Using Occupation Data in IMPLAN

INTRODUCTION

IMPLAN has added its occupation employment by industry data to the IMPLAN application. This dataset shows estimates of occupation employment, wages, hours, and core competencies which include knowledge, skills, abilities, education, work experience, and on-the-job training levels for each of 823 different occupations. Occupation data is available for all models, including models of combined regions, aggregated industry models, and customized models. Occupation data will match the current Data Year in IMPLAN (ie 2018 Data Year will show 2018 Employee Compensation).

There are two different types of Occupation Data that are useful during your analysis: Regional Occupation Data and Occupation Impact Data.

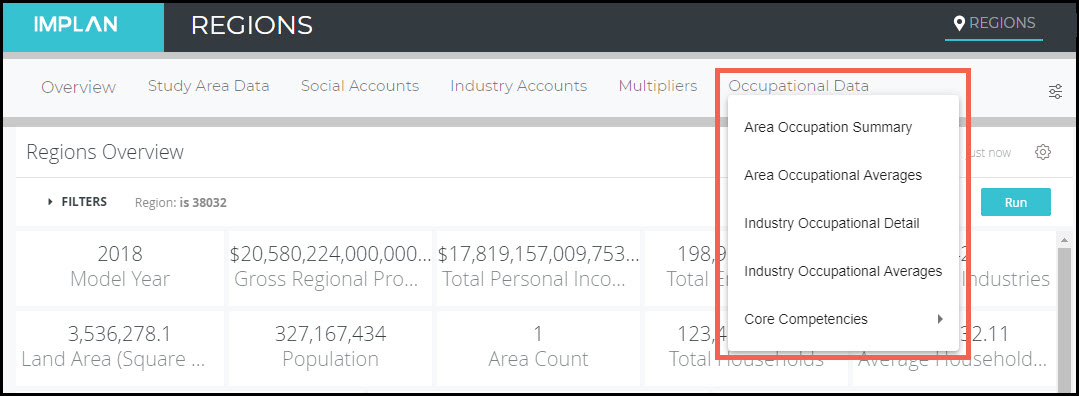

Regional Occupation Data shows the Occupations, Wages, and Core Competencies that are already present in the Region you are studying. You can find this data Behind the i on the Region page.

Occupation Impact Data shows the details for the Occupations, Wages, and Core Competencies that accompany your specific impact or contribution.

DETAILS

Occupation data can be used to examine study area data to gain important insights into a Region’s existing labor force, the skill requirements of various Industries, and more. The Occupation Data can also be seen in the Results of any impact or contribution analysis run within the IMPLAN application.

The data levels generally correspond to the BLS’s Standard Occupational Classification (SOC) codes. Major is the most aggregated, followed by Minor, Broad, and Detail. All data is based on national averages but brought to the regional level in IMPLAN. As with Employment, you may see fractional Occupations, especially for small firms where a few employees are spread across multiple Occupations.

The SOC categorizes occupations into one of 823 detailed occupations which contains 459 broad groups, 96 minor groups, and 23 major groups.

|

Level |

Name |

Records |

Example |

|

Total |

All occupations |

1 |

All Occupations |

|

Major |

2-digit |

23 |

51-0000 – Production Occupations |

|

Minor |

3-digit |

96 |

51-7000 – Woodworkers |

|

Broad |

4-digit |

459 |

51-7030 – Model Makers and Patternmakers, Wood |

|

Detail |

5-digit |

823 |

51-7032 – Patternmakers, Wood |

WHERE TO FIND OCCUPATION DATA

REGIONS OVERVIEW

The tables located in the Regions Overview provide insight into the model Region’s occupation makeup. Descriptions of the data found here are detailed in our Occupation Data – Behind the i article.

