Producer value or price (Proval)

Casinos: Acing the Impact

INTRODUCTION:

Casinos and the gambling Industry are unique in IMPLAN and don’t follow a single Sector. This article outlines a few considerations to bet on when modeling them.

THE GAMBLER:

One thing to keep in mind when thinking through casino impacts is that Output for casinos is revenue net returns to the gambler. That means that the casino Output already excludes all of the payments made to those that walked away winners. This is total revenue less losses to the house. Your Output value may need to be adjusted to reflect that definition.

CORNER POCKET:

Sometimes what seems like gambling, may be considered basic amusement. Remember to check the IMPLAN Sectors or the NAICS codes to ensure that you are capturing the Industry you want to model. For example, IMPLAN Sector 496 – Other amusement and recreation industries includes billiards and pool halls while Sector 490 – Racing and track operation covers dog and horse racing tracks.

NUMBERS GAME:

Running a basic casino through IMPLAN can be done through Sector 495 – Gambling industries (except casino hotels). This assumes, however, that the only activity in the facility is gambling. Many modern casinos operate a few businesses under one roof; restaurants, retail, and hotels. Splitting out the operations of each entity is the best way to model a casino with multiple businesses.

Following the definition of the BEA, IMPLAN separates the different business functions of both Sector 503 – Gambling industries (except casino hotels) and Sector 507 – Hotels and motels, including casino hotels (546 Sectoring scheme). These are divided between

- Construction

- Retail

- Real Estate

- Performing Arts

- Gambling

- Amusement

- Hotels

- Personal Services

The casino’s business may match multiple IMPLAN sectors and should be distributed appropriately. Note that some entities within the hotel may actually operate as separate businesses. For example, a casino may contain a chain restaurant that would not be included in the Output for the casino.

ATLANTIC CITY TO YAVAPAI:

Gambling is not legal everywhere in the US. Therefore, when you are trying to model it in your region, it may not exist. You can borrow the Output equation from a comparable region or the national model as outlined in the article Adding an Industry by Customizing a Region or Adding an Industry that Doesn’t Exist Yet.

Also, a state may be drastically changing their laws. For example, they could currently have a state lottery, which would fall under the same Sector as casino gambling. Adding a large-scale casino to the state would drastically change the spending that occurs within that Industry. Even though Sector 495 exists, it may not reflect the spending that will happen when the casino opens.

Even when a state has legalized gambling, illegal activities might still occur. At this point, they are not included in the BEA accounts (Fun Fact: Eurostat already addresses this in their data). You can read all about it in the article Including Illegal Activity in the U.S. National Economic Accounts by Rachel Soloveichik. Per the BEA’s Concepts and Methods of the U.S. National Income and Product Accounts, “these activities are excluded from the U.S. accounts because they are by their very nature conducted out of sight of public scrutiny and so data are not available to measure them.”

THE HOUSE:

Casinos are owned by different entities. Corporately-owned casinos will fall under Sector 495 – Gambling industries (except casino hotels). However, many casinos are owned by Native American tribes and these establishments will actually show up in Sector 526 – Other local government enterprises.

RELATED ARTICLES:

Private equipment & software expenditures

Primary suppression

MRIO: Multi-Regional Input-Output Analysis FAQ

1. What data is required to create an MRIO?

In general, you need to have the data for your Core Region and the additional regions from which you want to see feedback linkages/impacts.

If you want to analyze data at a state level, you need to have State Package data. This data set allows you to create the Rest of State (ROS) Model by combining all of the counties in the state minus the counties where your Direct Effect occurs. These Direct Effect counties are endogenized in the State Total file, and thus you can only use a State Total file with counties that are not included in that state. Attempting to create an MRIO by linking Direct Effect counties within a state to the State Total file will produce erroneous results.

2. When would you use MRIO? Would you use MRIO if you only wanted to analyze the impacts to one specific county?

Both Single-Region and Multi-Regional Input-Output Analysis are valid methodologies. MRIO offers the advantage of providing a more robust and accurate picture of a local economy because most economies are not isolated to a single county.

