Income FAQ

1. Why is the Average Household Income in my Model Overview so High?

In IMPLAN, we base household income on the Bureau of Economic Analysis (BEA)’s “Personal Income” numbers controlled to current BEA National Income and Product Accounts (NIPA) for the nation. In contrast, per capita household income reported by the Bureau of the Census is “Money Income” based. Due to a number of data source differences, definitional differences, and variances in scope and purpose the numbers reported in these two data sources vary significantly. For more information about these differences please explore this article

2. Why are Oil & Gas extraction sector proprietors appearing in a study area that does not in reality contain oil wells?

This is due to how Proprietors are accounted for in the IMPLAN system. Unlike the place-of-work Wage and Salary data used by IMPLAN to account for employees, the Proprietor Employment data are place-of-residence based. That is, a well-owner who lives in NJ but whose well is in another state will show up in the BEA data (and subsequently, in the IMPLAN data) as a proprietor in O&G extraction sector in the NJ data set. That proprietor is then allocated a certain proportion of the U.S. O&G extraction output, since the output data are reported at the U.S. level only.

In addition, the BEA considers ownership by partnership a proprietor. Therefore, it is possible to have many partners in oil and gas in a county in which there is no oil and gas.

3. Why are there different definitions for GRP?

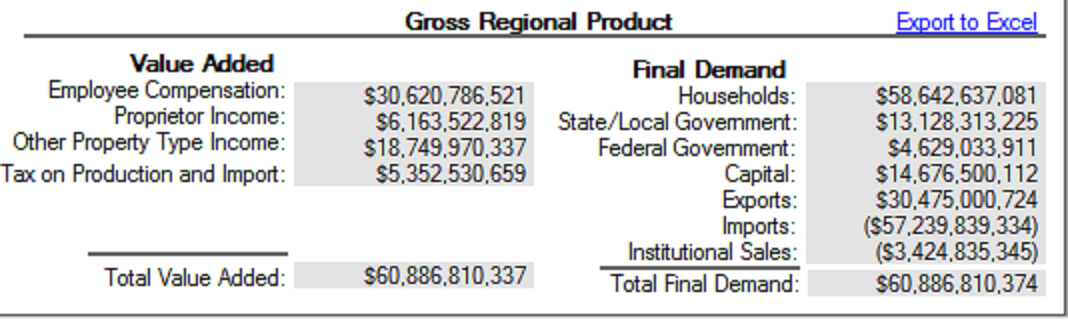

Gross Regional Product describes the wealth in a region and is a common measurement of economic stability and growth. GRP can be measured on an expenditure basis (Final Demand) or on an income basis (Value Added); thus the Model Overview screen provides a breakdown of GRP looking at both measurements.

- Final Demand describes the value of goods & services produced and sold to final users during the calendar year. These final users would include governments, households, exports (net), and investments (Capital).

- Value Added describes how income is distributed to these same Institutions or final users.

Looking at the Model Overview

Viewing the Model Overview we can see that just because the method of measurement differs, since both methods measure GRP, the resultant value is the same (some variance will occur after the first seven significant digits due to rounding).

| Value Added | Final Demand |

| Employee Compensation: The entire cost of employees including wages and salaries payroll taxes and benefits: sometimes referred to as fully-loaded wages or income. This value is a primary source for households and a source of monies for governments (in the form of payroll taxes) for final demand purchases. | Households: Households make payments to industries for goods and services used for personal consumption (PCE) and to governments in the form of taxes, fees, fines, etc. This is the largest component of final demand and is derived from household income in the region as a result of Employment Compensation, Proprietor Income and Other Property Type Income payments to households, as well as governments and payments from other households. Thus payments from these Value Added categories provide the basis of household consumption in final demand. |

| Proprietor Income: Income for sole proprietors and partnerships that drive household income for final demand and tax payments via income taxes for governments. | State & Local Governments: Public education purchases are for K-12 and higher education institutions. Non-education purchases are for all other state and local government administration activities including police protection and sanitation. Funds for these purchases result household income as well as corporate taxes captured from Employment Compensation (payroll taxes and income taxes), Proprietor Income (income taxes), Other Property Type Income (income taxes) and Taxes on Production & Imports (fees, fines, sales taxes, licenses, etc). |

| Other Property Income: Income derived from dividends, royalties, corporate profits, payments for rent, and interest income. Thus Other Property Type Income provides a source of income for households, business, and govenments. | Federal Government: Federal defense includes spending by all agencies in the Department of Defense. Non-defense purchases are made to supply all other Federal government administrative functions. Federal Investment consists of all Federal government demand for capital goods. Funds for these purchases result fromhousehold income as well as corporate taxes captured from Employment Compensation (payroll taxes and income taxes), Proprietor Income (income taxes), Other Property Type Income (income taxes) and Taxes on Production & Imports (fees, fines, sales taxes, licenses, etc). |

| Taxes on Production & Imports: Sales and excise taxes, customs duties, property taxes, motor vehicle licenses, severance taxes, other taxes, and special assessments. Subsidies are netted out and thus can be negative for some industries in some years. Thus, this is primary source for income for governments for final demand. | Capital: Household savings and private industry purchases of capital equipment and construction, driven by corporate profits captured in the Other Property Type Income component of Value Added. |

| Exports: Goods and services produced within the geography of the Model sold to both domestic and foreign buyers. These exogenous purchases by industries and households in other regions provide income (Employment Compensation, Proprietor Income and Other Property Income) to local households and corporations and to governments as taxes (Taxes on Production & Imports, Other Property Income and payroll taxes). | |

| Imports: Purchases of goods and services by households, governments and industries from outside the region that represent a loss of income to the Model geography. Imports are wealth leaked to other regions. | |

| Institutional Sales: Sales of goods and services by Institutions. These are subtracted from the other components of Final Demand. |

In both cases the total wealth in the economic geography is identical. On the Value Added side we see how Industries contribute to that growth through production, and on the Final Demand side we view how consumption drives local industries to produce products for local demand.