ABP: Analysis-by-Parts & Bill of Goods Using Commodity or Industry Events with Labor Income Event(s)

INTRODUCTION:

Analysis-by-Parts (ABP) is a technique by which you can split the “stemming ripple effects” of an event into its individual impact components – in this case if you have spending by line item and income. Separating the pieces with Analysis-by-Parts gives the researcher more flexibility and customization capabilities in the analysis.

DETAILED INFORMATION:

To perform an Analysis-by-Parts using a bill of goods approach, you will want to know Direct Labor Income and the budget details. Many times, you may be given the budget by the client that outlines their total spending along different businesses or products. This information can be directly translated into Events in IMPLAN.

STEP 1 – EXPENDITURES

In the bill of goods approach, the researcher is presented with a budget. This will either contain a list of companies from which the institution or industry purchases things (industries) or a list of the items that it purchases (commodities). The researcher will need to first determine if they will be modeling Commodities or Industries.

- A Commodity is a product or service that may be produced by one or by many industries.

- An Industry represents a group of establishments engaged in the same or similar types of economic activity.

Next, choose the Specification that best matches each line item of purchase either by IMPLAN Sector code or IMPLAN Commodity code.

Enter each line of spending as either a Commodity Output Event or an Industry Output Event. There will be many different Event lines in the model.

- Remember to apply Margins as necessary

- When you have expenditure data by Industry, retail/wholesale purchases can only be modeled via the retail or wholesale Sectors. Only retail/wholesale industries can be margined. If the expenditure value is a full retail sales value, you can leave the Margin default setting of “Total Revenue,” which will apply margins to the expenditure value. The estimated retail margin will then get applied to the retail Multipliers. The wholesale and transportation margins, as well as the production value will be leaked out of the model.

- When you have expenditure data by Commodity and the expenditure value is the retail sales value of the Commodity, margins should be applied. Again, in this case you can leave the Margin default setting of “Total Revenue,” which will apply margins to the expenditure value. For Commodities, marginning will estimate not only the retail margin, but also the wholesale and transportation margins, along with the production value. Here, nothing will be leaked out of the model except for any Commodity Supply that will come from Institutional Sales or Inventory.

- Changing the Margin selection to “Marginal Revenue” indicates you are entering the producer price, the producer being indicated by the Specification on the Event. For Commodities and Industries that are not marginable “Marginal Revenue” will be the only option.

If you need to make adjustments to IMPLAN’s margins, learn more about Manually Margining.

- Also remember to appropriately specify the portion of the purchase that is coming from local production

- Adjust Local Purchase Percentage (LPP) for Commodity Output Events as necessary. If we know the Commodity will be produced in the Region we will leave the Local Purchase Percentage at 100%. If we don’t know where the purchase was produced (which is often the case), setting Local Purchase Percentage to SAM is most appropriate. You can also enter your own known percentage for the portion of the purchase that will be local.

- For purchases by Industry, only purchases from local businesses should be modeled and included in the Industry Output Event Values.

For example, let’s say a small dog treat bakery is opening up in North Carolina. We know what items they will purchase (commodities) to operate their store.

- Since the purchased Commodities are known, each purchased Commodity will be entered as a Commodity Output Event.

- For each of these items, we will find the appropriate Commodity code. Peanut butter is commodity code 3099 – Roasted nuts and peanut butter manufacturing, as an example. Repeat this step for each of the Commodities that will be purchased.

- All of the bakery’s retail purchases should have margins applied by leaving the selection of “Total Revenue.” Since the place of production would likely be unknown, LPP should be set to SAM. Other purchases, such as local utility payments would have the selection of “Marginal Revenue” because the amount the bakery pays for these Commodities is a Producer Price. For payments to utility providers in the Region, LPP should be left at 100%.

A more simple alternative approach, as opposed to modeling each Intermediate Expenditure, is to run the total Intermediate Expenditures value through the Industry Spending Pattern that best reflects the industry you are modeling. For this approach, follow the instructions for Analysis-by-Parts: Using an Industry Spending Pattern Event with Labor Income Event(s).

STEP 2 – LABOR INCOME

Next, a Labor Income Event must be created either for Employee Compensation (EC), Proprietor Income (PI), or both.

In our example, the bakery will be run by the owner (proprietor) who will receive $75,000 in labor income and one additional employee that will receive $55,000. A Labor Income Event will be created for each: $75,000 for Proprietor Income and $55,000 for Employee Compensation.

