INTRODUCTION:

This article is designed to offer IMPLAN users some important descriptions of, temporary solutions for, and status updates regarding known technological issues which have been identified and are actively being addressed within IMPLAN. Should you encounter any issues which are not addressed in this article, please let us know by contacting us at (800) 507-9426 or at support@implan.com. Issues which were previously identified, but have since been resolved, are documented in IMPLAN’s product release notes which are published upon the release of new features and capabilities within the IMPLAN tool.

ISSUES BEING ADDRESSED:

Each of the technological bugs described below have been identified and are being addressed (as you read!) by the IMPLAN Product Team. So don’t worry—we’re on it! But, should you encounter any of these issues between now and the deployment of their official fixes, there are workarounds which can provide effective (albeit manual) solutions in the meantime.

1. MRIO ANALYSES TAKE LONGER TO FINISH CALCULATING RESULTS

The Issue

An MRIO study requires a much higher number of calculations than non-MRIO studies as the trade of all the sectors are analyzed between regions. As such, we expect these types of studies to take longer to finish than non-MRIO studies. The amount of time it takes to finish will depend on the number of events and the number of groups that the user has entered. The expected time for an MRIO analysis to finish can range between a few minutes for smaller studies to several hours for larger studies.

The Workaround

The best practice for MRIO and other larger studies is to leave yourself lots of time to run the analysis! Keep an eye on the Progress Panel in the lower right corner of the Impact screen that will provide notification of the progress of the study. Notification will be provided if the study has timed out. That can happen for various reasons with the most common being that the size of the study exceeds our processing limits. While we have made great strides in increasing the processing power, you still may see longer wait times. That said, in order to minimize wait times or potential for “timing out” with regard to processing performance, we suggest limiting your MRIO analyses to a) include a maximum of ten Events and b) limit your number of combined Groups to four or five. If your MRIO analysis absolutely must include more than ten Events or Groups which contain more than three Combined Regions, we suggest that you contact your Customer Success Manager at 800-507-9426 or support@implan.com to personally discuss potential strategies for managing the size and/or complexity of your study.

2. WHEN RUNNING MULTIPLE STUDIES, SMALL STUDIES CAN TAKE AN UNUSUALLY LONG TIME TO FINISH

The Issue

The user kicks off a large study and wants to run a second study while the first is processing. Even if the second study is a small study, it doesn’t finish in the expected time frame.

The Workaround

The best practice for larger studies, including MRIO that we expect to take longer, is to plan ahead. Run smaller studies first since studies that are kicked off after a large study get placed in queue and will not start until the large study has completed. This is to prevent too much data hitting the server at once and crashing the system. The second study analysis will automatically begin without any further action from the user.

3. GROUPS WITH MORE THAN 100 EVENTS MAY NOT COMPLETE.

The Issue

Groups with more than 100 events may not complete or may take a long time to complete.

The Workaround

We are still exploring, testing, and discovering the current limits of the tool’s processing power and the amounts of data that it can communicate to our servers at any one time. That said, in order to minimize wait times or potential for “timing out” with regard to large studies, we recommend keeping the number of Events in your Groups to less than 100. If your study requires more, contact your Customer Success Manager by calling 800-507-9426 or emailing support@implan.com to personally discuss potential strategies for managing the size and/or complexity of your study.

4. FILTERING IN REGION OVERVIEW

The Issue

When looking at the data in the Regions Overview, there is an intermittent issue facing filtering. In a section that requires the use of a filter to choose a specific Industry or Commodity, the list of possibilities is not always populating after the first use of the search.

The Workaround

To do another search, just navigate back to the same screen and the Industry or Commodity list should be there again.

5. ALL EVENTS WIPING OUT DESPITE SAVING THEM

The Issue

If the users time out on the impacts screen, all events are being erased even if their work is saved. This occurs when a user is idle for too long causing the project to crash. Our product team is actively working towards fixing this issue.

The Workaround

We recommend that a user leave the impact screen while the project is running or any other time that they are NOT actually active creating or editing on the page.

