Multipliers Changing Over Time

INTRODUCTION

IMPLAN introduces new data each year. With new data, comes new multipliers. In general, it is not advisable to treat annual IMPLAN datasets as a time series as our data sources and methods often change from year to year. Additionally, some of our raw data sources revise estimates, so that, for example, what a source reports about 2013 in 2018 is different from that source would report about 2013 in 2019. This is especially true of data from the Bureau of Economic Analysis. On a 5-year basis (following the incorporation of a new BEA Benchmark, Census of Agriculture, and IMPLAN Industry scheme) we publish Panel Data, spanning from 2001 to the latest annual IMPLAN data year, to facilitate year-over-year analysis. These datasets use all the data and methodological changes incorporated over the preceding 5 years, and are reported in the same (latest) IMPLAN sectoring scheme.

DETERMINING MULTIPLIER SIZE

Again, as the data changes over time, it is not uncommon to see changes in the multipliers. Changes of less than 10% (positive or negative) are quite routine and expected. Larger changes can be expected if comparing non-consecutive years or years that span one of our 5-year data sets (see next section on Five Year Data). Employment and Value Added multipliers can vary greatly across geographies and years whereas Output multipliers tend to be relatively more stable.

Multipliers are influenced by many factors, so it is not possible to isolate a single factor when examining their changes over time. These factors include some that are specific to the geography in question, while others are specific to the Industry in question. Still others may be related to global trends. Here are some reasons why there are yearly changes.

- A greater reliance on imports (whether foreign or domestic) will result in lower RPCs in general, which, all else equal, reduce multipliers.

