What can an LQ do for you?

INTRODUCTION

Location Quotients (LQ) compare the relative concentration in a specific area to the concentration in the U.S. They are mainly used for descriptive and comparative purposes for analyzing Industrial or Employment concentration. The technique compares one economy to a larger, reference economy. LQs identify specializations or weaknesses in the reference economy.

DETAILS

There are three things to identify first: a specific Industry or Occupation to examine, the regional economy, and the reference (or comparison), larger economy. This larger economy is often the U.S., but it can also be a group of states, state, or really anything larger than the economy of study.

The value for LQs will hover around 1. An LQ equal to 1 signifies that the local share is equal to the national share; basically the region of study is identical to the reference economy. An LQ of less than 1 means that the local share is less than the national share. This means that the Industry or Occupation’s share of local employment is smaller than its share of the nation; which can highlight a weakness in the local economy. An LQ of greater than 1 (or sometimes 1.2 as a more conservative number) means the local share is greater than the national share and is typically an exporter or perhaps has a specialization in that Industry or Occupation. These Industries employ a greater share of the local workforce than the reference economy or produces more goods and services than can be consumed locally (and are then exported). An LQ over 1.2 shows a regional specialization. So in summary, if the LQ > 1 it is an export, if it is less than 1 it’s an import (Bogart, 1998).

CAUTIONS

Note that using LQs is not advisable for small regions. This is because the smaller the region, the less likely it is to be economically diverse. Also, places that have a small overall employment but a few very specialized businesses will return very high LQs. Therefore, check these high LQs against the total employment in your region (Grodach & Ehrenfeucht, 2016).

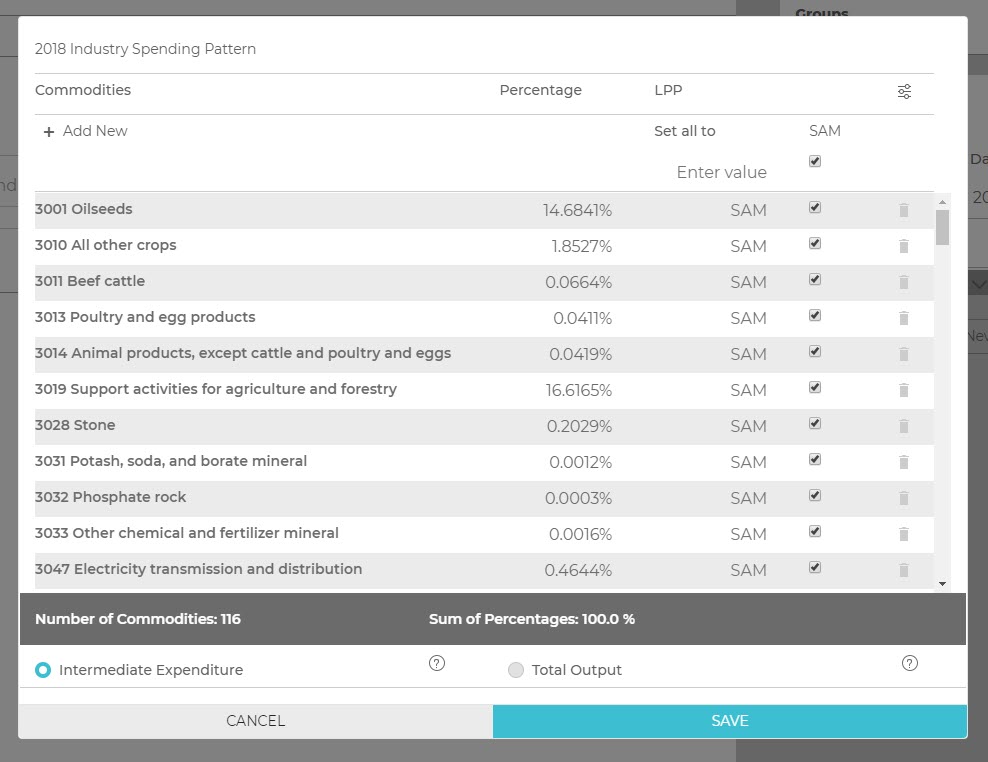

When Industries or Regions are aggregated, there will be loss of detail that may show less of a concentration (Bogart, 1998). Therefore, we recommend using the unaggregated IMPLAN Industries.

