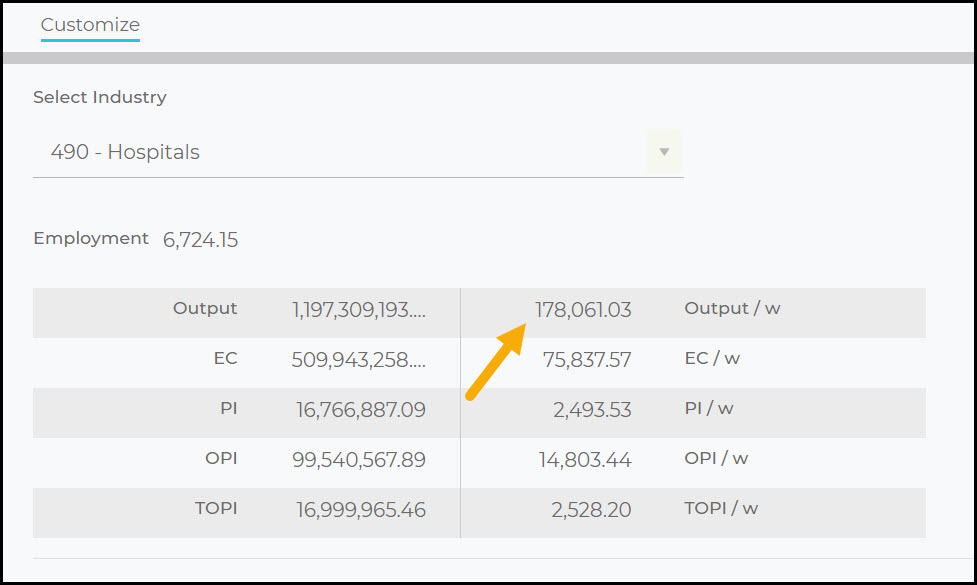

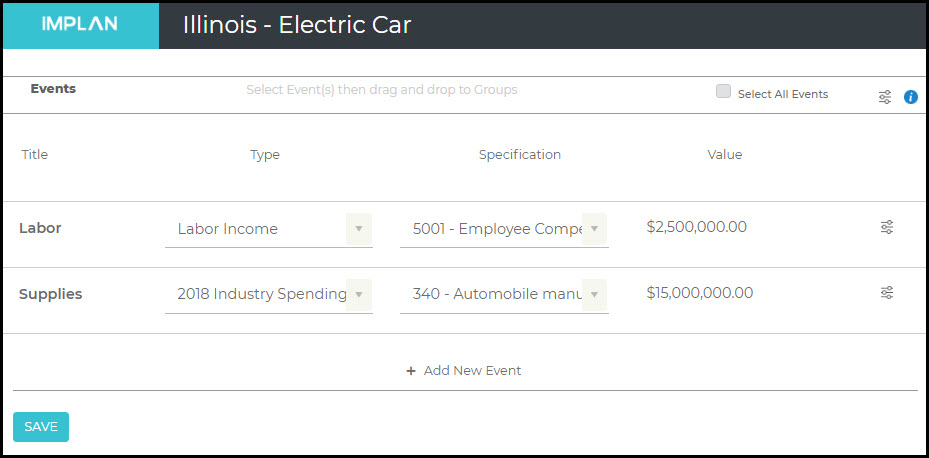

and then clicking on the Advanced Menu

and then clicking on the Advanced Menu  and selecting Customize Region

and selecting Customize Region