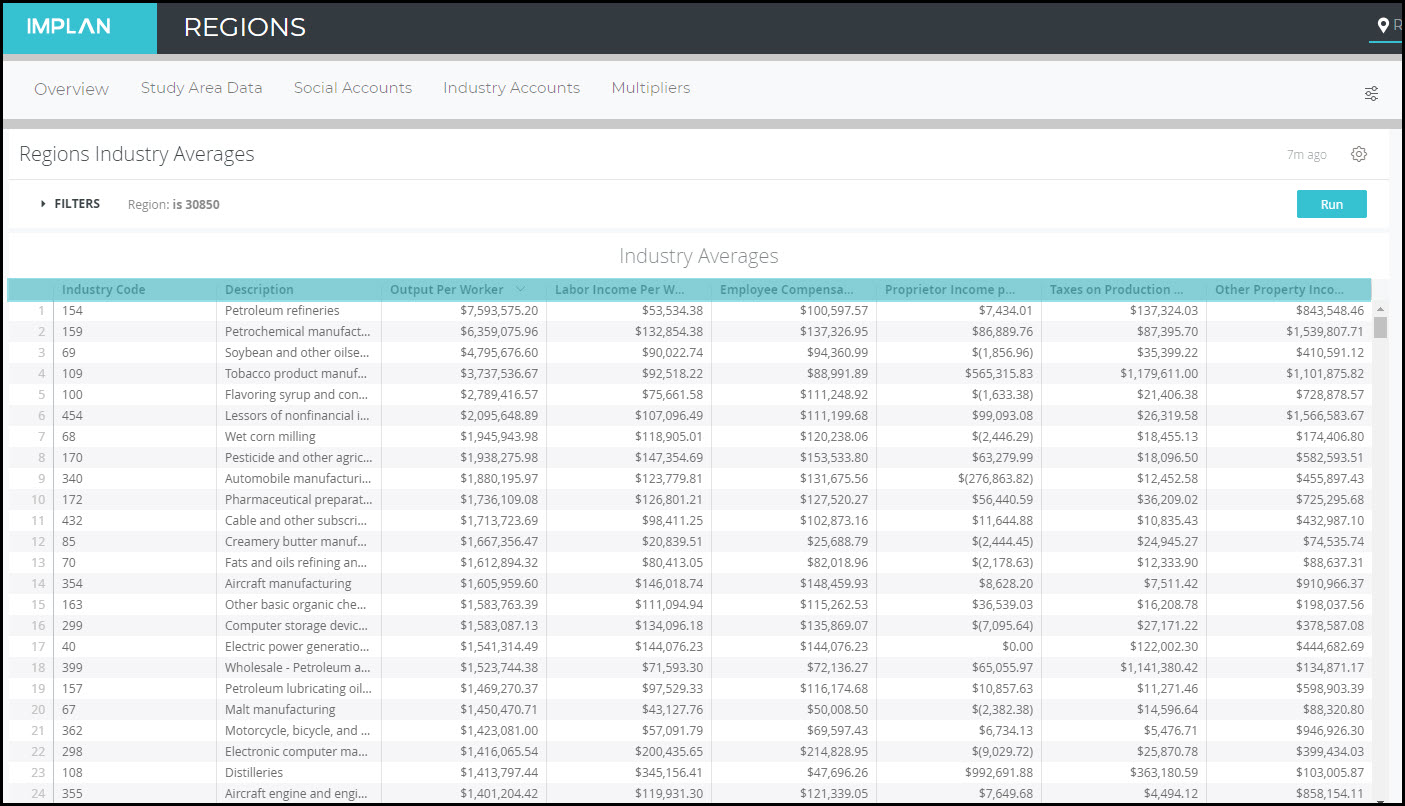

- When productivity, as defined as Output per worker, rises in a given Industry, the Employment per dollar of Output falls. All else equal, a smaller Direct Employment will result in a larger Employment multiplier for this Industry.

- Change in Labor Income per dollar of Output, whether from changes in wage rates or the changing fortunes of proprietors, will change the magnitude of Induced Effects, and therefore multipliers. Proprietor Income can be negative and can vary substantially from one year to the next.

- A decrease in a multiplier can also be caused by a large increase in corporate profits and/or taxes paid per dollar of Output. Corporate profits make up the bulk of Other Property Income (OPI), a component of Output that is treated as a leakage in I-O modeling, in the sense that they are not spent within the model and therefore do not generate Indirect or Induced Effects. Similarly, all taxes, while accounted for in the tax impacts report, do not generate additional rounds of impacts. The larger the percentage of Output that goes to OPI and taxes, the less leftover to drive Indirect and Induced Effects.

FIVE YEAR DATA

Some raw data sets are released only every 5 years; thus, larger year-over-year changes can be expected when comparing IMPLAN data across two years that span the release of one of these 5-year data sets, like between 2017 (536 Industry Scheme) and 2018 (546 Industry Scheme).

THE BEA BENCHMARK I-O TABLES – RELEASED EVERY 5 YEARS

A new BEA Benchmark provides new industry spending patterns for all IMPLAN industries. The magnitude of total Intermediate Input purchases per dollar of Output and the relative mix of input purchases both influence Indirect Impacts, and the Induced Impacts associated with those Indirect Impacts.

A new BEA Benchmark also provides data on the foreign imports and exports of Commodities. While we have annual Census data for the foreign trade of all shippable Commodities, no such data source exists at this level of Commodity detail for the annual foreign trade of services. Thus, we turn to the BEA Benchmark to give commodity detail to the NIPA control total for the foreign trade of services.

A new BEA benchmark also provides new national indicators of the relationship between Output, Employee Compensation, gross operating surplus (PI + OPI), and TOPI. These relationships are especially important for farm data, as many of our annual sources report data for agriculture only at the farm level. We use the BEA Benchmark for other components, including detailed Commodity margins, which will have more minor effects on multipliers.

THE CENSUS OF AGRICULTURE – RELEASED EVERY 5 YEARS

The Census of Agriculture provides us with data on farm counts (both proprietor-owned and corporate-owned) by farm sector, by county. These data are used annually to distribute state-level farm Output data to counties and to provide Industry detail to the aggregate farm BEA REA data we use for farm Industry Employment and Labor Income.