Finally, just because your Region has a small LQ does not necessarily indicate that there is a case for import substitution by building up this Industry. For example, the LQ for tree nut farming in North Carolina is 0.01. This is mostly due to the climate required to grow things like almonds, pecans, and walnuts, which isn’t in North Carolina.

FINDING THEM IN IMPLAN

The LQs reported in IMPLAN will always use the U.S. as the reference economy. Data on LQs can be found in Region Details.

> Occupational Data

> Area Occupation Summary

In the Location Quotient column, you will see a value that compares your region, in this example North Carolina, to the U.S. This shows the wage and salary employment based location quotient for the occupation. Clicking on the column title, you can sort the columns to show the largest and smallest LQs. In North Carolina in 2018, the largest LQ was in the Occupation 51-6063 Textile Knitting and Weaving Machine Setters, Operators, and Tenders at 6.91. In fact, the top eight Occupations are all in the Broad (4-Digit) category (51-60XX).

You will also find LQs in Core Competencies.

> Occupational Data

> Core Competencies

> Area Summary

In the three tables for Ability, Knowledge, and Skills, you will find the competency based LQ as compared to the U.S. as a whole.

In the three tables for Education Required, Work Experience Required, and On-the-Job Training, you will find the Wage and Salary Employee count based location quotient as compared to the U.S. as a whole.