An MRIO analysis allows you to keep the Multiplier identity of the core county (or region) while still being able to see how activity in the core region (where the Direct Effect takes place) touches other regions within a functional economy. Therefore, even if you were interested in the results in a single county, you could use MRIO if you wanted to capture feedback linkages to the core region from purchases your region made to those connected counties. However, in most cases this will not provide significant changes to your results.

3. Does the MRIO analysis provide a different net effect (or multiplier) than an analysis using only a single region?

The only way to determine the Multipliers associated to an MRIO anlaysis is to calculate them by hand. We recommend exporting or copying/pasting your results to an Excel spreadsheet and summing the results to calculate the Multipliers using the base equation Total Effect/ Direct Effect. Please read this FAQ article to get more information about summing results from an MRIO and calculating the new Multipliers. The reason the Multipliers are different from single-region Multipliers is that we are capturing leakages to the linked regions that are lost from a single-region analysis. Therefore, there may be feedback from linked regions that will increase the effects in the core Study Area Region as well as the additional captured linkages represented in the linked Models.

The reason that this is a recommend analysis type is that it avoids the Aggregation Bias of aggregating Model regions. The state Multipliers will represent an average of all the firms in the state and their relationships for Output per Worker and Labor Income per worker. These can be drastically different from those in a smaller region, a cluster, or an MSA. Users are occasionally confused when the state actually has smaller values than the region where the Direct Effects occur; MRIO avoids this apparent anomaly that occurs when the supply of a commodity is concentrated in a single geography or a small group of geographies in a state, and thus demand at the state level increases without a substantial increase in supply. This happens in examples like Silicon Valley when considering tech Sectors.

4. Does MRIO provide region-specific effects from the aggregate analysis or completely different results from an aggregate region analysis?

MRIO Multipliers are unique and will be different from the aggregate region’s Multipliers (a region where all the files have been built into a single Model). The Multipliers in an aggregate Model are a weighted average of the region’s individual Industries and are thus subject to Aggregation Bias. These Multipliers are displayed in the Multipliers screen in the Explore menu. Conversely, MRIO Multipliers are unique to each set of linkages and must be calculated for each analysis as at no point are the regional Study Area Data information from the different areas combined.

5. Is MRIO effectively quantifying the ongoing chain of impacts?

MRIO, in effect, extends the supply chain impacts into surrounding regions while still keeping the Multipliers for the core region intact and unique. Thus the rounds of additional impacts are extended to include feedback between all the linked regions until all purchasing dollars are leaked from the Indirect and Induced Effects.

6. Are you able to aggregate the impact results of all models in the MRIO analysis into an “Impact Summary” within IMPLAN instead of exporting to Excel?

Not at this time. Impact results of all models in an MRIO analysis must be exported in order to sum the results. This allows you to individually quantify each regional impact and provides the flexibility to sum the regional impacts together to get a Total impact.

7. How do you aggregate the counties into “regions” and the “rest of state”?

You do this through the Model build process. When you build your Models you will select all the regions that you want incorporated into a single Model and then build that Model. This article provides additional information on aggregating Study Area regions in the Model building process.

8. How do you calculate a Multiplier for an MRIO Scenario?

You take the Total Effect (the sum of all the linked regions and the core) and divide this value by the Direct Effect for each factor. For additional information on how this is done, please see this Knowledge Base article.

9. Do you need to enter the Activities into the linked models?

No, you only build the Activities in the region where your Direct Effect occurs. The Model linking process will calculate the impacts in the secondary Models. If you have Direct Effects in multiple regions, then you need to build a series of Models for each Direct Effect.

So let’s assume that we are dividing the state of CA into 4 regions: North California (NCA), North Central California (NCCA), South Central California (SCCA), and Southern California (SCA). If we only had impacts in NCA, we would need four Models: the NCA Model where Direct Effects are occurring and the three remaining Models we are linking to.