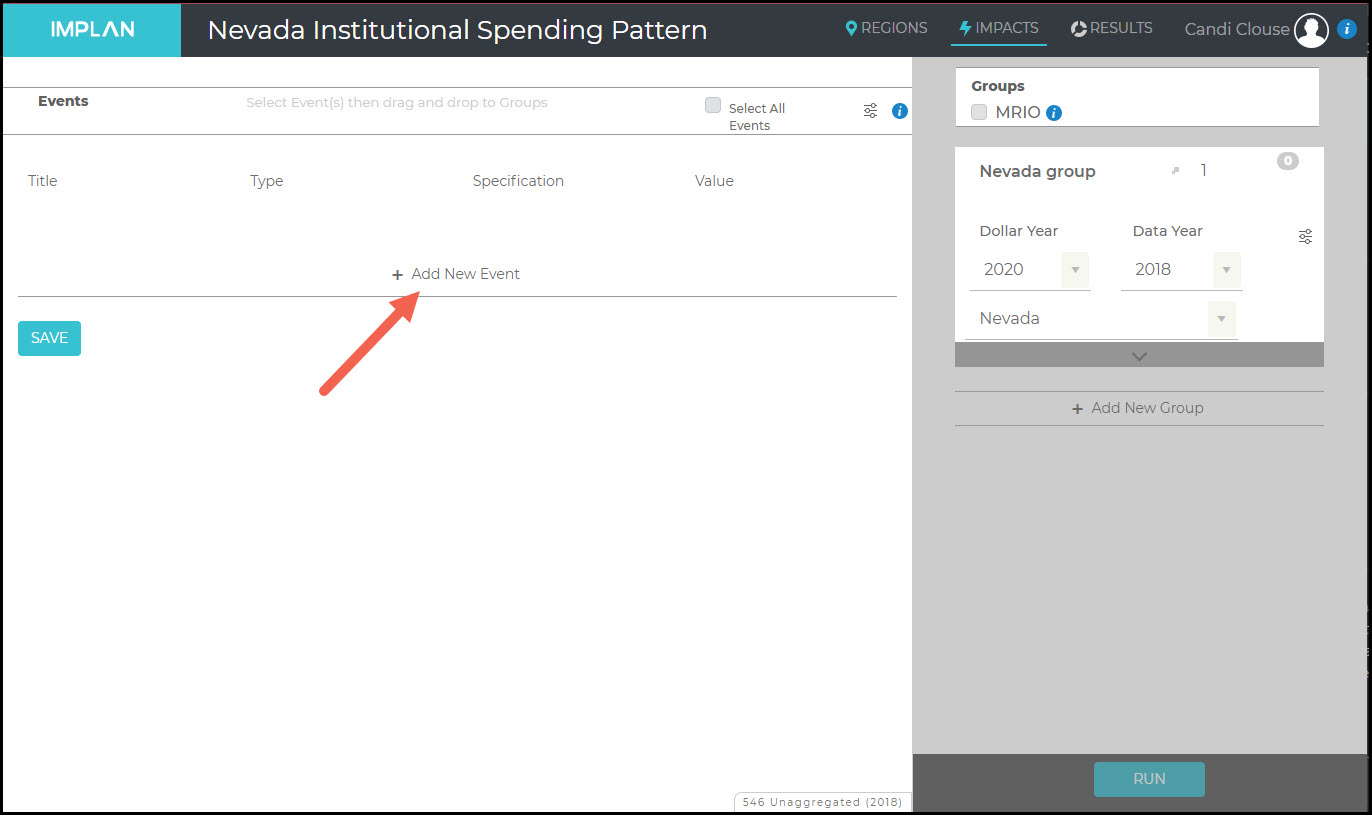

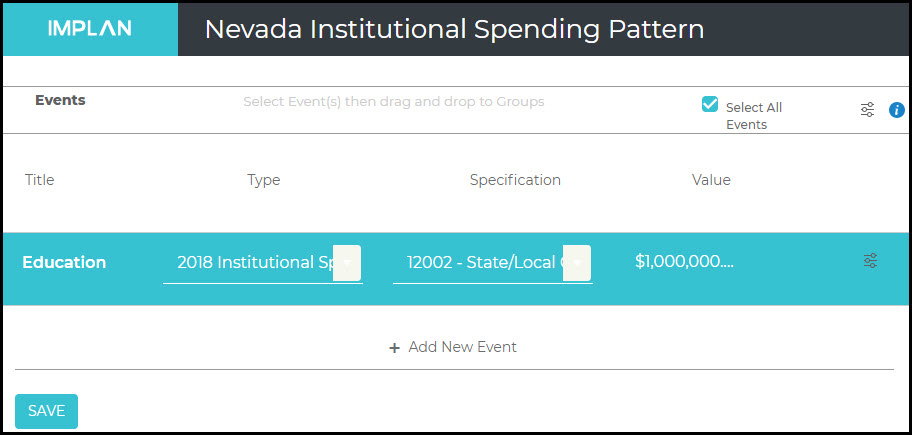

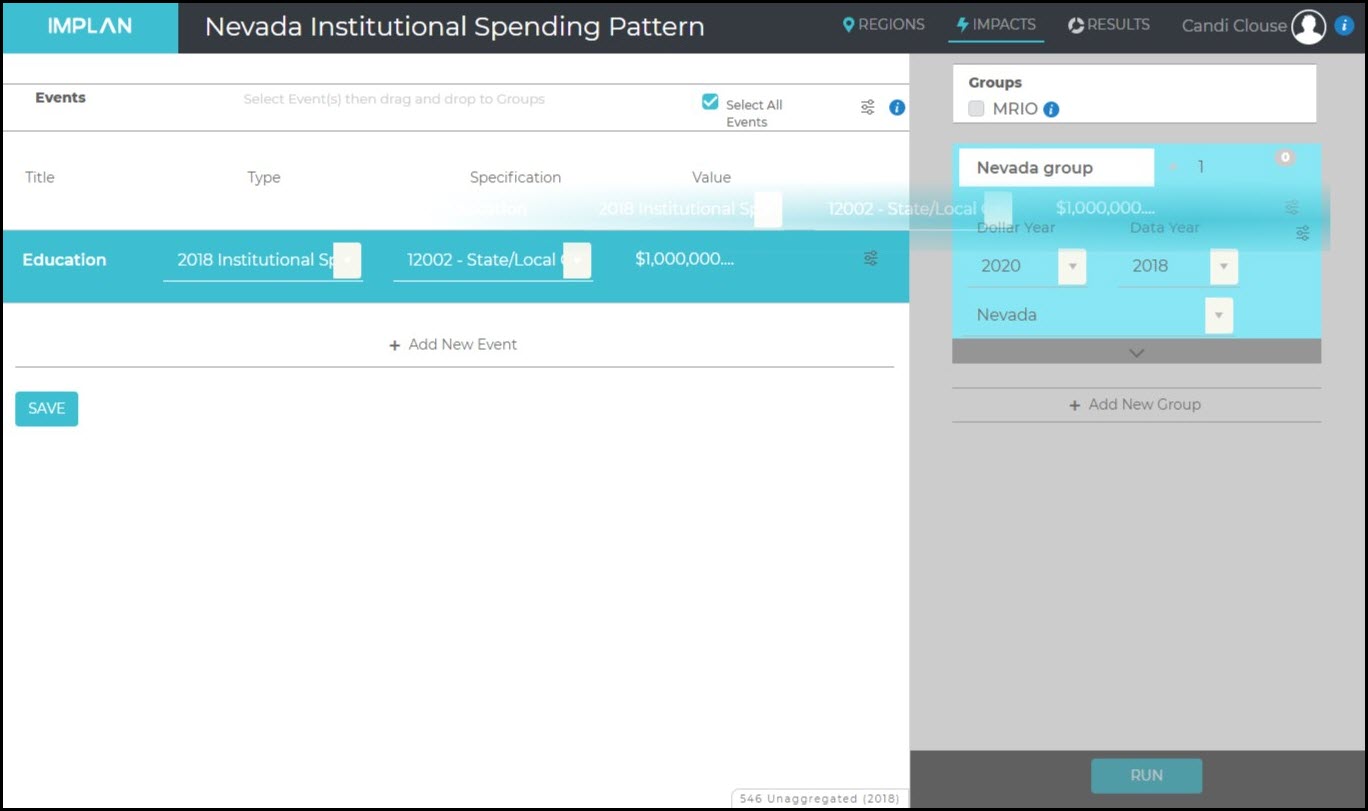

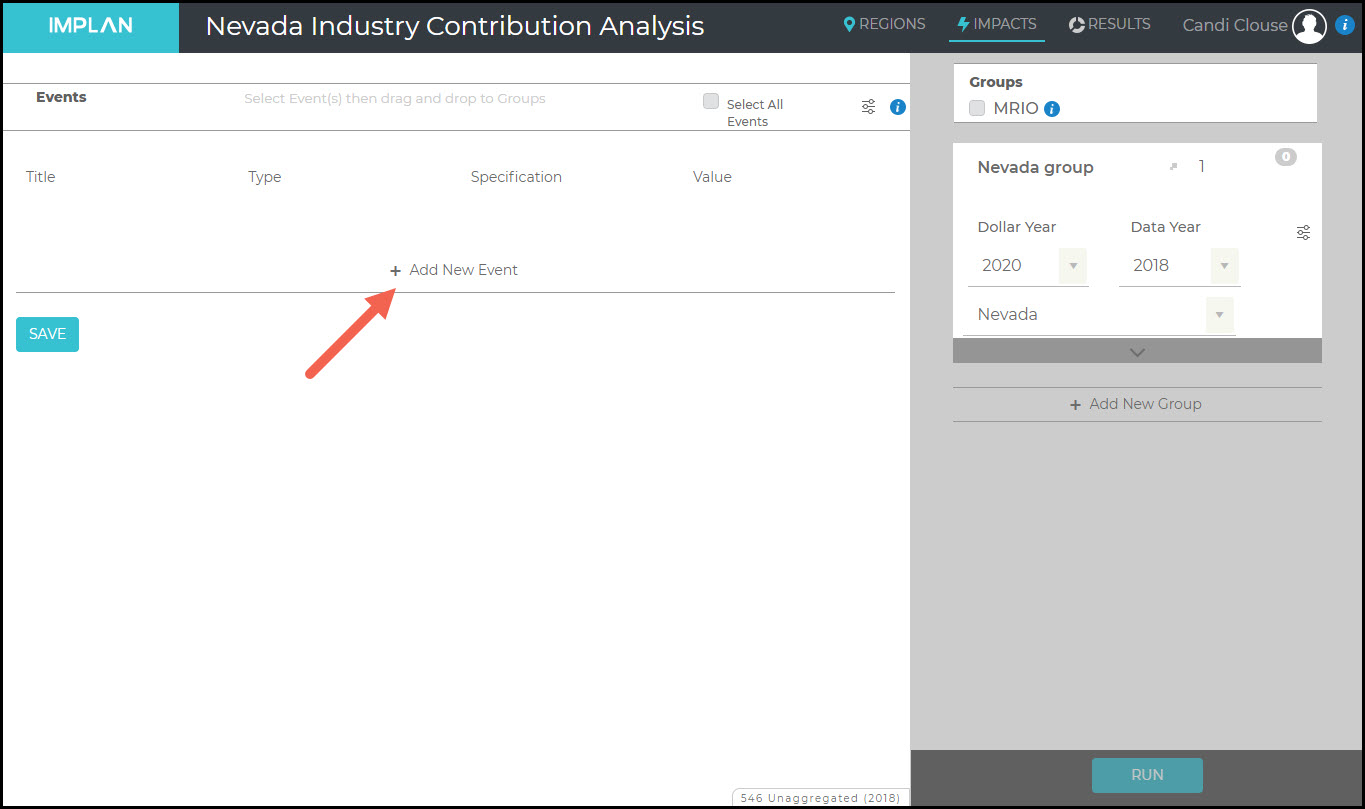

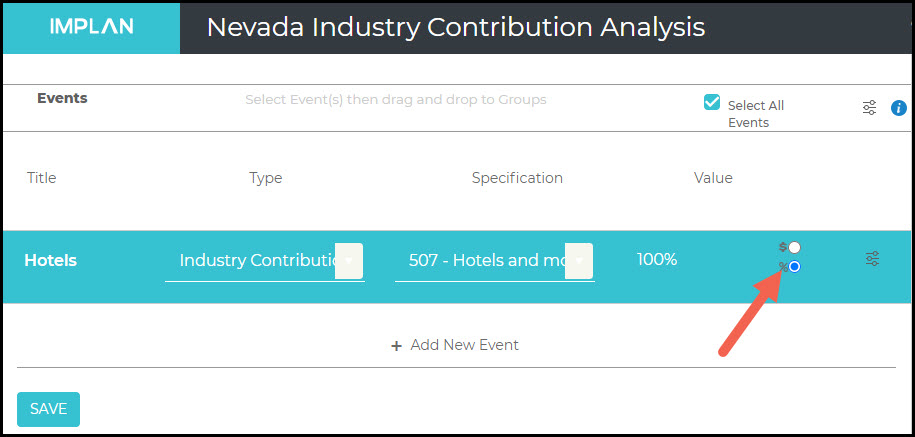

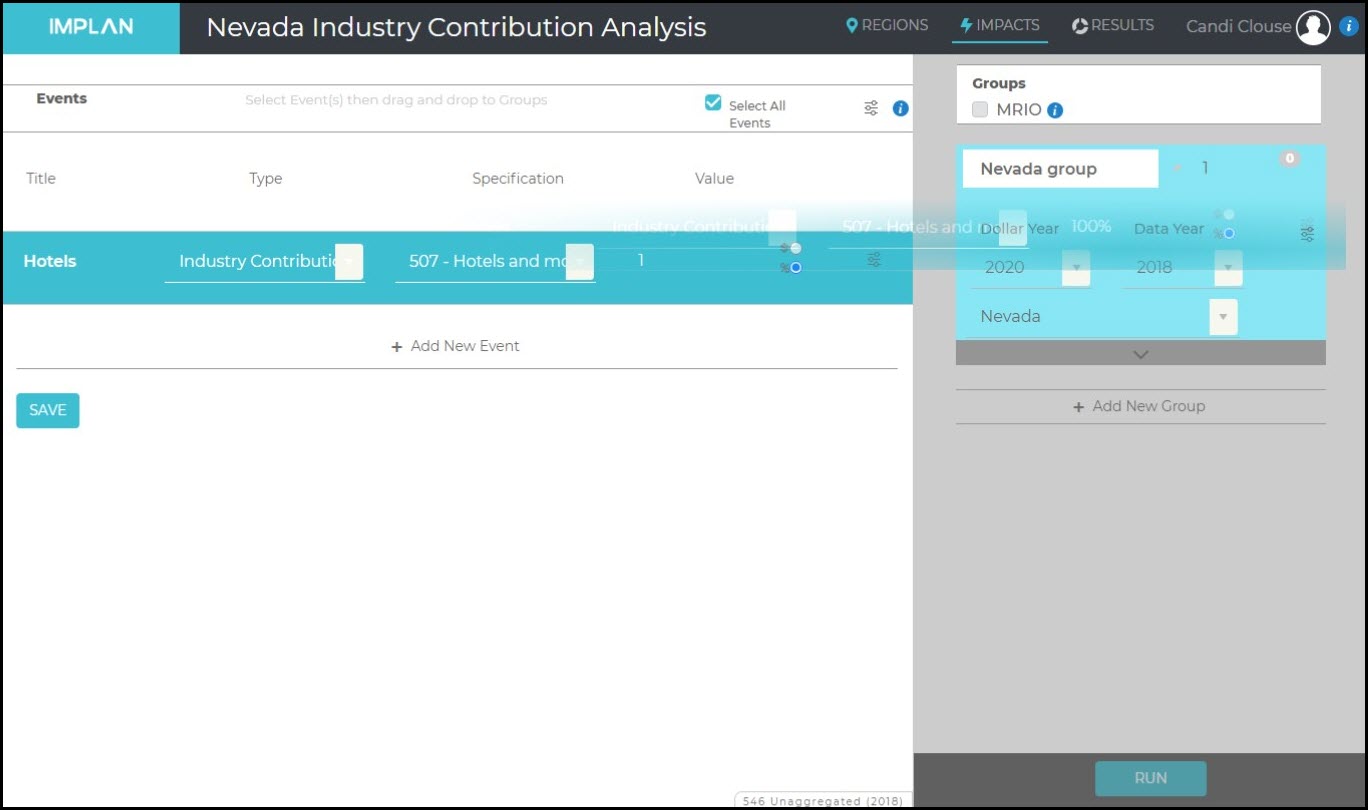