CALCULATING THEM ON YOUR OWN

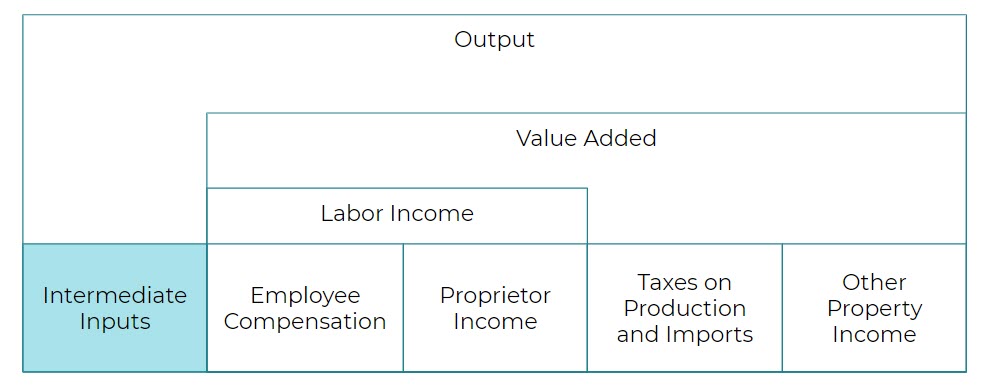

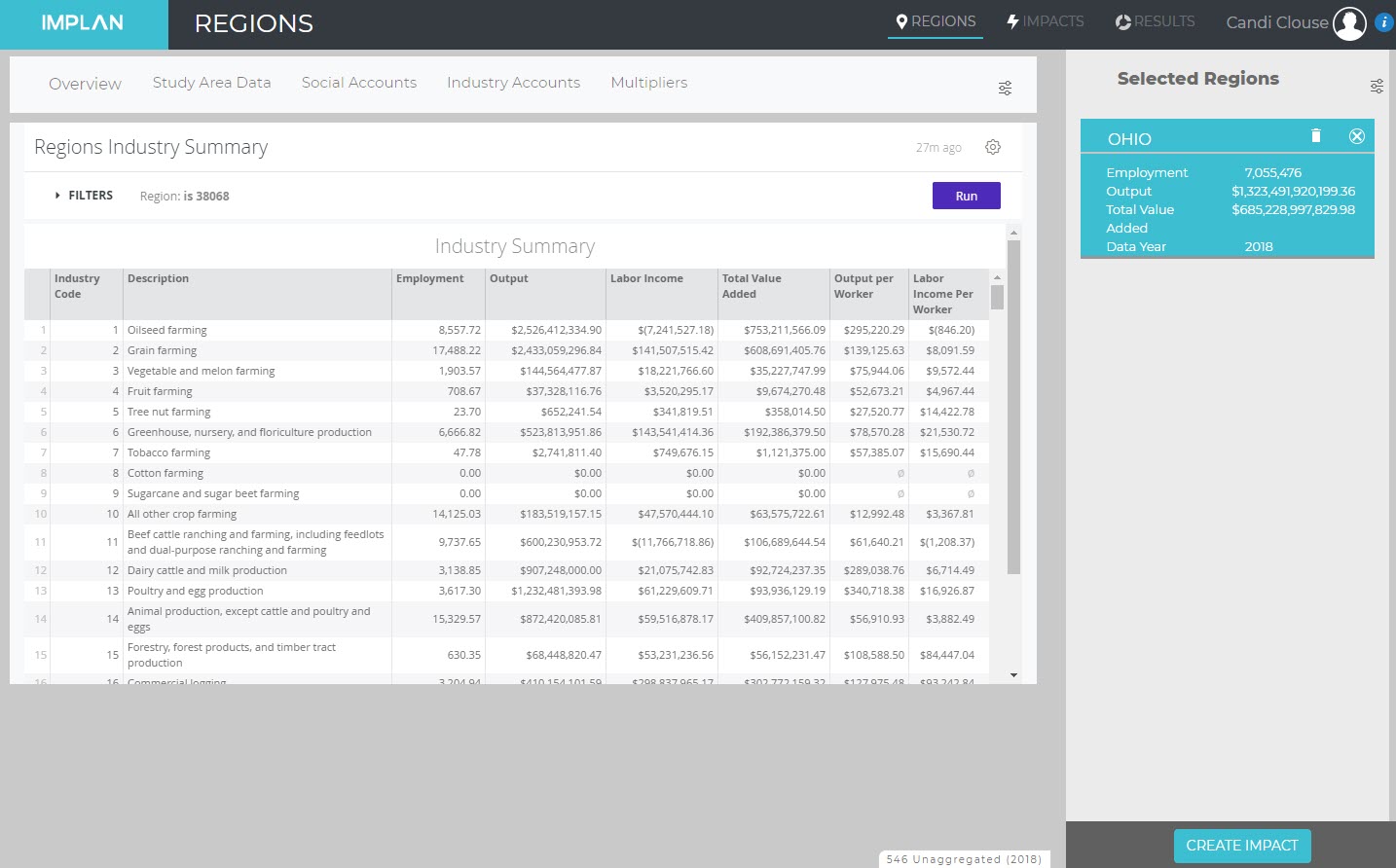

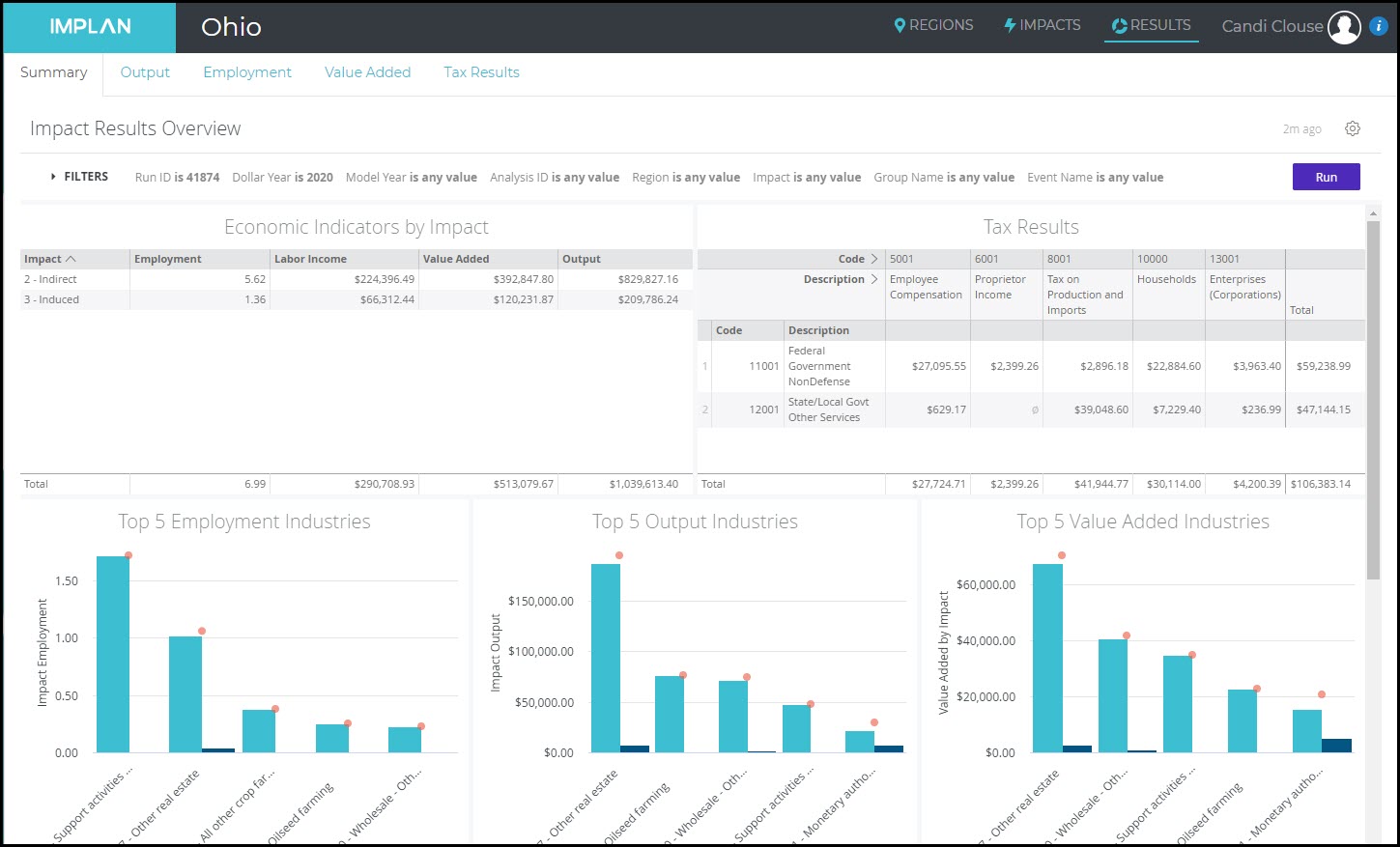

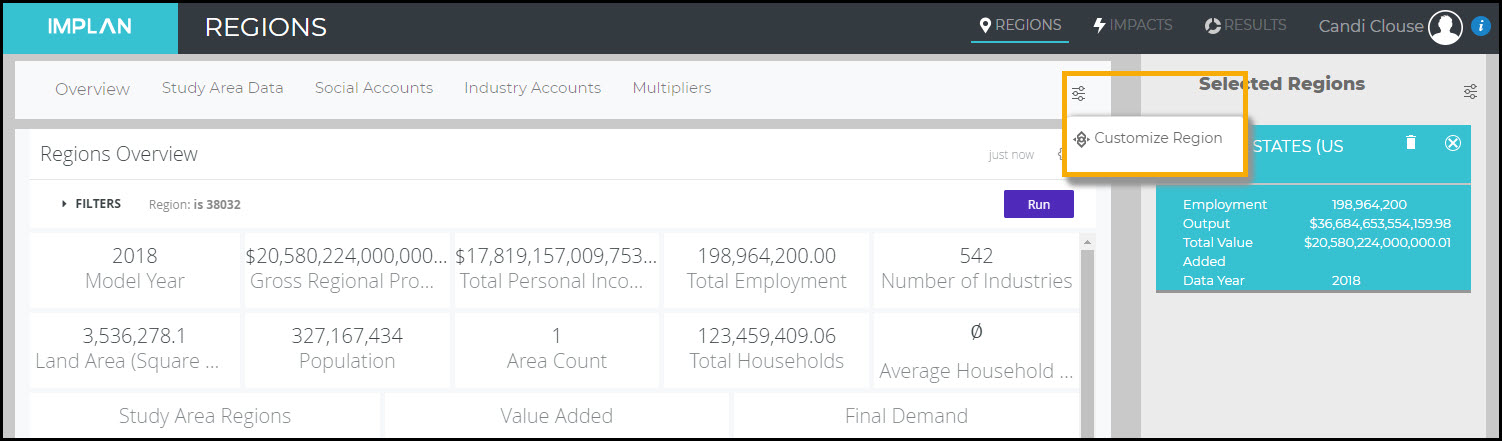

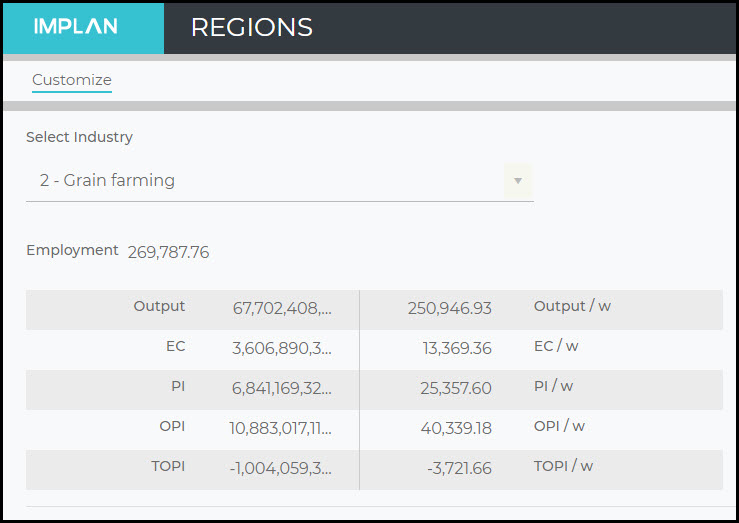

If you are looking for LQs for Employment, Labor Income, or Output, they are very easy to calculate using IMPLAN data. Select your Region and head Behind the i. On the Regions Overview screen the table at the bottom will list IMPLAN Industries with their associated Employment, Labor Income, and Output. You can download the table by clicking on the ellipses as shown. This will open up an Excel spreadsheet with the values.

