INTRODUCTION:

Examining tax breaks, tax credits, tax exemptions, and tax incentives for firms and Industries is common in IMPLAN. This article outlines the basics on how you can use IMPLAN to examine the changes in your regional economy when tax policy affects Industries.

TAX BREAKS:

Tax breaks for certain Industries are common across the U.S. Municipalities offer huge tax incentives for site selection decisions or to encourage growth in basic Industries. Most times, these are in the form of foregone taxes; reducing the amount of future payments that would be required.

Even if the Direct taxes aren’t collected because of the incentive, there are still Indirect and Induced taxes generated because of the new activity. Showing the ripple effect of the government investment helps bolster support from taxpayers and justify the spending (or lack of tax collection). The return on investment (ROI) can be estimated using IMPLAN.

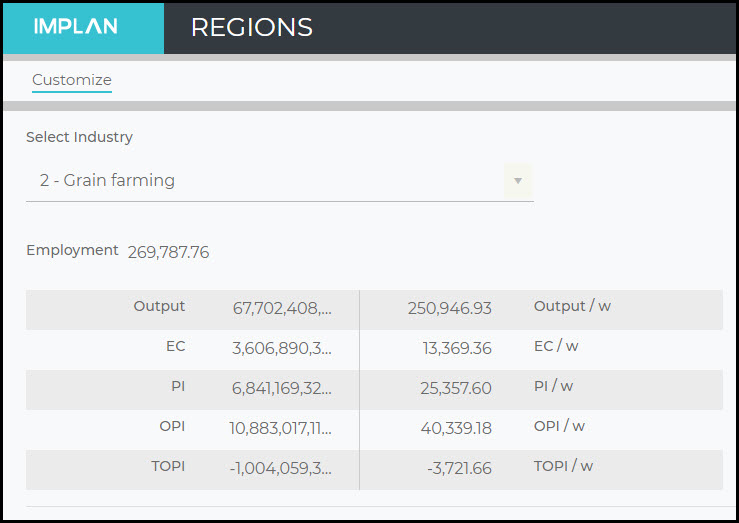

Let’s say for example, the state of North Carolina is going to give a complete Tax Exemption for 5 years to a new banking enterprise of the McDuck family. Their business plan estimates sales of $20M each year. We can run an Industry Output Event for $20M in Industry 441 – Monetary authorities and depository credit intermediation. Taking a look at the Tax Impact Results for the state, we see that Direct Taxes are reported. Now we know that they won’t be paying any Direct Taxes, so we can set our Filter to only show us Indirect and Induced Tax Results.

Tax_Breaks_-_Filtering_Indirect_and_Induced.jpg

Scanning down the screen, we see that because of the state investment which allowed for the resulting business to open in the state, North Carolina will see an additional $316,038 in Indirect and Induced Taxes in 2020. The state would not see the $325,106 of Direct Taxes in the first five years, but in year six, they would start seeing those revenues as well. If the argument can be made that but for the exemption, the McDuck family would have chosen another state for their bank, then it seems like it would have a positive effect on the state coffers; not to mention all of the sub-state level governments that will be collecting taxes.

Sometimes, however, businesses are given direct payments from the government to increase production, hiring, etc. These can be modeled through standard Industry Events in IMPLAN as new Output to the Industry.

Keep in mind that the distribution of the TOPI is based on the average of all Industries for you Region. If there is nothing unique about the tax structure of the business you are studying, then the resulting estimates are appropriate. However, if you are modeling a change in an Industry that will pay a higher share of a certain type of tax, it is best to edit your Direct Results to show that higher rate; IMPLAN will only show an average across all Industries. So if you are modeling Andrew’s Bootleg, a new distillery, and you know they will pay an additional sin tax or excise tax based on your local laws, it is best to use your estimate of the Direct Tax, and then use the Indirect and Induced tax results from IMPLAN.

TAX CHANGES:

Tax changes that affect an Industry vary widely; perhaps a new tax on production or inventory, new licensing requirements, etc. Analyzing these tax changes in IMPLAN depends on what the market reaction of the businesses will be. Will the business close, layoff employees, cut production, or see smaller profits? This determination is up to the analyst. Generally with a corporate tax increase, the first thing you will see is a reduction in corporate profit (OPI). In Input-Output models, corporate profit is treated as leakage as there is no way to know exactly how and where those profits are used as they could be reinvested in production, used for capital purchases, pay for additional hiring, distributed to shareholders, etc.