Remember, these should be fully loaded payroll values which include wage and salary, all benefits (e.g., health, retirement) and payroll taxes (both sides of social security, unemployment taxes, etc.).

If you need to convert your wage and salary data to fully loaded payroll, please use the 536 FTE & EMPLOYEE COMPENSATION CONVERSION TABLE.

STEP 3 – RUN THE IMPACT

Now either use the button at the top to select all or highlight each Event and drag them into your Group. Next, hit run.

STEP 4 – INTERPRET THE RESULTS

When your analysis is complete, the results will show you the economic impact of all of the Events you entered which will include the Commodity or Industry Events and the Labor Income Event(s).

In our Dog Bakery example, this investment has an economic impact of almost 21 jobs, $840,500 in Labor Income, $1.4 million in Value Added, and $3.1 million in Output.

- The Direct and Indirect Effects are from the Commodity/Industry Events only and represent employment in the local industries directly affected (via a purchase from within the Direct business’s supply chain, in this example, the dog treat bakery).

- The Labor Income events only create Induced Effects.

If you want to look at the results by Event, remember to use the FILTERS button and select which of the Events you would like displayed.

STEP 5 – MODIFYING RESULTS

Because your Direct Effects are from the Commodity/Industry Events, which only reflect the purchases made by the true Direct business, the Results should be modified. Your Direct Effects are actually Indirect Effects.

- Subtract you Direct Effect from your Direct Effect so the Direct Effects become all zeros.

- Add these Direct Effects to the existing Indirect Effects to generate a new Indirect Effect.

- Define your Direct Effect:

- Direct Labor Income = total Labor Income. You should use the values run through the Labor Income Event(s) from Step 2.

- Direct Value Added = Direct Labor Income + Tax on Production and Imports + Other Property Income

- This can also be derived from the Output equation in the model:

- If you have Output, you can use the equation Value Added = Output – Intermediate Expenditures (the sum of your expenditures)