If we then have multiple Direct Effects in each region, we will need 16 Models: NCA, NCCA, SCCA, and SCA where NCA is the Direct Effect; NCA2, NCCA2, SCCA2, and SCA2 where NCCA is the Direct Effect; NCA3, NCCA3, SCCA3, and SCA3 where SCCA is the Direct Effect, and finally NCA4, NCCA4, SCCA4, and SCA4 where SCA is the Direct Effect. This prevents exponential explosion of the impacts from cross linking Models.

10. Where can I find information about the methodology IMPLAN uses to calculate the inter-regional flows of commodity?

We have a white paper in our downloads section that talks about the Gravity Model that lies behind the trade calculations. In addition, commodity flow data from the Bureau of Transportation is used as a Benchmark for the IMPLAN Trade Flows.

11. Where can I find additional documentation about MRIO?

We have some free documentation about setting up an MRIO on our website, and we also have available for purchase our Principles of Impact Analysis & IMPLAN Applications user manual. In addition, we can certainly assist you with analysis setup on our community pages.

12. Do ZIP code areas function similar to counties when conducting an MRIO Analysis?

MRIO is not viable for ZIP Codes at this time, as these data do not have Trade Flows. The level of data currently available at the ZIP Code level is too sparse for us to develop confident Trade Flows. However, there is a methodology for mock MRIO that can be done with ZIP Code level data and also Congressional Districts, which likewise do not have Trade Flow data.

Unfortunately, this means that if you add a ZIP Code or Congressional District level file to your county Model, the resulting Model will not be available for MRIO.

13. As an MRIO analysis links multiple study regions, how does IMPLAN determine each region’s share of the regional purchasing coefficient?

RPCs are calculated on the basis of the Gravity Trade Flow Model in the standard build (eRPC and Supply-Demand Pooling are also options you can exercise). The Trade Flows are also the basis of the MRIO analysis. This Trade Flow Model takes into account a variety of factors including the gravity of certain economies, impedences to trade, and cross-hauling.

14. How does MRIO take into account regions that border another country (Mexico)?

Unfortunately, IMPLAN does not have international trade flows at this time. Thus if imports are from outside the U.S., they are recognized by the Model as foreign imports/exports and are not tracked after they cross the national border. Therefore, international flows cannot be captured by the current Model. The Trade Flow data and MRIO are looking at domestic commodity flows.

Currently IMPLAN does not have data for most regions of Mexico, and therefore we are unable to develop Trade Flows at this time for North America; although, that is certainly something that we have in mind. It is important to note that the foreign imports/exports of commodities themselves are known, we just don’t have at this time flows to track where those foreign commodities are produced. This limitation is also exasperated by the limits of up-to-date raw data for international countries and their states and provinces.

15. How is MRIO’s ability to account for leakages an advantage over traditional Single-Region analyses?

Knowing where leakages go allows you to account for them. In a single region analysis, leakages are just lost. Thus, importing 75% of commodity A means that 75% of the value of commodity A is lost in the first round of the impact analysis. But in reality, that 75% goes to some economy somewhere. MRIO allows you to see if and how your impact in the core region is affecting surrounding regions. Thus if you can buy an additional 5% from region R2, then you can now account for (in region R2’s results) that 5% and demonstrate both where it goes and that it results from your change to the economy. Likewise, if that 5% in region R2 is spent on a commodity that can now be imported from region R1, you capture that additional round of impact.

Primary product

MRIO: Multi-Regional Input-Output Analysis When More Than One Region Includes Direct Impacts

INTRODUCTION:

Sometimes you may have more complicated analyses that you want to run. Let’s say the bank opening up in Mecklenburg County, NC from the Introduction to MRIO article will also be opening up a smaller office in York County, SC. This can be modeled with Multi-Regional Input-Output (MRIO) analysis to see what the effect of each project will have on the two counties together and separately.