If the tax burden is so great as to force some businesses to reduce production, relocate, or close, this is an impact that could be modeled in IMPLAN. A simple Industry Output Event in the affected Industry could show the losses to the economy because of the new tax forcing out a local business.

OPPORTUNITY COSTS:

Another way IMPLAN can be used in examining tax issues is by looking at the Opportunity Costs – the benefit that is gained when one choice is made over another. Perhaps incentivizing the banking Industry would yield a smaller tax impact than the same dollar amount invested in automobile manufacturing. Not only can comparing these two potential scenarios show you the differences in how each affects the Regional economy of study but it will also show the differences in potential tax revenue.

EDITING TAX RESULTS:

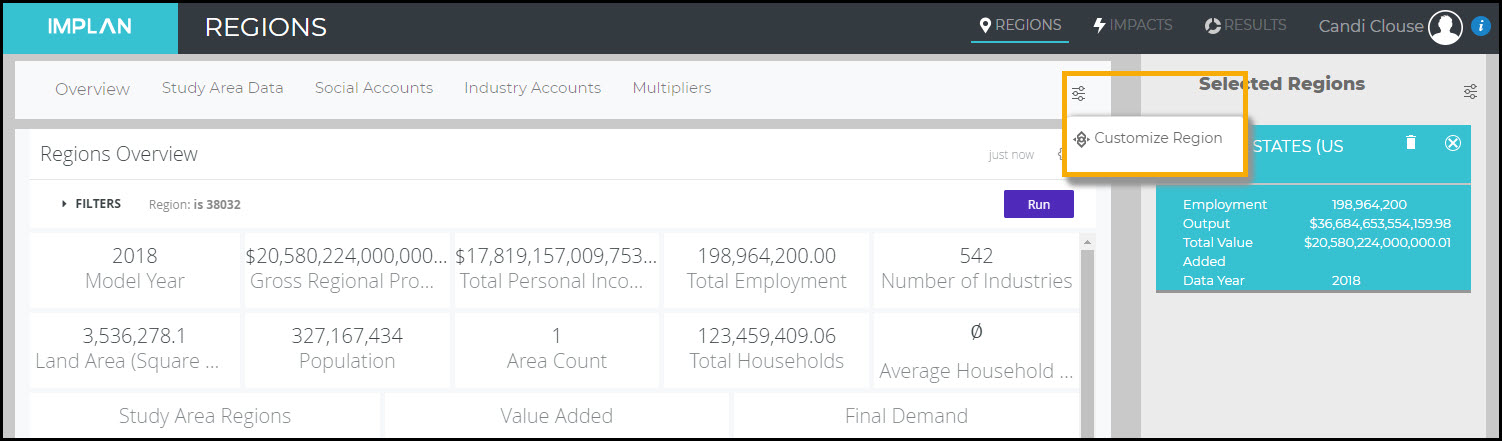

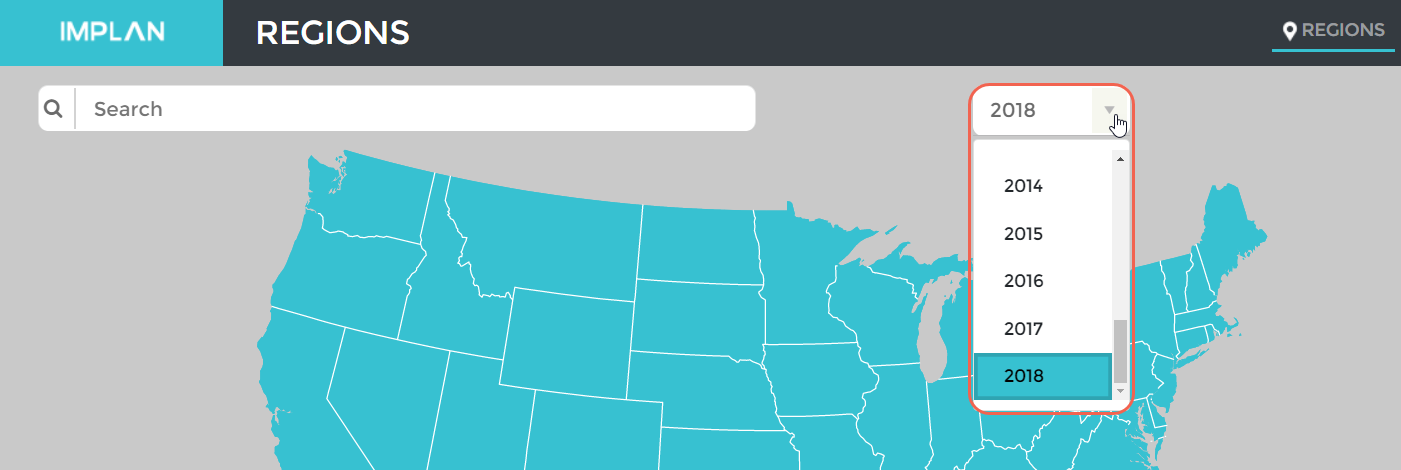

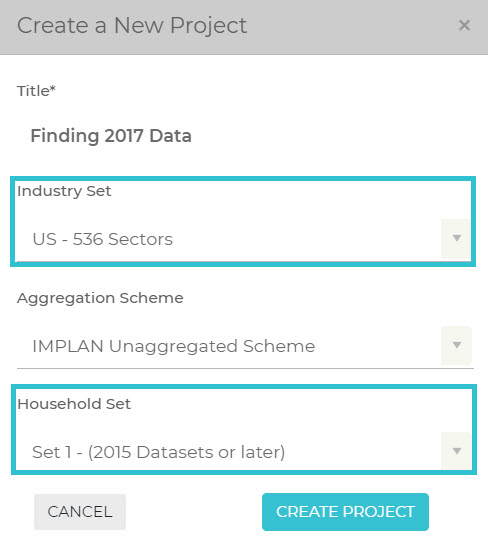

You may have more specific knowledge about specific Direct Taxes that you want to adjust with the IMPLAN Results. Here’s how to do it.

Let’s say we have a plastics manufacturing firm that has chosen to remain in New Jersey due to the state’s offer to exempt them from Property Tax. We can run an Industry Output Event for their $5B in sales in 2020 in Industry 193 – Other plastics product manufacturing. On the Tax Results screen, Filter for the Direct Tax as the tax exemption is only being offered to the Direct business, and therefore Direct Tax is the only piece that will not be fully paid. Click on the ellipses to download the State Tax Impacts. Then click the download button and open up your Excel file.