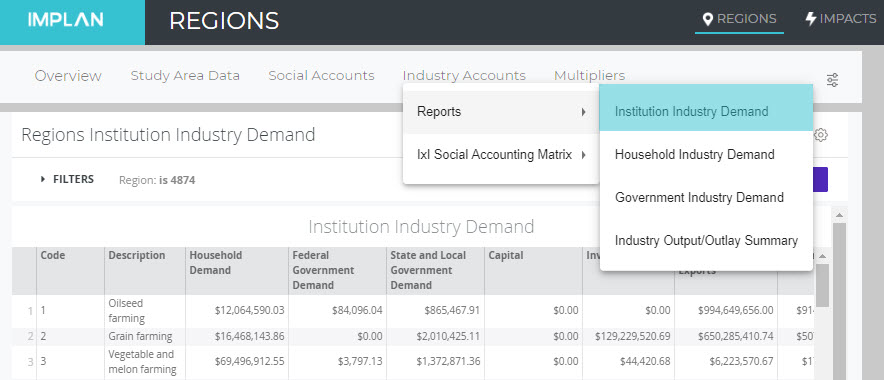

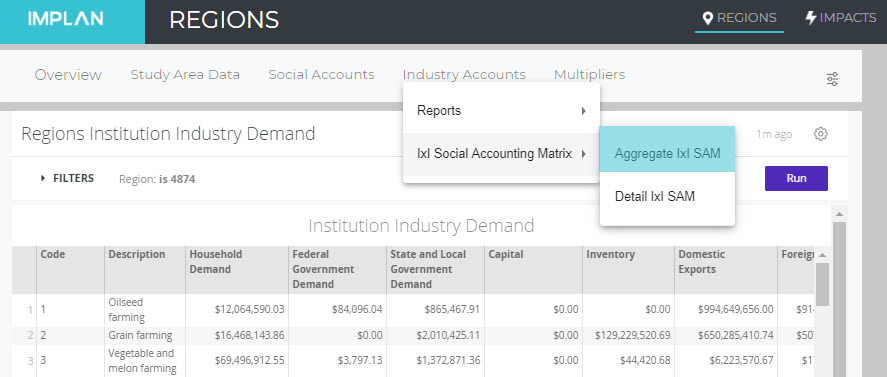

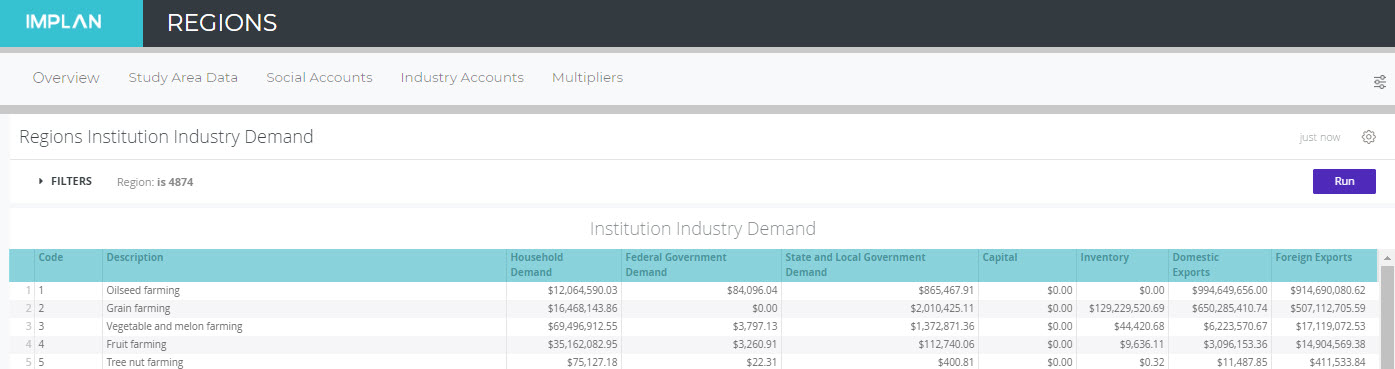

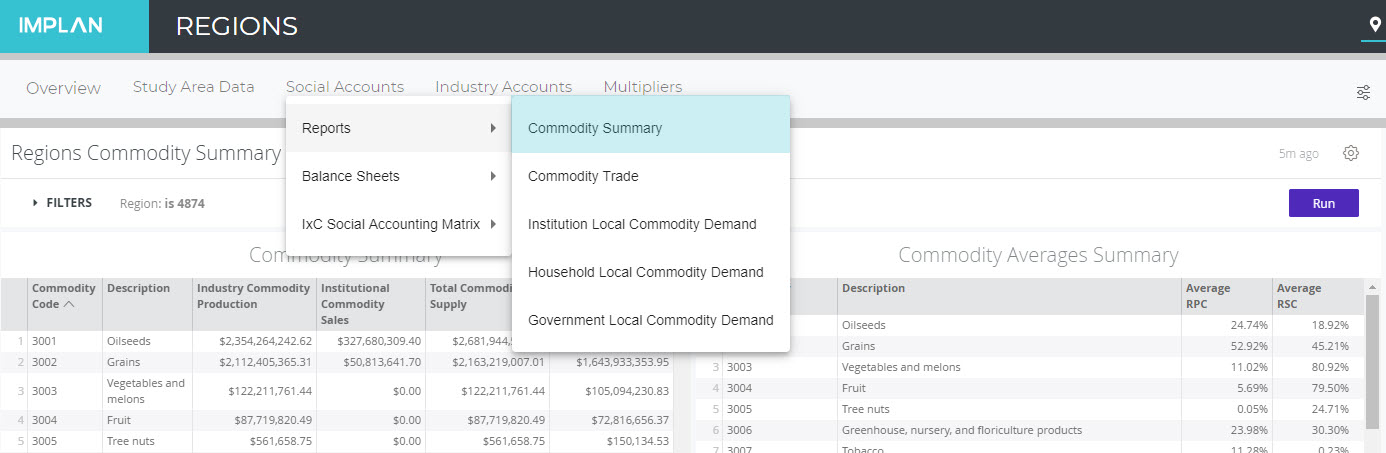

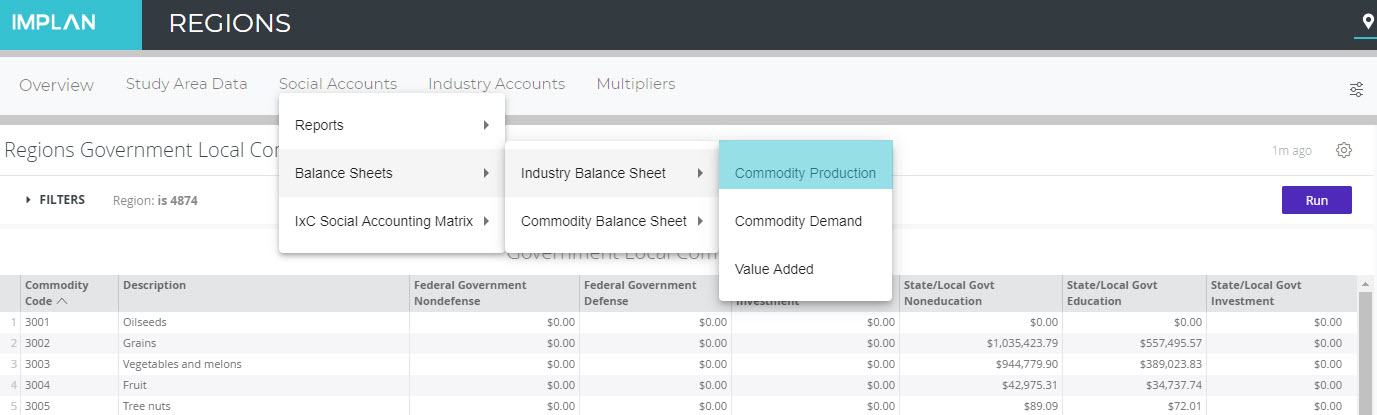

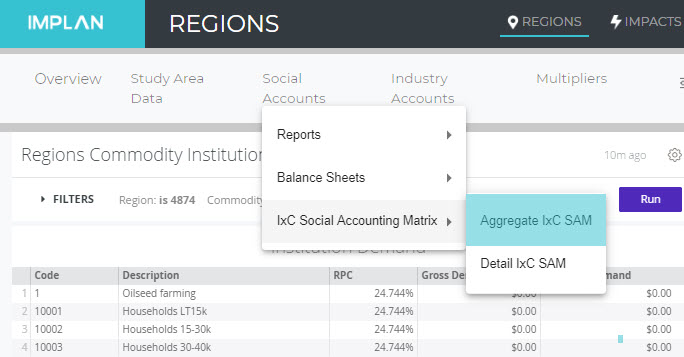

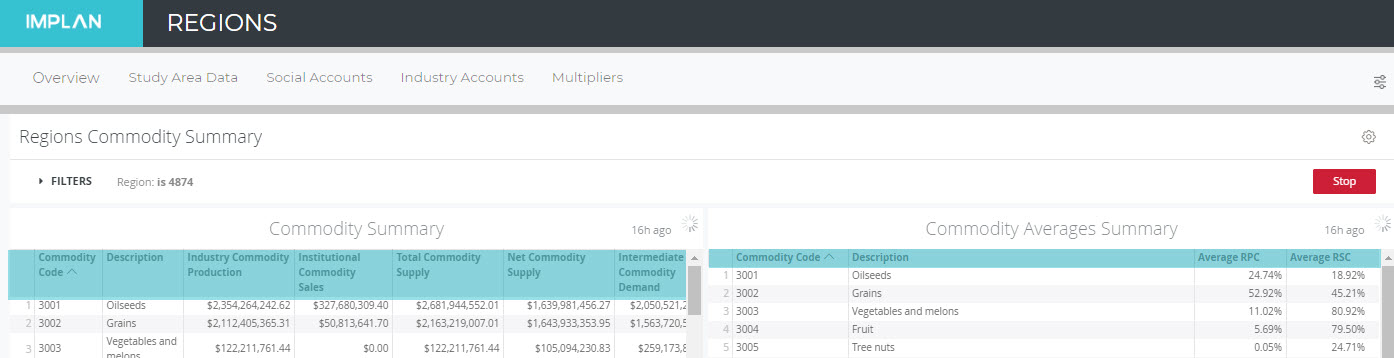

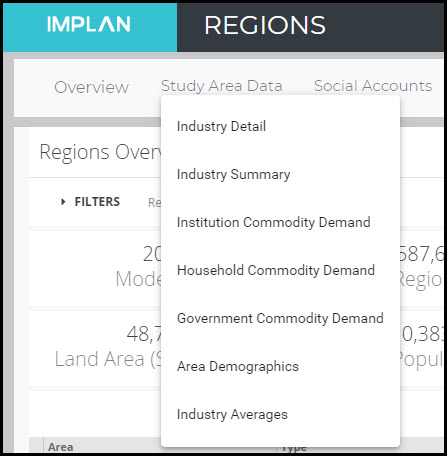

- If you only have sum of expenditures and Direct Labor Income, you’ll need to find out how these values relate to Value Added in the Output equation for the Sector that best represents the Direct Industry, in Region Details > Social Accounts > Balance Sheets > Industry Balance Sheets

- Using the Value Added Tab, Value Added can be calculated as (Labor Income/Labor Income Coefficient) * Value Added Coefficient. The Labor Income Coefficient being a sum of EC and PI Coefficients.