6. NO NOTIFICATION WHEN AN INDUSTRY DOES NOT EXIST IN A REGION

The Issue

When running an Industry Event on a Sector that does not have any activity (no Output, no Employment, etc.) in the Region used in the analysis, the user will get all zero results. This is because there is no data or Sector averages for that industry in the Region, which is necessary for IMPLAN to estimate the effect of some change in that Sector within the given Region. IMPLAN does not provide any notification to the user that the Sector does not exist. When running an Industry Event on a Sector that doesn’t exist in the Region in combination with other Events that successfully produce non-zero results, it is very possible to overlook the fact that one of the Events has produced all zero results.

The Workaround

You can ensure the Sectors you will be impacting exist by checking for data on the given Sector in the Region Details. Study Area Data (Industry Summary table) is a great place to check. Users can model the effects of a new Sector being introduced to a given Region by either first adding the Sector by customizing your Region and then modeling the effect using an Industry Event or by taking an Analysis-by-Parts approach.

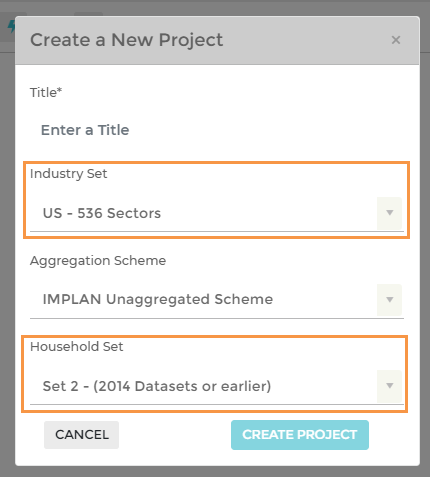

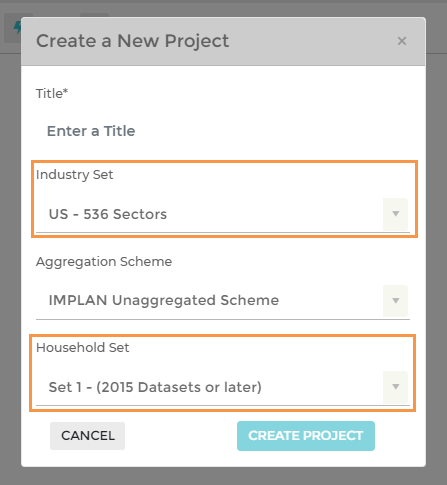

7. THE EVENTS TEMPLATE WILL NOT UPLOAD EVENTS WITH INDUSTRY SPECIFICATIONS GREATER THAN 536

The Issue

When uploading large numbers of events using the events template, industry specifications cannot be greater than 536 sectors. For the 2018 data set and later, this means that industries 537-546 cannot be included in an events template.

The Workaround

We would encourage that you familiarize yourself with our special industries before using them in a study. As industries 537-546 are commodity-only or administrative payroll specifications, it is unlikely that they would be included for a study that makes use of the events template. If you need to include them, these industries can be added manually by clicking “Add New Event.”