INVESTIGATING A CHANGE

If you see a change in multipliers that has you curious, here are four steps to investigate what may be causing it.

STEP 1: PRELIMINARY CHECKS

- Are both data sets in the same Industry Scheme?

- Is any aggregating or splitting needed to make the Industries comparable?

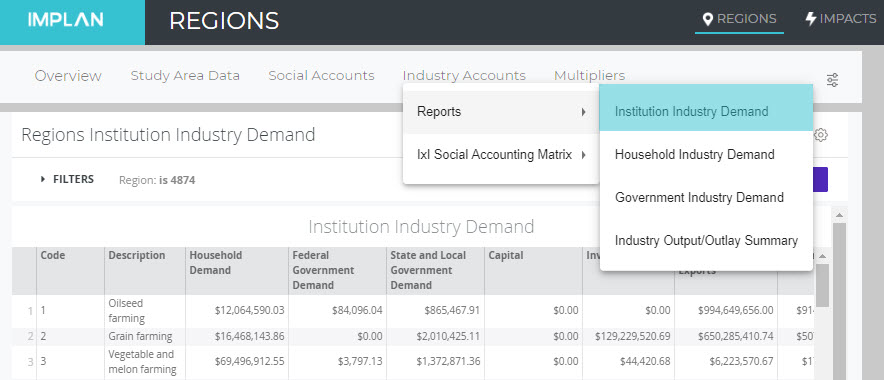

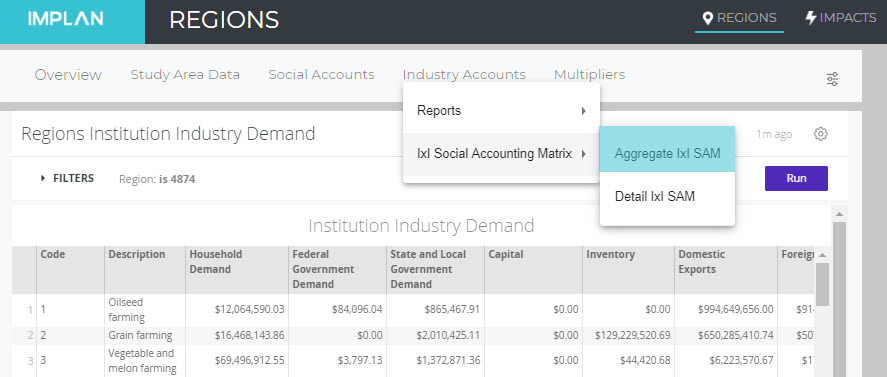

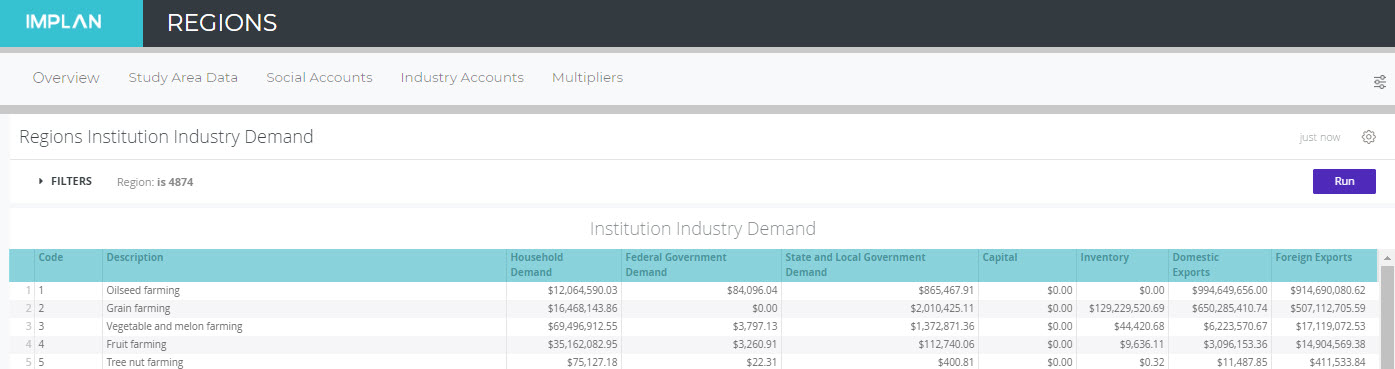

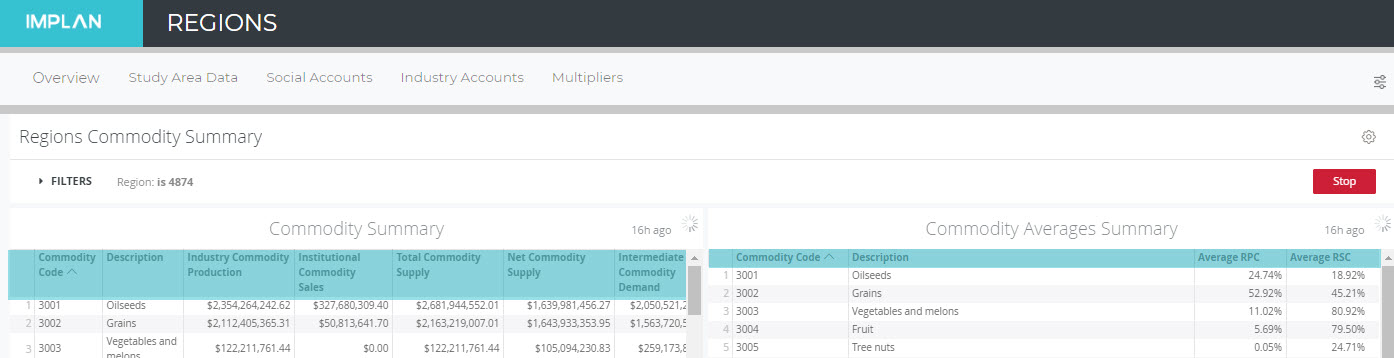