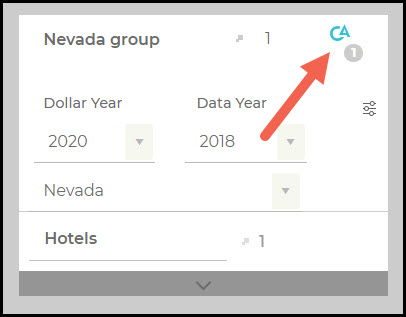

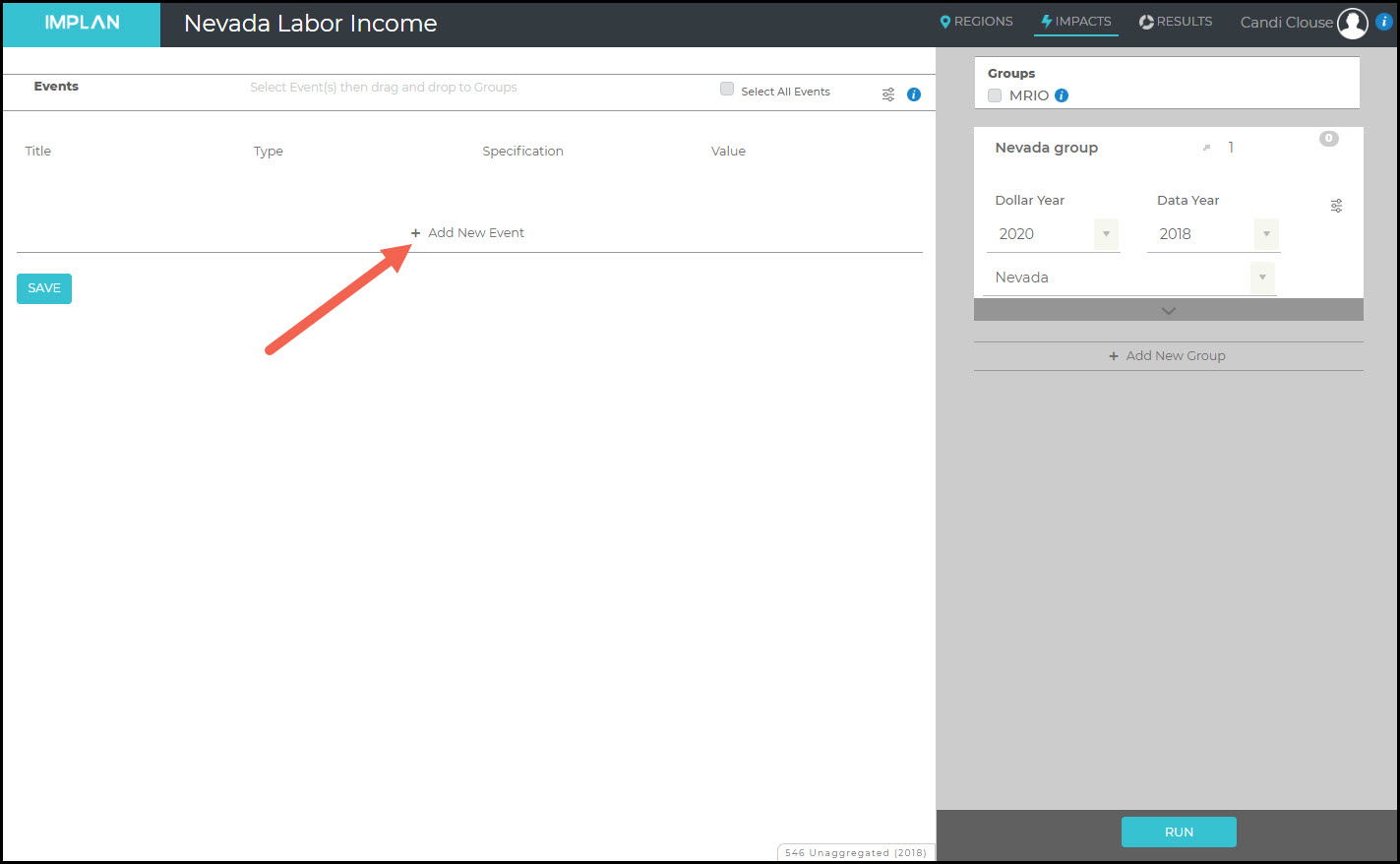

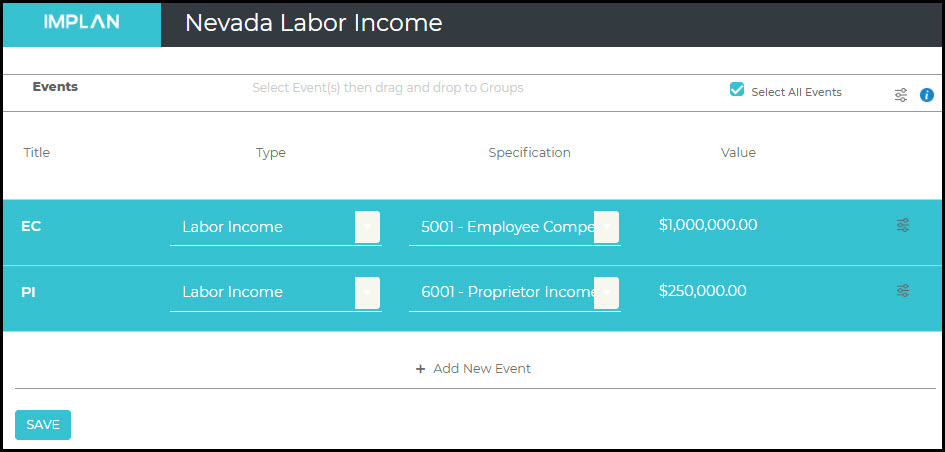

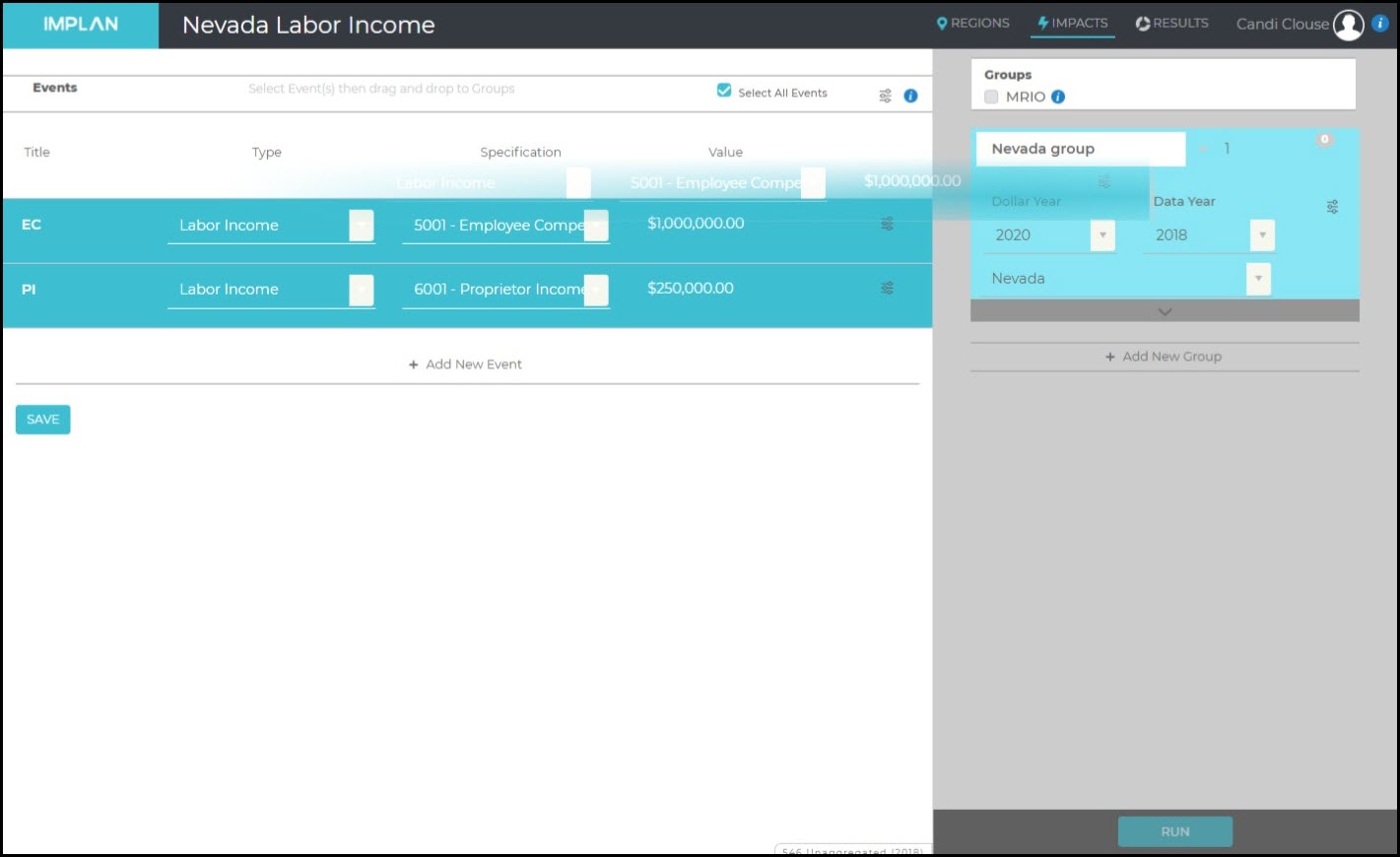

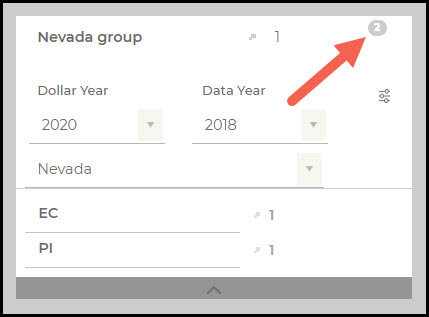