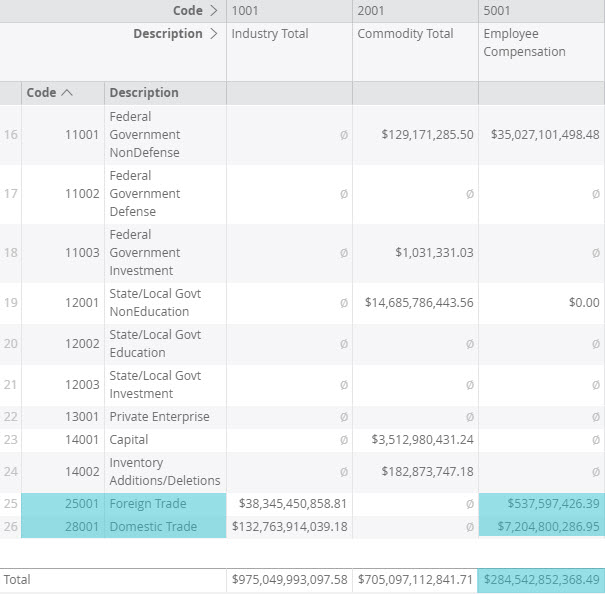

8. DIRECT OUTPUT EFFECT OF COMMODITY EVENTS NOT EQUAL TO EVENT VALUE WHEN THEY SHOULD MATCH

The Issue

When only Industries are the producers of a Commodity in a given Region (according to the Commodity Market Share), 100% of the Event Value for these Commodity Output Events should generate Direct Output. Therefore, when Dollar Year on the Impacts Screen matches the Dollar Year on the Results Screen the Event Value and Direct Output Effect should be exactly equal. Things are working just fine when Dollar Year and Data Year are the same in the Impact Screen. The issue arises whenever Dollar Year and Data Year on the Impact Screen do not match. In this situation, currently, there is some discrepancy between the Event Value and the Direct Output when there are multiple Industry producers (and no Institutional producers) even though these values should match when Dollar Year in the Impact Screen and Results Screen are the same.

The Workaround

Aside from disregarding the slight discrepancy, a workaround to this issue is to multiply the Commodity Output Value by the Commodity Market Shares to convert the Commodity Output into Industry Output. The portions of Commodity Output produced by Industries can be analyzed as multiple Industry Output Events.

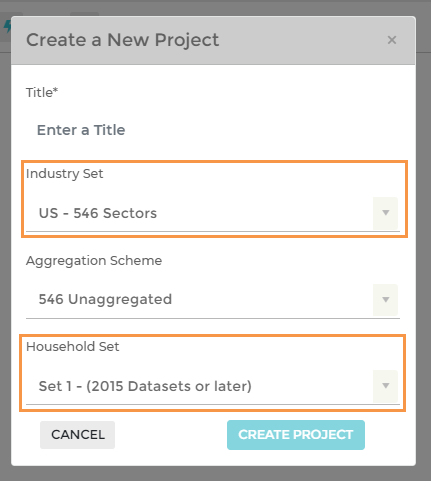

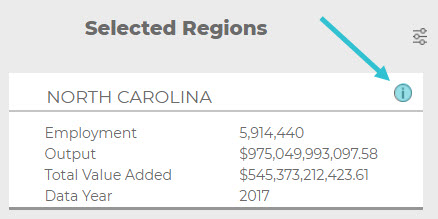

9. CUSTOMIZED REGIONS

The Issue

Chrome is the recommended browser for using IMPLAN. When customizing a Region, if you are using Edge as a browser, it will not allow any number below one to be entered.

Once you have completed your Region customization, the Customized Region will not automatically appear in the Selected Region field.

The Workaround

Once you have completed your Region customization, search for and select the name of the Customized Region in the search field on the Region screen. The Region will be shown in the Selected Region field. If the Region is still building your will see a spinning wheel on the Region window. Once the Region is built, you can check for your customization Behind the i.

10. NORMALIZATION RESETS UNEDITED LPP’S TO THE SAM VALUE

The Issue

In an industry spending pattern, the option to set a local purchase percentage for each commodity is available. If you uncheck the box labeled “SAM” which sets the LPP for the commodity to the RPC pulled from our Social Accounting Matrix (SAM), the software will update the LPP to 100%. If you uncheck the SAM box to set to 100% and then use the Normalize feature, the checkbox is reset to the SAM value.

The Workaround

The appropriate methodology would be to make edits to your commodities and normalize, then set custom LPP’s if they are known. If you would still like to enter LPP’s before normalization, any commodity that you intend to have a 100% LPP for should have the LPP field cleared, and a “1” entered.

11. FALSE ERROR AFTER CANCELING A PROJECT

The Issue

If you are running a project, hit cancel, hit run again, and then navigate away from the Impacts Screen, when you return to the Impacts Screen a coral error bar will appear. There is actually no error, however.

The Workaround

Good news! There is nothing you need to do (aside from ignoring that coral error message).

12. COMMODITY EVENTS AND USER-DEFINED LPP

The Issue

When using a Commodity Event, with Total Revenue (default) selected, and changing the LPP to anything besides the default 100%, the change in LPP is not sticking.

The Workaround

This fix is in the works and should be out soon. To adjust for this, only enter the percentage that you want applied to the multipliers in the Event Value.

13. COMBINED REGION NAME CHANGE

The Issue

If you have two Combined Regions with the same name, and you run a project using one of them, you may find the name changed when you return to the Impacts screen.

The Workaround

Have no fear on this one. Although the name may have changed, because you have two identical Combined Regions with the same name, IMPLAN just pulled in the other name for it.