THE PROCESS:

STEP 1 – SETTING UP THE EVENT

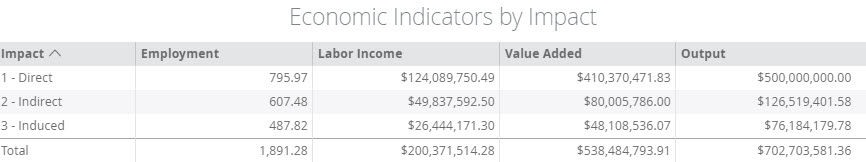

In our example, the new bank HQ will be opening in Mecklenburg County, NC with $500M in projected Output. Taking this one step further, the bank plans to open a smaller back office facility in York County, SC with a projected $10M in Output. As with the HQ example, this office will closely resemble a financial institution and not support services, so Sector 433 – Monetary authorities and depository credit intermediation was chosen as the sector.

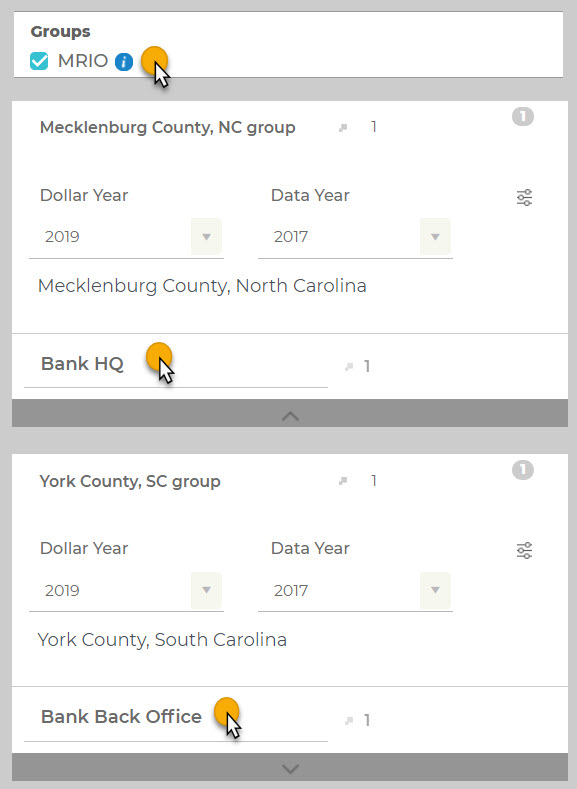

First, on the Regions screen, select both Mecklenburg County, NC and York County, SC. Click Create Impact.

Create an Industry Output event in Sector 433 – Monetary authorities and depository credit intermediation for $500M. Save the Event and drag it into the Mecklenburg County group on the right side of the screen.

Create a second Industry Output event in Sector 433 – Monetary authorities and depository credit intermediation for $10M. Save the Event with a different name than the first so that it can be identified later. Drag it into the York County group on the right side of the screen. Each Region has its own Event associated with it.

Ensure that the MRIO checkbox at the top of the screen is checked.

Click Run. When using MRIO, the software will take a little longer than a standard analysis. Grab a cup of coffee and when the analysis is complete, click View Results.

STEP 2 – VIEWING THE RESULTS

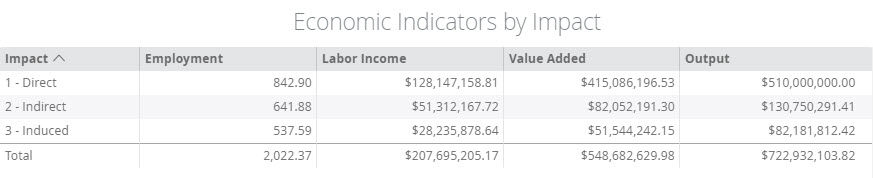

When you look at the Results screen, you see the Total Direct Output of $510M; $500M in Mecklenburg for the HQ and $10M in York for the back office. Together, they have an indirect effect of $131M and an induced effect of $82M, for a total economic impact of $723M. These results include the impacts of the HQ and back office locations on both Mecklenburg County, NC and York County, SC.