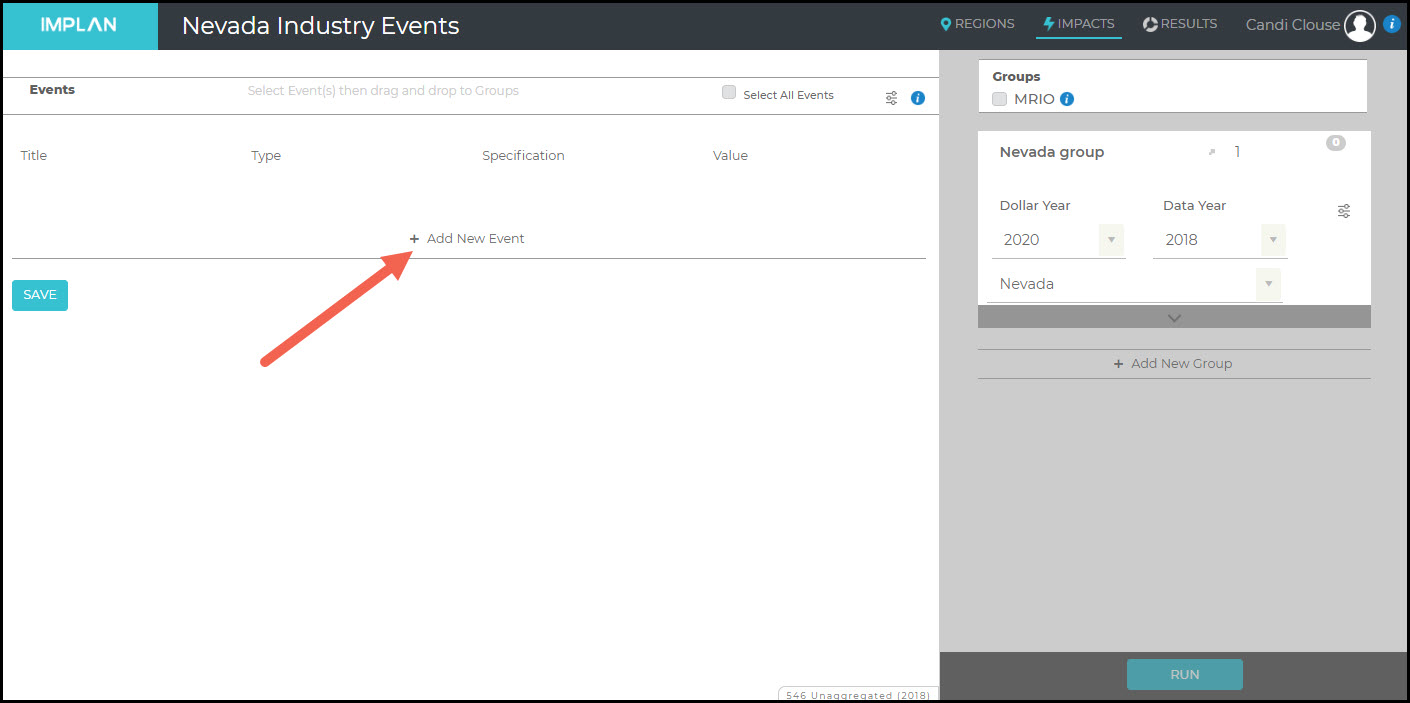

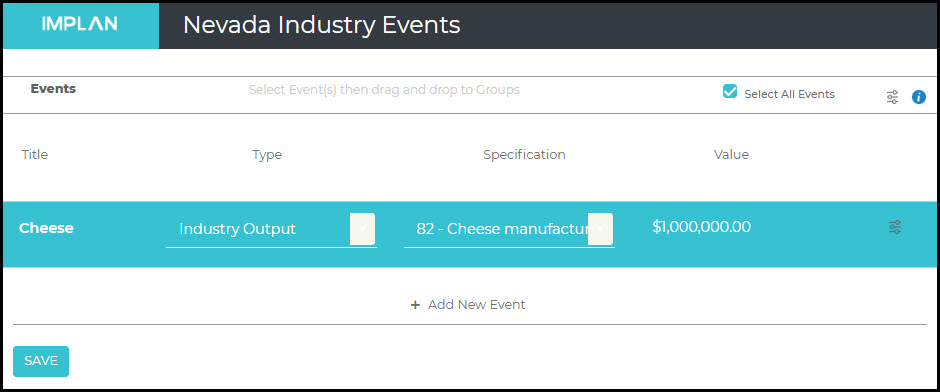

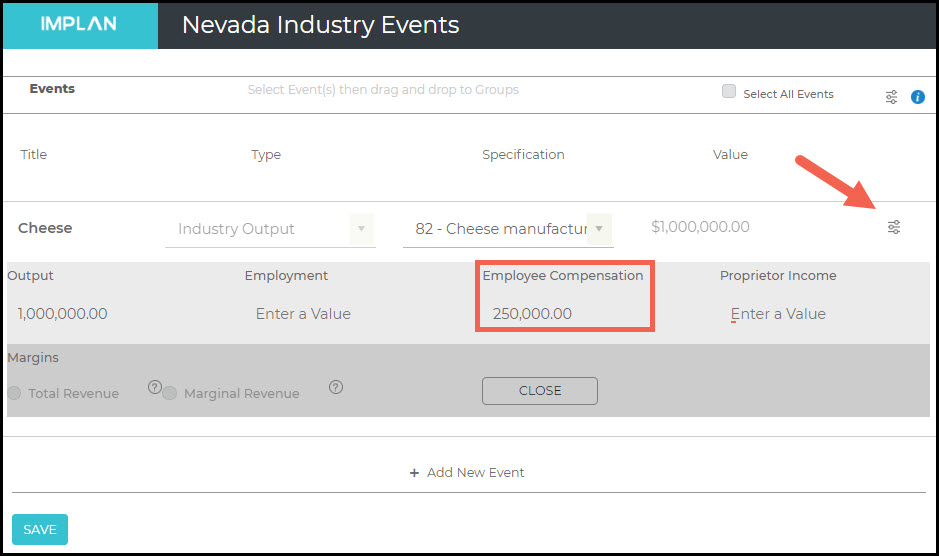

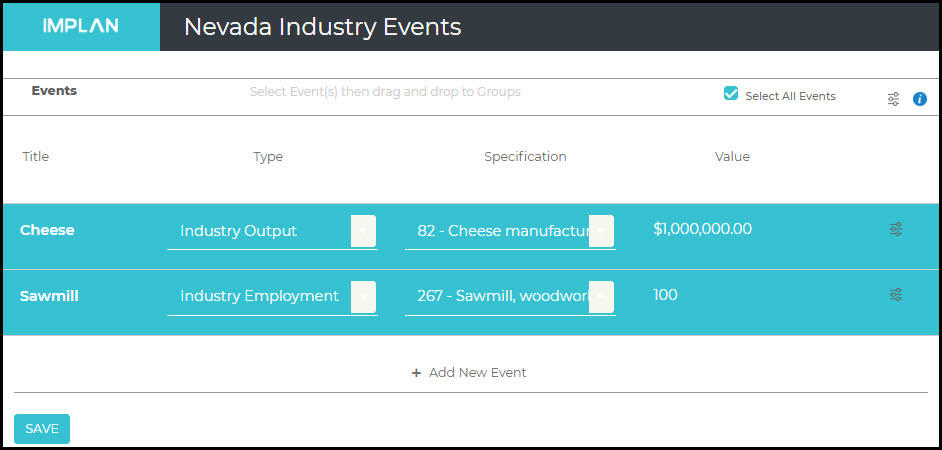

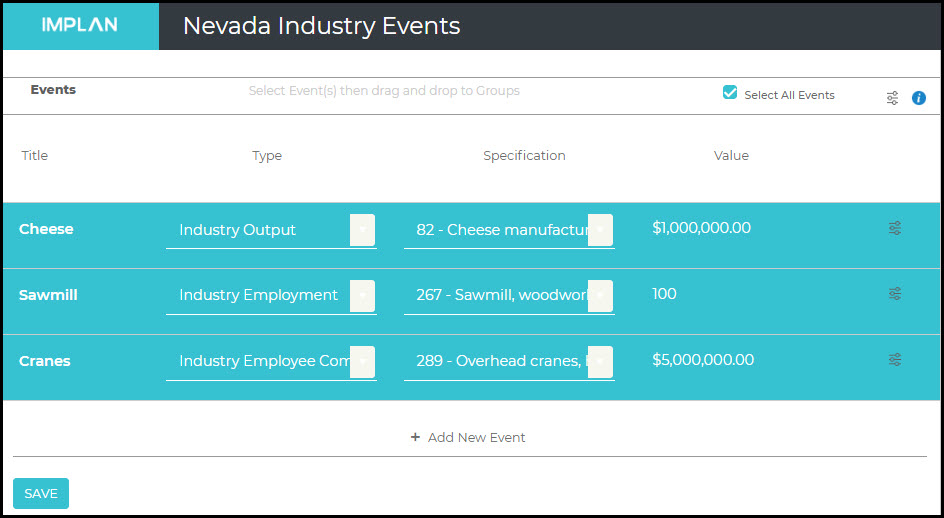

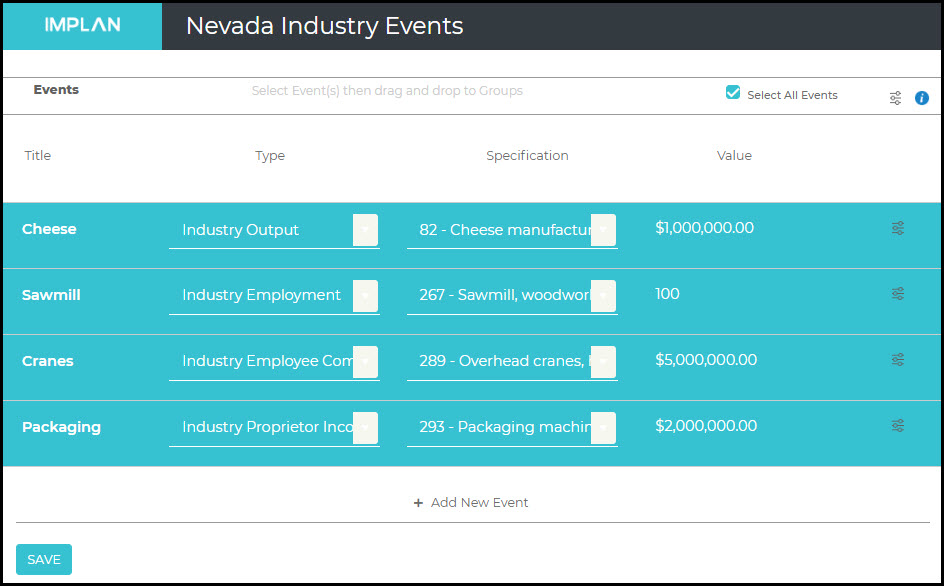