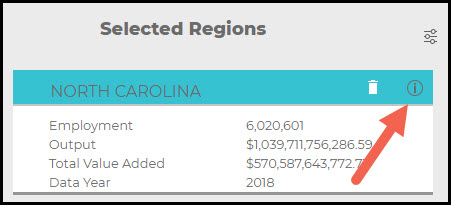

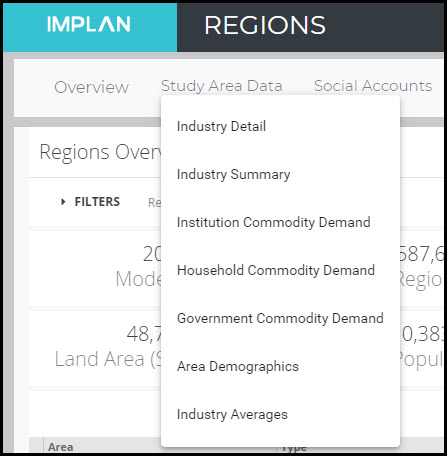

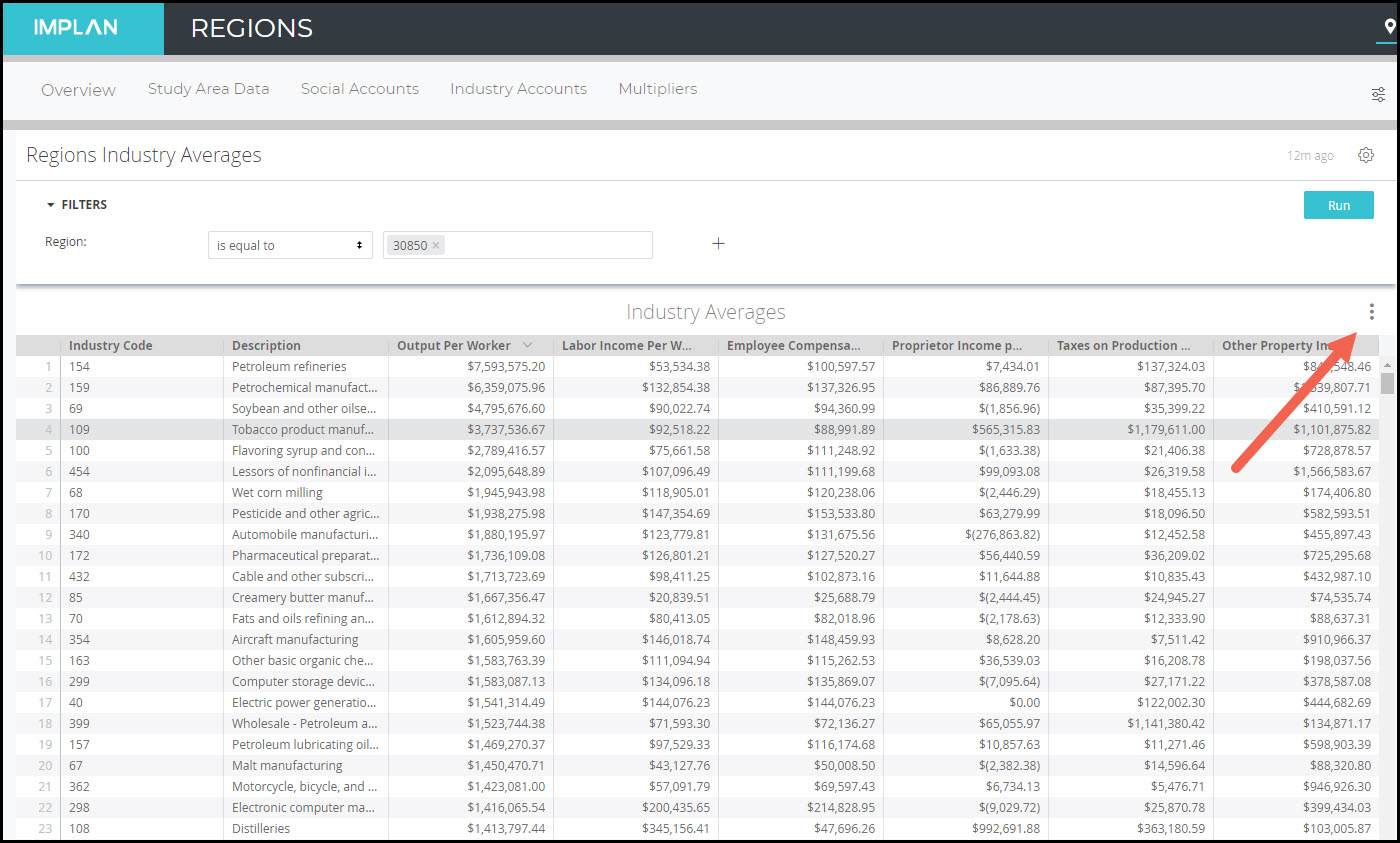

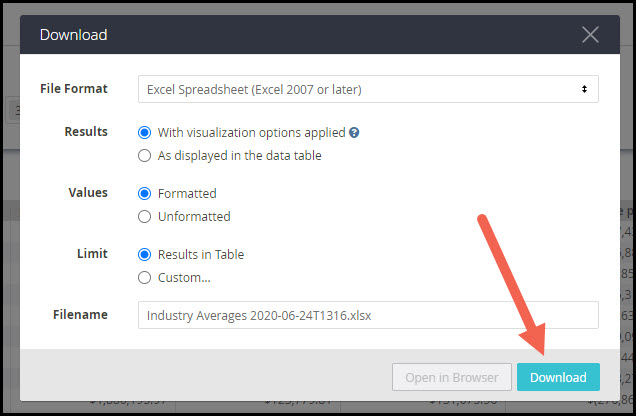

STEP 2: EXAMINE THE STUDY AREA DATA

- Has Employment per Output changed significantly?