- Value Added could also be calculated using the Commodity Demand tab, Gross Absorption column total and Value Added Coefficient as (sum of expenditures)/Gross Absorption Coefficient * Value Added Coefficient

- Note that if these two approaches produce different results it is because your sum of expenditures and Labor Income values don’t follow the same ratio to one another as the Output Equation suggests and some assumptions about how your Output Equation differs will need to be addressed.

- This can also be derived from the Output equation in the model:

- Direct Output = Sum of all expenditures (Intermediate Expenditures) + Direct Value Added

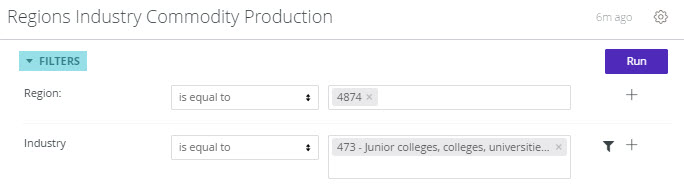

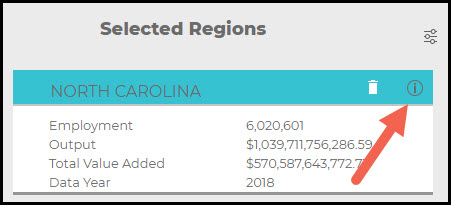

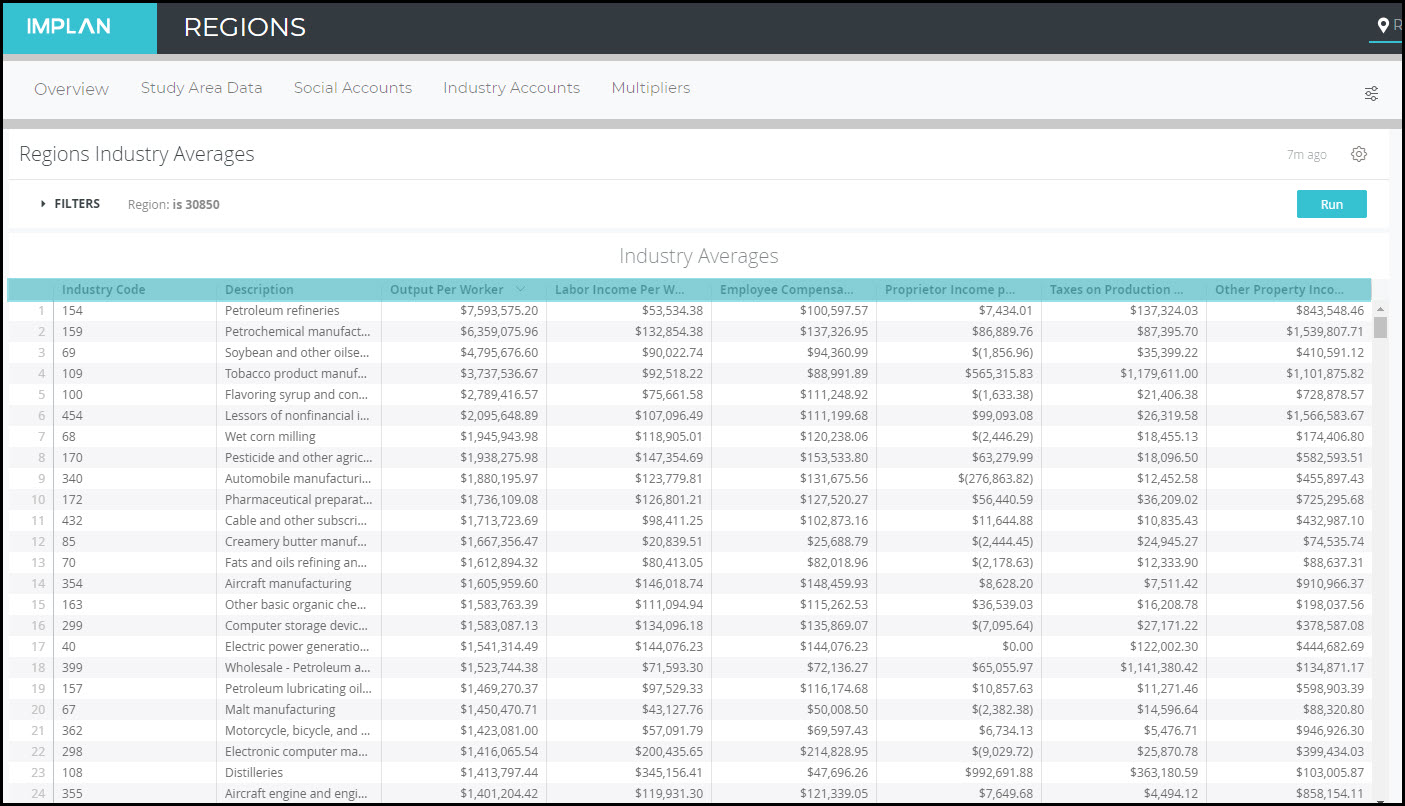

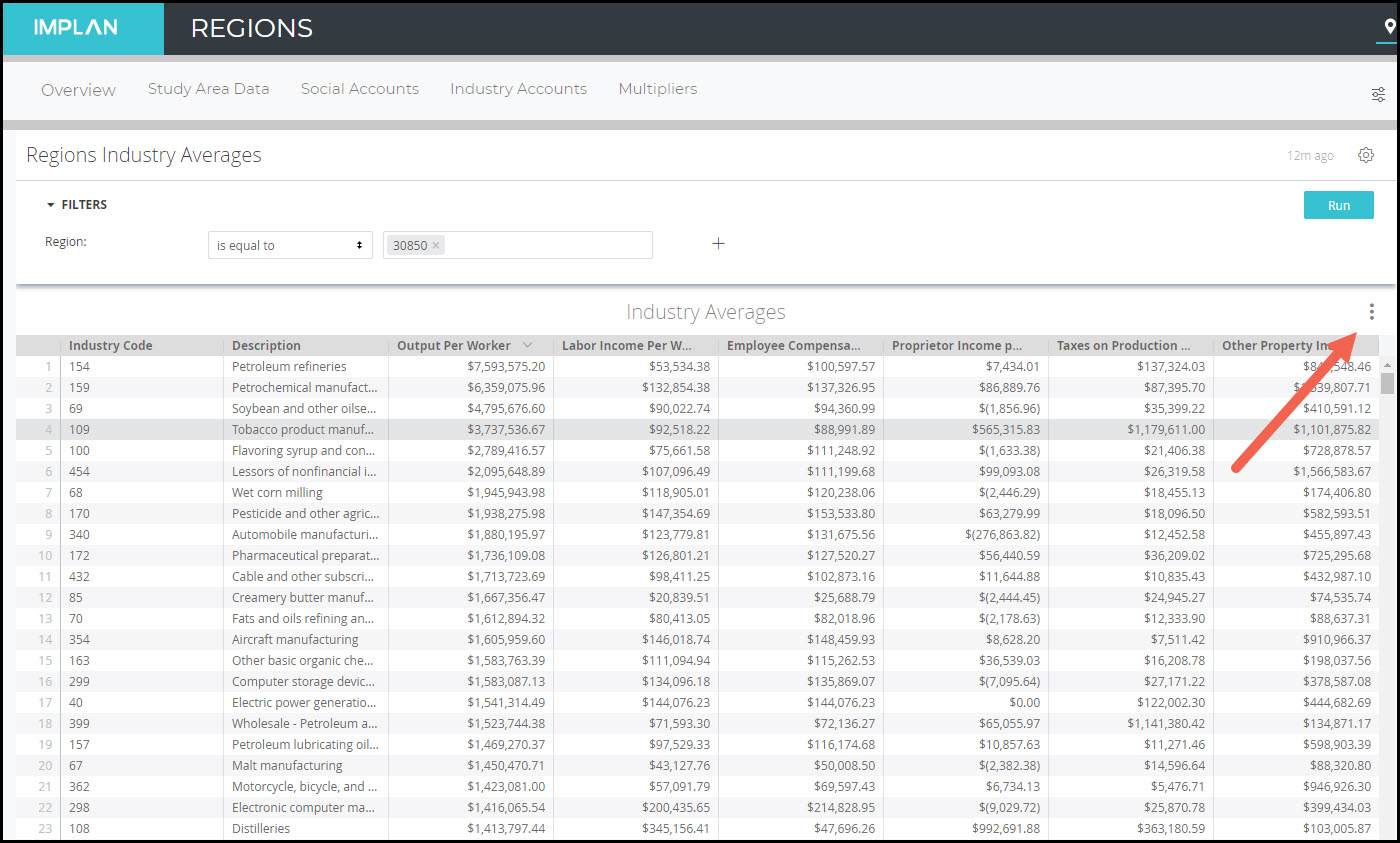

- Direct Employment = known Direct Employment, in this example, we already know there are only 2 Employees. If Employment is unknown, you can calculate it on your own by dividing Direct Output by Output-per-worker for the Sector that best represents the Direct Industry. Output-per-worker can be found by Sector in Region Details > Study Area Data > Industry Summary.