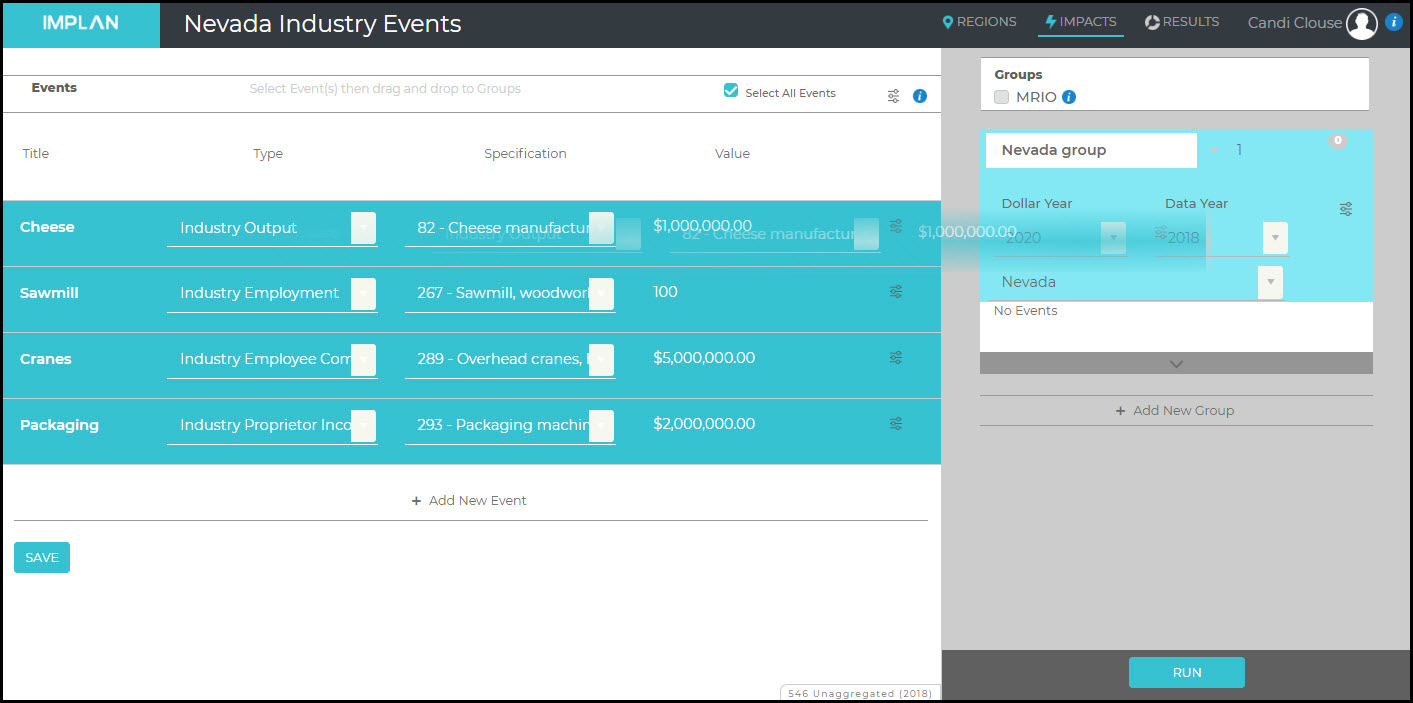

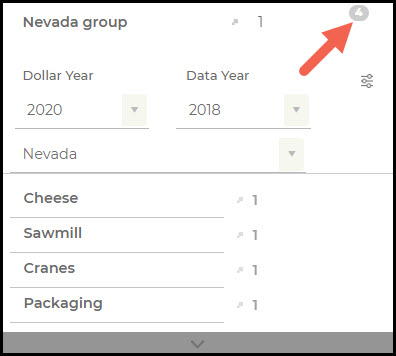

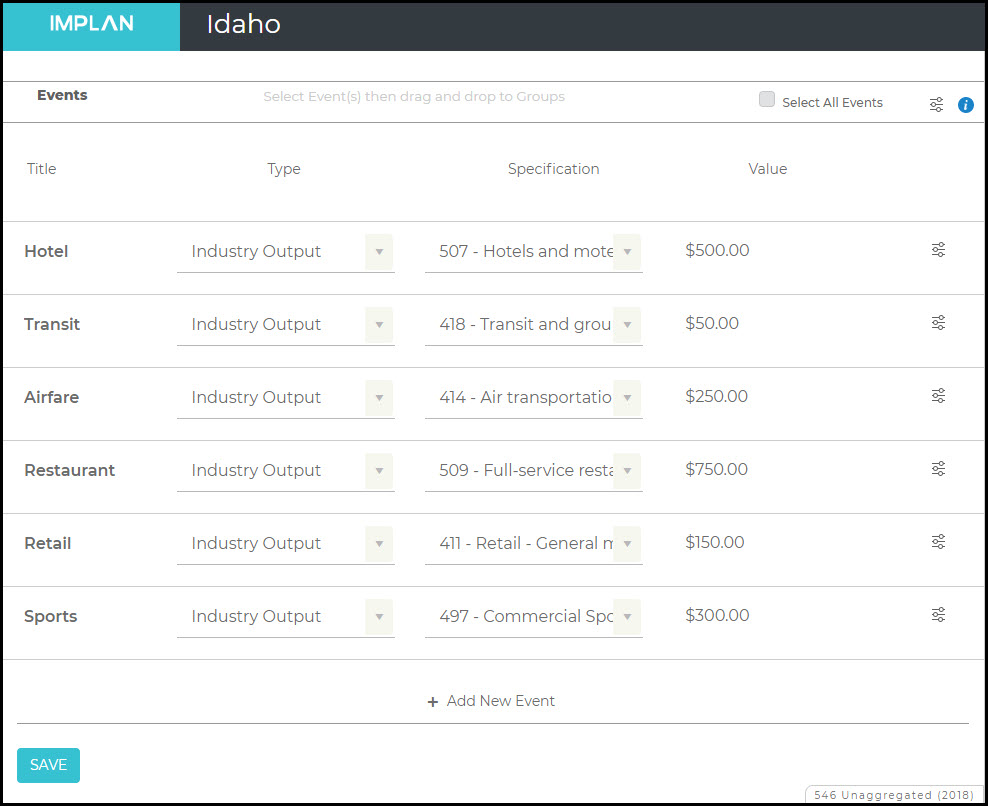

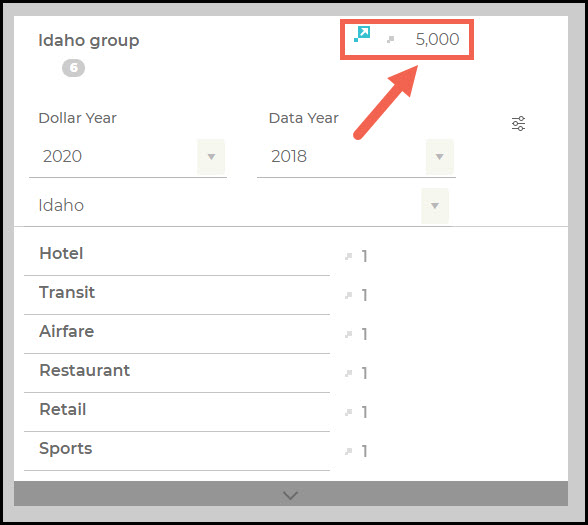

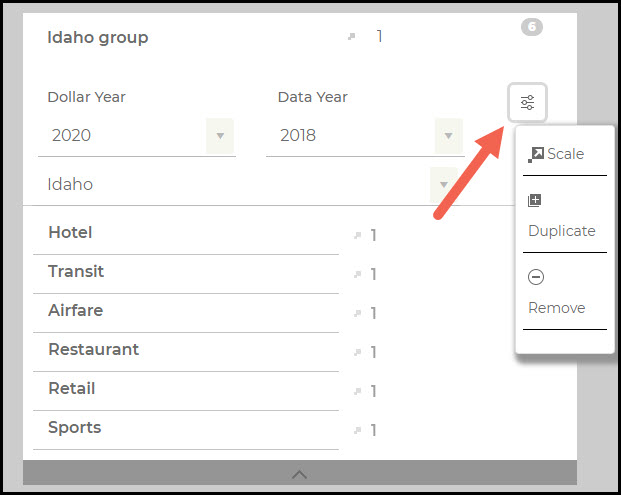

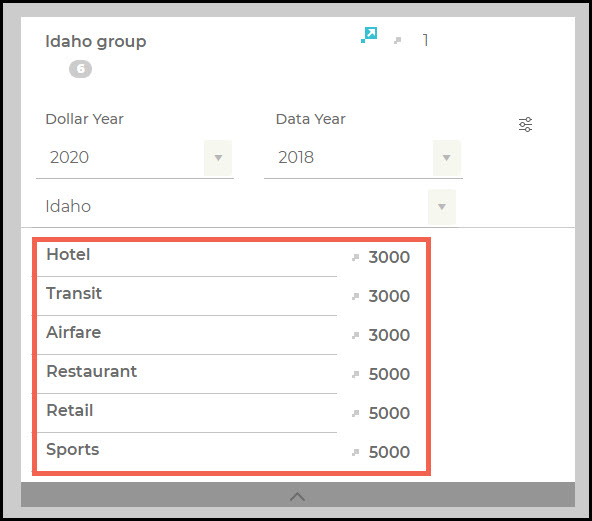

IMPACTS

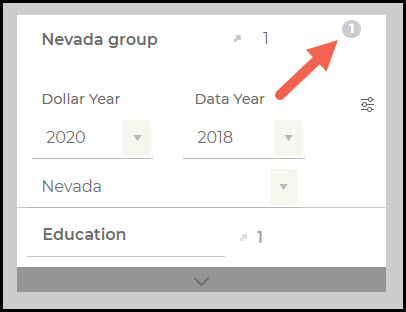

Distributions of occupation employment, wage, and core competencies are applied only to regional and results data. At this time, you cannot run impacts based on occupations.