Tax_Breaks_-_State_Tax_in_IMPLAN.jpg

Zooming in on the Property Tax, we see that there was a payment from Tax on Production and Imports (column) to TOPI: Property Tax (row) in the amount of $6,379.05. This would be the amount the state of NJ is giving up in Property Taxes.

When this data is in Excel, you can delete the $6,379.05 TOPI: Property Tax value from cell E7. You will need to recalculate the sum for Column E to show the new total as well as the sum of the Property Tax row in Column P and the sum of Column P itself to reflect the change. The new total for all of the Direct Taxes in NJ is $55,507,169. You can replace the original Direct Tax Figure with this new, lowered amount that will be collected by the State of New Jersey.

Tax_Breaks_-_Zero_Prop_Tax_in_Excel.jpg

You can Filter for the Indirect and then the Induced Taxes to see the amounts paid at the state level in order to calculate the total state taxes.

Tax_Breaks_-_New_State_Total_Tax_in_Excel.jpg

This process can be used to zero out or change any of the Direct Taxes on the IMPLAN results. For instance, you may know exactly how much a certain business will pay in a certain tax. Or perhaps you’d like to use your Industry-specific tax knowledge to shift around the distributions of TOPI or OPI in your Direct Tax results to compensate for the limitation in IMPLAN’s data on industry-specific tax distributions as mentioned in the Taxes: The Basics of the Breaks article. Use your bona fide knowledge of your subject to override the estimated Direct tax results in IMPLAN.