Hospitals: Considerations when Conducting Hospital Economic Impacts

INTRODUCTION:

Hospitals can pose an interesting case for IMPLAN analysis. Many are large institutions with immense buying power. But even the smallest of hospitals are anchor institutions, rooted in our communities and unlikely to close or move.

Hospitals will be classified differently in IMPLAN depending on their legal status and how they operate. They also may have facilities that fall under more than one IMPLAN Sector.

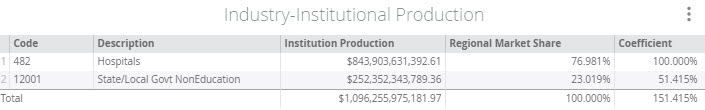

Across the United States in 2017, hospitals accounted for 2.5% of total Output and 2.6% of total Employment. Hospital services were split between the Hospital Sector (76.981%) and State/Local Government Non-Education (23.019%). This means that about ¾ of hospitals across the country are privately held or are nonprofits, while ¼ are run by state and local governments. This data can be found for your study area on the Regions screen by navigating to

Social Accounts >

Balance Sheets >

Commodity Balance Sheet >

Industry-Institutional Production

and then using the Filters button to choose your Commodity of interest. In this case, we used Commodity 3482 – Private Hospital Services.

CHANGE IN DEMAND FOR HOSPITAL SERVICES:

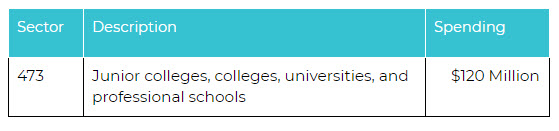

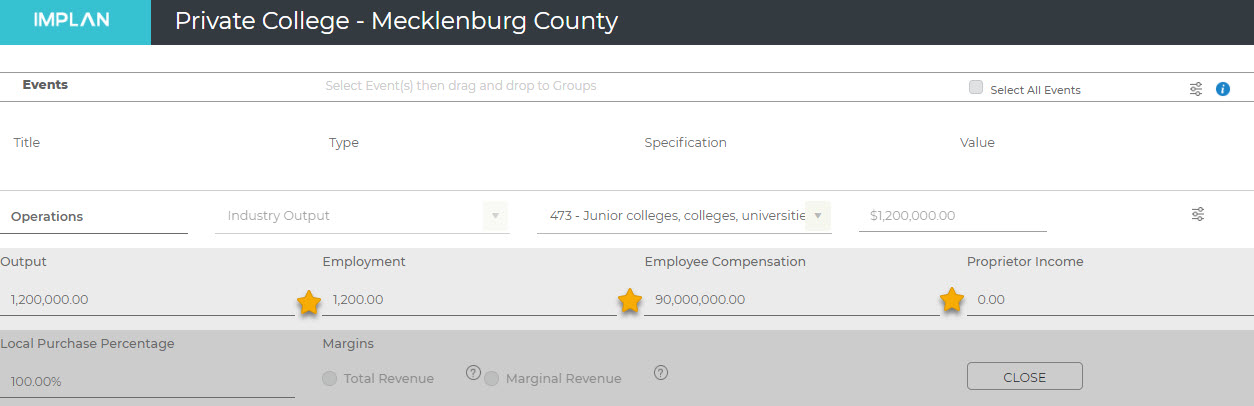

We know from the Industry-Institutional Production information that the Commodity 3482 – Private Hospital Services is produced by both private Hospitals and State/Local Government Non-Education. If there was an increasing population and we wanted to model that change in demand for hospital services, we might not know what combination of private, nonprofit, or public (government) hospitals will absorb the new influx of patients. In this case, running a Commodity Event would be the best option.

SECTOR CONTRIBUTION:

Analysts may want to examine the entirety of the hospital industry. In this case, the best method would be to conduct an Industry Contribution Analysis (ICA). ICA removes buybacks to the Sector(s) of interest and more accurately represents the true contributions of the Sector at the current level of production.

CONSTRUCTION OF HOSPITALS:

Hospitals invest significantly in construction projects and this construction differs greatly from building a new house or highway; therefore hospital construction spending should be modeled through IMPLAN Sector 52 – Construction of new health care structures. Major improvements and renovations to hospitals should be modeled through IMPLAN Sector 62 – Maintenance and repair construction of nonresidential structures.