You can use the LQ Template to calculate the Employment LQ for your Region against the U.S. Copy the Employment for all IMPLAN Industries from your downloaded file and paste them into Column E – Your Region’s Employment. The spreadsheet will automatically calculate the LQ in column G.

If you want to examine either Labor Income or Output, simply replace the national figures in Column C with the values for Labor Income or Output for the U.S. Then paste the Labor Income or Output value for your Region in Column E.

You can also compare your Region to something other than the nation. For example, we could look at the Charlotte–Concord–Gastonia Metropolitan Statistical Area compared to the state of North Carolina. In this case, simply replace Column C with the North Carolina values and Column E with the MSA values.

THE MATH

The formula is LQ =

Local Concentration / National (or reference Region) Concentration

More specifically the formula for the Employment LQ is:

LQ ir = (xir/xr) / (xin/xn)

where

xir = employment of sector i in region r

xr = total employment in region r

xin = employment of sector i in the reference region

xn = employment in the reference region

GOVERNMENT RESOURCES

BEA: What are location quotients (LQs)?

QCEW Location Quotient Details

REFERENCES

Bogart, W.T. (1998). The Economics of Cities and Suburbs. Upper Saddle River, NJ: Prentice Hall.

Grodach, C. & Ehrenfeucht, R. (2016). Urban Revitalization: Remaking Cities in a Changing World. New York: Routledge.