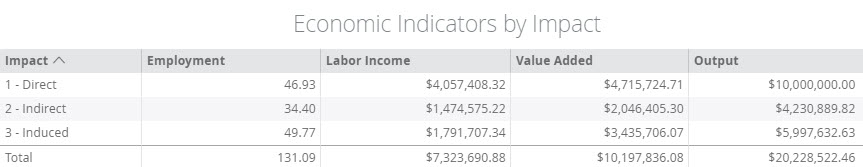

Mecklenburg County & York County Impact – HQ and Back Office

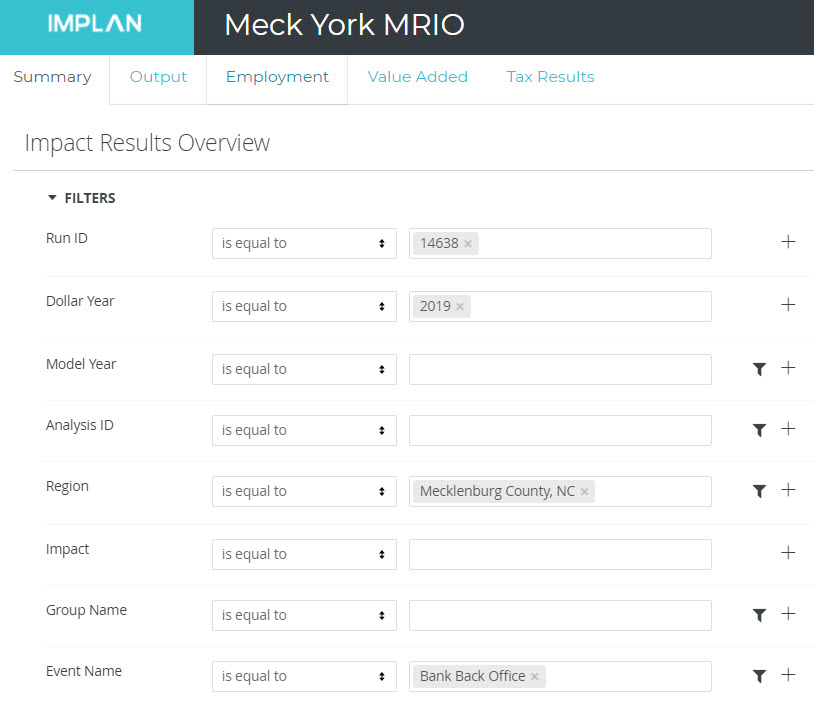

Unlike when there is only one region with an Event, now there are two options for Filtering the results. We can see how the new back office operations (located in York County, SC) will spur economic activity in Mecklenburg County, NC. In the Region box, choose Mecklenburg and in the Event Name box choose “Bank Back Office.” Hit the run button on the right.

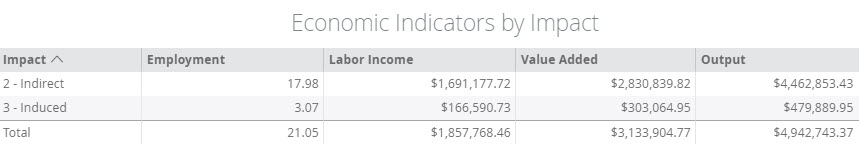

Notice that there is no Direct impact. You do see a total Output impact of almost $5M. This is money that will flow into Mecklenburg County because of the $10M in bank back office operations in neighboring York County.

Mecklenburg County Impact – Back Office

By only filtering the Region for Mecklenburg, we will see the effect of the HQ and the back office on the county. This shows us the Direct Output of $500M for the HQ, but not the $10M in Direct Output for the back office.