All construction Sectors in IMPLAN exclude Furniture, Fixtures, & Equipment (FFE). FFE consists of movable furniture, fixtures, and other equipment that is not directly attached to a building. Specialized medical equipment is also not included and therefore should be modeled separately.

Additionally, any land purchases are not included in IMPLAN as the sale of the land has very little impact on the economy. The purchase of the land necessary for a construction activity should not be included as Industry Output for the construction sectors because land sales are considered asset transfers, where one person receives money while the other receives tangible property. Thus, the land sale itself has no value in IMPLAN. Some small impact may be captured however, by creating an Event for real estate fees, and for large commercial projects legal fees.

OTHER HOSPITAL SERVICES:

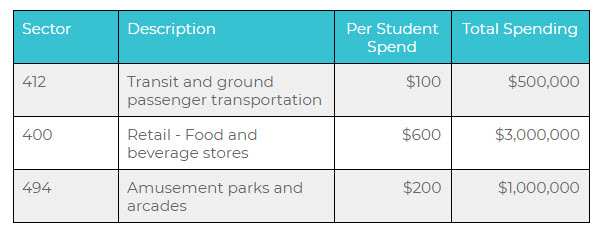

Hospitals may provide care beyond services that fall under Sector 482 – Hospitals. For example, they may have on site home health care agencies (Sector 480 – Home health care services) or ambulance services (Sector 481 – Other ambulatory health care services). Each of these functions should be modeled separately.

As with any type of analysis in IMPLAN, the more details you have available as the analyst, the more accurate the results. You may have to split out a nonprofit hospital from its privately held ambulance service. Also, you may consider separately modeling the doctor and technician offices that are located on hospital grounds. Each different function, which will fall under a different IMPLAN Sector, should be modeled as its own Event (of group of Events) so that the results can be examined for each of the business functions of the hospital.

Physicians owning their own private practice are often sole proprietorships (LLC or S-Corp). These sole proprietorships can be paid in different ways depending on the hospital; some might be considered wage and salary employees while others are contractors. Be careful not to double count the spending on these doctors in your analysis.

CAUTIONS:

Deciding what to include and what to exclude in your hospital economic impact analysis can be a very delicate balancing act. While you may choose to include certain associated Sectors with your hospital impact, do not fall into the trap of adding every Sector that exists in the hospital supply chain. Incorporating too much not only dulls the focus on the actual impact of the hospital, but it also lowers the credibility of the entire study.

You may want to assume that but for this hospital, there would be no regional impact in the Sector. However, consider that other entities might expand or open facilities in the absence of the one you are modeling.

COMMUNITY & HEALTH BENEFITS:

In order to model a real-life event in IMPLAN, the initial economic effect in terms of a spending or production change, needs to be determined. Some circumstances require additional assumptions by the analyst before modeling.

A few extra steps may be necessary to determine the economic effect of a real-life event including socio-political impacts, environmental impacts, policy changes, price changes, forward linkages, and feasibility analysis.

Modeling tax impacts, like a change in Medicare or Medicaid benefits, falls under the umbrella of socio-political impacts. Therefore, the spending behavior associated with the tax impact/change would need to be determined by the analyst before it can be modeled in IMPLAN. These government policies can affect citizens in many different ways. For example, if a policy is enacted that decreases health care rates, households may spend the money that would have been spent on health insurance on something else.

Another modeling consideration is the savings the hospital might see by decreasing emergency room visits in favor of encouraging patients to seek preventative care and health screenings. The cost differential between the primary care and emergency care could be modeled as a cost savings to the hospital.

A final consideration is potential savings to companies for healthier employees. Fewer sick days and lost productivity could be modeled. Additionally, the ability to work additional years might be modeled as productivity increases.

RELATED TOPICS:

Hospitals: Modeling Private Hospital Impacts with Analysis-by-Parts

Hospitals: Modeling Public & NonProfit Hospital Impacts with Analysis-by-Parts

ABP: Introduction to Analysis-By-Parts

CASE STUDY:

The Economic Impact of Mayo Clinic: Now, Then & All Points in Between