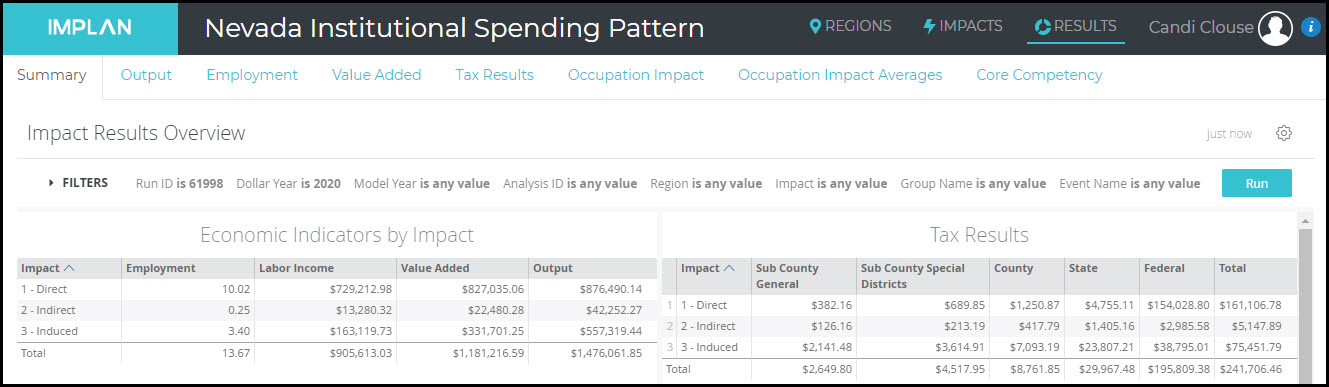

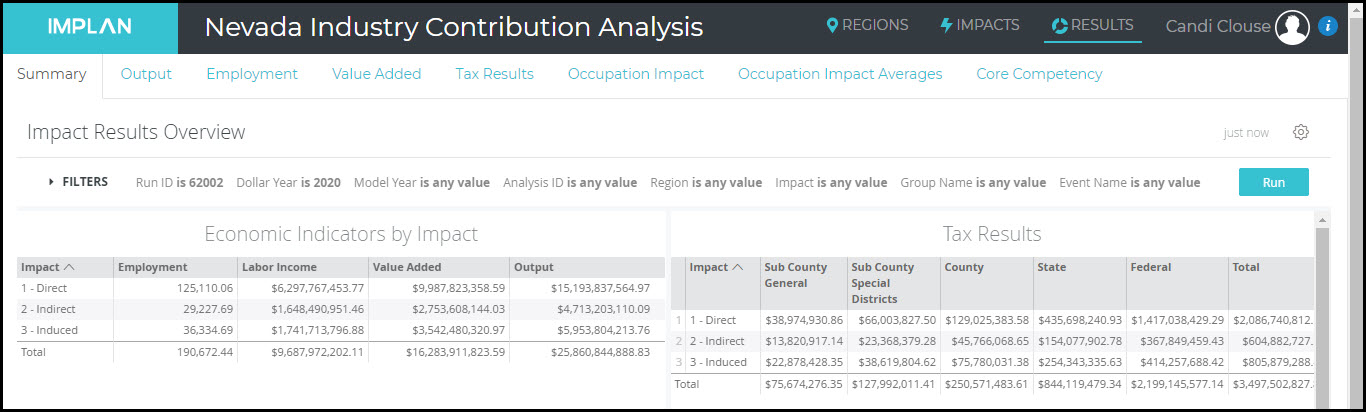

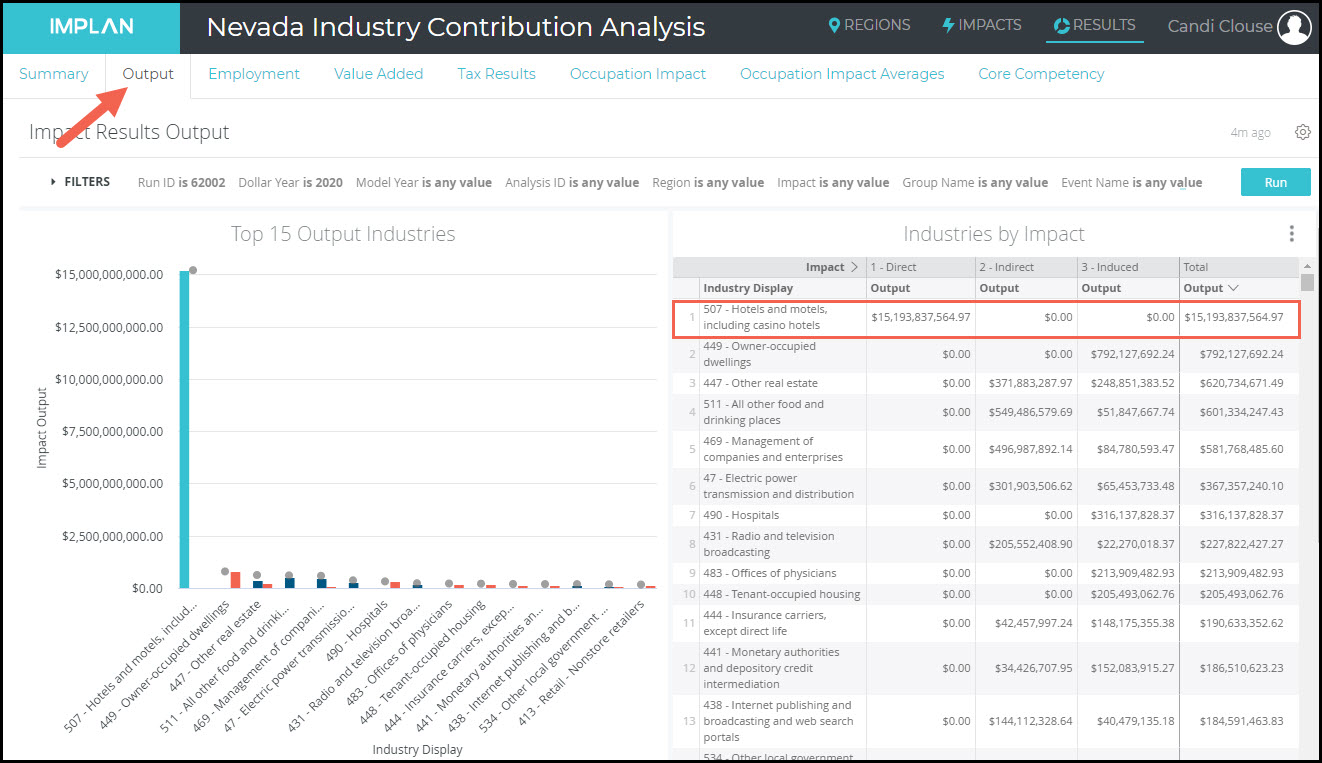

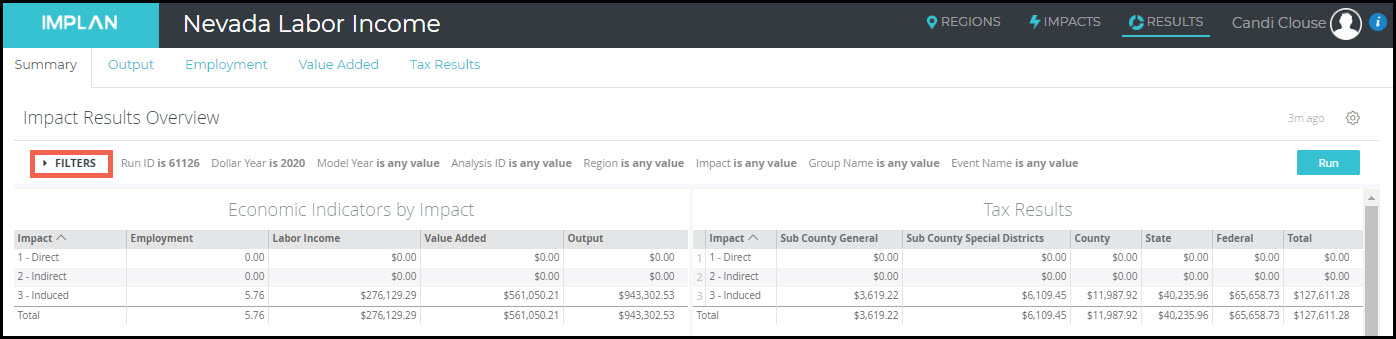

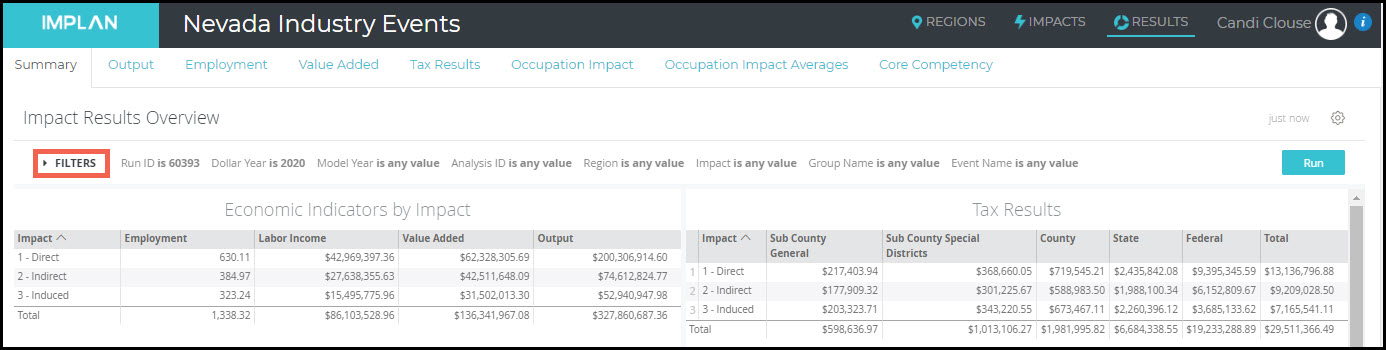

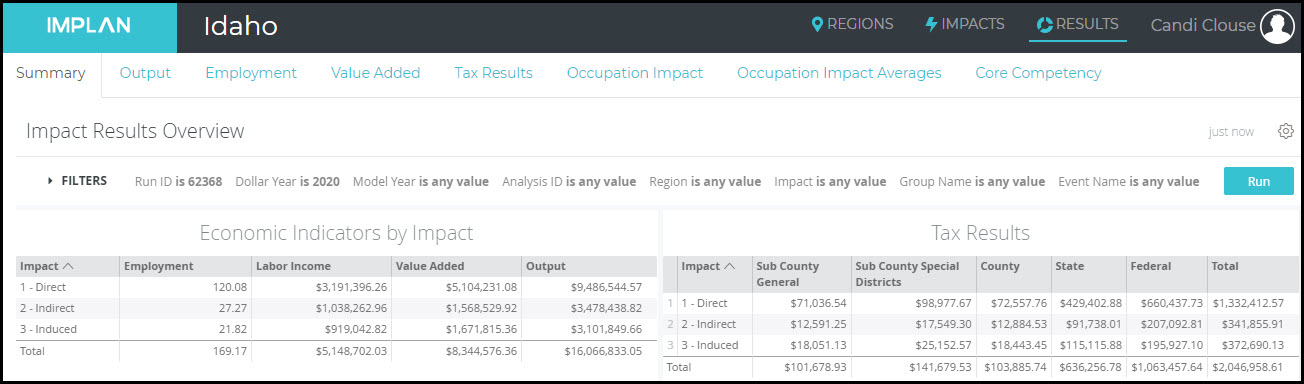

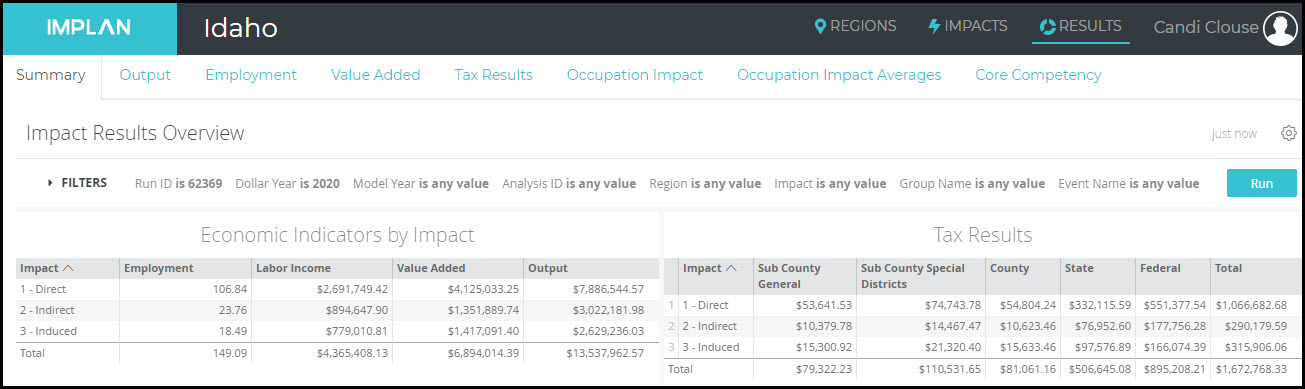

RESULTS

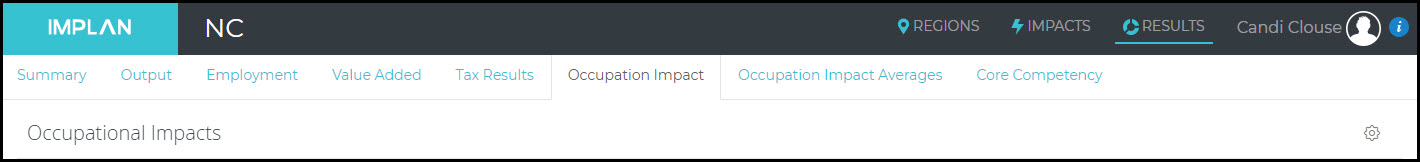

The Occupation Impact Data shows the details for the Occupations, Wages, and Core Competencies that accompany your specific impact or contribution in the Results tab. Descriptions of the data found here are detailed in our Occupation Data – Behind the i article.

The Occupation Impact Tab opens the Occupation Impacts screen containing a single table detailing regional employment and wage impacts by-occupation. Use the Filters to limit results to desired Region, Group, Event, and Industry. The Filter can also be used to select a different occupation aggregation level.

The Occupation Impact Averages tab opens the Occupation Impacts screen containing a single table detailing the average regional employment and wage impacts by-occupation. Use the Filters to limit results to desired Region, Group, Event, and Industry. The Filter can also be used to select a different occupation aggregation level.

Core Competency opens the Competency Impacts screen containing tables for each core competency category (Ability, Knowledge, Skills, Education Required, Work Experience Required, On-the-Job Training Required). Use the Filters to limit results to desired Region, Group, Event, Industry, and occupation. The filter can also be used to select a different occupation aggregation level.

DOWNLOADS