- Has Labor Income per Output changed significantly?

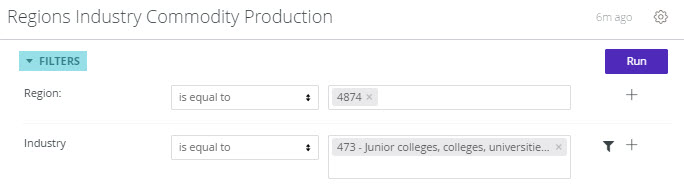

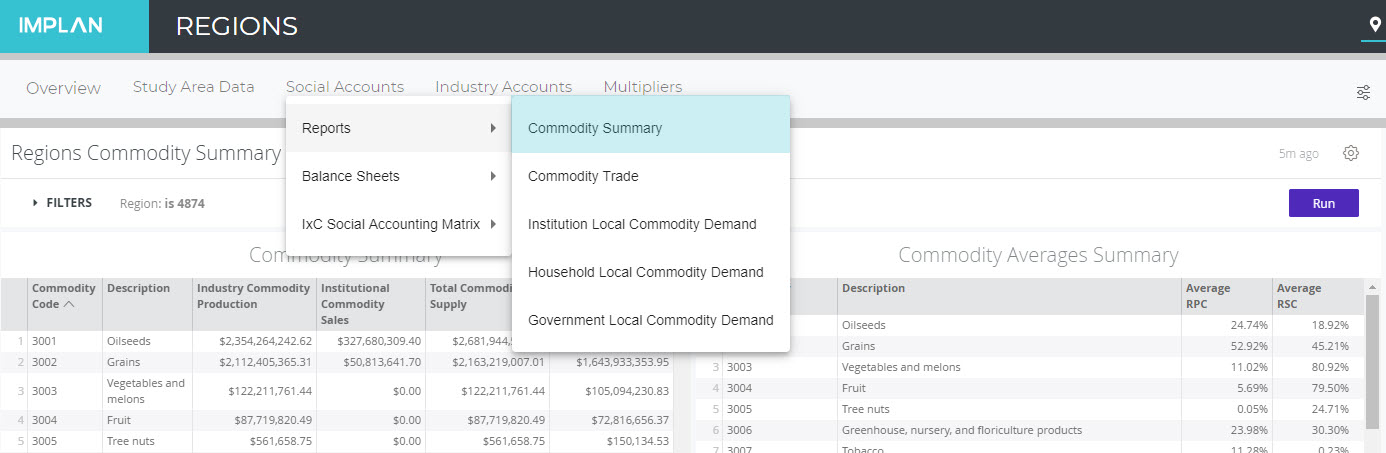

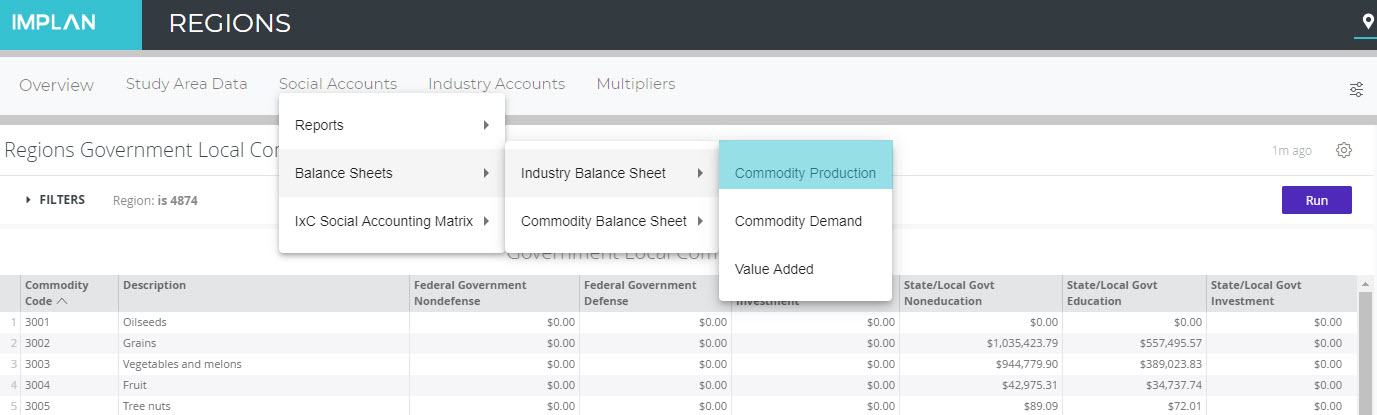

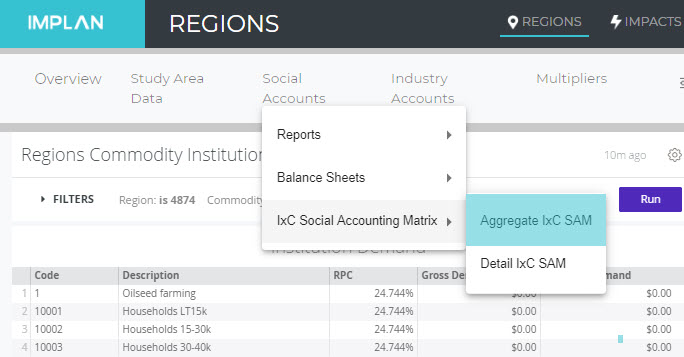

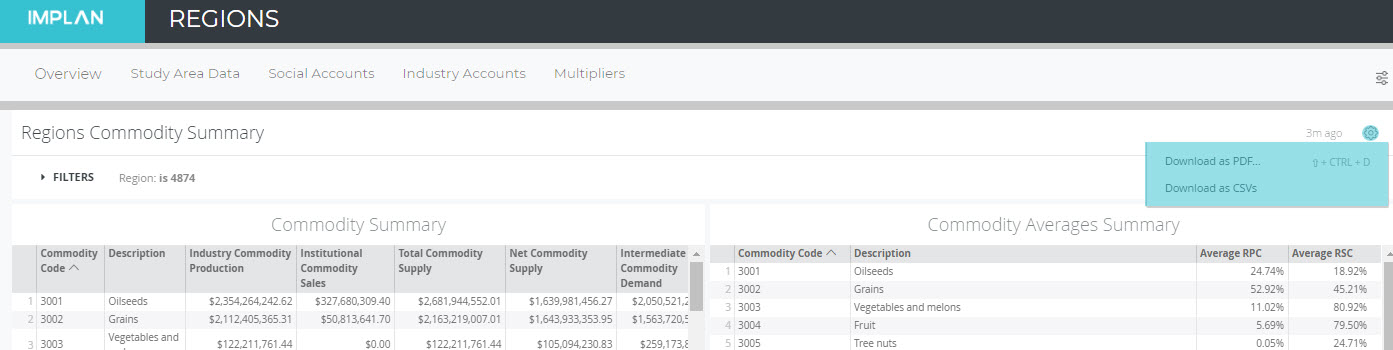

STEP 3: EXAMINE SPENDING PATTERN AND RPCS OF TOP ITEMS

- Has the ratio of Intermediate Inputs per Output changed significantly?

- Have the RPCs of the top few Commodities purchased by the Industry changed significantly?

STEP 4: CONTACT IMPLAN SUPPORT FOR ASSISTANCE

Help us help you! To expedite the process of investigating a value, it is extremely helpful for us to have the following details at the outset:

- What type of multiplier are you concerned with (Employment, Output, etc.)?

- What specific IMPLAN Industry or Industries, with the associated Industry number(s) are in question?

- What are the two data years being compared?

- What is the geography in question?

- Is the multiplier in question from the Multipliers Report in IMPLAN or calculated based on impact results?

Then shoot an email to support@implan.com and our Data Team will take a look!