Mecklenburg County Impact – HQ and Back Office

If the Region is filtered by York County, you will see the effect of the HQ and the back office on the county. This shows us the Direct Output of $10M for the back office, but not the $500M in Direct Output for the HQ.

York County Impact – HQ and Back Office

If you add the Economic Indicators from Mecklenburg and York counties, you will get the total Output impact of $723M seen before the Filter was applied.

RELATED TOPICS:

Introduction to Multi-Regional Input-Output (MRIO)

Considerations when using MRIO

Size of Your Impact – Questions & Concerns about Small vs. Large Study Regions & MRIO

Primary inputs

MRIO: Size of Your Impact – Questions & Concerns about Small vs. Large Study Regions

Introduction

Larger study areas tend to reflect larger impacts, because larger geographies typically capture more production as ‘local’ and are subject to less in-commuting. However, analysts are occasionally surprised to find that the economy of a smaller subset region, such as a county, reflects a greater Indirect and Induced impact than that of the larger aggregate region (i.e., the state). Although not exhaustive, this article does highlight the most common reasons for such an occurrence. One easy way to avoid these issues, if you are using IMPLAN Pro, is to use the MRIO methodology.

Detail Information

Why does this occur? How can a smaller region have greater Indirect and Induced Effects than it has when you include surrounding geographies?

Typically larger Indirect and Induced impacts in a smaller subset region are the result of areas of high production surrounded by more rural regions. This creates a situation where we see only a small bump in production between the smaller geography and the larger one, but a significant increase in demand. This change can be economy wide, or it could be related to a specific commodity as a result of regional specialization or clustering. In these areas, the supply relative to demand is much higher in the smaller region than in the larger region (i.e., the RPCs for what is regionally available in the smaller region exceeds that of the larger region). Therefore, the larger geography sees a much larger increase in demand for the products produced in the smaller geography but does not substantially increase the supply available to meet that demand. Wyoming is a classic example of this type of activity because there are few regions of supply and a vast state of demand.

These same principles can apply in regards to Labor Income and Value Added because the regions of greater production often pay higher wages per worker and may pay higher taxes (or be subject to additional taxes such as city taxes not collected in the rest of the county). Since Value Added = Labor Income + Other Property Type Income + Taxes on Production & Imports Net Subsidies, if either or both income and taxes are higher, or if profits are higher in the core region, “upside down” effects, where the results are higher in the smaller region (county) than in the larger region (state), may be generated.

When using Employment to estimate the impact of an Industry an additional caveat arises because a difference in Output per Worker can generate significantly variant Output estimates. If the Output estimate in the smaller region is substantially larger the Output estimate in the larger region, this can result in Indirect impacts in smaller subset regions being larger than in the aggregate regions. Production areas with a greater Output per Worker than the larger surrounding area may reflect a larger impact than the aggregated region as a whole.

Usage

Typically, when impacting a larger study region, the results will follow the “normal” pattern of the Indirect and Induced producing large impacts. However it is still advisable to match the Event values in the larger region to those of the county, as this results in a consistent estimate of the Direct Effects.

This same technique also works for adjusting these smaller regions that produce higher impacts than their larger aggregate. Modify the Event in the larger region to match the Event in the smaller region (e.g., same output-per-worker, same labor income per worker) will typically resolve this issue.

However, if sufficient data is availalbe, IMPLAN recommends MRIO (Multi Regional Input Output) rather than direct comparisons of the aggregate state file to a county subset. Before IMPLAN had MRIO capability, analysts were forced to:

- Choose the small region where the actual direct impact occurs but lose much of the indirect and induced impact to leakage.

- Choose a larger region to capture those leaked impacts, but now the impact location is less precisely defined.

This is no longer necessary with the ability to use MRIO. Now the smaller region can be chosen for the Direct impact while still affording analyst the ability to see the impact on the neighboring regions (and those regions’ feedback effects back on the smaller region). MRIO also allows for each region to keep it’s unique identity and for you to be able to see how the impacts in the core sub-region and the larger aggregate region occur.