RELATED TOPICS:

ABP: Introduction to Analysis-By-Parts

ABP: Analysis-by-Parts Using an Industry Spending Pattern Event with Labor Income Event(s)

ABP: Analysis-by-Parts with Manually Margining Bill of Goods

Hospitals: Modeling Private Hospital Impacts with Analysis-by-Parts

Hospitals: Modeling Public & Nonprofit Hospital Impacts with Analysis-by-Parts

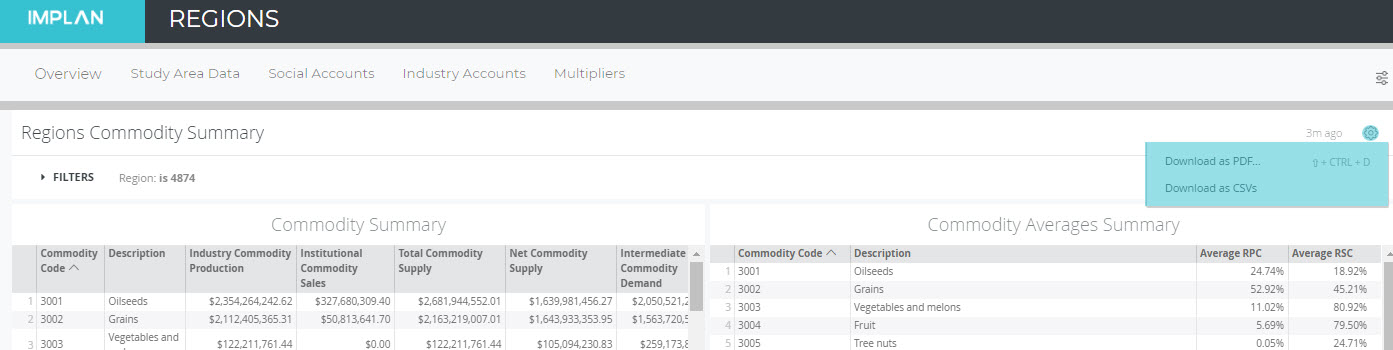

will display the default selection of Intermediate Expenditures, indicating the Value entered in the Event should be the value of Intermediate Expenditures. This can be changed so that Value entered should be Total Output, in which case the regional proportion of Intermediate Expenditures out of Total Industry Output for the selected Industry is multiplied by the Value before it is modeled as spending on the commodities included in the Industry Spending Pattern. The proportion can be found as the Total Gross Absorption percentage found in Region Details > Social Accounts > Balance Sheets > Industry Balance Sheet > Commodity Demand. Whether Intermediate Expenditures or Total Output is selected, the Sum of Percentages will stay at 100% unless you modify the Percentage on an individual commodity.

will display the default selection of Intermediate Expenditures, indicating the Value entered in the Event should be the value of Intermediate Expenditures. This can be changed so that Value entered should be Total Output, in which case the regional proportion of Intermediate Expenditures out of Total Industry Output for the selected Industry is multiplied by the Value before it is modeled as spending on the commodities included in the Industry Spending Pattern. The proportion can be found as the Total Gross Absorption percentage found in Region Details > Social Accounts > Balance Sheets > Industry Balance Sheet > Commodity Demand. Whether Intermediate Expenditures or Total Output is selected, the Sum of Percentages will stay at 100% unless you modify the Percentage on an individual commodity.